Axis Short Duration Fund-Reg(G)

View the direct plan of this scheme

Rs 30.9866 -0.0047(-0.015 %) NAV as on 20 Jun 2025

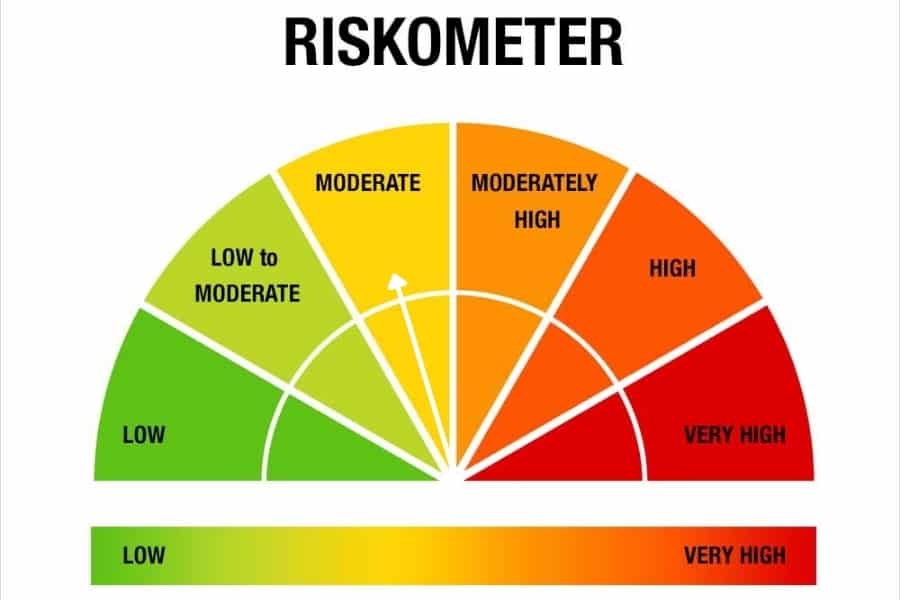

Scheme Objective: The scheme will endeavor to generate stable returns with a low risk strategy while maintaining liquidity through a portfolio comprising of debt and money market instruments.

Performance (As on 20 Jun 2025)

| 1 week returns | 3 month returns | 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|---|---|

| Scheme | 0.15 % | 3.25 % | 5.21 % | 9.44 % | 7.67 % | 6.26 % | 7.61 % | >

Portfolio

Short duration debt funds invest in debt instruments ranging from money market instruments to corporate and bank bonds and government papers. Average maturities for these funds hold below 2-3 years. These funds can be volatile in the very short term as bond prices react to potential interest rate changes, but this volatility is usually contained and evens out. Funds can pick instruments across the credit rating spectrum. Therefore, some can be far riskier than others.

These funds suit any investor with a minimum investment horizons of 1.5 to 3 years but can be held for longer periods as well. Ensure that funds do not have a high share of low-rated debt if holding for the short term.