The author is an external contributor. Views are personal and do not reflect the opinion and views of PrimeInvestor.

The Nifty 50 index continued to power ahead and crossed the 24,000+ target that was mentioned in the beginning of this calendar year. While the Nifty sailing at all-time highs may convey a bullish picture, there may not be as much enthusiasm at the portfolio level. The deterioration beneath the surface is not quite captured by the frontline indices trading at lofty levels.

Let us try to decipher what is in store for the Nifty 50 index in the near term and which sector / index to focus on, in the present market environment.

Nifty Short-Term Outlook

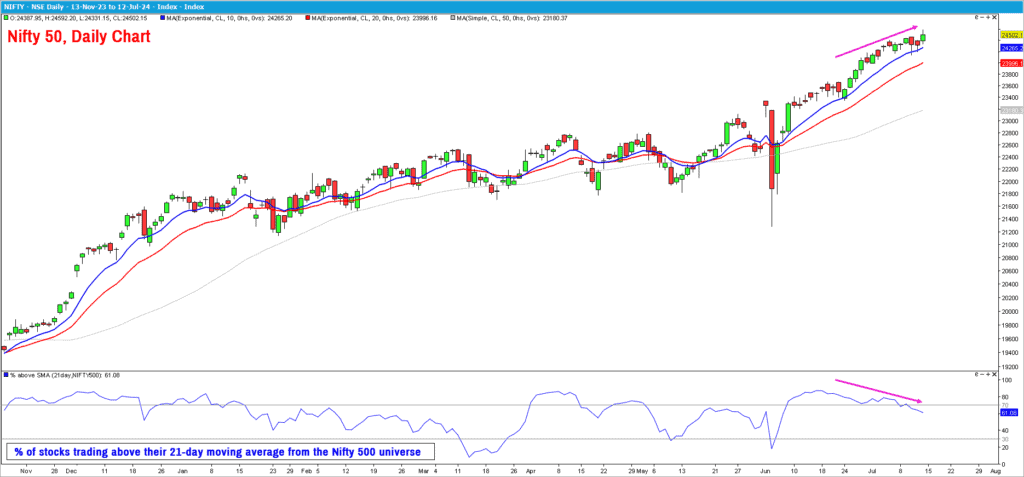

Here is the daily chart of the Nifty 50 index. The price continues to move higher and has maintained the bullish structure of higher highs and higher lows. Hence, there is nothing bearish technically in the Nifty 50 chart. The next probable target for the index is 25,100-25,200 zone. The short-term outlook would remain bullish as long as the index trades above the recent swing low of 23,300.

While the Nifty 50 index is at all time highs, there are quite a few red flags that one needs to take cognisance of.

As highlighted in the chart above, there is a stark divergence between the Nifty’s price action and the short-term breadth indicator. The lower pane in the chart above captures the percentage of stocks from the Nifty 500 universe that are trading above their 21-day exponential moving average.

As highlighted in the chart, the breadth indicator is tracing out a series of lower highs even as the Nifty 50 index is coasting higher. This is a sign that the market participation is thinning out and fewer stocks are participating in the rally which seems to be centred around a few stocks from the Nifty 50 basket.

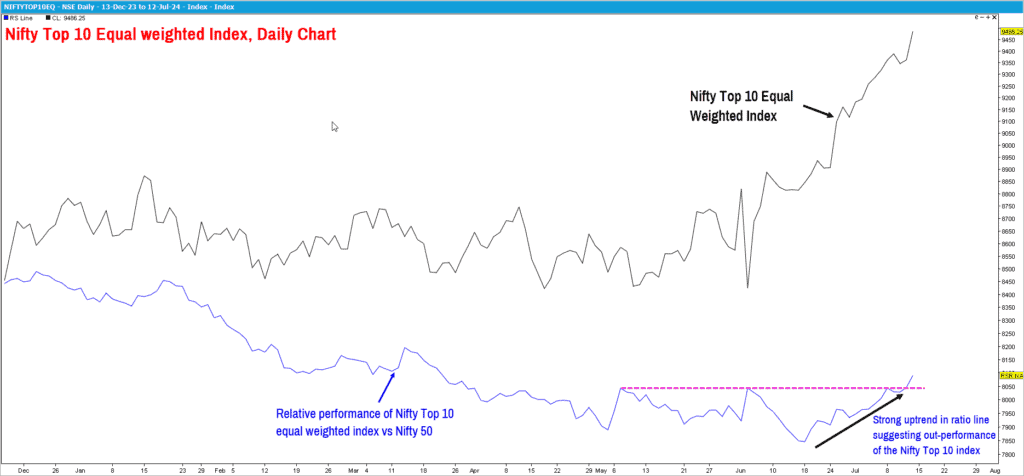

Here is another dimension to the Nifty behaviour and the price action being limited to a narrow basket. Have a look at the relative performance chart of the Nifty Top 10 equal weighted index versus the Nifty 50 index.

