Automotive components manufacturer Sona BLW Precision Forgings (Sona Comstar) has come out with an IPO totalling to Rs 5,550 crore – with fresh issue of shares at Rs 300 crore and Rs 5,250 crore of an offer for sale by private equity investors and promoters. At the upper end of the price band of Rs 285-291 the post-issue market cap of the stock on listing would be ~Rs.17,000 crore and the post issue price earnings ratio would be 79 times. The offer closes on June 16. The fresh issue shall be utilised towards debt repayment and other corporate purposes.

Post issue, Sona Autocomp and Blackstone Group will hold 33% and 34% respectively in the company.

About the Company

Sona BLW Precision Forgings is one of the key suppliers of high quality niche forging components such as differential gears and differential assemblies to the domestic and global market. In India, it has market share of 80%-90% in Commercial Vehicle (CV) segment, 55%-60% in Passenger Vehicle (PV) segment and 75-85% in tractor segment, respectively for these products. Apart from competition, some of the original equipment manufacturers (OEM) import or source these products from their affiliates and that does not count in the above market share.

Sona BLW has been supplying differential gears in the global Electric Vehicle (EV) market since April 2016 and differential assemblies since 2018 with 5% market share. With the acquisition of Comstar Automotive in FY20, the product portfolio expanded to include starter motors, BSG systems, EV traction motors (BLDC and PMSM) and motor control units for automotive OEMs for both EV and conventional powertrain segments.

In FY20, Sona BLW acquired Comstar Automotive, a BlackStone Investee Company, for a net consideration of Rs. 822 crore. The company has also accounted for intangible assets of Rs.400 crore as Customer Relationship and Rs.175 Crore as Goodwill related to this acquisition.

For the period between 5th July 2019 and 31st March 2020, the acquired entities comprising its subsidiaries, Comstar Automotive group, generated revenue of Rs.499 Crore and PAT of Rs. 44 Crore. Pursuant to this, the company allotted 2.2 crore shares at Rs. 384.83 per share in July 2019 to Blackstone Group that enabled it to fund the acquisition without debt. The company is awaiting approval from NCLT for the merger of subsidiaries with itself.

Comstar Automotive, Comstar Automotive Technologies Pvt Ltd and SonaComstar e-Drive Pvt Ltd are Indian subsidiaries of the Company while Comstar Automotive USA LLC and Comstar Automotive Hongkong Ltd are material overseas subsidiaries. The company has provided consolidated financial information for the last 3 years. Income from the acquired company Comstar Automotive will reflect from the date of acquisition (5th July, 2019) in FY20. An extract of the financial information is given below.

*Exceptional item relate to gain on account of extinguishment of control over overseas subsidiary (Sona BV) and the gain include cash consideration received, liabilities extinguished and other items. Please refer to Page 309, Note 49 of RHP for detailed information

Positives

#1. Geographic diversification with focus on Passenger vehicles

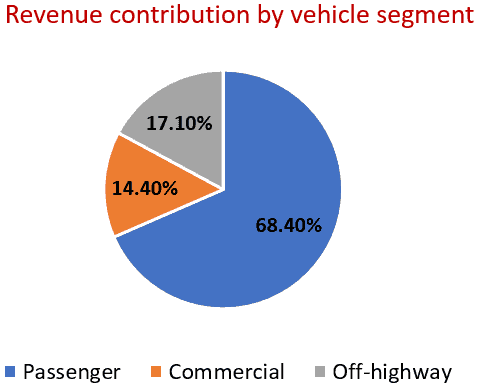

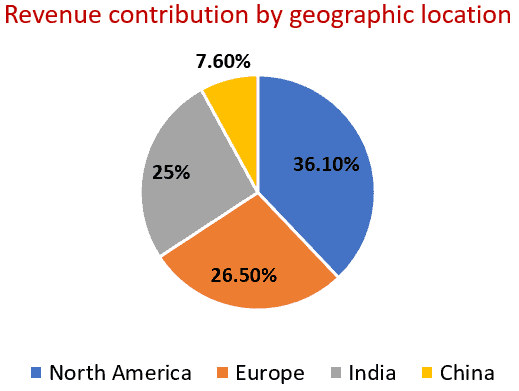

Sona BLW supplies components to six of the top 10 global Passenger Vehicle OEMs, three of the top 10 global commercial vehicle OEMs and seven of the top eight global Tractor OEMs. It has nine manufacturing and assembly facilities across India, China, Mexico and USA, of which six are located in India. While it has not mentioned the names of its key customers due to confidential reasons, some of its customers in the domestic and global market that it disclosed include Ashok Leyland, CNH, Daimler, Escorts, Geely, Jaguar Land Rover, John Deere, Mahindra and Mahindra, Mahindra Electric, Maruti Suzuki, Renault Nissan, Revolt Intellicorp, TAFE, Volvo Cars and Volvo Eicher. For FY21, sales to top 10 customers accounted for 79% of revenues of the company. It revenue is spread across Europe, North America and India.

