Thanks for visiting PrimeInvestor!

Hi, My name is Srikanth Meenakshi - I am a co-founder at PrimeInvestor. Thanks for visiting. After reading this article, I welcome you to check out our offerings here. You can also learn more about our team . And, you can start using our services by signing up for a trial.

We help you be careful with your money. Stay informed. Sign up today!

Coronavirus and Capital Markets – Where should you invest now?

Vidya Bala, Head of Research, PrimeInvestor

(With inputs from Aarati Krishnan)

Do you remember the last time that the Nifty fell over 500 points on a single day? Wondering if it was in 2008? No, because it never did in absolute value terms. That’s what makes March 9, 2020’s Nifty fall so scary. And because it is scary, many investors are taking the flight to safety route, looking for safe debt options or piling on to gold instead of volatile equities.

But at Primeinvestor, we think this is the time to raise allocations to equities and not to take refuge in debt or gold. Here’s why and where to invest.

Not the time to chase gold

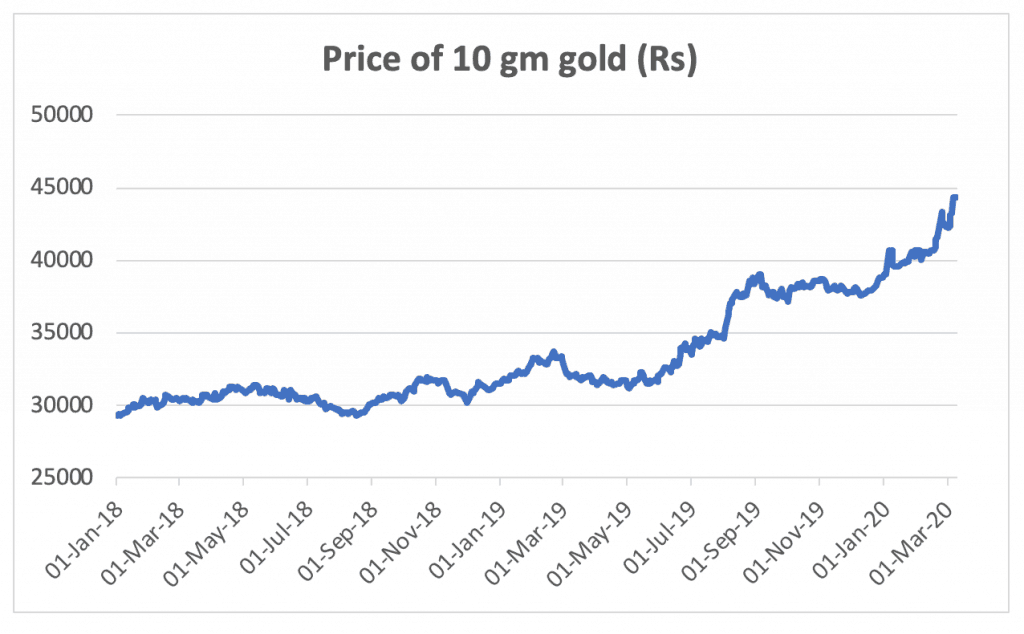

With the deadly cocktail of coronavirus and recession fears hitting global markets, gold has been the recent hero. Globally gold prices have now gone back to highs of 7 years ago (2013) but in India, thanks to Rupee depreciation, gold is at a life high. From the last low of August 2018, gold has risen an absolute 51% or 25% annualized till March 9, 2020. About 11% of those gains have come after the news of coronavirus gripped the market in the latter part of January 2020.

But gold’s recent performance is in itself a good reason to stay away from raising allocations to it, in your portfolio. Chasing assets that have performed well in the recent past always leads to sub-par returns in the long run. What’s more, the key role of gold in any portfolio is that of a hedge, an insurance. You don’t take an insurance after the event has transpired because that’s when premiums are sky-high. The purpose of insurance is to take cover before risks crop up. Yes, gold will likely rally for a while until the uncertainty of coronavirus or recession fears linger. But as an entry point, this is the wrong time to raise allocations to gold.

