Aditya Birla SL Corp Bond Fund(G)-Direct Plan

View the regular plan of this scheme

Rs 115.0128 -0.1144(-0.099 %) NAV as on 11 Jun 2025

Scheme Objective: The investment objective of the scheme is to generate optimal returns with high liquidity throughactive management of the portfolio by investing in High Quality Debt and Money Market Instruments.

Performance (As on 11 Jun 2025)

| 1 week returns | 3 month returns | 6 month returns | 1 year returns | 3 year returns | 5 year returns | Returns since inception | |

|---|---|---|---|---|---|---|---|

| Scheme | -0.32 % | 3.40 % | 4.98 % | 9.85 % | 8.29 % | 7.09 % | 8.32 % | >

Portfolio

Corporate bond debt funds invest in a variety of debt instruments such as corporate and bank bonds, PSU bonds, and government securities. They invest at least 80% of their portfolio in debt papers rate AA+ and above and portfolios are therefore made up of high-quality instruments. Returns primarily come from interest accrued on bonds held, though some funds with longer maturities may also sometimes earn from bond price appreciation. Average maturities for these funds can vary from short-term to long term.

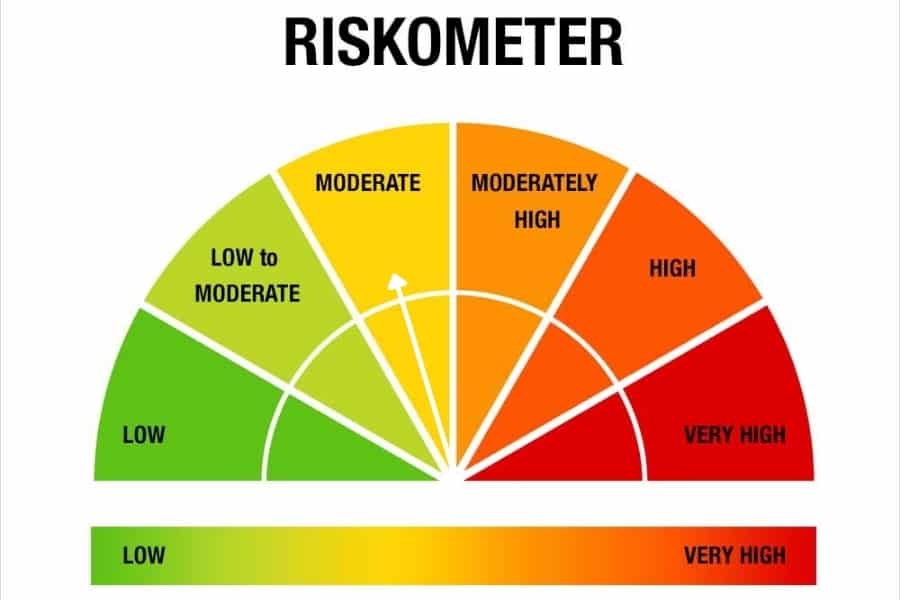

These funds suit any investor with investment horizons around 3 years and longer. They can be higher-return alternatives to fixed deposits in exchange for a little higher risk, or part of debt allocations of long-term portfolios.