Notwithstanding the risks and volatility that come with it, equity remains the asset class of choice for investors seeking to build wealth and beat inflation. Gains come in the form of capital appreciation and dividends. Because alpha on stock investments may sometimes seem elusive and capital gains are not real until profits are booked, you may prefer stocks that provide a dividend which acts as a stream of income. But how does one view and evaluate stocks to identify them as the best dividend paying stocks? Here is a look at the metrics that will and will not help in this evaluation.

What is dividend?

First things first, dividend is a distribution of profits by a company. It is a ‘reward’ for shareholders and can take many forms. Dividends are usually distributed out of excess profits or retained earnings. It is not mandatory for a company to pay dividends and typically younger companies tend to pay less dividends as they plough back profits into growing the business. Mature companies with stable profitability and sizeable reserves are more likely to make regular dividend payouts. Dividends are declared by the board of directors. Dividends can be interim (declared and paid during the financial year) or final dividend (declared at the end of the financial year at the annual general meeting).

When looking at identifying the best dividend paying stocks, three metrics usually pop up – dividend rate, dividend yield and dividend payout. It is important to know the difference between these metrics as they can otherwise be misleading.

#1 Dividend rate

The dividend rate is simply the total dividend per share for the year in question as a percentage of the face value of a share. It is primarily useful in comparing year on year dividends of the same company because the denominator, which is the face value, remains constant. For instance, if a company declares a final dividend of Rs. 30 per share and the face value of one share is Rs. 10, the dividend rate would be 300%. For identifying the best dividend paying stocks, though, this is not really a useful metric.

#2 Dividend Yield

Dividend yield is probably the most commonly used – as well as misused – tool to pick stocks that will fetch dividend incomes, and is associated with the investment approach of guru Benjamin Graham. The dividend yield, expressed as a percentage, shows annual dividend as a percentage of the current share price. The dividend yield denotes the return (from dividends alone) relative to the price paid for the stock. Theoretically, a high dividend yield means that the stock has paid out good dividends for the price you are paying for it.

However, a high dividend yield is often mistakenly believed to be an attractive investment opportunity. A deeper look tells you that setting store in high dividend yields alone is not going to get you to the best dividend paying stocks.

If one were to quickly screen stocks based on dividend yield alone, one would end up with a list that looks something like this table below.

But can one really take this list at face value? There are several observations that can be made, seeing the data above, on using the dividend yield as a deciding factor.

- Behind a high dividend yield could be hiding lackluster or even falling sales and operating margins, concerning levels of promoter pledge, inefficient working capital management, a weak balance sheet among many other issues. Next, the dividend yield simply tells you the past dividend paid in relation to the market price now – it does not mean that the dividend itself is high.

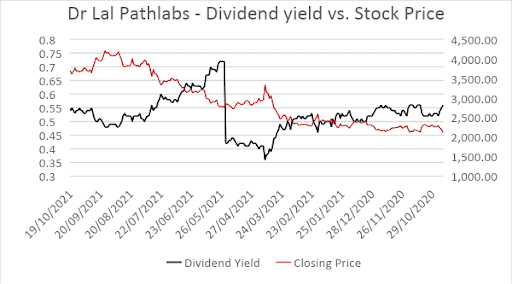

- The factors that affect the dividend yield are the dividend and the share price. If the share price were to be low, the yield could be high. For companies where fundamentals are on shaky grounds, as mentioned in the preceding point, the stock’s price could reflect those poor prospects. Such falling share price could result in a dividend yield that is rising, even without the company paying out much in dividends. Conversely, a high share price can result in a lower dividend yield, but this does not mean the stock is a poor one or that it does not pay out dividends. This inverse relationship can be seen in the graph below.

Therefore, what looks like an attractive dividend yield may actually just be buoyed up on a crashing stock price or vice versa. What will also usually figure on a list of high dividend yield stocks are PSUs that are mandated by Government guidelines to pay a certain minimum dividend each year. While this is a huge plus for investors as it increases the likelihood of getting stable dividends, the future prospects of the business have to be studied with the same lens as other companies.