#2. Opportunities in the global Electrical Vehicle (EV) transition

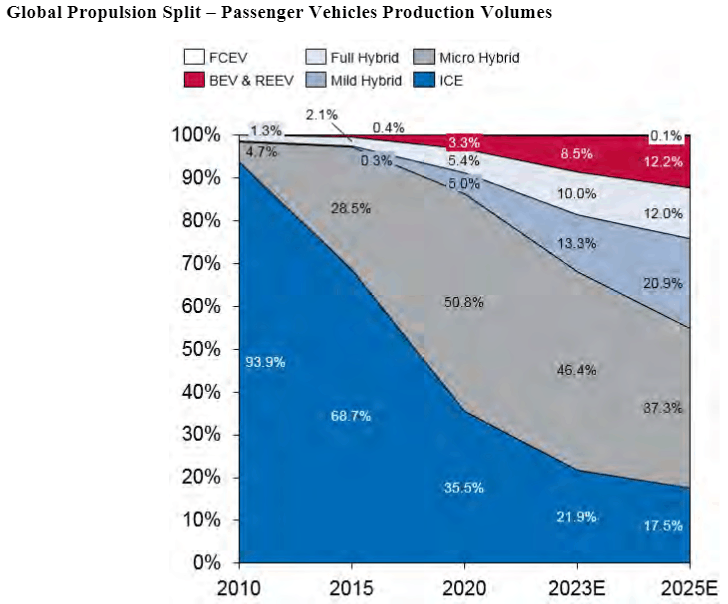

Global Passenger BEV (battery operated electric vehicle) segment is expected to grow at a CAGR of ~36% between calendar years 2020 to 2025 with increased market penetration, according to the RICARDO Report and the volume is expected to grow from 2.3 million units in CY2020 to 11.2 million units in CY2025. RICARDO expects micro hybrid (12V start-stop) to be a standard offering across passenger vehicles and hence will account for significant share ~38% of the propulsion split in calendar year 2025 while Mild and Full hybrids account for ~32% of the propulsion split with mild hybrids being the dominant technology. It expects BEVs to account for ~12% (11.2 million units) of the global production.

Demand for electric two-wheelers is India expected to grow at a CAGR of 72% to 74% between fiscal years 2021 to 2026, according to the CRISIL Report and the electric three-wheeler segment is expected to grow at a CAGR of approximately 46% between calendar years 2021 to 2025 to reach 400,000 units in sales, according to the Ricardo Report.

Sona BLW with its focus on the Passenger Vehicle segment will stand to benefit from this shift given that it is already spread out across geographies and across product lines.

#3. Expanding product portfolio beyond components to systems and subsystems

Sona BLW is eyeing the emerging EV space, both globally and in India, with its niche product portfolio as well as capabilities it is building to move up the value chain in terms of systems and sub-systems for EVs. The company is in a position to integrate the three key constituents of the electric powertrain namely - differential assembly, high voltage traction motors and high voltage inverters - into a single matched unit, offering an efficient and compact solution to EV OEMs. It has been developing solutions and alternatives for improving the power density and light weighting of differential assemblies and EV traction motors (BLDC and PMSM) and motor control units through R&D efforts. It has developed 48V, 72V and 96V BLDC drive motors for electric two wheelers and three-wheelers, which use PM synchronous reluctance technology with weight ranging between 5.2 kg to 17.5 kg and peak power generation of up to 16.5 kW and expect to launch in FY22 both in air cooled and liquid cooled designs. Further, the company has also developed a 48V BSG motor for hybrid PVs, for which it has completed vehicle level demonstration for selected global OEMs.

R&D expenditures as a percentage of turnover was 5.8% in FY21 Vs 3.3% in FY20

Sona BLW is one of the major suppliers of BLDC motors and control units in India for the two-wheeler and three-wheeler EV market and also one of the two major exporters of starter motors from India and with 3% share in the global market. According to Ricardo, the BLDC motor market in India is largely driven by 2/3Ws in the next 5 years as the extent of electrification is expected to be high in both the segments. For FY21, the sales from BEV (battery operated electric vehicle) segment was Rs.205 Crore contributing to ~14% of total sales, out of which 13% is from a single global OEM. The company also generated 27% of sales from Micro-hybrid starter motors amounting to Rs. 397 Crore.

Limitations

#1. Legacy issues in the inorganic route

Though Sona BLW in its present form appears to have good business prospects and showcases sound financial metrics in recent years, it has gone through massive business restructuring in the last 3 years. As mentioned under "Divestment of the Sona BV Group'' under “History and Certain Corporate Matters" in the prospectus, in FY20, the Company completed transfer of 81% of Stake of SONA BV to Sona Autocomp, a Promoter Entity, for an aggregate consideration of Rs. 140 Crore. Sona BV and Group ceased to be subsidiaries of the company with effect from July 5, 2019.

