Passive investment options just received a new addition. UTI AMC has kicked off the NFO for UTI Nifty 200 Momentum 30, which tracks the Nifty 200 Momentum 30 index. The NFO, already open, will close on March 4 and reopen for subscription after that. The Nifty Momentum 30 is drawn from the Nifty 200 index. Momentum as a strategy is designed to pick stocks that are on a return uptrend and gain from the continued upswing. A momentum strategy should ideally deliver on the upside.

Does the Nifty 200 Momentum 30 meet this? What is its performance like and how does it compare with other options?

Index construction

There are different ways to measure momentum and follow a momentum strategy. The Nifty 200 Momentum 30 uses a stock’s 12-month and 6-month returns, divided by the daily price deviations for 1 year to arrive at the momentum score (essentially, a stock’s risk-adjusted score). Stocks with the top 30 momentum scores form the index.

This translates into picking stocks that have moved higher, but only those that are less volatile; it makes it more likely that the stock is in a steady trend. It reduces the risk of picking stocks seeing sudden spurts in returns.

The weight for each stock in the index is decided by multiplying the momentum score with the stock’s free-float market cap. Stock weights are capped at 5%. The index is rebalanced (along with redoing weights) every 6 months.

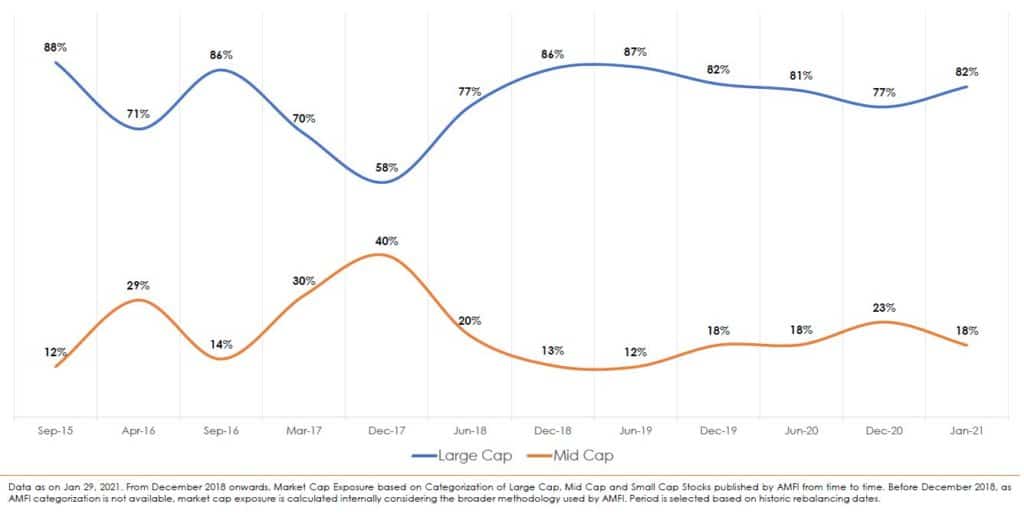

The Momentum 30 will have a mix of mid-caps and large-caps as the parent Nifty 200 itself is a blend of large and mid-caps. The share of mid or large-caps will be dependent on the market stage. The image below shows the market-cap movement.

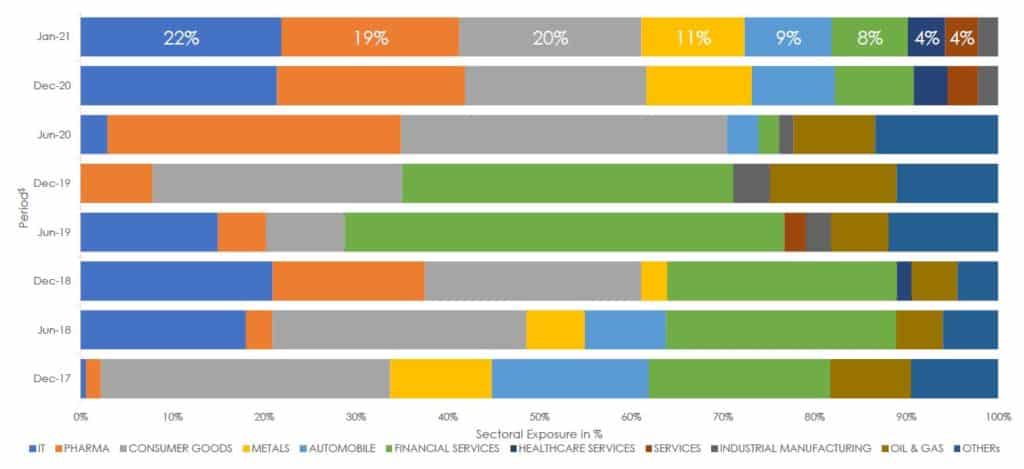

The sector rotation bears out the index methodology’s ability to pick up sectors that markets favour. IT, for example, went from almost no allocation in December 2019 to the top weight now. Pharma and consumer goods had a significant allocation mid-2020 but are now pared down in favour of more cyclicals such as metals and automobiles. The image below shows the sector movement over the past few years.

