Equity index funds are meant to track markets passively and not built to necessarily beat active funds. But if you had an Indian index that is able to beat comparable active funds with consistency, generates strong return, adds diversification to your portfolio and even substitute some categories of active funds, would you not consider it?

It is the Nifty Next 50 index. This index is made up of the 50 biggest stocks beyond the Nifty 50. In effect, it is the Nifty 100 stocks less the Nifty 50. The Nifty Next 50 is a great addition to long-term portfolios for these reasons:

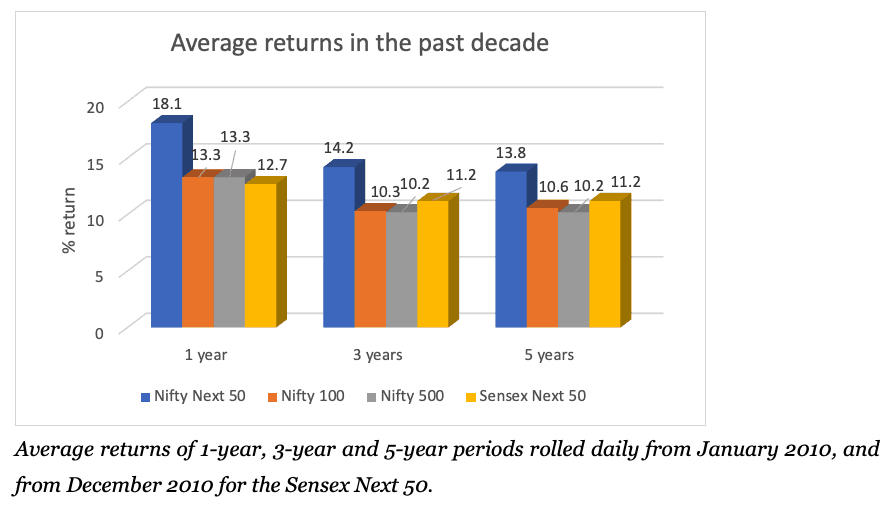

- One, it beats the Nifty 100 and the Sensex Next 50 across timeframes. It even often manages to deliver returns better than mid-cap indices such as the Nifty Midcap 100 in longer timeframes.

- Two, its sector allocation is more diverse than the Nifty 50 and is less heavily weighted towards a few key sectors such as financials.

- Three, most active large-cap funds have struggled to deliver better than the Nifty Next 50 in longer-term periods. Several multi-cap funds, too, in recent years, do not fare well when compared with the index.

Diffused sector presence

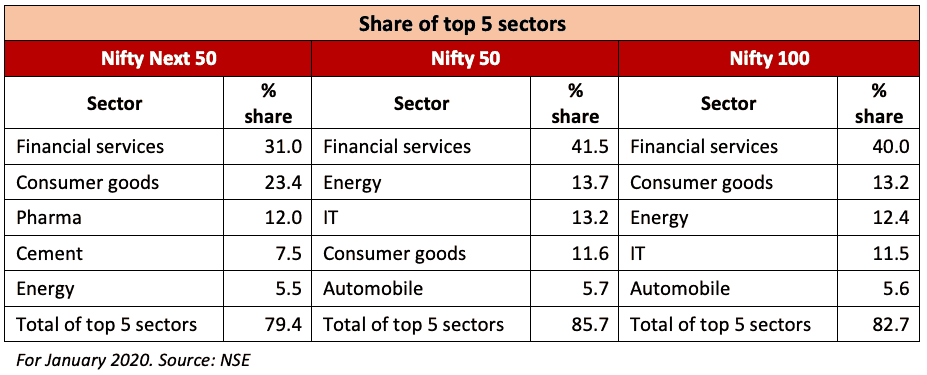

The Nifty Next 50 (Next 50) has wider stock and sector coverage than the Nifty 50 and is more evenly distributed (see table) compared with the Nifty 100 as well.

While the Next 50 is also dominated by financials, the index has a significant contribution from other sectors such as consumption and pharma. Its consumption exposure has, for example, helped its strong performance in the past years while the relatively lower cyclical sector share helped contain losses. On the financials side, it’s not just banks – the index constituents include insurance and other finance companies.

Capturing the growth

The Next 50 has the unique ability to capture a stock’s growth as it gets larger and larger to eventually make it into the Nifty 50. This is partly why the Next 50 is able to deliver extremely well during market upswings. The Nifty 100, while also housing these stocks, is far more diffused with lower individual stock weights, while the Next 50’s small set provides focus.

Average returns of 1-year, 3-year and 5-year periods rolled daily from January 2010, and from December 2010 for the Sensex Next 50.

