Target maturity funds invest with a stated maturity and pay you back when the maturity is reached. You can call them an FMP but one that is open-ended and takes fresh inflows and allows outflows.

With yields beginning to move up, more funds are now beginning to talk about a ‘roll down strategy’ or a strategy where a maturity date is fixed thereby ensuring that the portfolio’s average maturity steadily falls as it nears maturity. For example, a 2027 target date fund will have a 6-year maturity now and a 5-year maturity in 2022 and so on, until the maturity reduces to near zero in 2027.

Bharat Bond funds were among the early movers in this space with PSU bonds. Nippon India came up with a PSU bond cum SDL combination in November 2020.

Two more fund houses have now come up with unique, open-ended target maturity funds – essentially passive funds with low cost that seek to track an index:

Roll down strategy

Some of you, especially from the advisory community, have asked us to cover more funds with roll-down strategies and wanted more details about such funds.

Target maturity funds by default use a roll down strategy. But it is noteworthy that some AMCs adopt a roll-down strategy in their open-ended debt funds – across, banking & PSU debt, corporate bond, dynamic or medium duration.

However, we prefer proper target date funds (with maturity) to play this strategy for a couple of reasons: one, open-ended funds do not state that they follow a roll-down strategy clearly in their mandate and merely disclose in their conference calls with advisors or at best in their presentation. Retail investors are hardly aware. Two, the open-ended funds do not have an exit date. So, if you do not know when the date is rolled down to zero, you may once again see a new roll down strategy or a completely new strategy. Three, the fund manager is under no compulsion to stick to such a strategy unless it is part of a mandate.

At this juncture, when duration is generating negative returns for you, what comfort do the target maturity funds from IDFC and Nippon India offer? Read on.

IDFC Gilt 2027 and 2028 index fund

There are 2 debt index fund NFOs being made available by IDFC. One an index fund that will invest in the constituents of the Crisil Gilt 2027 index, that will terminate on June 30. 2027. The second will mimic the Crisil Gilt 2028 index. In essence they will invest in 6- and 7-year-terminating indices.

Now, you are aware that in a rising yield scenario, the prices of debt instruments will fall and that means the NAV of funds will fall too. In essence, longer duration funds will be impacted in the short to medium term. So, what is the sanctity of a 6- and 7-year gilt, and at this stage?

Why 6-and-7-year periods?

The proposition here is interesting. Look at the graph below. It is the current yield (as of March 17, 2021) of various gilts across maturity buckets of 1-15 years.

- You will see that the yield on the 10-year is lower than 6–9-year tenure. That means, the 6–9-year range offers better returns on a risk-adjusted basis (lower downside than the 10-year).

- The curve steepens (sharper rise in yields) at the 6th year and hence offers higher opportunities. In other words, for lower volatility (than the 10-15 year), you would get superior returns. Whether this steepness will remain for long, one would not know. To that extent, there is some element of timing in this fund.

So, the superior risk-return proposition at this juncture that appears to be the thesis for choosing the 6–7-year tenure.

Will you incur losses?

