With Franklin India winding up 6 schemes, owing to the high credit risk and resultant illiquidity, we’d like to give a bit of explanation on our own processes.

Many of you ask us about VRO Ratings or Morningstar ratings and why our ratings differs. We wish to take this event as an illustration to explain why our approach is different and why we are much more than a rating tool or an article publishing site.

We will, in the process also explain the ratings history and our calls on the Franklin funds in question. Before we do so, since we will be making references to our products, know that there are 3 layers of products we offer as far as mutual funds (which is just one of our offerings) go:

- One, Prime Ratings – our in-house MF rating tool.

- Two, MF review tool – this tells you whether certain funds are buy or sell or holds and provides alternatives

- Three, Prime Funds – our list of recommended funds that ensures there is variety in fund strategy, the risks do not overweigh return potential and the funds are bucketed in terms of time frame in the case of debt.

- Four, Prime Portfolios – our readymade portfolios built for a range of goals and timeframes that use mutual funds, ETFs, deposits and other schemes.

Now we will explain how we tackle some of the key metrics that are not easily quantified in debt funds.

Credit risk as a key rating and review criteria

Since all debt categories (and even hybrid categories) carry credit risk, portfolio allocation to lower-rated papers is a key factor in ratings across categories. We don’t just look at latest portfolios – we look at historical credit allocations too, to understand the risk tendency of a fund.

Especially in categories meant for short maturities, holding papers of low credit qualities opens up risks of illiquidity and potential NAV write-offs due to downgrades or defaults. By using credit exposure as a metric across debt categories, we’re able to penalise funds that take undue risk. Depending on the category, we assign different weights to credit risks.

Why is this important? Because of the way SEBI categorises funds. There is a separate category called credit risks. While you might know this carries risks, you may never know of similar risks in other categories where SEBI does not define the credit quality. Hence you end up picking funds with high returns in lower duration, not knowing where the returns came from.

The high penalty for such credit risk in our ratings, especially in lower duration funds, reduces a fund’s overall score. Still, ratings can also mask underlying portfolio quality risk, especially when returns are high and the fund hasn’t suffered any NAV erosion.

In order to move beyond just ratings, we additionally call out risks in the MF Review tool. This tool provides our buy/sell/hold views on funds. Where we see that risks are not in line with the objective of the fund or category, we make specific calls regardless of the fund’s returns or ratings.

On these two aspects, we differ significantly from other publishers of mutual fund ratings.

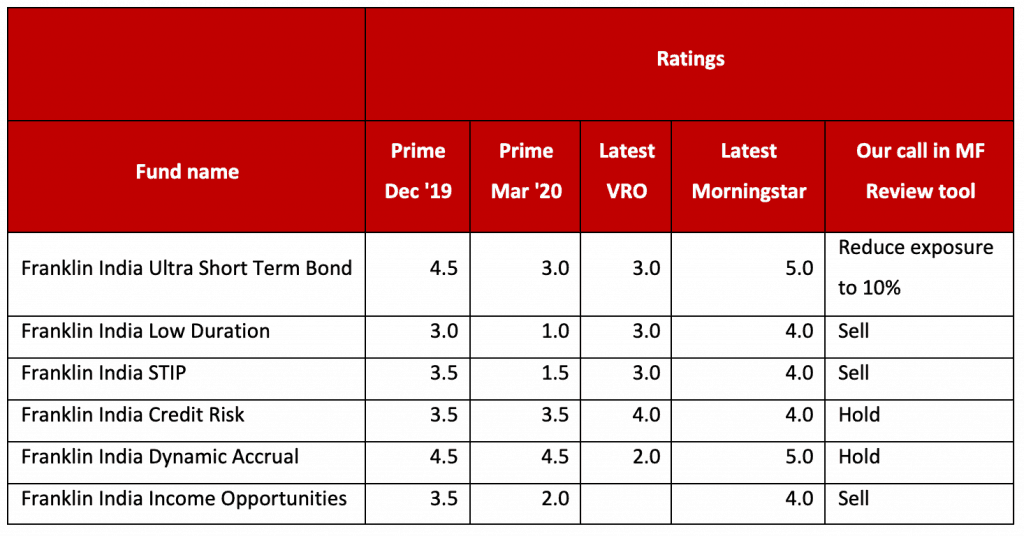

The table below shows how our ratings stack up against other major ratings, and the additional qualifications we make in the review tool to sound you off on what you should be doing with the funds (do note that this is as of yesterday, before the Franklin event).

