Most of you are now comfortable with the fact that gilt funds can deliver negative returns in the short to medium term when rates move up. We have also written about it here. But the negative return prevalent in the past month or so, across most categories in debt funds has troubled many of you.

In our last debt fund call, we discussed the volatility in debt returns and what should be your course of action. But many of you are concerned about the fall in short and medium duration fund categories – especially in our recommendations across floater, short duration and corporate bond funds. This article will explain why this is happening, whether it is normal and what you should do.

Before we go to reasons, you need to remember the fundamental characteristic of your debt fund’s return. As yields move up the prices of bonds fall. This is sharper in longer duration bonds and gentler in lower duration bonds. But the price fall is inevitable when yields move up – until funds adjust to the new yields by acquiring bonds with higher coupon.

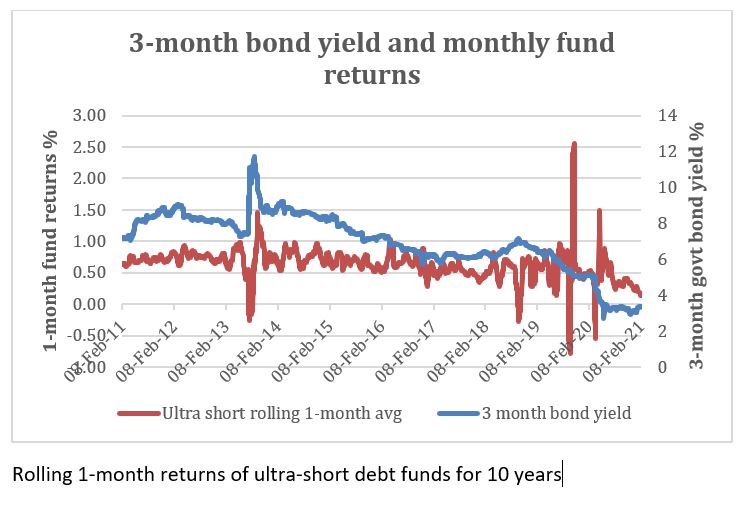

The graph above will tell you that after the unusual, very short-period, rise in yields in March 2020, bond yields fell steadily, stabilised but started climbing up from end November 2020. Some ultra-short and low duration (which are the comparable funds for the above bond tenure) funds did make marginal negative 1-month returns but have now bounced back (due to RBI OMO activity).