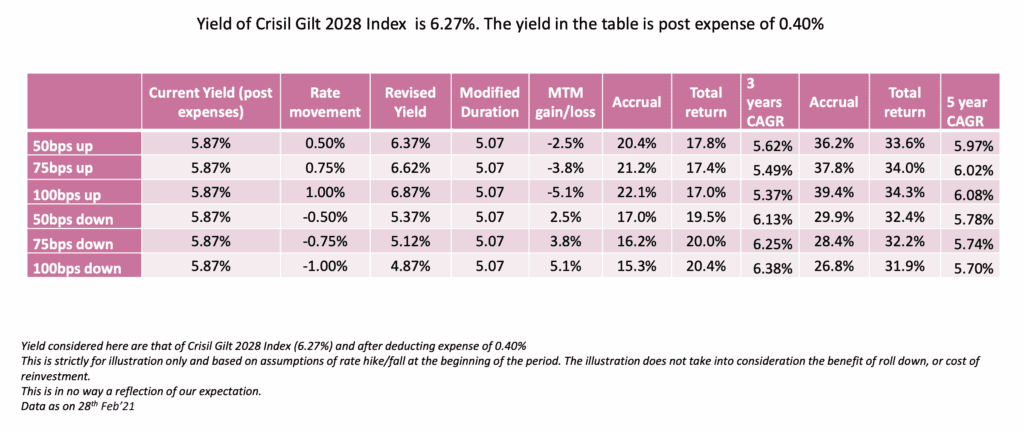

Yes, you are going to have losses when yields move up. The fund has provided an illustration of this (given below). For example, if you assume that rates go up by, say, 100 basis points, the loss on a 6.27% (yields have moved up since) yielding 7-year gilt could be as much as 5.1% post expense of 0.4%, states the illustration. However, the interest (called accrual in the image) will adequately make up for the losses and still generate a 5-year CAGR of 6.08% as per the illustration. Please note that this is not a return forecast as yields will be different when you enter.

Simply put, the mark-to-market losses you will incur will be normalized by the higher interest generated and still deliver.

Will this fund generate more losses than illustrated? For example, if rates move up by more than 100 basis points will the losses not be high? It would be. But the probability of very heightened losses may be low. The reason being – the roll down strategy ensures fresh money is deployed at lower and lower maturity, as the fund needs to maintain the target of 2027 or 2028. In other words, it is not a fixed maturity strategy where the maturity of the fund will be constant. So even if one more rate hike scenario happens in the fund’s lifetime, your losses will be lower as the fund would be fewer years away from its maturity (because the lower maturity would make it less vulnerable and take a lower hit during the rate hike).

Should you invest?

- This is not an option for those looking for high returns. If you have a mental return benchmark like 8% plus – there is no assurance that you will get it. Yes, if the returns soar during any falling rate cycle (before the fund’s maturity), you may exit with higher returns.

- It is also not an option for those who cannot take losses soon after investing (which will exactly be the case in these funds)

- This is a good proposition for those wanting decent post-tax returns for nil credit risk.

- It is ideal for those whose goals are aligned to the fund’s maturity. But even then, you need to insulate this with very low tenure funds like liquid, ultra-short or even short-term FDs when you build a portfolio. The fund house itself recommends this.

- An investment now will provide a 7-and 8-year indexation (for a 6/7 year maturing fund), since we are at the end of a fiscal year. That makes it more tax efficient. You can check the illustration by the fund house (in the download section), comparing a tax-free bond, a traditional debt investment like FD and the Crisil 2027/2028 index on a post-tax basis. The illustration provided a 40-basis point expense ratio for the IDFC funds. Actual expense ratio will be known post NFO. The scheme NFO closes on March 19th and will reopen on March 24th.

- If you plan to invest, do so before March 31 to get the additional year of indexation.

Nippon India ETF Nifty SDL – 2026 Maturity (Nippon SDL ETF)

Nippon SDL ETF is an open-ended target maturity exchange traded SDL fund predominately investing in constituents of Nifty SDL Apr 2026 Top 20 Equal Weight Index. This ETF will mature in 2026. The fund house earlier came up with a Nifty CPSE Bond Plus SDL – 2024 maturity when the yields hadn’t hardened like they have now.

The proposition here is to invest in the Nifty SDL equal weight index that has top 20 largest state development loan papers issued before January 31, 2021. State development loans are also considered as government papers. In terms of strategy, the fund will have a roll-down strategy. To this extent, everything we mentioned for the IDFC index funds will apply here.

The differences are as follows:

- First, the maturity is 5 years from now whereas the IDFC fund has 6-and-7-year maturity.

- Second, the underlying papers for the Nippon SDL ETF are state loans and not central govt. securities like IDFC funds. SDLs can carry higher coupon (and higher yields) as some of the states have lower credit. However, given that the index goes by largest issuances, it is typically better-quality papers that make an entry into the index.

- Third, the IDFC funds are index funds, the Nippon fund is an ETF (i.e, you need a demat account to invest in them).

