Neobanks in India

Neobanks are banks that are 100% virtual. What makes these Neobanks in India interesting is that they simplify the whole banking process.

Neobanks are banks that are 100% virtual. What makes these Neobanks in India interesting is that they simplify the whole banking process.

Stocks to Riches explains the fundamental concepts one needs to understand, to achieve success in the stock markets. Concepts like investing, differences between trading and speculation, loss aversion, sunk cost fallacy (and how to avoid falling into it), decision paralysis, mental accounting, and herd mentality. Every investor has dealt with and will have to deal with these situations in their investment journey. So having all these concepts neatly compiled and explained in one book certainly helps.

If you’re wondering where to invest money in India, here are 8 different options you can consider. “Today people who hold cash equivalents feel comfortable. They shouldn’t. They have opted for a terrible long-term asset, one that pays virtually nothing and is certain to depreciate in value.” – Warren Buffett

What are the best ELSS funds?

There’s a lot of research work that needs to be done when finding the best ELSS fund. You need to look at factors such as:

Consistency in performance against peer group and benchmark

Volatility in performance

Ability to contain downsides in a correction and ability to deliver in bull markets.

Investment strategy across market cap

Expense Ratio (the lower, the better)

In this article, we’re going to discuss 2 powerful ways on how to save money from salary. Set aside a portion of money from your salary the moment you get paid. Then, do what you like with the rest. Don’t pay anybody else that money. That amount is YOURS. That is the first lesson in how to save money from salary and a super-important concept.

How to invest in share market -The first step you need to take (even before you invest in the share market) is to identify your goals.

What is an ETF? And what gives ETFs that edge?

If you’re looking to invest your money in a well diversified investment, with little active management from your side and at an extremely low cost, then ETFs are A GREAT CHOICE for you!

What is a demat account? A Demat account is used to hold demat shares (and other assets like ETFs, mutual funds, bonds, and government securities). SEBI has made it mandatory to allow trading only for those who have a demat account and demat holdings. This means that you cannot buy or sell shares without having a demat account.

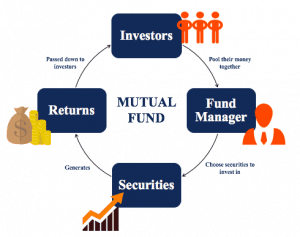

What are mutual funds? Mutual funds as an investment alternative has been gaining prominence over the decade. Since it is integral to gain more information about it before investing, this article seeks to act as a starting point in your mutual fund journey.

Hold On

You are being redirected to another page,