Performance comparison

When it comes to assessing performance, we’ve adopted a more practical aspect. What you need to know is whether or not the Nifty Momentum 30 is a good index option given the other index funds or ETFs that are available. For this reason, we’ve considered the following indices.

- The Nifty 50, as it’s the single most important market gauge

- The Nifty Next 50 as it also has the ability to outperform during rallies

- The Nifty Alpha Low Vol, given that an alpha strategy also aims at picking stocks with excess return.

Here’s how performance for the Nifty Momentum 30 fares.

#1 Returns and upsides

Average 5-year returns rolled daily for the past 15 years for the Nifty Momentum 30 comes in strong at 28.4%. That’s a good 13 percentage points above the Nifty 50. It beats the Next 50 as well, but by a smaller margin of 5 percentage points. The same holds for shorter timeframes such as 3 years as well. A good part of this performance comes from the Nifty Momentum 30’s ability to score on the upside. Considering 1-year returns, the index, on an average, captures 140% of the Nifty 50’s gains.

Against the Nifty Alpha Low Vol, though, the Nifty Momentum 30 is not that dominant. Average 5 year returns for both indices are very similar. In terms of upside capture, the Alpha Low Vol is lower at 128%, but it makes up against the Momentum 30 thanks to its ‘low vol’ factor. We’ll explain more in further points.

#2 Consistency

In this, we are looking at the Nifty Momentum 30’s ability to steadily outperform. Here again, the index scores handsomely against the Nifty 50. On a rolling 1-year basis over the past 15 years, the Nifty Momentum 30 beat the Nifty 50 75% of the time. Stretching it out to 5 years has the index beating the Nifty 50 95% of the time. Again, this is not too surprising given the mid-cap component in the Momentum 30.

Against the Nifty Next 50, the index does not fare quite as well given that the Next 50 is also a strong performer. But it does beat the Next 50 with a good degree of consistency at 79% of the time on a rolling 5-year basis.

The story is different against the Nifty Alpha Low Vol. While the Nifty Momentum 30 scores in market rallies, the performance takes a hit during corrections or flat markets – this is in any case the nature of a momentum strategy. The Alpha Low Vol index weights both alpha (outperformance) and low vol (low volatility). As a result, the Alpha Low Vol index is far better at downside containment and this shows up in longer term returns even if performance during rallies is lower than the Nifty Momentum 30.

Going by rolling returns of different timeframes – 1, 3 or 5 – neither index is a clear winner. The Nifty Momentum 30 beats the Alpha Low Vol 40-50% of the time across timeframes over the past 15 years. Of course, if you were to shorten the timeframe to, say, rolling 3 year returns since 2014, the Nifty Momentum 30 has a much better consistency score. But then, 2015-2017 was also a strong market uptrend where a momentum play would have certainly fared very well.

#3 Volatility and performance during corrections

The difference between the Nifty Alpha Low Vol and the Nifty Momentum 30 is clear in years such as 2018. In this time, the Nifty Momentum 30 trailed the Alpha Low Vol a good 3-4 percentage points. In terms of downside containment, the Nifty Alpha Low Vol captures, on an average, just 58% of a correction in the market bellwether Nifty 50 (based on 1 month rolling returns over the past 10 years). The Nifty Momentum 30 captures nearly 80%.

This fall and rise results in higher volatility for the index itself. It is more volatile than not just the Nifty Alpha Low Vol but also its parent Nifty 200 and the Nifty 50.

A market cap weighted index still scores

Consider the latest 1-year returns. The Nifty Momentum 30 delivered 22.1% while the Nifty 50 clocked in 26.1% . We’re in a market that’s breaking new highs. So why the underperformance in a strategy that chases the outperformers?

To put it simply, the Nifty 50 has heavier weights to top stocks. And when there are sharp rallies in these stocks, the bigger weights add to returns. The top 4 stocks in the index, which account for a third of the weight, have rallied 31%-61% between them in the past year. Not just that, the Nifty 50 has seen strong returns in several of its stocks.

The Nifty Momentum 30, though, has weights capped and will see a smaller impact of heavy run-ups in prices. Both an outperformer and an underperformer can have very similar weights. The same issue holds in the Nifty Alpha Low Vol.

Therefore, a market-cap weighted index (which is what the Nifty 50 or the Next 50 are) can work much better at times. In market rallies such as the one in 2009-10, the Nifty 50 far outperformed the Momentum 30. The Next 50 delivered more than double that of the Nifty Momentum 30. The Next 50 was a better performer in the 2012 market rally as well. And in the narrow 2019 market, the Nifty 50 beat out the Nifty Momentum 30.

This apart, the index was launched only in August last year. The index levels/sector allocations before then are back-calculated and to this extent, not real-time. We will need to watch more real-time movements.