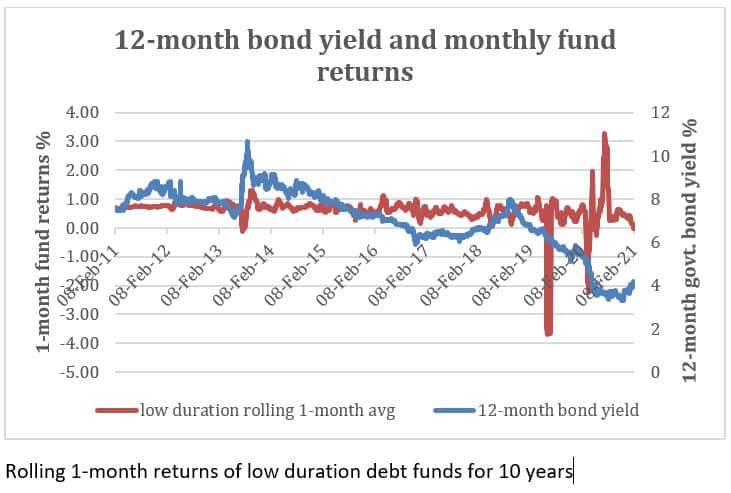

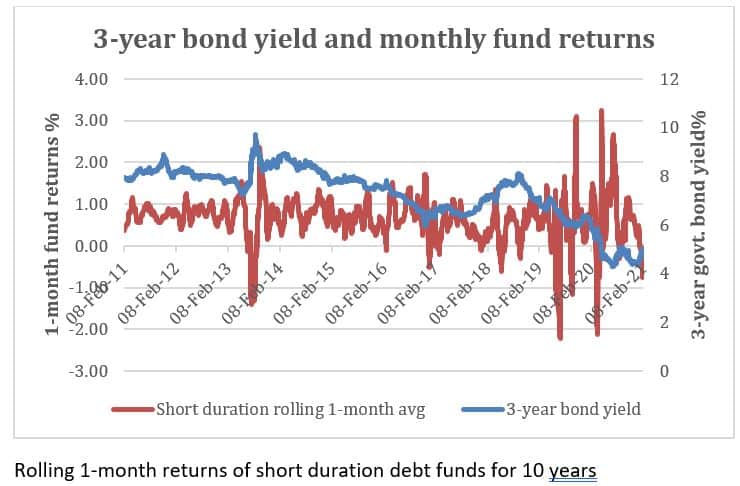

In medium and long-duration bonds, you will see that the move was different. The 3-year yield fell sharply and since January 2021 rose sharply – causing 1-month losses in your short duration, floater, banking & PSU and importantly corporate bond funds.

Takeaway: Your debt fund returns will rise when yields fall. When yield moves up, there can be losses. When the yield up move is gentle, you feel less pain. When it is sharp, it is a lot more painful. A very sharp up move for just a couple of days of March 2020 is case in point.

Gear up for more volatility

If we agree that rate up moves should cause a fall in your debt fund returns, then the next question should be, how bad can the fall be? We can refer to previous cycles here.

When yields bottomed out in December 2016 and started climbing up – short duration funds fell -1.2% for that month. This was for a 40 basis-point up move in 1-year govt. bond yield. In the past month now, a 20-basis point rise in bond yield caused a -.0.7% fall in short duration funds.

But then there’s evidence that debt fund returns are getting more volatile. Instead of absolute numbers, let’s look at the standard deviation of 1-month returns of some of the fund categories that have been around for a while now.

The data above will tell you that the volatility has gone up. It is significant in lower duration categories than in the already liquid and volatile gilt space. (We have not taken the newer categories of corporate bonds and banking & PSU and they did not exist as a category until 2018).

Beyond duration and credit, there have been other macro changes in the debt market that have caused your debt NAVs to swing more. We list them below:

#1 Regulatory changes

From late 2017, SEBI has been steadily rehauling debt-fund related guidelines. As a result, what was earlier loosely defined in terms of investment universe and valuation has become watertight.

Category changes

SEBI brought in new categories that became effective over early to mid 2018. One of the key elements of the changes was defining the duration of many debt fund categories. Low duration funds for e.g.: needed to have a Macaulay duration (MD) of 6-12 months while the limit for ultra short was 3-6 months. Earlier, such a distinction did not exist and these categories of funds roughly had similar tenures. Similarly, short duration had a MD of 1-3 years.

As a result, the average maturity of some of the fund categories increased to comply with newer norms, making their volatility profile higher than before.

The 3 graphs below will show you the increased volatility in different categories recent years – even as the rate spikes are not sharp (barring the one-off event in 2013).

Bottomline: Funds have less leeway to change duration now and therefore need to take more volatility.

Investment & valuation norms

SEBI also brought in a series of changes in valuation and investment norms for debt funds in 2019. Among those, 2 important changes are: the valuation of debt instruments of over 30 days was made mark-to-market (as opposed to the earlier amortisation method) . Effective April 2020, all instruments were to follow mark to market subject to the guidelines given by SEBI. Second, debt funds could not invest over 10% of their assets in unlisted instruments.

The first-mentioned measure made NAVs more volatile as they were closer to market reality than they were before. The second removed discretion in valuations and ensured better price discovery.

Bottomline: Prices of underlying instruments of debt funds are now linked more closely to market moves and hence show more swings.

#2 FPI activity

Just as in stocks, higher foreign flows in Indian bonds has contributed to the volatility too. The government has been proactive in terms of increasing the allowable limits for FPIs in corporate bonds – raising it to 15% (of outstanding amount) in 2020 from 9% earlier. The table below will show you how the limit has been upped. While the limit hasn’t been fully utilised, the higher FPI participation has given space for a more active bond market and heightened volatility (read quicker price discovery too). Rupee strength and falling rates usually heighten FPI flows (see the limit utilised in 2019).