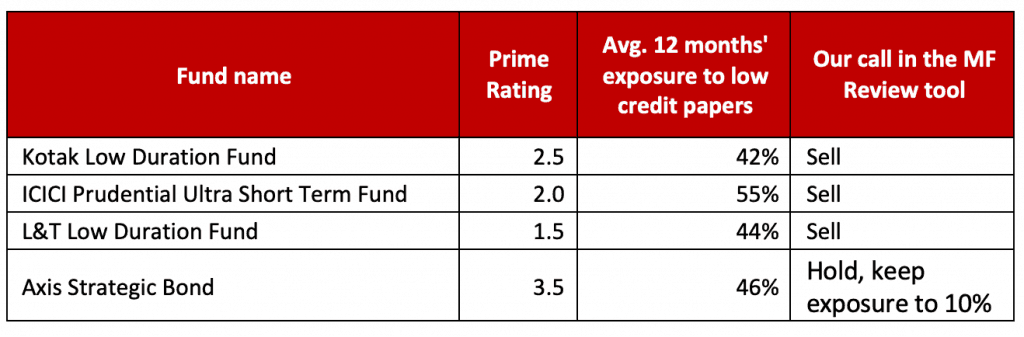

Morningstar, for example, has some of the funds mentioned above in their gold or silver categories. The table below shows a few more examples of funds in different categories, but which have credit risk and our ratings and calls on them.

It is worth noting that funds such as Kotak Low Duration and ICICI Prudential Ultra Short Term are 4-star rated in VRO. The fact that credit risk is higher did not come off in the rating.

Other measures of risk

Holding low-credit papers, while being a key risk factor, is not the only one we use to rate debt funds. In some categories, for example, we look at

- volatility

- AUM loss

- downside probabilities

- concentration risks both in instrument and group

- AUM as a gating criteria for ratings and in some categories AUM size as a metric for scoring a fund.

- Negative cash holdings suggesting possible leverage on portfolio due to redemption

And these are just some of the metrics we use in our ratings!

The metrics we look at and the weights we assign to each depend on the category and its objective. Therefore, we do not follow a one-size-fits-all approach to our rating system.

While we update Prime Ratings and recommendations on a quarterly basis, we sound you off on actions you may need to take based on events. Back when the Vodafone issue first broke, we had issued alerts – even before the big write-offs. We reiterated our sell call for a second time, when the situation worsened.

Being selective in Prime Funds and Prime Portfolios

Prime Ratings, while comprehensive, is not the sole basis on which we draw up the Prime Funds list. And all Prime Funds aren’t used in Prime Portfolios.

In Prime Funds, we

- Look at underlying portfolios for exposure to different sectors, industry groups, nature of issuers, and diversity in holdings.

- Stay well away from credit risk in shorter timeframes. That is, in Prime Funds buckets up to 3 years did not feature funds that took any credit risk.

- In longer-term buckets, we allowed some credit risk as the timeline was long enough to recover from any NAV hits. In the 3-5 year and 5+ year buckets, we had Franklin India Corporate Debt (1 year avg. 14% holding in low-rated papers) and SBI Magnum Medium Duration (1-year avg. 37% holding in low-rated papers). We had Franklin Ultra Short in the 5+ year bucket in our last quarter.

- But events over the past six months prompted us to be even stricter on credit even in the long-term recommendations. In our recently-completed Prime Funds review, we moved both Franklin Corporate Debt and SBI Medium Duration to the longest-term bucket and asked you to trim exposure if you had a less than 5-year timeframe. We removed Franklin Ultra Short Term altogether and asked you to reduce exposure to this fund.

- In light of the current events, and potential of liquidity issues in low-rated papers increasing more than we anticipated, we decided to remove SBI Magnum Medium Duration from our list in order to avoid as many risks at this time as possible. This fund is the only one in our list to hold significant credit risk. Franklin Corporate Debt remains part of the list as its quality-majority portfolio offsets credit risk.

In Prime Portfolios, we have:

- Overall given allocations to debt funds with high credit quality across all portfolios.

- In longer portfolios, to reduce active management of debt component, we added a gilt fund with a specific strategy.

- We did not pick any fund from the credit risk category.

- We had given funds that have some exposure credit risk in portfolios with longer timeframes or where it is built to deliver high growth. In these cases, we had kept allocations to such risky funds low.

- In the review, we took the same call of reducing potential of credit risk, even in portfolios classified as long-term and high risk. To this end, we had already removed Franklin India Ultra Short Term Bond as we had it in a couple of long-term portfolios. We had no other high-risk debt fund in our portfolios.

To summarize: