SIP returns are seemingly not up to par in the past several months. Are you better off investing lump sums instead? Not necessarily. To know whether lump-sums or SIPs are better, you need to understand how the two modes of investment work.

Lump sums for very long periods work very well if – one, there is a long period of a sustained bull rally, and two, when there is limited volatility in the markets. In both scenarios, there is little scope for your funds to average costs. SIPs thrive on market volatility or phases of corrections, since these situations provide opportunities to average down costs.

Structural bull run

The first point is broadly true of funds that have been around for a decade or more. Take a fund like HDFC Equity. Between 2002 and 2012, it delivered a solid 29.6 per cent compounded annually between 2002 and 2012. A SIP in the same fund over the course of these ten years would have delivered an IRR of 21 per cent, despite a steep fall in 2008. This is because the decade saw markets chart a growth that was extremely strong, multi-fold, and sustained for several years. The Sensex moved from 3200 to 18300. Getting in at 3,000 market levels would have paid off extremely well, since those were extreme market lows.

So, are we at lows now? Keep in mind that the decade mentioned above saw a transformation in our stock markets – from the way trading was carried out, to different derivative instruments, to foreign institutional money flowing in, besides a hugely positive global economy and a strong domestic economy that was showing immense promise. While the 2014-2017 period also saw markets chart a blistering growth, it wasn’t backed by fundamental corporate and economic growth and has since corrected sharply as you know. Hence to expect a similar six-fold jump in the next decade may be hard.

Volatility

Indian markets are also marked by high volatility. It is such markets that provide scope for rupee cost averaging that SIPs are known for. Take the case of last two years. A monthly SIP in Aditya Birla Sun Life Equity Advantage, for example, would have resulted in a lower cost per unit than a lump sum invested in September 2017. Should the markets remain subdued, cost per unit can continue to gradually reduce.

The bigger advantage of an SIP is that it helps you save a bit each month and therefore reach whatever financial dream you have. Even if a lump sum delivers higher returns it will not help you reach that goal unless you have invested a large enough amount to begin with. For example, to get to Rs 30 lakh in 10 years at a 12% annual return needs you to invest about Rs 9.5 lakh today!

Lump-sum time

That said, compounding works wonderfully in lump sum when the investment stays for a long period. In SIPs, subsequent investments are compound for a shorter period. So how do you make the best use of compounding in SIPs and lump sum?

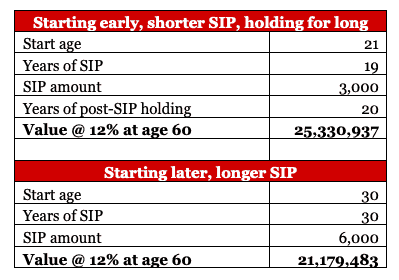

One, start SIPS early, continue to run for a set number of years, then stop and hold these investments. The illustration shows the advantage of investing small sums early on and then holding on for several years, as opposed to investing until the end of your goal.

Incidentally, this also shows you why you need to start investing as early as possible! As commitments get in the way, your expenses may not allow you to save much. Early investing gives you the freedom later on, to manage for expenses or other financial goals.

The other way to benefit from better compounding is to use market corrections such as the one underway to deploy a little extra. This results in you investing a larger sum at lows, giving you the better compounding that lump-sums enjoy.