Child Education Planning Calculator

Know what this Child Education Planning can calculator do

What is Child Education Planning?

Inflation is a very real obstacle to be overcome in the wealth building process. But it’s not just food and other living expenses where we feel the pinch of inflation. Education costs too are galloping and going by data, at a rate faster than overall inflation.

The fact that education costs can rise much faster than headline inflation tends to get missed very often. To put the impact of inflation in perspective, consider an inflation of 6 per cent a year. An engineering course that costs Rs 6 lakh today will grow to Rs 14.4 lakh after 15 years. Similarly, an MBA course that costs around Rs 10 lakh would cost around Rs 24 lakh after 15 years.

At the time of need, therefore, parents suddenly find themselves short of funds, and will then have to resort to loans to bridge the gap. Taking on debt at a later stage in life also throws other financial goals such as retirement in disarray.

This makes planning for your child / children’s education extremely important. An ever growing variety of higher education courses to choose from and not just in India can complicate matters further.

But it’s not as simple as finding out the cost of a few possible courses and then putting away that much. You need to plan for how much these courses could cost when your children will enrol in them which could be 10 or 15 years away. To do this, you not only need to estimate the goal, but also the steps you need to take (in terms of investing regularly) to hit that goal. You also need to make sure that the returns on your investment outpace education inflation. This is child education planning.

Benefits of using Child Education Planning Calculator

- A child education plan calculator helps you understand how much college courses can cost down the line so that you are not caught off guard at a crucial time. This helps reduce your dependence on loans to meet your child’s educational needs.

- A child education planning calculator helps you plan how much you need to invest to build the amount required, and helps prioritise savings as education is a non-negotiable goal.

- Estimation of the amount needed both in terms of total cost and monthly savings allows you to choose the right mutual fund schemes and investment avenues to .

How to Use the PrimeInvestor Child Education Planning Calculator?

The following are the steps to follow to use the PrimeInvestor child education planning calculator:

- Step 1: Input the cost of education in today’s value. The cost of education will vary depending on the nature of course. Since you do not really know what course your child will take, you can take a rough average of the bigger and more popular courses to get an idea.

- Step 2: Arrive at the number of years you have until you need the money for your child’s education.

- Step 3: Enter the rate of inflation by which education costs can go up. While you may want to simply go with the overall inflation number, you can use specific breakdowns available for education inflation for a more accurate estimate. This will be available on the website of the Ministry of Statistics and Programme Implementation.

- Step 4: Enter the rate of return on the investment that you expect. Do bear in mind that being realistic with your return expectations will help you achieve your goal better.

After keying in the above details, the calculator will give you two results: one, the estimated future cost of education and two, the monthly savings that will help you reach that amount.

Let us take an example to understand the steps involved in the education calculator better.

For instance, let’s say the cost of doing an engineering course in 2024 is Rs 10,00,000 and your child is now in the 8th grade. You would therefore require the amount in 5 years. We set the inflation at 6% and return expectation at 12%.

INPUT

Cost of education in today’s value: (Rs) 10,00,000

Number of years remaining: 5 years

Expected inflation: 6%

Expected returns from investments: 12%

OUTPUT

Estimated future cost of education: (Rs) 13,38,226

Monthly investment needed: (Rs) 16,386

Start managing your finances better with quality research & recommendations from us

FAQ

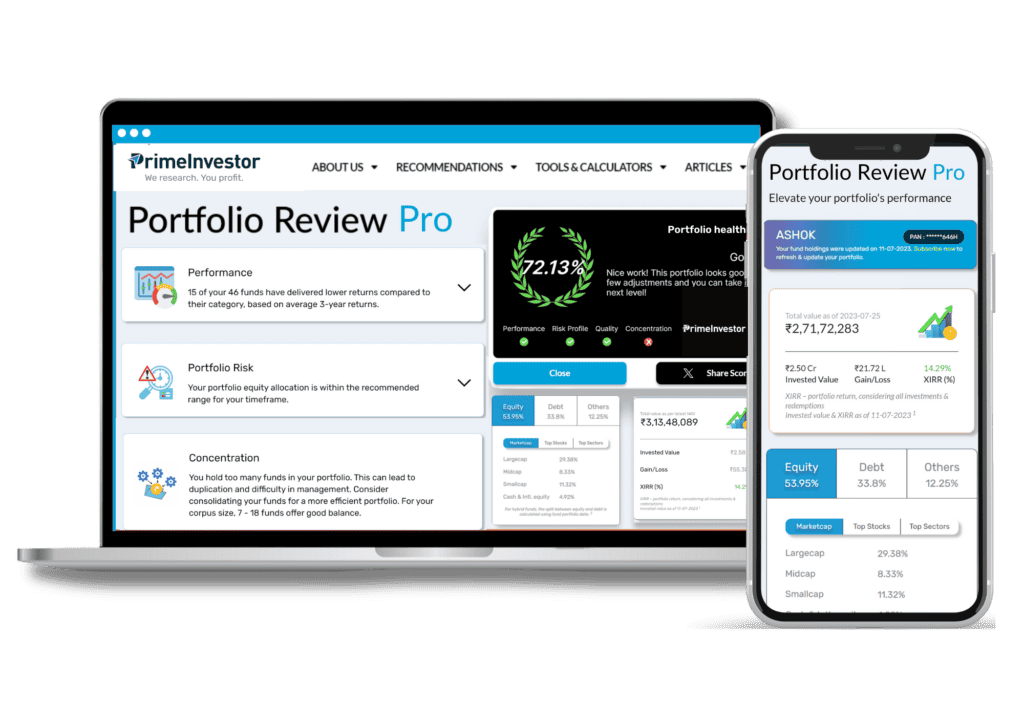

Review your mutual fund portfolio now !