It is apparent from the above chart that the Nifty Top 10 Equal Weighted index has outperformed the Nifty 50 index in the recent weeks. This indicates that the select index heavyweights are powering the index higher.

The broader observation is that the participation is thinning out in the broader markets as well as within the Nifty 50 basket too. In this environment, it would be safer to take strategic short-term bets in select stock and sectors. This is probably not the time to enhance equity exposure as broader market participation is not lacking.

Let us shift our focus to few sectors and market segments. To begin with, let us get started with the Nifty SmallCap 250 index.

Nifty SmallCap 250

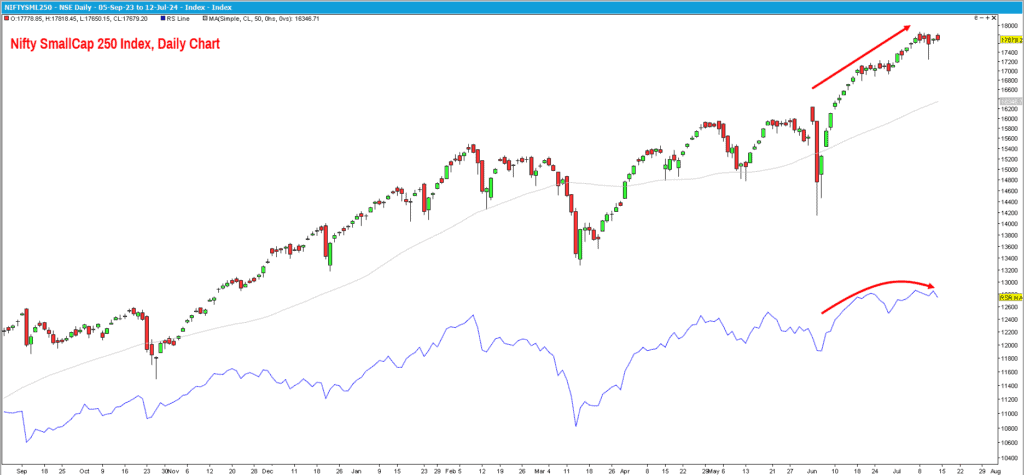

As highlighted in prior updates, the Nifty Small cap 250 index has been an underperformer versus Nifty 50 over the last several months.

After a brief bout of outperformance, the relative performance of this index seems to be tapering off in the last few weeks, suggesting underperformance. Select small cap stocks continue to display strength and it would be advisable to focus on those pockets or sectors from a short-term trading perspective.

From a technical perspective, the trend remains bullish. A breach of 14,100 would indicate a major trend reversal while a fall below 16,700 would be an early sign of weakness.

Nifty India Digital Index

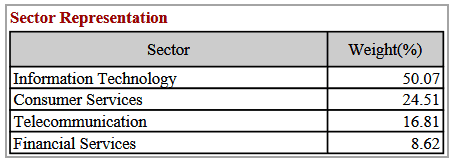

This index is in a strong uptrend and has also managed to outperform the Nifty 50 index recently. Here is the sectoral weightage of this index, sourced from the www.Niftyindices.com website.

While the IT stocks have a significant weightage in the Digital index, there is an interesting mix of stocks from other sectors including telecom and financial services. The short-term outlook for the index remains bullish and expect a rally to 10,000-10,100 in the near term. The bullish outlook would be invalidated on a close below 7,100.

Nifty IT Index

We had highlighted this index in the previous technical outlook, suggesting that the outlook is turning bullish and the relative outperformance was the last missing piece in the puzzle. The recent rally in the IT index has resulted in a strong outperformance of this index versus Nifty 50.

The IT index is perched close to its all-time highs and the relative performance chart is in a strong uptrend in the short-term. This suggests that the IT index is the one to focus on, in the near term. The immediate target for index is 41,250-41,500 range and a push to 43,500-44,000 may not be far-fetched. A drop below 34,500 would warrant a reassessment of the bullish outlook for the Nifty IT index.