As an index fund, we would also need to watch for the tracking error. While UTI AMC’s other index funds sport low tracking error, how well UTI Nifty Momentum 30 tracks the index will unfold only over time.

Key takeaways

To summarize:

- The Nifty Momentum 30 is a strong performer against the main market Nifty 50. However, these market-cap indices have their own merits and periods of strong outperformance. Therefore, if you want to use the Nifty Momentum 30 index, it needs to be in addition to indices such as the Nifty 50 or Nifty 100 and not a substitute. It also needs to be paired with index/ active funds that are strong in keeping volatility low. Note additionally that a momentum strategy is not really suited for conservative investors.

- If you hold the Nifty Next 50 in your portfolio, adding the UTI Nifty Momentum 30 fund can significantly increase volatility. Unless you’re able to offset this with lower-volatile options such as debt funds, or other lower-volatile equity funds, you may have to pick between the two.

- Similarly, if your portfolio houses quality funds that beat markets consistently and which are a blend of different styles, then adding the UTI Nifty Momentum 30 may be unnecessary. You can consider only if you have a large corpus and wish to reduce concentration in your portfolio.

- The Nifty Momentum 30 does not have clear performance advantage over the Nifty Alpha Low Vol, which follows a similar strategy premise. If you hold this index (through the ETF), its best to skip the Momentum 30.

This is a review of the new fund and not a call on this index. We will watch for performance of the index funds vis-à-vis other passive strategies and check tracking error before we decide to provide a recommendation.

18 thoughts on “Is the UTI Nifty 200 Momentum 30 index fund NFO worth it?”

Hi Bhavana

We now have more than a year of history of the performance of The UTI Momentum 30 index fund. While it may not be a long tenure as you may have liked, this tenure had a good mix of bull market and volatility of last 6 months. Would you do a comparison of this index with NN50 and advise if we should stick with NN50 or switch? Why NN50 – because it is part of your recommendation for >7 years portfolio.

We’ve actually done a comparison with the Next 50 in this article – the Momentum does beat the Next 50 but not by a very significant margin. Both are high-volatile. If you have the Next 50 in your portfolio already, it’s best to stick to it. – thanks, Bhavana

Where can we get Alpha, Beta, Sharp ratio of N50, NN50, ALPHA LOW VOL 30, MOMENTUM 30. Thanks.

Month-end factsheets for each index on http://www.niftyindices.com will give you some of the info like beta and std deviation. For the others, you’ll have to calculate it yourself using the index level data.

Thanks,

Bhavana

Thank you

Thank you for the detailed analysis. Can we see this fund shaping up as an ideal “Contra” strategy against a “buy and Hold” Stock investing or Nifty 50 index investing.? worth considering some allocation..?

In a manner of speaking, yes, the index works opposite to a buy-and-hold methodology. But because it’s got no composition history – like we said, the index is newly launched with back-worked levels – so we don’t actually know the churn as this info is not available. We’ll know this over time. But in your portfolio, it still is a long-term play.

Thanks,

Bhavana

I am surprised to see Bajaj Finance in the list. It is an extremely volatile stock. How come it made it to the risk-adjusted returns list?

That depends on the volatility and returns of the other stocks as per the index’s methodology. It’s always a relative measure – so there may be other far more volatile stocks, or lower-returning stocks. We don’t know the individual scores :-).

Thanks,

Bhavana

Bhavana, Informative, Thanks.

Thanks for the detailed analysis.

Considering that this a momentum based strategy, how does it fare as compared to Edelweiss BAF which also follows a momentum based strategy? Yes, its an active fund with no weight limits, but then to have a clearer picture, it may be considered.

The two funds cannot be compared. The Edelweiss fund is not a full equity fund, it uses broader (and not stock-specific) market indicators to decide how much to hedge.

Thanks,

Bhavana

Thanks for such a deep analysis, instead of usual momo jumbo like “its a new offer wait for 6 months for its performance”. Of course I still need to read few more times to get full understanding of the analysis,

Most NFOs do not lend themselves to any analysis as we do not have portfolio information to go by, which is why they always need to time to understand to see performance. Because this is an index and we have the history, we’re able to get a better picture. The fund still needs watching for tracking error.

Thanks,

Bhavana

Dear Madam,

I am not holding Nifty Alpha Low Vol ETF. Should I go for this ? If yes , how much allocation to be given ?

It depends on other funds in your portfolio, as it may contain other high-risk funds. Please note that we are yet to understand tracking error in this fund and we do not yet have a clear recommendation on it. If you wish to take exposure, you can consider smaller amounts for now.

Thanks,

Bhavana

I believe the Nifty 200 Momentum 30 index is rebalanced half-yearly. I wonder if a half-yearly frequency makes sense for a Momentum Index, in a current market where momentum shifts rapidly.

True, momentum strategies in active portfolios follow a more frequent update cycle…but going by the index’s history, they have still managed well and do see shifts in composition. As we said, the past index data is more a theoretical exercise and we need to see how it works in real time.

Thanks,

Bhavana

Comments are closed.