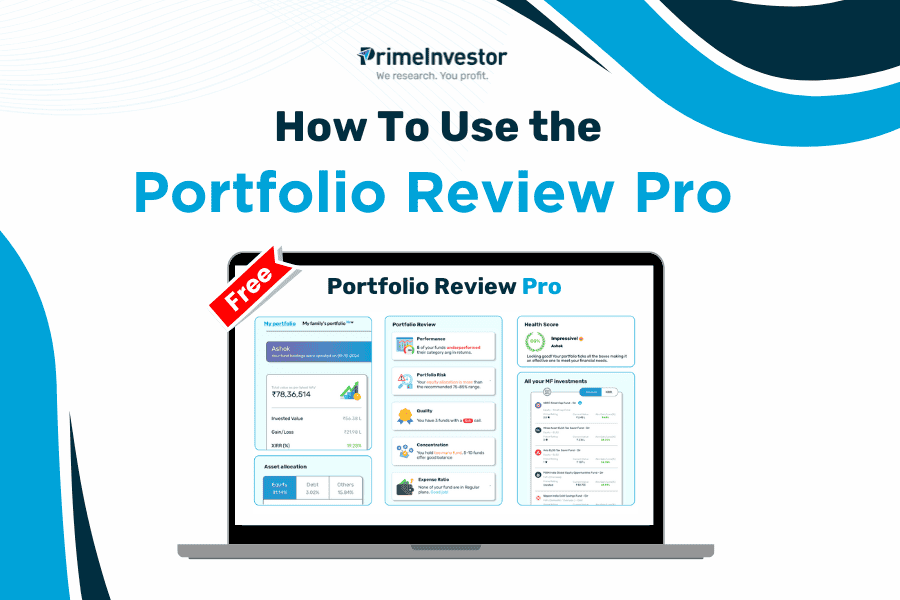

How to use Prime Portfolio Review Pro?

Prime Portfolio Review Pro is a one-of-a-kind tool that guides you into making prudent decisions with regard to your mutual fund portfolio.

It allows you to track your mutual fund portfolio and gives you useful and actionable insights on your portfolio holdings, based on the inputs you give. And it is absolutely easy to use! We fetch your data with just your PAN, phone and an OTP, instead of the cumbersome statement upload that you have to deal with in most other platforms.

Portfolio Review Pro does a thorough health check of your live mutual fund portfolio and tells you the following:

- Where your equity-debt split stands & where it should be

- How risky your portfolio is, and the risk contributors

- Buy/hold/sell calls of the funds you hold

- Concentration or problem of too many funds & the ideal number of funds to hold

- Whether the cost of regular plans is eating into your returns

In essence, it is a complete DIY guide to fine tuning your portfolio to deliver better with optimal risk.

Here is more about how the Portfolio Review Pro works, how to get the most out of it, and some frequently asked questions.

- How to use Prime Portfolio Review Pro?

- Portfolio Review Pro – Getting started

- Portfolio Review Pro – Taking action

- Portfolio Review Pro – FAQs

- What goes into the portfolio review?

- Is the tool an ‘advice’ on my portfolio?

- Who should use Portfolio Review Pro?

- How do I know what action to take in my portfolio?

- How frequently should I use this tool?

- How is the Portfolio Review Pro tool different from others in the market?

- How do I fetch my funds?

- Why do you need my PAN and phone?

- How many PANs can I enter?

- Do I need to enter my PAN every time I want to view my portfolio?

- Where do you get my mutual fund data from?

- How frequently can I refresh my data?

- Can PrimeInvestor make changes to my portfolio?

- How safe is my information with you?

Portfolio Review Pro – Getting started

The Portfolio Review Pro brings together all the mutual funds you hold, under a single view. Here’s how to start your review:

Step 1

Enter your PAN and phone number. The tool will fetch all funds linked to your PAN.

Step 2

Enter the OTP. These two steps will permit us to fetch your fund details. This could take a few minutes to complete, so do wait!

Step 3

View a snapshot of all your holdings such as portfolio value, absolute gain, XIRR, the asset allocation and finer details. Information on current value, gains, asset allocation and so on will be updated every day. If you make any fresh investments or redemptions, you will have to refresh the data using an OTP. The number of such refreshes are moderated based on your subscription (see FAQs).

