You can either choose to treat a serious injury that is slow to heal with intense medication and therapy or give it time and allow it to heal by itself, just providing the necessary nourishment and support. It appears that the budget is taking the second route for economic revival.

For those who looked for growth revival through the budget, the disappointment was apparent in the way markets reacted on budget day.

But trying to hasten healing with excessive intervention may not always work. It is debatable whether booster shots would even work for the economy, as the nature of the malaise ailing the economy may be far too deep. Why?

We are not confronted with a simple case of the government spending to boost demand. Both investment and consumption are down to the extent of dragging GDP growth to a forecasted 11-year low. The stress in the financial sector has spread to other sectors thus feeding into a loop: bad lending – hit to financial sector – risk aversion – no credit – liquidity dry up – financial stress in other sectors – assets in such sectors turning bad – further stress to banking & finance system. For this painful loop to break itself free, the reforms in the financial space are a necessary bitter pill to swallow.

And do note if the government does get extravagant but does not get the desired results, it would be left with both a yawning deficit and painful currency value and sovereign downgrades at a global level.

Hence, we are not surprised at the lack of market-desired action from the government. Between the market rout on budget day and the personal tax woes (please read our coverage here), not much is being spoken of the multiple peripheral issues that the government is doing to help the economy and specific sectors help themselves. These focus on a long route to revival and growth.

We will take a few areas to understand what working on the side-lines means for the economy. Big picture: The budget is rationalising subsidies and focusing on capital spends. It is not helping the banks or NBFCs directly but providing ways for them to revive themselves. It is not going all out on rural spends but focusing a great deal on the quality of rural/social spends to boost the rural economy and focus on doubling their income by 2022.

Agri/rural – focused spend

Allocation to agriculture sector and rural development is up 13% for FY-21 compared with the revised estimates of FY-20. While the allocation is not extravagant, the budget steadily focuses on the 7 key areas that were identified earlier to double farm income by 2022 as well as rural employment.

For example, the Pradhan Mantri Gram Sadak Yojana saw a 39% increase in allocation to Rs 19,500 crore while the Pradhan Mantri Krishi Sinchayee Yojana saw a 41% increase in allocation. Similarly, programmes such as the MGNREGA although kept flat will ensure about a third of the rural households get support.

Besides allocation for development of dairy, horticulture and fisheries, there are interest subsidy schemes for short-term credit to farmers and measures to improve marketing and warehousing. Innovative schemes such as solar pumps for 20 lakh farmers besides helping farmers set up solar farms on their barren land (to transport power to the grid) and augment their income hold promise. With these, it appears that the government is set on its agenda to double rural income – if well-implemented, that is.

Banking/NBFC reforms

After the Rs 70,000 crore of capital infusion into public sector banks, the government is now going slow on further infusion as recovery is in sight. We do believe need-based infusion will still happen as the government has always pitched in.

The budget has stuck to measures that can help banks build confidence and raise their own funds. Higher deposit insurance not only benefits you but helps boost the overall confidence placed on the banking system. This in turn can help banks remain an attractive destination for deposits, which is their key source of borrowing. The Finance Minister also mentioned that few banks will be encouraged to raise money from the capital markets, a feat that private sector banks have achieved thanks to their higher efficiency.

For NBFCs, now a lower loan ticket size (Rs 50 lakh) is needed to start an asset recovery process under the SARFEASI Act. According to reports, this means at additional 12-15% of an NBFC’s loan against property will fall under this Act. This measure is likely to help ailing NBFCs get their act together in cleaning bad loans. To ensure uninterrupted flow of credit to the ailing MSME sector and to also keep default rates under control for finance companies, the budget is extending an earlier scheme that permits MSME loan restructuring without being classified as a bad asset, to March 31, 2021. This will put less stress of bank and NBFC balance sheets and encourage them to lend.

The budget is also providing opportunities for NBFCs to penetrate the working capital finance/invoice finance segment that is largely dominated by banks.

Capex spending remains high

The increased fiscal deficit of 3.5% (for FY-21) appears largely on account of capex and rural spends. Capital outlay for FY-21 is budgeted to increase by 18%. However, the public sector resource has seen a decline, which indicates that the direct support for infrastructure has reduced.

