DSP Midcap Fund-Reg(G)

View the direct plan of this scheme

Rs 147.42 0.514(0.35 %) NAV as on 27 Jun 2025

Scheme Objective: The primary investment objective is to seek to generate long term capital appreciation from a portfolio that is substantially constituted of equity and equity related securities of midcap companies. From time to time, the fund manager will also seek participation in other equity and equity related securities to achieve optimal portfolio construction. There is no assurance that the investmentobjective of the Scheme will be realized.

Performance (As on 27 Jun 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | 0.95 % | 4.58 % | 23.40 % | 22.18 % | 15.54 % |

| Nifty Midcap 150 | 3.65 % | 5.39 % | 29.35 % | 30.66 % | N/A |

Portfolio

Mid-cap funds invest in stocks from the 101st to the 250th in terms of market capitalisation. As they invest in stocks of smaller companies, they tend to be volatile but can deliver very strong returns during market uptrends. The Nifty Midcap 100, Nifty Midcap 150 or the BSE Midcap can be used as benchmarks to measure performance.

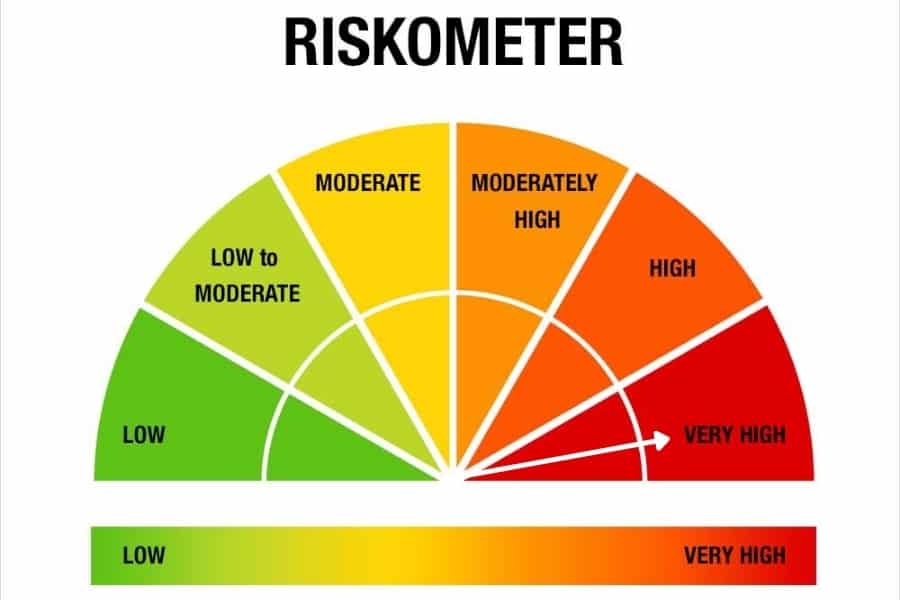

Midcap funds suit investors with moderate to high risk appetites. The minimum period for which these funds need to be held is 5 years. Higher risk investors with longer timeframes can allocate more to these funds.