HDFC Flexi Cap Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 2184.193 15.623(0.72 %) NAV as on 26 Jun 2025

Scheme Objective: To generate capital appreciation / income from a portfolio, predominantly invested in equity & equity related instruments. There is no assurance that the investment objective of the Scheme will be realized.

Performance (As on 26 Jun 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 7.69 % | 11.41 % | 28.99 % | 30.50 % | 17.33 % |

| NIFTY 500 | 4.85 % | 4.82 % | 20.79 % | 22.39 % | N/A |

Portfolio

Flexi-cap funds invest in stocks across all market capitalisations. The allocations between large-cap, mid-cap, and small-cap stocks changes depend on market opportunities. These funds tend to be more volatile than large-cap funds but have the potential to deliver better returns over time. The Nifty 500 or the BSE 500 indices can be used as benchmarks to measure performance.

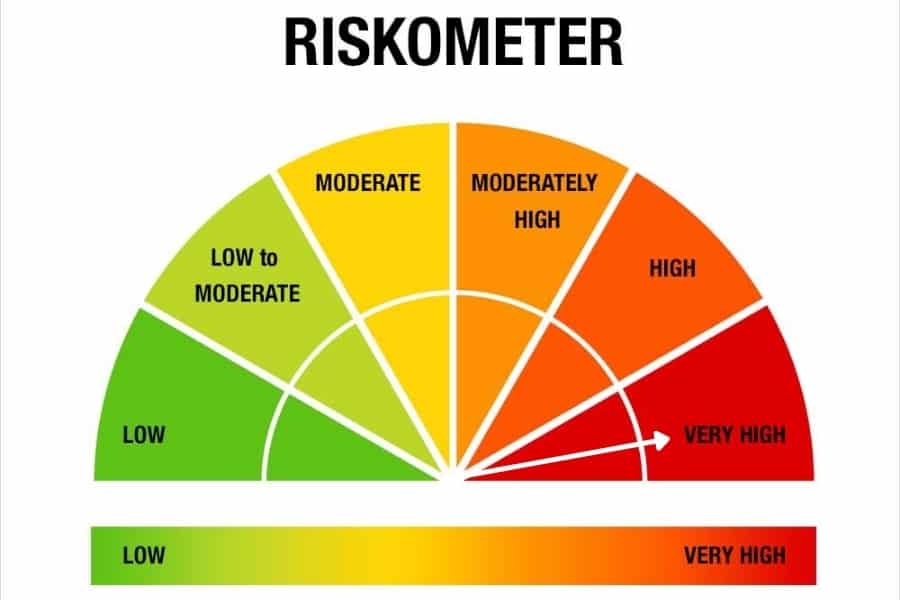

Flexi funds suit investors of all risk appetites. The minimum period for which these funds need to be held is 5 years.