Capital Outlay (Rs. Lakh Crore)

But this needs to be seen in light of the National Infrastructure Pipeline, which has already laid the road for infrastructure with a Rs 103 lakh crore spend. And the budget tries to fund infrastructure projects through sops. For example, 100% exemption is proposed on interest, dividend and capital gain on investments in infrastructure in India by foreign sovereign wealth funds. Other urban programmes such as AMRUT and Smart Cities have seen a close to 40% hike in allocation proposed for FY-21.

On the capex side, engineering and capital goods companies can benefit from spending in other sectors. For example, agri/rural schemes such as solar pumps for farmers, Jal Jeevan spends, refrigerated rail coaches and higher milk processing capacity could generate orders for solar players, pipeline infrastructure companies, rail EPC companies as well as other machinery manufacturers. Similarly, programmes such as the fibre to the home (FTTH) connection to Gram Panchayats or the production-liked incentive for mobile phone manufacturing and electronic manufacturing can boost telecom and electronic segments. The point here is that demand revival could come in the form of spends in other segments and eventually (long term) trigger investment activity.

The Budget is not without its flaws – whether it is about revenue targets from telecom (including AGR) or the focus on NSS for non-market funding that could possibly result in banks keeping borrowing and lending rates sticky. Also, policies focused on protectionism of local industries could eventually make India less competitive globally.

But it is noteworthy that it is taking cues from the Economic Survey for inclusion of ‘Assemble in India’ for the world into ‘Make in India’, use privatisation to foster efficiencies and eliminate policies that undermine markets through government interventions when not necessary.

What it means for equities

The equity market clearly didn’t like the budget and reacted negatively on budget day, falling close to 1000 points and is volatile today. The bond market, though, valued the fiscal prudence and awarded he 10-year G-Sec with a 1.4% price rally (at the time of writing this Monday morning).

In our equity outlook for 2020 we did not factor any immediate boost to the economy or markets and rather opined that this would be a year of consolidation and slow revival. Our premise is validated by the Budget proposal’s response to the economic ills. Most of these are long drawn but very focused in nature.

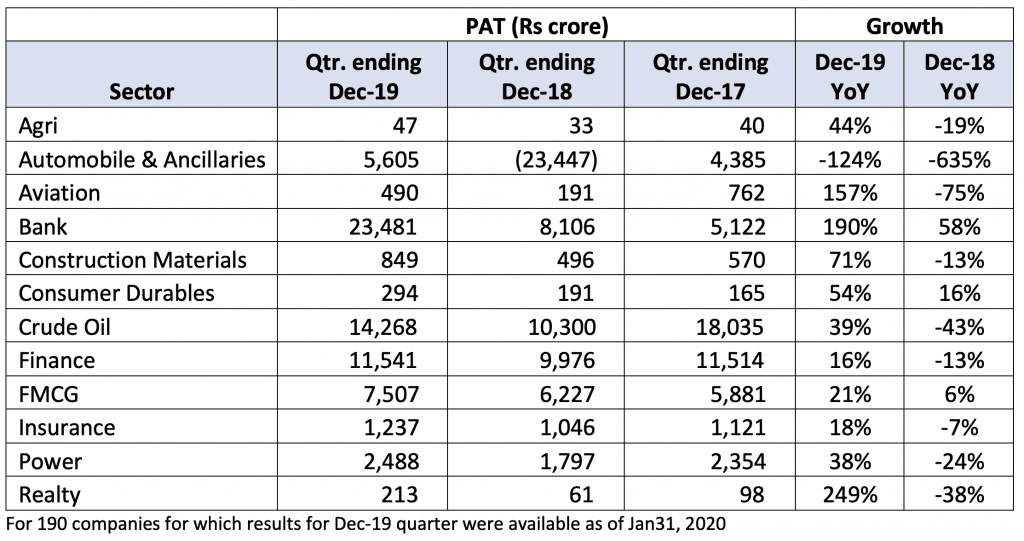

The only booster shot came from the corporate tax cuts in late 2019. And the effect of this is already being felt in earnings. While the December 2019 earnings are just beginning to come in, the initial signs are encouraging. Profits after tax jumped 102% over a year ago (Dec-18) on a low base for the 190 companies for which data was available. But importantly, ailing sectors such as auto & auto components have moved to profits while earnings for the realty space has sharply jumped.