Nifty Bank Index

While the Nifty Bank index displayed a lot of promise a few weeks ago, the bullishness has fizzled out recently. While the index reached the 53,000-target mentioned in the previous update, there are signs of relative weakness versus Nifty 50 index. The overall trend remains bullish for Nifty Bank and a rally to 55,000-56,000 appears likely.

The bullish outlook for the Nifty bank index would turn bearish on a break below 46,800. Along with the IT index, the Bank index could play a key role in keeping the Nifty aloft.

Nifty MidSmall IT & Telecom Index

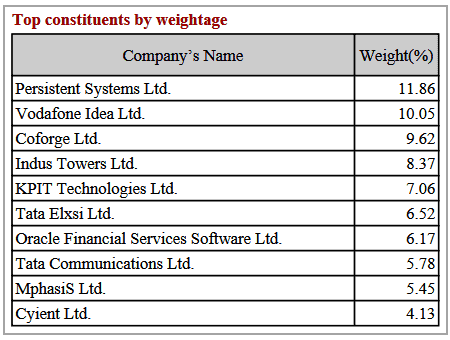

This is another interesting and bullish index. As the name suggests, this index tracks the performance of mid and small cap stocks from the IT & telecom sector. Here is the list of top 10 stocks of the index in terms of their weightage. The data is sourced from www.nseindices.com

The short-term outlook for this index too is bullish and a rally to the next target of 12,500-13,000 appears likely. Keep this index in your watchlist and look for entry opportunities in appropriate stocks. Also check if there is any mutual fund tracking this index. The bullish view for this index would be invalidated on a close below 8,800.

Other Sectors

The stocks from the defence and railways sector have been performing well recently. Avoid big exposures to these sectors at current levels as the rally seems to be slightly extended, at least from a short-term perspective. Wait for a pull back or a price consolidation before taking fresh exposures in these sectors.

Those having exposures in defence and railway stocks may remain invested and focus on their exit criteria.

To sum up, the trend for the Nifty 50 index remains bullish though the lack of stock participation is a glaring divergence. Be cautious and be extremely selective in picking stocks. Look for stock / sector specific opportunities and take strategic short to medium term bets. This is probably not the time to make big lump sum allocation in the market.

11 thoughts on “Technical Outlook: Market participation thinning out for the Nifty 50?”

Hi,

Does Franklin India Technology Fund have EMS stocks in it or which fund invests in them?

Thanks

Rajiv

if you mean electronic manufacturing – nothing meaningful. it is unlikely we have that many stocks to play it as a portfolio. it is best to go the stock way for this. We have a global semi-conductor fund – Nippon India Taiwan Equity Fund but not sure whether it is open for investment. Vidya

Hi,

Does Franklin India Technology Fund cover the Nifty India Digital Index & Nifty Mid Small IT and Telecom Index?

Thanks and Regards

Rajiv

It is an active fund and does not necessarily cover these indices. Vidya

Namaste Krishnakumar ji,

Is it time to book profits/sell the holdings and move to Debt Funds/FD?

Thanks in advance

Hello:

That depends on your goals and investing time frame. Please consult your financial advisor for such decisions. I would suggest caution and manage the existing positions. No need to press the panic button yet. Always have an exit plan and stick to it.

B.Krishnakumar

For Nifty Small Cap 250 Index, levels should be written in reverse order.

Is there a typo in your second line you have clarified above? “This is not probably not the time…as broader market participation is not lacking – makes sense if we were to say “broader participation is lacking”.

Hello:

Looks like a typo. We have corrected it. Thanks.

Could you please elaborate on the following two lines:

The broader observation is that the participation is thinning out in the broader markets as well as within the Nifty 50 basket too.

This is probably not the time to enhance equity exposure as broader market participation is lacking.

Hello:

Regarding the first line, the point am trying to convey is that even within the 50-stock constituting the Nifty 50 index, not all stocks are participating in the rally. A handful of index heavyweights are powering the index higher. That was the message!

The second point is that even in the broader market (think of Nifty MidSmall Cap 400 index or Nifty 750 index), there is lack of participation. Meaning, not all stocks are moving up in unison even though the headline nifty 50 index at all time highs.

Given this backdrop (lack of participation), I am suggesting to avoid fresh exposures in the equity markets for now.

Hope this helps.

B.Krishnakumar

Comments are closed.