Yield at 11-year low not conducive

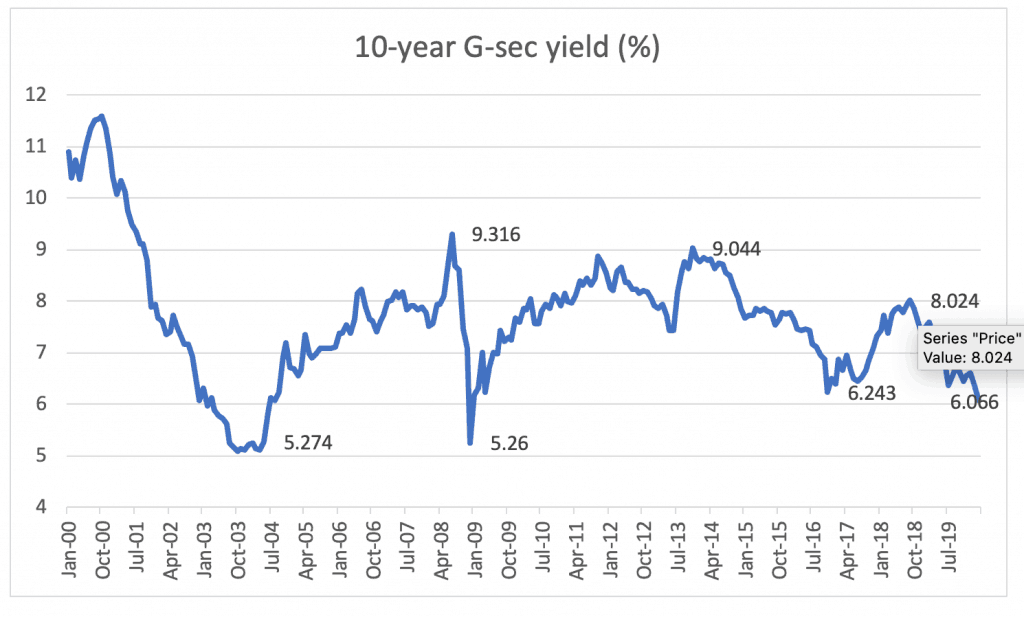

If this isn’t a great time to add gold holdings, debt investments in India are also at an unattractive entry point. Historically, the best time to raise your debt allocations in India has been when the 10 year government security yield hovers between 8-9%. After the recent bonds rally, we’re now at the opposite end of the spectrum – with the 10 year at 6.06 %. Entering bonds now will mean a double whammy on your debt returns – from low interest accruals and a possible capital loss when rates eventually bottom out and begin to rise.

To place this in context, during the financial crisis year, Indian 10-year yields remained elevated at an average 8% for whole of 2008 and only by end December 2008 did they fall below the 6% mark and that too for a brief while. In the past 20 years, the 10-year g-sec has fallen below 6% just 8% of the times and did not go below 6% even once after January 2009.

Are you staying with good quality funds? Use our MF review tool to know whether to buy hold or sell your funds. All this and more with a PrimeInvestor membership. Sign up today for a free trial!

While one can argue that India might resort to further easing of rates, the following points are noteworthy:

- Market yields mostly run ahead of actual rate cuts, tuning in to market cues and inflation expectations.

- The RBI has paused rate cuts and seems to prefer using more innovative tools such as the Operation Twist and long-term repo operations instead, to manage borrowing costs and liquidity

This essentially means that whether you lock into deposits or lock into quality bonds today, your return prospects will suffer from low interest income or low capital gains or both. If you decide to search for higher interest rates, you may have learnt by now from DHFL and Yes Bank that they do not come without risks at this juncture. This is true of high yielding mutual funds too. This does not mean you should stay away from debt entirely. Please read our recommendation part to know when and how to use debt.

Time for equity

When it comes to asset allocation, adding when everyone’s fearful is the best maxim to follow. Equity certainly makes the cut today as there’s plenty of pessimism in the markets, with people taking a negative view of every event.

Here’s why we think this is good time to start raising your equity allocations and start deploying surplus cash if any.

- India is one of the few countries to actually gain, over the medium term, from the oil price wars that have sent crude oil to sub$40 levels. According to reports a $5 per barrel change in crude oil per year can bump up India’s GDP by 25 basis points, arising from lower current account deficit. The relief arising from lower crude prices can be quite significant for the economy and for companies using petro-linked inputs too. Industries spanning transportation, logistics, auto, cement, airlines, FMCG and paints will benefit from lower input prices with margin improvements from favourable crude prices.

- The coronavirus assault has ended the uncertainty about whether global central banks will launch another round of rate cuts and stimulus. The US Fed by cutting rates by 50 basis points has already set this motion. If the present global mood of easing rates to rescue economies from coronavirus continues, that’s a boost for global liquidity which will find its way into India through the FPI route. As things stand, India is better placed than many emerging nations, in terms of impact from the virus outbreak.

