Axis Ultra Short Duration Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 15.5317 0.0036(0.023 %) NAV as on 27 May 2025

Scheme Objective: The investment objective of the Scheme is to generate regular income and capital appreciation byinvesting in a portfolio of short term debt and money market instruments with relatively lower interestrate risk such that Macaulay duration of the portfolio is between 3 months and 6 months.

Performance (As on 27 May 2025)

| 1 week returns | 3 month returns | 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|---|---|

| Scheme | 0.15 % | 2.22 % | 4.07 % | 8.07 % | 7.47 % | 6.25 % | 6.78 % | >

Portfolio

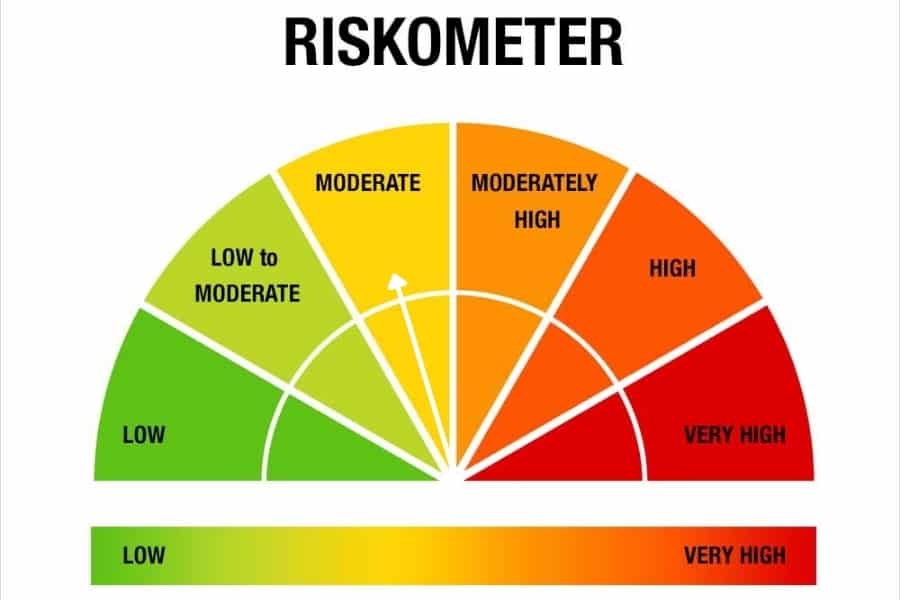

Ultra-short duration debt funds invest in debt instruments such as commercial paper, certificate of deposits, treasury bills and other money market instruments. They maintain an average portfolio maturity of around 6 months. These funds may deliver losses on a day-to-day basis but are generally low volatile. While most funds pick instruments that have a high credit rating, some can go into papers with lower credit ratings in order to deliver higher return.

These funds suit any investor with investment horizons of 6 months to a year. Ensure that funds do not have a high share of low-rated debt. These funds can also be used to maintain emergency money as well.