For you as an investor, the impact of this could be felt across banking & PSU debt, short duration and corporate bond funds as the instruments in these fund categories are typically the ones preferred by FPIs; other than gilt.

Bottomline: Like the equity markets, the debt markets too may gradually see more foreign money driven moves.

#3 RBI’s active intervention policy

From a time when RBI was using the monetary policy to control rates we now have the Central bank actively intervening in markets to provide liquidity and manage government borrowing costs . Apart from ‘open market operations’, RBI used ‘operation twist’ pre Covid to flatten the yield curve.

Post March 2020, it made massive purchases through open market operations and opened special liquidity windows for distressed sectors. This kept rates stable and eased yields after the sharp up move in March 2020. Recently however RBI has provided signals that it would like to gradually normalise it’s exceptional liquidity support to markets, as the economy consolidates post Covid. Sans RBI intervention market yields may move up in response to higher government borrowings and elevated deficits.

Bottomline: As liquidity tightens, the climb in short term yields can trigger volatility.

What this means for you

Very simple. The above triggers are here to stay. Greater room to market forces and more participants mean more volatility. Remember gold? It has become a more volatile asset in the past decade, thanks to significantly increased participation by ETF investors globally.

But this also means your funds are more reflective of reality and do not artificially keep your NAV loaded! So here are the takeaways.

- If yields move up, your funds will react negatively. Such response may be higher than what it was in the past.

- Mark-to-market will mean your NAVs will reflect market realities more than before.

- In a rising rate scenario, short and medium duration funds will re-adjust to newer rates and generate higher coupon (interest) once they have more recent securities added.

- If rates remain rangebound or low, you may still face volatility from FPI moves or from a post OMO – withdrawal syndrome.

As an investor, you need to live with this volatility across categories barring overnight and liquid funds and to some extent ultra-short funds. Simply stick to your original duration in line with your goal instead of trying to see if you should change your maturity to suit rate moves. There is bound to be volatility – long or short. Longer duration is more sensitive than shorter duration. But there is no escaping volatility. Get ready for a new normal. If that sounds too adventurous for you, the government schemes do offer a ready alternative.

Update: You can find rolling returns of many debt funds here in our rolling returns tool.

48 thoughts on “Why your debt funds have negative returns and what to do”

Hello ma’am,

This is about this point: “But the price fall is inevitable when yields move up – until funds adjust to the new yields by acquiring bonds with higher coupon.”

Suppose the fund follows an accrual strategy and simply hold the bond till maturity. Near maturity, if I understand correctly, the bond will be valued in an amortized manner than MTM, right ? (I think SEBI regulations allow this for maturity < 30 days, if I'm not wrong)

So would't any fall in the NAV of a fund due to a bond B it holds, be automatically adjusted for, when the fund receives the full value of the bond B and the interest at maturity.

Essentially, to paraphrase my question, the long-term returns of accrual strategy funds shouldn't depend too much on these short-term gyrations right ?

Thanks,

Arun Vasan

1. SEBI regulation – have moved to MTM for all maturities – amortisation can be followed if it is within SEBI prescribed deviation from MTM price.

2. Accruals too reduce maturity and make way for new bonds.

3. Buy and hold is seldom done in active fudns barring a few when rates transition.

4. Yes, all held to maturity will have only notional losses. That is why investors should simply handle them temporarily.

Accrual funds will react positively once the initial transition settles as they will definitely add higher coupon papers. You will seem their YTMs moving up. thanks, Vidya

Thanks for the detailed response. Appreciate this!

For investors who have large lumpsum to park in debt for next 3-4 years. What should be the strategy to enter given that interest rates have bottomed and are only likely to go up from here over next 2 years. Does it mean low return for next 2 years ( read 5-6%)? In such a scenario is it worth taking risk at all for an additional 1-2% returns over FD (relatively no credit or interest risk).

