Franklin India Pension Plan(G)-Direct Plan

View the regular plan of this scheme

Rs 241.5466 0.5609(0.233 %) NAV as on 27 Jun 2025

Scheme Objective: The scheme aims to invest in a portfolio of equity / equity related securities and fixed income securities (debt and money market securities) with a view to generating regular income together with capital appreciation.

Performance (As on 27 Jun 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 4.23 % | 8.40 % | 13.89 % | 11.78 % | 10.63 % |

| NIFTY 500 | 5.23 % | 4.80 % | 20.64 % | 22.48 % | N/A |

Portfolio

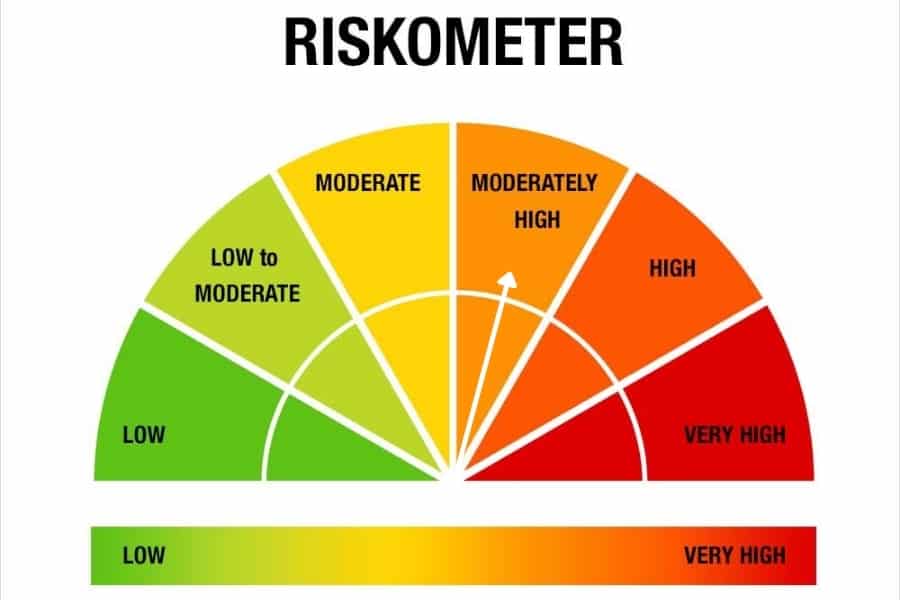

Retirement funds are funds that invest in a combination of debt instruments and stocks. Typically, an AMCu2019s retirement fund comes in low-risk, moderate-risk, and high-risk variations. Equity allocations are the lowest in the low-risk variant and highest in the high-risk variant. These funds come with 5-year lock-in periods (or on attaining retirement age) and most qualify for deductions under Section 80C of the Income Tax Act. Exit loads may also be high in the initial years. The tax treatment of these funds depends on whether the equity allocation to domestic stocks is at least 65%.

These funds need holding periods of at least the lock-in period or longer depending on the extent of equity exposure in the fund.