- The dividend itself also matters. At the top of the high dividend yield list above is Aurum Proptech, formerly known as Majesco, with a dividend yield in excess of 1000%. While this number is high enough to make some people fall off their chair, a look beyond the dividend yield shows that a dividend of Rs. 974 per share (dividend rate of 19,480%) for FY 21 is behind this astronomical yield. Not just that, this is an unusual dividend, with the company’s track record of Rs. 1 and Rs. 2 in the past. The dividend was a result of the company deciding to sell the US arm of its business and distribute the resulting excess sale proceeds with the likelihood of delisting sometime in the future. This current dividend yield figure, though eye-catching, is not sustainable and could be misleading.

The dividend yield, therefore, is best used as a valuation metric rather than an indicator of being a good dividend payer. We’ll explain more further down.

#3 Dividend Payout

If the dividend yield does not tell you about how good are dividends a company is, what does? Look to the dividend payout ratio. This is the proportion of earnings (profits) that a company pays out as dividend. It is obtained by dividing the dividend per share by the earnings per share for the same time period. Several factors have to be considered while interpreting the dividend payout ratio.

- Look at the dividend payout ratio over a period of time to understand the trend for the company. A single year’s payout ratio can come from one-off events as explained above. Past payout ratios can offer clues as to the future dividend payout that can be expected.

- If you are looking for companies that pay up good dividends, you need to identify those that have stable payout ratios over the years, and where such payout ratios are above average (more on this below)

- Younger companies could have low or even zero dividend payout ratios as they plough back their earnings into growing the business – such companies are not the choices if you are keen on identifying the best dividend paying stocks. Instead, you need to look for more mature businesses which will have higher dividend payout ratios that are also more likely to remain stable year on year.

- Payout ratios could also be an indicator of a company’s ability to expand; a too-high payout ratio could indicate that the company is not reinvesting enough in its growth which could in turn weaken long term prospects.

- A ratio that is over a 100 percent indicates that the company is distributing more than it earned that year and could also raise concerns over whether such dividend payouts will be sustainable.

- Payout ratios also tend to differ across industries.

How to identify the best dividend paying stocks

Let’s take a simple filter of the Nifty 500 stocks with their financial year ending in March 2021, filtering companies with:

- a dividend payout ratio above the average payout of all the Nifty 500 stocks for the last three years,

- increasing dividend per share in the last three years

- have not had a payout over 100%

The results are captured in the table below.

What stands out in the list above is that most don’t have a dividend yield ratio of above 3%. That is, these companies have steadily paid out a good chunk of their earnings as dividends, but are also favoured by the market.

Therefore, if your intention is to pick the best dividend paying stocks, here’s putting together all that we have explained above.

- Dividend yield and dividend payout are two different metrics and need to be used correctly.

- Dividend yield is more a valuation metric to know if a stock is underpriced. One half of the dividend yield equation is the price. A high dividend yield on a stock that is still strong on growth and fundamental aspects could indicate buying opportunities; the high dividend yield here indicates that prices of an otherwise quality stock could be depressed, thus presenting a ‘value’ buy.

- Dividend payout ratio is the real indicator of a company’s dividend-paying ability. If the company is also a sound, quality one with steady growth and strong fundamentals, or if markets have already picked up on the dividend opportunity in these companies, chances are that their dividend yields are low.

- Dividend yields can be used to compare across peer stocks and can help in determining the entry level for a stock after it has been selected. The higher the entry price of the stock, the lower will be the dividend yield. If you specifically are looking for the best dividend paying stocks in order to build up a portfolio of stocks to earn income through dividends, then the focus should be more on identifying steady payers and pay less attention to dividend yields.

- There can be no substitute for sound fundamentals. The only way to select the best dividend paying stocks is to study the performance, balance sheet strength, business and potential of the company. Dividends are not guaranteed or assured and are dependent on earnings growth the company generates and how well it is placed to expand. This makes company quality a key factor in determining if the stock is worth holding on to for dividends.

- Our earlier articles, ‘In dividends we trust: The right way to approach dividend yield investing’ and ‘Value Investing with 2 accurate case studies’ have invaluable insights on how to approach dividend yield investing and stock selection. Component stocks of the Nifty Dividend Opportunities Index and the S&P BSE Dividend Stability Index could provide good starting points.

To summarise, if you intend to benefit from dividend income, you need to identify companies with a longer-term record with above-average dividend payout ratios – and which are also quality companies in terms of growth and fundamental strength. You need to accumulate significant sums in these stocks for the dividend amounts to be meaningful. And finally, you need to hold them for long term for the cumulative dividends over the years to provide you with your dividend yield.