If we assume rates will go up, then post the initial volatility almost all categories in the very short and short duration will do well and likely better than FDs. Just handle the near term volatility. thanks, Vidya

Thanks Vidya. For a large corpus what would be your views on the below allocation strategy

Fixed Deposit – 15%

Ultra Short and Low Duration – 15%

Short Term Debt – 25%

Corporate Bond/Banking and PSU Funds – 30%

Floating Rate Debt Funds – 15%

Sir, as you will be aware, we do not (and should not) provide suggestions on individual allocations. Since you have asked – If your time frame is over 3 years, it should be fine. Vidya

Mam, will the bond yields move in a very narrow range in the near to medium term as the government has a huge borrowing program and the RBI in all likelihood keep the borrowing costs in check.

For the kind of borrowing programme, bonds should ideally move up fast but RBI OMOs are keeping them in check. thanks, Vidya

It was advised by Financial advisors, to move out from equity to debt fund, on reaching your goal. In present scenario what alternatives are there to debt funds? Would it be more prudent to shift bank FDs , one to two years before reaching the goal?

Not necessary if you choose the right debt funds with low credit risk and suiting the remaining time frame. thanks, Vidya

How about Liquid funds only in the debt portion of the portfolio, Because already we are investing Equity portion with much risk,, then why to experience one more volatile nature of other category of debt funds, This is just my query, Should an investor invest only Liquid funds in Debt part.( When he understood the returns are not so big in Liquid funds compare to other medium / long term bonds).

The debt volatility pales in comparison to equity. So they are not comparable 🙂 We want investors to know that debt also has some volatility even in short duration so as to set expectations right. That’s all. Liquid can very wll be the only debt component if returns is not the primary objective. thanks, Vidya

Thanks for the lovely article Vidya.. It gives us an idea of what to expect from the Debt funds. I do understand that Volatility is there to stay and if the returns from the Debt funds would be subdued, why are the FPIs looking to invest in these especially in the scenario of rising yield.. Also, could you throw light as to what caused the yields to fall in the previous 2 years.. What tools does the fund manager have in such a scenario to tame the volatility..

Thank you sir. FPIs do not look at absolute value. They look at relative opportunities. As you would have seen, the inflwos have come down. Yield fall – low inflation, controlled currency, tight deficit and poor growth. Fudn manager tool – none except intelligent trading at times. But this is just 1 month volatility. So let it not bother you too much 🙂 We wrote this as most investors did not expect short term volatility in debt. thanks, Vidya

Thanks Vidya, again a timely article.

I will have to read this a few times to understand this fully, however a basic question( this exposes my lack of understanding but nevertheless…)

why do very short,short duration funds or say corporate funds in particular are mpacted by govt yields? I understand they might be related somehow but dont understand the link

Every bond’s yield is measured as the excess from g-sec yield. As G-sec is considered the risk-free yield, it is treated as a reference point and the excess over g-sec (since every instrument carries more risk than g-sec) is called the spread. So, the base rate essentially is g-sec rate. thanks, Vidya

understood and thanks

Hi Vidya, this is a very well timed article. It gives a lot of clarity, kudos.

“Simply stick to your original duration” – in an earlier article, I saw that you had recommended short term debt funds only if the redemption was likely after 2 years. What would you suggest for ultra-short and low duration funds?

3 months-1.5 years – depending on the nature of the fund. Floater funds need longer holding, ultra short need shorter holding and rest fall in the middle. thanks, Vidya

Hi Vidya

I have quite lot of debt MF in my portfolio. Main reason for this is, save tax as I am in higher tax bracket. I do not

need this money in the near future minimum 5 years as I have other incomes. My expectations at least I should get 6 to 7 percent in the long run. I am not in a hurry. If I wait, can I get the expected return. I have sufficient other fixed incomes,rental period and equity.

Kindly clarify

Regards

Sankar N

Hello Sir, Please be aware of the volatility. That’s all. There is no need to change your expectation of return or strategy over a 5-year period. thanks, Vidya

So with more volatility for longer duration funds, does this mean that FDs are now a better and safer option for longer duration returns?

Sir, we did not discuss longer duration funds here. That is discussed separately (link given in the beginning). We are simply conveying that as investors you should know about debt fund volatility even in short and medium term and why they are occuring. FD is for safety and fixed returns – never for superior returns 🙂 thanks, Vidya

Comments are closed.