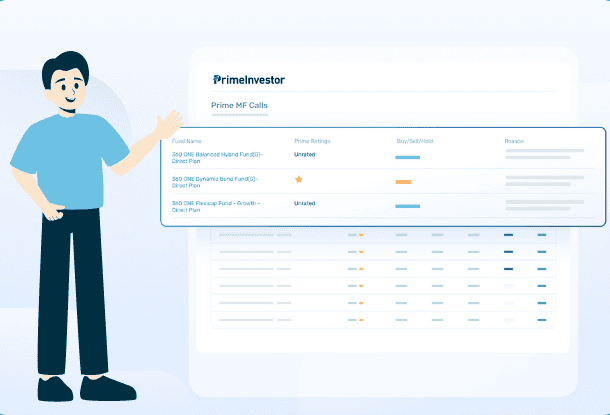

Prime MF Calls

Buy/ Sell/ Hold calls on mutual funds across categories

What are Prime Calls on Mutual Funds?

Buy, sell or hold?

Know what to do with mutual funds you hold or get our call on funds you're interested in

Beyond ratings

Blending quantitative metrics with factors such as portfolio, market scenario, trends & more

Call reasoning

Crisp explanation for the reasons behind each call for your understanding

Regular plan calls

Separate calls on regular plans where expense ratio excess over direct is higher than average

Fund specific

Calls taken based on fund performance alone, without any bias

Regular updates

Reviewed every quarter to catch performance trends for timely decisions

Ready to achieve investment success? Start your free 7-day trial now!

No credit card or payment needed!

How do Prime

Buy/Hold/Sell Calls

benefit you?

Timely action

Weed out poor funds and step up quality performers to take the right action for your portfolio.

Easy management

Clear calls makes it easier & faster for you to periodically review your portfolio.

Avoid return bias

Ratings & returns can hide performance trends. Prime Calls helps you avoid relying on these alone.

Easy decision-making

Direct calls makes it easy for you to know where to invest, without having to do the homework yourself.

GopalaKrishna NarayanMoni

“PrimeInvestor is just the kind of tool/website a common man needs. The articles, tools and features cater to folks of all maturity levels, right from a novice investor to a seasoned investor. I am a big fan of the MF review tool or the nice write up on stock recommendations which is a hit almost 75-80% of the times. I extend my membership every year without blinking my eyes.

Money well spent! Please keep up this standard Srikanth and team!”

Micheal Arun

Their services are evolving every day and I am looking forward for a long association.

Prasanth Ethiraj

Their write-ups especially on Term Insurance & Mutual funds are indeed more valuable and makes our understanding much better.

Balaji V

There are many firms which gives advise, I find PrimeInvestor to be more balanced , simple and authentic. They cover a wide range of product for retail investors Stock MF Bonds etc. There many tools available which are useful to use. The filters which are available for mutual funds are very unique, wide and no other website offers such a wide range.

Ready to achieve investment success? Start your free 7-day trial now!

No credit card or payment needed!