Step 4

Hit Review My Funds. This will begin the review process. The Portfolio Review Pro has built in the flexibility for you to choose the funds you want to review as a portfolio, so this is the additional step you need to take to complete the review. So, if you have earmarked a few funds for a specific goal, then choose only those funds, so that you will be able to give the right time frame and risk profile for that specific goal.

Step 5

Provide the inputs for the portfolio you want to review – age, timeframe, risk. Select the funds you have earmarked for this portfolio. If you don’t have such specific portfolios for goals, simply select all funds (which is the default option). You can review as many times as you like, so you can separate out your funds into different goals. Then hit Review Funds.

Step 6

The Portfolio Review Pro will provide an overall health score on the portfolio. You will get detailed observations on fund performance, portfolio asset allocation, portfolio risk, fund quality, portfolio concentration, number of funds, and expense ratios (if you hold regular plans). These insights will highlight the aspects where your portfolio stands strong and where you will need to make changes.

But since your own investments and redemptions, fun performance, asset allocation, expense ratios and such all change over time – not to mention additional investments or redemptions – don’t stop at a one-time review.

Step 7

Hit Download PDF to download and save your review for future easy reference. Then plan your course of action! Based on the insights that the Portfolio Review Pro offers, decide what changes to make. How? We explain in the next section.

Portfolio Review Pro – Taking action

The Portfolio Review Pro highlights where your portfolio needs tweaks. Where such tweaks are minor, you can perhaps take your time! But if there are more important warning flags, get down to fixing your portfolio asap.

Portfolio Risk

The Portfolio Risk section provides insight on the equity-debt allocation in your portfolio, as well as the risk of your portfolio.

Asset allocation: Suggestions on equity-debt allocation are made based on ideal ranges, determined by our research team, for a given timeframe and risk appetite. The objective of such an ideal asset allocation is to contain the downside while optimising on returns. You can override the suggestions based on your individual need and philosophy.

- For timeframes of less than 1-2 years, equity allocation needs to be zero to very low regardless of your age or risk level. Any equity should come only from low-risk hybrid funds such as equity savings or conservative hybrid.

- For timeframes of 3 years and higher, ensure that you hold debt funds to curtail equity risk and truly diversify. Balanced advantage funds equity savings or multi-asset funds can be part-substitutes but do not substitute debt fully with hybrid funds.

Portfolio risk: Portfolio risk is calculated by looking at your allocation to different fund categories in context of the timeframe you have mentioned for your portfolio, including the category’s suitability for that timeframe.

Compare your portfolio risk to your own risk level (that you have mentioned) to know if your portfolio suits you. Additionally, look at the Risk column in your review. Then use the guide below:

Additional tips: Apart from the asset allocation and category allocation guidelines above, there are a few other points that can come in useful for decision-making:

- When you need to increase or decrease your equity or debt allocation, you can either rebalance (reduce one and increase the other) or bring in fresh sums if you have the surplus.

- You can go for passive funds or active funds or a combination when adding to your portfolio. There are no cut-offs or rules on active-passive allocations.

Portfolio quality

The Quality section gives the Prime Research team’s view on the funds you hold. These calls are based on each fund’s performance compared to its category, taking into account returns across timeframes, trends in returns, and other metrics.

- Funds with a Buy call can be further invested in.

- Funds with a Hold call can continue to be held, but try to avoid further investments. If you have SIPs in these funds, stop them and shift the SIP to Buy funds or Prime Funds. However, if there are only a few installments (6-8) left to complete, then you can let it run fully.

- Funds with a Sell have seen poor performance relative to peers. You can exit in one go, phase it out based on your tax impact, exit at the time of rebalancing or when you need the money. Reinvest in funds with a Buy call or in Prime Funds.

- Funds with ‘No Opinion’ do not cross our gating criteria (in terms of track record or AUM), or are thematic/international. For new funds that are recently launched, you can choose to hold until they build up some record. For thematic/international funds, you can contact us for our research team’s views.

Do note that you can go for passive funds or active funds or a combination when adding to your portfolio. There are no cut-offs or rules on active-passive allocations.