The turnaround/improvement stories in sectors thus far are given below. We have ignored sectors like infrastructure where the result is just one data point thus far.

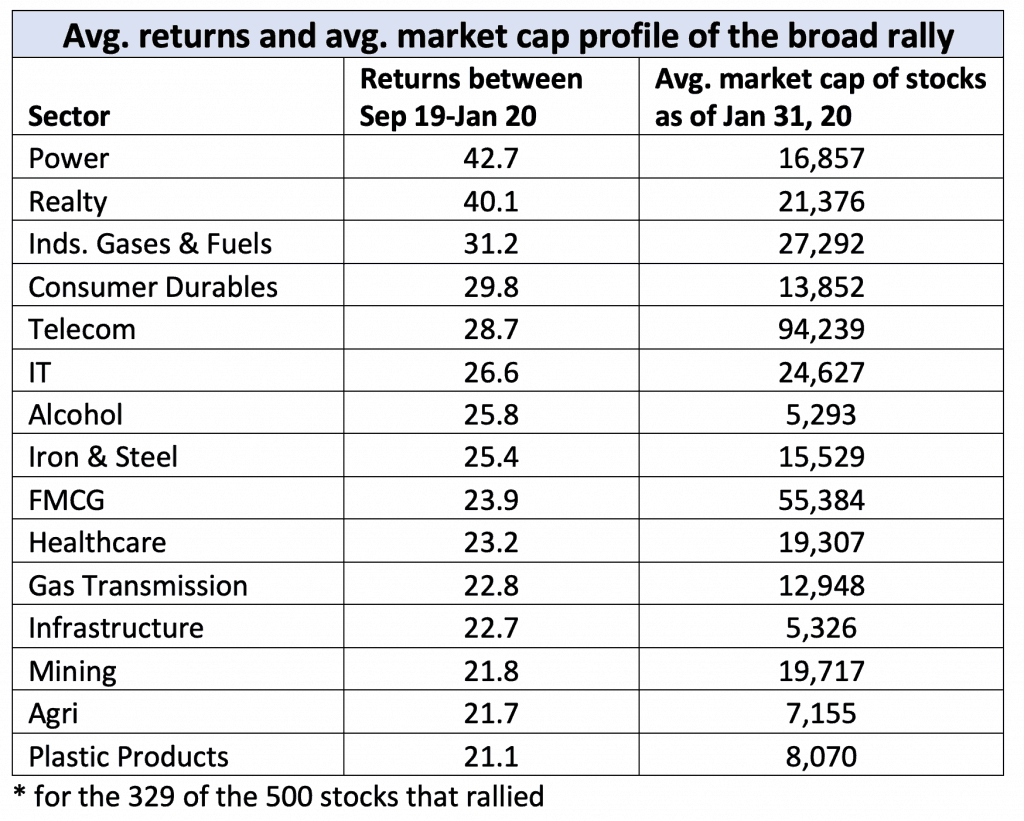

Another important trend that is emerging (as mentioned in our outlook too) is the broader rally in the market from September 2019.

2 in 3 stocks in the Nifty 500 rallied between September 2019-January 2020.Besides, 215 of the 500 stocks or close to 45% rallied over 10% in these 4 months. And if one looks at where the rally came from, beaten down sectors such as power, realty, telecom and durables all find a place.

The second point to note is that this comes from the second leg of the market-cap – outside of the large companies (blue chip India), falling into the Next 50 and beyond (mid and small caps). The third thing is that those that rallied in the finance segment came from brokerages, small finance banks and mid-sized NBFCs.

The point here is that the stock market may not been waiting for budget cues alone in these segments. Low stock valuations and medium to long-term potential appears to be a strong factor for the rally.

What the budget together with these numbers mean

Take the 3 primary points we mentioned above about the budget’s impact on some of some key segments. Take the rally and the revival in earnings. You will see that the budget has offered some fuel to fan the revival in segments such as capital goods, NBFC, power, infrastructure and agri segments. An organic uptick here with some support (if spending plans go well) would be the path for the earnings revival for the broader market as well.

In light of this, we reiterate our strategy given earlier on which segments of the market to ride and through which funds to ride. Do read our subscriber-only strategy if you missed it.

A separate article on the debt market takeaways from the budget is available here.

You can also read our review on LIC Jeevan Akshay 7 here.