Other useful links to use

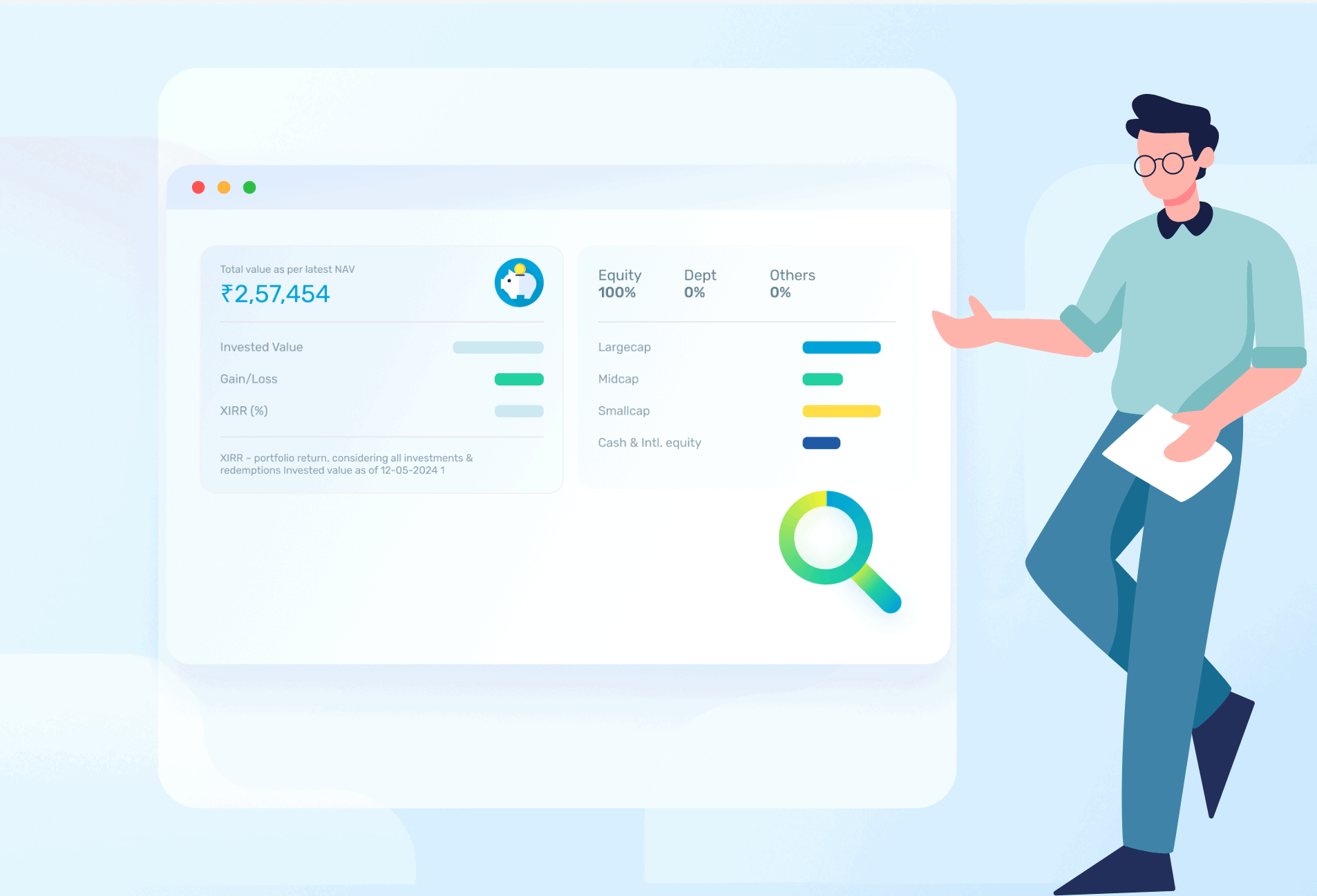

Portfolio Review Pro

Your one-stop to monitor & review performance, risk & allocation of your MF portfolio and take corrective action.

Build Your Own Portfolio

Create and customise your own portfolio with the best funds, guided by research.

SIP Value Calculator

Investing every month? Know how much you will get at the end of your investment time frame.

MF Direct/Regular Expense

Save cost. Check if you’re paying too much in a regular plan and if your fund is costlier than peers.

Recent Articles

StocksCategoriesPremium

Prime Stock update: Book profit in this automotive play

-

N V Chandrachoodamani

- No Comments

Research ReportsCategoriesMutual funds & ETFsPremium

Quarterly review – Changes to Prime Funds, Prime ETFs & Prime Portfolios

Prime Funds is our list of recommendations in equity, debt, and hybrid mutual funds that are worth investing in. Prime Funds narrows down your choices

-

PrimeInvestor Research Team

- 2 Comments