Concentration

Suggestions on fund count and concentration are based on the ideal range given your portfolio size.

- If you need to reduce the number of funds, start with funds with a Sell call and then a Hold call. You can also exit funds which account for a very small part (<2-3%) of your portfolio.

- If you need to increase the number of funds or reduce concentration, go for funds that offer diversification or complement your existing funds. For example, in equity you can mix growth-style, momentum-driven, value-style, focused-style etc. In debt, you can mix different maturities.

Expense ratios – Regular vs direct

There are some funds where the regular plan is by far more expensive than the direct plan. Our research team arrives at this by looking at the differential in the expense ratios of the direct and regular plans of a fund and comparing this to the average for the category.

- Where the differential is higher than the category average, you will be able to make good cost savings by opting for the direct plan. For these funds, make fresh investments only through the direct plan. If these funds have a Sell call, exit these funds first.

- Where the differential is below the average, you can continue to hold these and if convenient, carry on investing. However, run a check once in a while to ensure that the fund expense remains reasonable.

- You can also choose to exit the regular plan and reinvest in direct, but be aware that this will entail capital gains tax.

Portfolio Review Pro – FAQs

With this, you know how to use the Portfolio Review Pro. But there will be other common questions about this tool, which are answered below.

What goes into the portfolio review?

The Portfolio Review Pro takes inputs on your age, risk and goal time frame. These go into arriving at the ideal asset allocation and assessing the actual risk level of your portfolio. Portfolio risk is calculated using your timeframe, the weight of each fund category in your portfolio and its risk plus suitability given the timeframe. For example, if you hold, say, corporate bond funds in a 1-2 year portfolio, the tool will highlight this to be risky as these funds tend to deliver optimal returns only over 3 years or more, and can be poor performers or volatile in shorter periods.

Similarly, higher equity allocation in short-term timeframes, holding higher allocation to small-cap or thematic funds, excessive allocation to gold, silver etc are all taken into account while arriving at the portfolio risk. You will need to assess this risk in context of your stated risk level. Your stated risk is considered to provide observations on your asset allocation alone.

Quality is assessed based on the fund performance and the research team’s call on the funds you hold based on its performance vis-à-vis peers (and not how well the fund has done for you). The tool calculates the extent of concentration in your portfolio, based on the portfolio size, number of funds you hold and AMC-wise exposure. If you hold regular plans, the tool also assesses those where expense ratios are disproportionately high compared to the direct plans.

Is the tool an ‘advice’ on my portfolio?

No. The Portfolio Review Pro uses the inputs you provide and arrives at an ideal allocation for such time frame, risk and age. These ideal allocations are driven algorithmically, based on time-tested allocation principles and years of back testing on risk-return payoffs for different time frames. The portfolio risk is based on the fund category’s risk and the suitability of the same for your time frame and allocation. The individual fund calls (recommendations) are done by our own research team based on fund performance.

All of these are meant to act as a guide and are neither advisory in nature nor tailored specifically for you. You should do your own research or consult an advisor before taking investment decisions.

Who should use Portfolio Review Pro?

Anyone with a mutual fund portfolio can use the Portfolio Review Pro. However, the tool is specifically designed for growth-oriented portfolios – whether for the short term or long term. This tool may not provide you with the right inputs on an income generating portfolio (such as funds being used for SWP). In other words, the tool is best used for growth portfolios with any time frame in mind.

How do I know what action to take in my portfolio?

You will get the following output from the Portfolio Review Pro tool:

- The ideal asset allocation to have

- Whether your portfolio risk is higher than what you had assessed it to be

- Whether the funds you hold are a buy/hold/sell based on our fund research

- The ideal number of funds to have

- Which regular plans are above average in cost, warranting a switch to direct.

These inputs will help you decide whether to reduce or increase your equity/debt, lower your risk (we have provided a guide on how to do it), exit poor quality funds and reduce the number of funds.

How frequently should I use this tool?

You can and should use it periodically but not too many times 😊 Your own investments change, your asset allocation changes unknowingly as markets move up or down and fund performances keep changing. To know whether you are on track and to make course corrections on time, it is necessary that you regularly use Portfolio Review Pro to ensure you are on the right track. This is possible only if you are a PrimeInvestor. If you are not a Prime subscriber, subscribe today to reap the full benefits of this unique tool besides the host of other recommendations and tools on the platform. Click here to subscribe.

