Baroda BNP Paribas India Consumption Fund-Reg(G)

View the direct plan of this scheme

Rs 31.3955 -0.0445(-0.142 %) NAV as on 27 Jun 2025

Scheme Objective: The primary investment objective of the Scheme is to seek to generate capital appreciation and provide long-term growth opportunities by investing in companies expected to benefit by providing products and services to the growing consumption needs of Indian consumers, which in turn is getting fuelled by high disposable income. The Scheme also seeks to generate income by investing in debt and money market securities.However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns.

Performance (As on 27 Jun 2025)

| 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|

| Scheme | -1.27 % | 3.55 % | 20.16 % | 20.58 % | 18.30 % |

| NIFTY 500 | 5.23 % | 4.80 % | 20.64 % | 22.48 % | N/A |

Portfolio

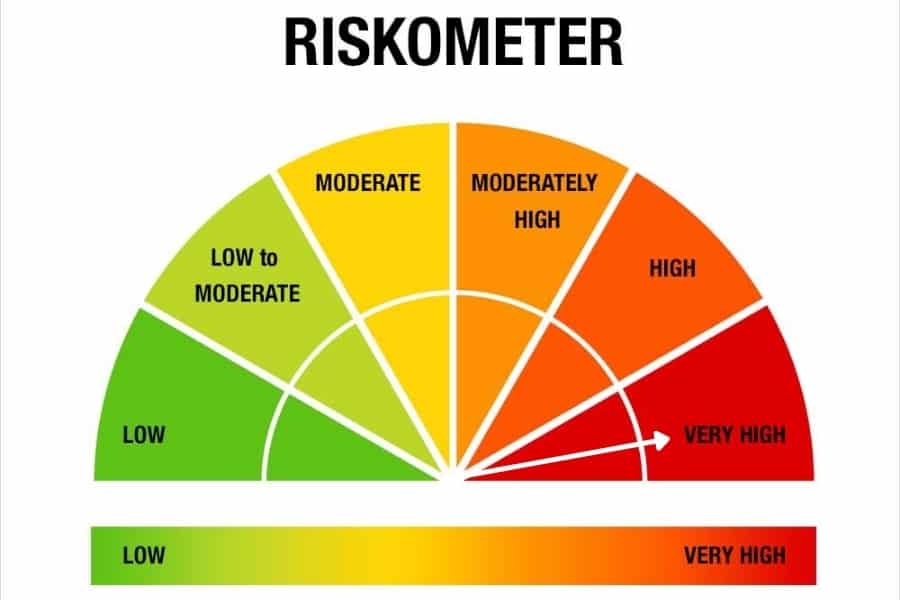

Sector funds focus their entire portfolio on one particular sector such as banking, infrastructure, or pharmaceuticals. These funds can have very high concentration in their top few stocks. A sector fund can deliver outsized returns compared to the market when the sector is in market favour during a rising market. These funds can be prolonged underperformers if markets dont pick up the theme or if the sector is going through a bad patch. These funds require well-timed entry at the low point and an exit at the high point in order to see returns.

Sector funds suit investors with very high risk appetites, and who have the knowledge and ability to track sector performance.