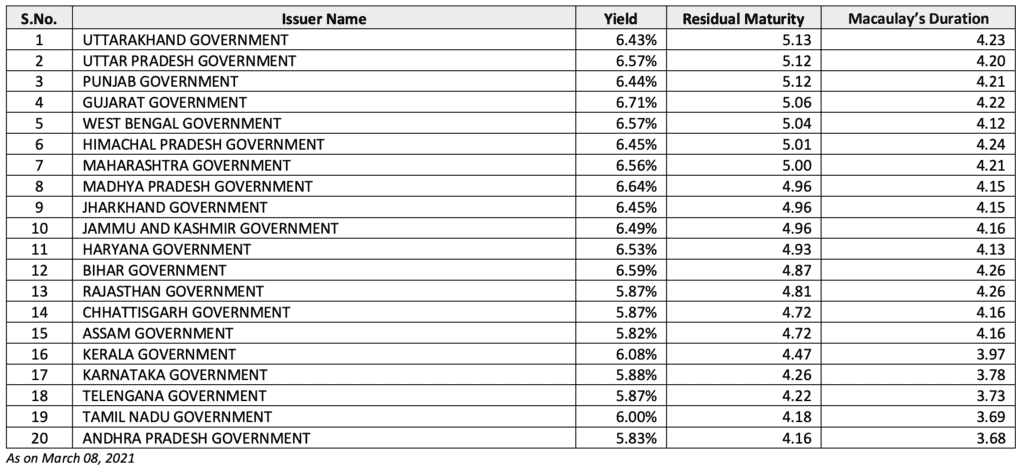

The portfolio of Nippon SDL is given below:

The yield of the above portfolio was 6.28% as March 8, 2021 and will likely be in the 6.4-6.6% range given that yields have moved up since. This is significantly higher than the current 5-year central government bond yield of 5.85%.

Should you invest?

- The spread (difference with a 5-year central govt. bond) of the Nippon SDL index, at about 70 basis points now, looks better than the spread that existed when Nippon India came up with its 4-year PSU plus SDL product in November 2020 (40 basis point spread then).

- Whether you want to invest in this depends on your time frame and risk appetite. While SDLs are technically government-backed (and therefore sovereign) they are not always as liquid as gilts. Hence, tracking error needs to be observed. You will also need a demat account.

- SDLs provide good accrual to a portfolio and can therefore provide sufficient cushion against near term losses. But if you decide to invest, be ready for losses in the short to medium term as is the case with the IDFC index funds.

- We will be watching the tracking error of this fund and any possible yield up-move before providing a call.

How about constant maturity?

Your next question may be whether a 10-year constant maturity or a gilt fund would deliver higher than the above funds – especially the IDFC passive funds . This is a tough one to answer. One reason is that constant maturity funds do not have a long record and much of their performance came at a low-rate scenario (for over 6 years).

So, we look at a rising rate scenario and took gilt funds as they are the closest to constant maturity in risk-return profile. We took the lowest rate scenario in the past 15 years. Had you invested in gilt funds at the lowest repo rate point of April 2009 and held on, your average returns over multiple time frames would have been as follows:

Interestingly, the above returns came when repo rate moved from 4.75% (April 2009) to 8% (January 2014)! Essentially, it was a full stretch of rising returns, with worst 1-year losses of 10-12% for a brief period (early 2010). But note that this is not a right representative of constant maturity as the gilts we took could tweak their maturities a bit (although most kept it long).

To summarize:

- Constant maturity funds are a lot more volatile, will fall more, but can generate higher returns if you hold the funds through at least one rate-fall cycle from here. Remember, constant maturity does not have a roll down strategy.

- If we had a period of only rate hikes, then a lower maturity like the IDFC fund can work better, relatively speaking. But 1-3 year maturity buckets work the best in such a scenario. This is why we have used constant maturity only in our 7-year plus portfolio (allowing it time to benefit from rate falls).

- If you prefer lower volatility or a 5–6-year time frame, go with the IDFC fund, but with the knowledge that you can be sitting on losses for at least 1 year (or more) when rates move up.