How is the Portfolio Review Pro tool different from others in the market?

There are a few tools that are currently available, and these primarily allow you to merely track your mutual fund portfolio by simply putting together all your funds. A few of these provide a handful of general observations on your fund holdings - but most are not actionable, do not help you in arriving at an optimal portfolio for you, and are not comprehensive. We can confidently say that PrimeInvestor’s Portfolio Review Tool is unique in its ability to allow you to track, analyse and offer actionable insights.

How do I fetch my funds?

If you are not a Prime subscriber, simply register with us for free, and enter your PAN and mobile number. You will receive an OTP. This will permit us to fetch all your mutual fund holdings, regardless of where you hold them. You can come back and view your portfolio at any time. If you are Prime subscriber already, you simply need to give your PAN the first time and enter the OTP you receive.

Why do you need my PAN and phone?

Your PAN and phone are collected to obtain your mutual fund holdings from the RTAs. The information procured will be used solely for analysis purposes and to provide insightful information about your portfolio to you.

How many PANs can I enter?

At this time, the Portfolio Review Pro allows only one PAN per user/subscriber. Therefore, please use the PAN for the portfolio you most frequently manage. We are working on permitting multiple PAN per user, and we hope to roll that out in a few months.

Do I need to enter my PAN every time I want to view my portfolio?

No. The Portfolio Review Pro auto-populates the details fetched when you first provide the PAN. So, the next time you view it, your portfolio value, fund returns and review will be updated. However, any additions or redemptions you make to your portfolio in the meanwhile, will not be updated unless you refresh the tool.

Where do you get my mutual fund data from?

We fetch your data from registrar and transfer agents (RTAs) of mutual funds.

How frequently can I refresh my data?

If you have made any changes to your funds after the last time you used Portfolio Review Pro, you will need to refresh to populate the fresh data. You can refresh the data through an OTP. If you have subscribed to our free trial, you will be able to fetch your fund holdings only once. After that, for any refresh to update your data and changes to your portfolio, you will have to become a PrimeInvestor subscriber. For Prime Essentials subscribers, you can make such refreshes once in 14 days. For Prime Growth subscribers, you can refresh once in 7 days. So even if we say so ourselves, Prime Growth, along with its other features, will be a great value-buy!

Can PrimeInvestor make changes to my portfolio?

Absolutely not. By using Portfolio Review Pro, you are merely letting us to fetch your data from multiple places and allowing us to analyse them to provide actionable insights about your portfolio. We simply have access to information on your fund holdings and cannot act or transact on your behalf in any way. We are not a transaction platform and have no agenda save for letting you know if your portfolio is doing well or otherwise. You will need to carry out the changes through the platform where you invest based on your own final investment decision.

How safe is my information with you?

All data are stored in highly secure, India-based servers and transmitted in industry-standard encrypted formats. PrimeInvestor Financial Research Pvt Ltd (PrimeInvestor.in) WILL NOT share any personal information about you with any third-party for any reason, unless required to do so by market regulators or government agencies. The information procured will be used solely for analysis purposes and to provide insightful information about your portfolio to you.

PrimeInvestor Financial Research Pvt Ltd (with brand name PrimeInvestor) is an independent research entity offering research services on personal finance products to customers. We are a SEBI registered Research Analyst (Registration: INH200008653). The recommendations of funds, if any, given in the tool, are our view on the individual mutual fund schemes based on qualitative and quantitative parameters specific to the scheme. They are not a view on your portfolio. The suggestions given in the tool are based on common asset allocation and holding practices for a given timeframe and risk and not specific advice on your portfolio. They should therefore not be construed as portfolio advice. The user must make his/her own investment decisions based on his/her specific investment objective, existing holdings and financial position and using such independent advisors as he believes necessary for the purpose.

Mutual funds and subject to market risks. Please read all scheme information and related documents before investing. Past performance of funds is not an indication of future returns.

Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Please read our disclosures and disclaimers here: https://www.primeinvestor.in/disclosures-and-disclaimers/