As observed in the previous update on targets for the Nifty 50, the index remained strong and also moved pretty close the target zone of 18,700-18,750. The index recorded a high of 18,662 on May 30 and has since been in a consolidation. In this update, we take a quick look at the short-term outlook for the Nifty 50 index and focus on a more detailed outlook for the broader markets and interesting sectors.

Short-term outlook

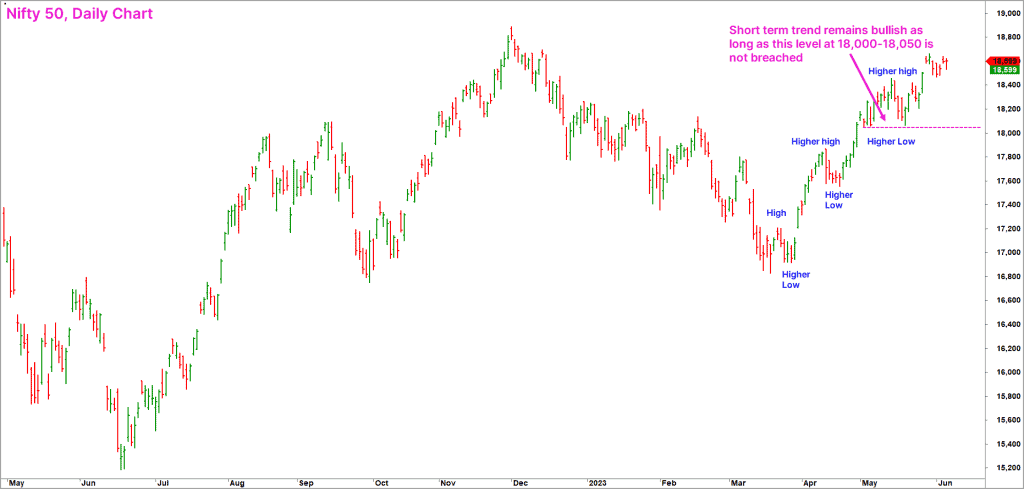

As always, let us begin by looking at the daily chart of the Nifty 50 index. As highlighted in the chart below, the bullish sequence of higher highs and higher lows is still intact.

The short-term outlook would remain bullish as long as the index sustains above the recent swing low and support zone at 18,000-18,050. Unless this zone is breached, the Nifty 50 index stands a good chance of reaching the target zone of 19,250-19,300 mentioned in the previous post.

But if the support zone at 18,000 is breached, it could trigger a short-term correction or consolidation. This, however, would not invalidate the medium-term bullish view. Nor will it spoil the chances of a rally to 19,250-19,300 zone. It is just that the rally to this target zone might be delayed should the 18,000-mark be breached.

The red flags remain

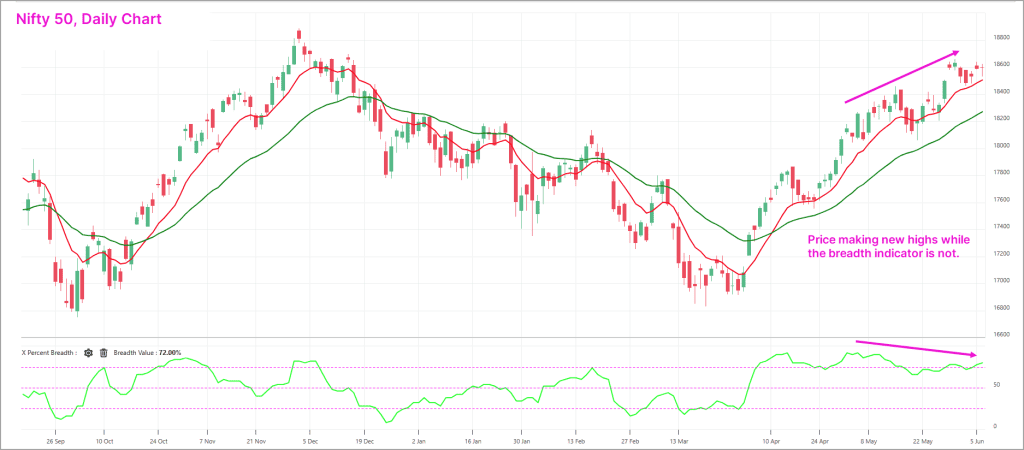

While the short-term outlook is bullish, we had highlighted a few red flags in the previous update. Those concerns are still valid. For a quick recap – we had said that the short-term breadth had turned overbought. This indicator remains overbought and, more importantly, there are signs of negative divergence between the price action in the Nifty 50 index and the breadth.

As always, we use the PF-X% indicator to assess short-term breadth. This indicator tracks the percentage of stocks in a bullish swing in the Point & Figure chart. The Nifty 50 chart with the PF-X% breadth indicator is below.

As highlighted in the chart, the Nifty 50 index has been making higher highs while the breadth indicator has not – which is a classic negative divergence. Though this in itself is not a trigger to be alarmed or run for cover, this negative divergence is definitely a development worth taking note of.

This negative divergence assumes greater significance if viewed in the context of the breadth in the medium-term timeframe. The PF-X% breadth indicator in the medium term has reached the overbought zone and is currently at 86%.

While the breadth across short-term and medium-term is overbought, the price has not yet reached overbought zone. Typically, a strong correction or reversal would happen when the price and the breadth reach extreme zones. In the current scenario, the breadth is overbought while price is not.

It is in this context that we expect the Nifty 50 index to reach the next target zone at 19,250-19,300 before any meaningful correction sets in. Keep an eye on the support zone at 18,000-18,050 zone and enjoy the potential ride. But do not get too adventurous by taking aggressive long trades or high fresh exposures at the current juncture. Just focus on managing the existing holdings and await a cool off before taking big fresh exposures.

Nifty Bank Index

In the previous update, we had highlighted the outperformance of the Nifty Bank Index versus the Nifty 50 index. This index moved higher as anticipated, and also reached the lower end of the target of 44,500-45,000.

However, in the past couple of weeks, the Nifty Bank index has displayed relative weakness versus the Nifty 50 index. Though this is not alarming and could turn out being a temporary phenomenon, the recent relative weakness is something that needs to be taken cognisance of.

The negative divergence between the momentum indicator and the price chart of the Nifty Bank index is another red flag. While the Nifty Bank index has been making higher highs in the daily and weekly charts, a sequence of lower highs is visible in the Relative Strength Index or the RSI indicator. This negative divergence could again be a forewarning of an impending correction in the index.

A fall below the 43,000-mark could be an early sign of the onset of short-term correction in the Nifty Bank index. Keep a close tab on this level and also be mindful of the relative performance of this index versus Nifty 50 to get insights about the overall market health.

Nifty MidSmall Cap 400 index

While there are red flags as far as Nifty 50 and Nifty Bank index is concerned, the outlook for the broader markets is relatively more bullish. This index continues to outperform the Nifty 50 index, which is a healthy sign. More importantly, the breadth indicator for the Nifty MidSmall Cap 400 index has displayed consistent improvement, suggesting buying interest in the broader markets.

The index has also managed to breakout above multiple resistances in the 11,500-11,600 range that was highlighted in the previous post. This breakout along with the relative outperformance indicate that the broader market is the space to focus on.

The short-term target for the Nifty MidSmall Cap 400 index is 12,800-13,100. The positive outlook would be under threat if the index drops below the 10,100 level. Apart from the MidSmall Cap 400 index, the Nifty Midcap 50, Midcap 100 and Midcap 200 indices are displaying bullishness and relative outperformance against Nifty 50.

Interesting Sectors

From sectoral indices, the Nifty Auto index continues to shine along with the Nifty FMCG index. We had highlighted these two sectors as clear standouts in the previous post. Both have continued to scale higher levels and remain star performers. The Nifty Realty index has shown a lot of promise recently. Keep an eye on this sector too and focus on high quality fundamentally sound names.

To sum up, the outlook for Nifty 50 and Nifty Bank indices remains bullish, but there are a few concerns to be mindful of. This is the time to be cautious and not get highly adventurous about fresh equity exposures, especially in the frontline indices such as the Nifty 50 & Nifty Bank.

1 thought on “Technical outlook – the Nifty 50 and broader markets”

Thanks Krishna ji for the post, have to say did make some money on taking small exposure in Nifty Auto.

Gratitudes for this 🌼🌸👍🏼🌼🌸

Comments are closed.