Prime Q&A: How are segregated mutual fund units taxed?

Budget 2019 brought some clarification on how the amounts received by an investor in segregated mutual fund units (also called side-pocketed units) need to be taxed

Budget 2019 brought some clarification on how the amounts received by an investor in segregated mutual fund units (also called side-pocketed units) need to be taxed

A few days ago, we conducted a survey among our (paid) subscribers. We got a fantastic response for it from our audience. Typically, for such surveys, a response of 5-10% is considered good. We got a whopping 25%+ response rate. That in itself shows how engaged and committed our customers are. Thanks to everyone who gave their opinion!

With the Finance Minister’s 5th economic package announcement being released even as we write this, the break-up for the Rs 20.97 lakh crore package is out. There can be many chapters to write about each of these packages and what they seek to achieve.

We have made our quarterly review and changes to our list of recommended ETFs – Prime ETFs. Before we move to the changes, a brief note on how we pick our ETFs. We start with comparing indices on which ETFs are built. We look at them from their ability to consistently deliver, contain downsides and beat peers and even active funds.

We are starting a new series of posts today. We plan to take REAL questions from customers and publish the question and our answer to it here for everyone’s benefit. We will choose only such questions where the answer would have a wide applicability. Nevertheless, please note that not every question and answer may apply to your specific situation. Caveat Emptor.

Repo and reverse repo rate cut, asymmetric LAF corridor, Long Term Repo Operations, moratorium. With words like these used freely in RBI’s package announced on Friday, ordinary borrowers and investors may be wondering if they have anything to cheer about. If you’ve been puzzled too, here are the measures explained in plain English.

While the Union Budget 2020 seems to have sorely disappointed stock markets which had built up hopes for everything from a Long-Term Capital Gains tax exemption to a magic pill for the economy, it seems to have given bond markets some reasons to cheer.

The budget is rationalising subsidies and focusing on capital spends. It is not helping the banks or NBFCs directly but providing ways for them to revive themselves.

Budget 2020 disappointed investors and markets. Is it all as bad as it is made out to be? We’ll discuss that in a more detailed article next week. For now, let’s look at the impact on your personal finance and taxes.

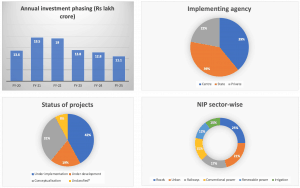

For the economy, the lack of push from the infrastructure has meant slower growth. In this scenario, will the National Infrastructure Pipeline (NIP) unveiled by the Finance Minister on New Year’s Eve provide a shot in the arm for the ailing economy and consequently, cyclical sectors?

The over 92,000 staffers who have opted for the Voluntary Retirement Scheme (VRS) from BSNL and MTNL are now faced with the challenging task of finding a safe parking ground for their money while making sure it earns reasonable income in a low interest rate environment. They need to factor in liquidity and tax efficiency too. If you’re a VRS optee, don’t worry. Here’s a list of attractive investment options, ranked in the order of their safety.

Owning bonds, unless you are well-diversified, has become a super risky proposition since September 2018. Credit risk and drying up of liquidity have proved to be lethal combinations to manage for investors. Now the debt ETF space may receive some life with the soon-to-be launched defined maturity PSU Debt ETF.

Hold On

You are being redirected to another page,