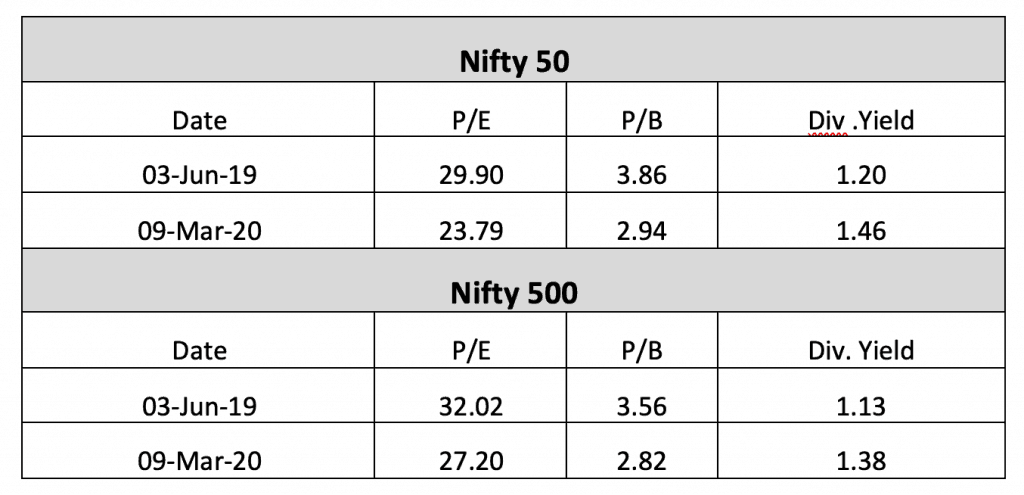

- India’s market valuations, seen from a price-book perspective are not as expensive as they were in previous market tops. While price to earnings went far lower during the 2008 correction, the price to book ratio remained elevated. From a peak of 6.5 in January 2008, it still remained an average 4.2 times for whole of that year (it hit a low of 2.1 in October 2008 before recovering). To this extent, the Nifty’s price to book value of 2.9 times and the Nifty 500’s 2.82 times today, offer some comfort that markets are not abnormally expensive. Do also note that while certain segments of the market have participated in this bull market and are expensive still, others have mainly sat on the sidelines and are already at attractive valuations. Not all sectors or stocks in the market bottom out at the same time.

Phased allocations

But if the time for allocating more to equity is here, should you deploy your entire cash or jump in with lumpsums right now? Our answer is to go in for phased deployment owing to the following:

Contained but not insulated: As things stand today, the coronavirus spread in India appears contained. But then the global impact has become too serious for India to say it is cocooned from the impact. When SARS broke out in 2003, China accounted from 4.2% of world economy. It now makes up 16.3%. Next, with Europe and US reporting serious virus breakout numbers, the impact in India cannot be isolated, global monetary easing notwithstanding. The volatility and downside from this will persist for some weeks or months and India will not remain unaffected.

Not a massive correction: The correction of 15% for the Nifty 50 and the Nifty 500 from the past peak of January 17, 2020 are hardly a blip from a historical perspective. In 2008, for instance, the Nifty 50 was trading at 23 times just a month after the correction began and went as low as 10.7 times in October 2008. Currently, after the correction, the Nifty valuation is at 23.79 times. This must also be seen in conjunction with the present earnings situation. The turnaround in earnings in September and December 2019 has largely been driven by banks. The Yes Bank issue could place a speed-breaker to the sector’s earnings recovery, as contagion effects play out and depositors and fund providers for banks go through risk aversion mode.

Gain access to the best mutual funds, ETFs, deposits and portfolios to invest in and get regular updates on them. Plus, top strategies for different markets. All this and more with a PrimeInvestor membership. Sign up today for a free trial!

Takeaway: The above points tell you that you cannot be sure this is the bottom. And if this really is the bottom of this market move, it is not good enough an entry point to put in all your money.

How to allocate?

So here’s what we think you should be doing now.

- Any funds kept for near term use – within the next year or two is best deployed in safe FDs and liquid funds or ultra short funds. You can check our fund recommendations at https://www.primeinvestor.in/

prime-funds/. In other words, don’t treat the present opportunity as a punt in equities, for short-term gains. You may be hurt. - If you have limited capital to deploy for the long term (over 5 years), stay off gold and debt.

- You should incrementally allocate to equities. But with the caveat that you should not need this for the next 5 years. Do read our article on https://www.primeinvestor.in/

investing-in-turbulent-times/ - If you are a seasoned investor, start allocating to stocks that you have been wanting to buy in 3-4 tranches, treating the present as tranche 1.

Would you like to know WHERE to invest in these turbulent times? Check out our list of expert picked investment options – Our Prime Funds List. Subscribe to become a PrimeInvestor for this and other benefits!

Looking for more such, well-researched, actionable insights? Sign-up for a FREE trial of PrimeInvestor today!