- Make sure you have a portfolio of very low to low duration deposits or funds to insulate the volatility in these funds.

- Also, if you decide to invest, please do not write to us asking why these passive funds are sitting on losses over the next 1–2-year period 😊 This will be true of constant maturity as well!

12 thoughts on “2 target maturity government bond fund NFOs – Should you invest?”

Hi Vidya,

Tnx for in-time input on TMFs.

(1) Can you please elaborate on … “Whether this steepness will remain for long, one would not know. To that extent, there is some element of timing in this fund.”

(2) What happens if the present steep yield curve (6-9 yrs) does not hold for long?

(3) Can one make tactical investments in TMF post NFO to generate higher interest at maturity? If yes, how & when?

(4) My conclusion from your article is one should stick to normal/constant maturity gilt funds for better returns over 7 years horizon and that TMF can be used for time specific goals around maturity of TMF.

Regards .. Jatin

1. the steepness is the current scenario of 6-7 year yield being higher than the 10-year and the sharp increase in yield post 4-5 year. This scenario may not remain.

2. Nothing happens – 10 year may seem more attractive again.

3. It is tactical yes, from an entry perspective. But if you mean tactically exiting quickly, that can lead to losses. To that extent it is not a ‘tactical one’.

4. Yes, in any case TMF cannot be used for oevr 7 years, given that it matures.

thanks, Vidya

Hey Vidya ,

Can you please explain how to make tactical entry into such TM F & ETF to realise better YTM.? I feel, tactical entry can work during rising interest rate scenario.. especially, during initial 1 to 2 year of NFO on fund employing roll down strategy.

Regards .. Jatin

When one enters a bond too the upside it isn’t quite tactical. In equity, because of the ‘unlimited upside’ an early entry into a good idea is not bad. But in debt, sicne upside is capped to the exten tof rate movement and coupon, tactical is not an easy show. Ideally in duration, entering at the early stages of rate fall is tactical enough. But entering into a just beginning rate upcycle is not really tactical IMO. It may be somewhat value to add while yields rise but that isn’t ‘timing’. For eg in this TMF, there is an elemet of ‘timing’ not a tactical entry in my limited view. thnaks, Vidya

Nice. Where do existing Kotak Bond fund fits in here?

You haven’t mentioned which kotak bond fund. In any case, it does not fit here if you are not talking about any target maturity fund. Vidya

Vidya, Kotak Bond Fund Plan A I was referring

Hello Sir, Got it, Thanks. No, it is not a gilt-only fund. SO other than duration, there is nothing in common. Thanks, Vidya

Any thoughts on the Edelweiss psu bond index and SDL fund?

It’s strategy is the same as this fund that we covered. https://primeinvestor.in/nippon-etf-cpse-bond-plus-sdl-should-you-invest/ Vidya

Could you help understand the different kinds of strategies that fund managers use in debt funds? For example, the roll down strategy is nicely explained by you here. If it’s not roll down, is it constant maturity every other time? Or are there more strategies involved?

As an investor, I would typically check for the AMC track record in debt fund space, the quality of papers held, average maturity and modified duration. Assuming all these parameters are satisfactory, that is, papers held are good credit quality, average maturity and modified duration are not too high, how significant is it then to understand the strategy employed by the fund manager in arriving at a decision whether to invest or not? And since you have pointed at the fact that AMC’s do not usually speak about the strategy they use for a particular fund, how can a retail customer know more?

Thanks

Hello Sir, you can read these:

https://primeinvestor.in/what-is-accrual-strategy-in-debt/

https://primeinvestor.in/a-duration-strategy-in-debt-funds-explained/

https://primeinvestor.in/how-primeinvestor-identifies-risk-in-debt-funds/

https://primeinvestor.in/how-to-identify-risks-in-debt-funds/

They will answer the strategies you want to know about. On your last part: “And since you have pointed at the fact that AMC’s do not usually speak about the strategy they use for a particular fund, how can a retail customer know more?” They speak but not through documents 🙂 And it can well change as well! Reason why we are there to keep tab! 🙂

Vidya

Comments are closed.