It is worth noting that subsequent to the completion of the said transaction, two of the divested Sona BV’s German subsidiaries (Sona Autocomp Germany GmbH, Subsidiary and SONA BLW Präzisionsschmiede GmbH, Step down subsidiary) filed for insolvency proceedings in self-administration on 28 January 2020. The final proceedings are said to have been completed by October, 2020. In other words, Sona BLW likely managed to hive off bad businesses to its promoter entity.

Besides, the prospectus also mentions that the company had to take write-offs or make provisioning related to business entities in USA (pertaining to investment in Sona BLW Precision Forging Inc, USA, a subsidiary till July 2019) for Rs. 107 Crore and Europe (pertaining to investment in Sona Holdings B.V., The Netherlands, subsidiary till July 2019) for Rs. 33 Crore. The latter went on to file for insolvency proceedings. The above transactions are somewhat discomforting for two reasons: one, the inorganic growth route has been writ with risks and failure for the company and speaks of sub-optimal capital allocation decisions. Two, importantly, transactions between promoter entities in these businesses (some with put or call option agreements but waived due to discontinued operations) do not bode well from a perspective of both related party transactions and on capital allocation front. Intra-group transactions accounted for 144% and 119% for FY-19 and FY-20 (including acquisition of Comstar Automotive) of the total income for the respective fiscal years. Refer Page 26, Summary of Related party transactions in RHP.

#2. Financials not reflective of poor past business decisions

The financials presented for the last 3 years does not give any indication of past business slip-ups of the group arising from foreign subsidiaries. This is due to the gains on divesting the Sona BV group (you will see an exceptional gain in FY-20 in the financials table given earlier) and also because of the Comstar Automotive acquisition beefing up financials in FY20.

There is no certainty that the company will not pursue acquisitions or diversifications or other capital allocation decisions that can haunt its financial performance in future.

#3. Other business risks

The company generates 75% of revenue from overseas markets including 36% form US and 26.5% in Europe. So, its overall performance will depend on the automobile industry growth prospects in those countries, including the EV transition related opportunities. Any distraction in this can stymie its global market growth.

The company’s business comprises supplies to conventional sectors as well as the emerging EV sector. While the EV business contributes to 14% of sales and is expected to grow at 36% CAGR, conventional business is expected to grow at much lower growth rate, especially in the domestic market which accounts for 25% of revenue. Even in the EV business, a single global OEM contributes to the bulk of it. According to a CRISIL Report, Indian CV and PV sales are expected to increase 9% to 10% CAGR and 12% to 14% CAGR, respectively, over fiscal years 2021 to 2026. While the risks in the global market together with competition remains a threat, such risk is not sufficiently hedged in the domestic market, given the slowing growth and opportunity.

Valuation

At the upper end of its price band, the issue is priced at 79 times FY21 EPS and over 10 times FY21 reported sales. In February 2021, the company issued bonus shares in the ratio of 11:1 taking the total number of shares to 57.29 Crore. The post issue share capital will be Rs. 583 crore comprising 58.3 crore shares. The sound performance of the last two years have come from business restructuring, including hive-offs and mergers. With PE investor Blackstone Group looking to exit its 33% stake for Rs.5,250 Crore, the post issue market capitalisation is ~Rs.17,000 Crore at the upper end of price band. For a story entirely built on the nascent EV business with a small revenue base of Rs 205 crore ( 14% of revenue), such premium valuation appears stiff. The massive bonus issue made to jack up the capital just before the issue does not also bode well. You can give this offer a skip.

Please note that this review does not take into consideration the possibility of listing gains.

15 thoughts on “IPO Review: Sona BLW Precision Forgings”

Very insightful thanks

You have not mentioned the names of Indian promotors nor names of top management of the company. The restructuring of businesses seems either haphazard or with other intentions.

It appears that the IPO is only to liquidate Blackstone equity and will not bring any cash in company’s balance sheet. Is my understanding correct ? The valuation also looks overstretched.

Thanks for your response sir.

We have focused more on business and governance as those areas required more attention

Insightful, the points 1 and 2 under limitations are well brought out. Thanks.

The communication from the brokerage house is generally supporting the issue. But like WB says – “never ask a barber if you need a haircut” so.. : ) thanks for the detailed note.

Regards.

Thanks. Very valuable inputs for decision making in otherwise noisy world.

Regards.

& any views on shyam metallics?

Hello Sir, Sorry, no view on it. thanks Vidya

Great and to the point analysis. Had a similar feeling that the valuation is extremely high and possibly will benefit only the PE investor and not public.

Good review. Thanks for the advise !

swetharanyan

Thanks.

Excellent as always. Thanks a lot for your insightful analysis.

Comments are closed.