Rolling the 3-year returns for the past decade, the Next 50 beats the Nifty 100 over 70% of the time. Stretching the period to 5 years, the Next 50 beats the Nifty 100 over 90% of the time. That’s a high degree of consistency in delivering better returns. The closest comparable, the Sensex Next 50, pales in performance.

The Next 50, despite being made up of large-caps alone, additionally beats the broad-market Nifty 500 all the time on a rolling 5-year basis, and close to 90% of the time on a rolling 3-year basis since 2010. In fact, the Next 50 sports a far better upside capture ratio.

Beating active equity funds

Recent underperformance of large cap funds aside, on a rolling 5-year returns in the past decade, the Next 50 still beats these funds over 70% of the time.

And it is not just large-caps that struggle. One in two multi-cap funds, too, tend to trail the Next 50 more often than they are able to beat it in the 3-year and 5-year periods.

Suitability

The index’s return drivers during market rallies also contribute to its underperformance in phases, such as the present one.

The poor 1-year performance compared with the Nify 100, for example, is a factor of the index’s lower weight to banking, which has been a star sector in the recent market rally. Two, because it has a relatively higher individual stock concentration compared to the Nifty 100, underperforming stocks such as Indiabulls Housing, Hindustan Zinc, and Aurobindo Pharma serve as a bigger drag.

The Next 50, therefore, is a much more volatile and therefore higher-risk index. In market corrections, the Next 50 fares poorly. For example, the worst 1-year loss for the Next 50 was 67%, against the 57% of the Nifty 100. In fact, the downside capture for the index is similar to that of pure mid-cap indices.

The Next 50, therefore, is meant only for long-term horizons of at least 5 years to allow volatility to play out. The index can be used in any of the following ways:

- One, as a substitute for a large-cap fund, or part of multi-cap exposure only by high-risk investors.

- Two, by moderate risk or conservative investors who want a substitute for aggressive midcaps.

- Three, by investors who want diversification in their long-term portfolios.

- Four, mix with value-based strategies as the index is a “growth” style index.

Funds and ETFs to invest in

The index is well-represented in the mutual fund and ETF space. Here are our picks:

- ICICI Prudential Nifty Next 50: This is the index fund we prefer. We chose this over the other Next 50 funds as it has a history enough to check tracking error, an important metric in index investing. We are also closely watching the UTI Nifty Next 50 which is performing well on all fronts but has a limited track record.

- Nippon India ETF Junior Bees: If you have a demat account, you can invest in this ETF. This ETF has among the most consistent and high trading volumes and value among those that track the Next 50. While ICICI Pru’s ETF comes close to Nippon, its trading volumes are far more erratic. Nippon Junior Bees also has a large asset size.

33 thoughts on “Prime Recommendation: An equity index that challenges active funds across categories”

Hi. I wanted to ask you if there are direct and regular index funds also? How much is the differential in expenses in that case? Also compared to index funds, are ETFs better or worse in terms of expenses and tracking errors?

Yes, there are direct and regular index funds as well. The expense ratio differential is not high in most funds, given their nature. For an understanding of the index-ETF question, please read this article: https://primeinvestor.in/should-you-go-for-index-funds-or-etfs/

Thanks,

Bhavana

Hi Bhavana,

Appreciate your detailed analysis of this interesting index. I’ve following questions.

How is this index poised now to consider, since Sensex/Nifty are cruising ahead?

Where can one quickly find the tracking errors for different index funds following same index?

How’s UTI Next 50 faring up now w.r.t. iPru Next 50?

Hello,

Well, this index can also cruise ahead 🙂 As we said, it generally tends to outperform the Nifty over time. Please don’t look at these from a 1-2 year perspective. For tracking error, you generally need to do the calculations yourself using the index levels and fund NAVs. Please check the Prime Funds list for details on funds.

Thanks,

Bhavana

Hi, you just mentioned that the nifty next 50 beats these actively managed large-cap funds over 70% of the time. Can you explain with a chart? I was comparing ICICI Prudential Nifty Next 50 with “SBI Bluechip Reg” and “Mirae Asset Large Cap Fund”

Ma’am hi, the next 50 index fund returns have been pretty descent as per the chart above. However the index fund returns haven’t been that great. Am i reading this correctly ?

Hello sir,

I am not able to understand what your exact doubt is…the Next 50 index is a high-returning, high-volatile index and delivers far better than the Nifty 100 or the Nifty 50. The index fund discussed here, to invest in the index, has some tracking error – all index funds/ETFs do – but this error is low and has improved as well, in the time since this post was written. We have also added another Next 50 index fund to our Prime Funds list in this quarter’s review. Hope this clarifies.

Thanks,

Bhavana

My bad, got it. thank you

Comments are closed.