Reliance Industries (RIL) put out more details of the proposed demerger of its Oil to Chemicals (O2C) business that it announced earlier in 2020. The company now seeks approval from shareholders, creditors, regulatory authorities, Income Tax authority, and the NCLTs in Mumbai and Ahmedabad to demerge and set up a fully owned subsidiary for the O2C business.

This article will simply seek to explain the contours of this demerger and any immediate impact if you are a shareholder in the company, in the form of a Q&A.

Q: Which segment is proposed to be demerged?

RIL came up with a proposal to spin off its O2C assets into a separate unit, first in an announcement in April 2020 followed by more details in September 2020.

The O2C assets is the downstream business of fuels (all refining, oil marketing and petrochemical assets), polymers, elastomers (rubber), aromatics & fibre intermediates and polyesters. The O2C segment accounts for two-thirds of the company’s consolidated revenue and 28% of the consolidated assets and is therefore a significant segment to contend with.

Q: What will be the proposed structure of the demerger and the consideration?

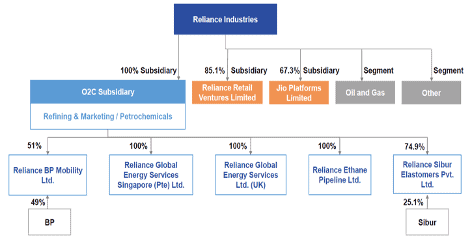

RIL will hold the O2C business as a fully-owned subsidiary. It has stated that the management control will continue to remain with itself. The chart below will tell you what companies will come under the O2C subsidiary and how the new structure will look.

Whenever there is a transfer of asset, there needs to be some consideration for the business being transferred. In this case, RIL will transfer $ 40 billion (Rs 2.89 lakh crore) of long-term assets other than non-current liabilities and net working capital to the O2C subsidiary.

The consideration for the same will be $25 billion (Rs 1.84 lakh crore) long-dated loan (linked to 1-year SBI MCLR rate with repayment flexibility) and $12 billion of equity (Rs 88,000 crore). The consideration, thus, is in the form of loans and equity. According to RIL, the consideration in tax neutral since it is being transferred at tax net worth. In other words, there is unlikely to be any cash impact for RIL from the demerger.

Q: Is there a listing of the subsidiary and what is the benefit for shareholders?

There is no listing. You will not directly benefit now by way of any share issue. Also, the consolidated financials will continue to remain the same. The cash accrual to RIL (from this subsidiary), though, will come in the form of interest from the loan given to the subsidiary, besides dividend, if any.

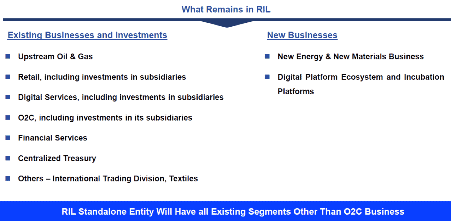

Q: Which businesses will remain with Reliance Industries now?

The chart below gives a summary of the various businesses under RIL. In other words: upstream oil & gas, as part of business segment, O2C, organized retail services and digital services (through holding) will be held by RIL. The petrochemicals business, refining, fuel retail venture with BP and other trading segments will be in the O2C business venture.

Q: What exactly is the idea behind this reorganization?

It appears that RIL wants to be a company with 4 key growth engines – new energy, new materials (both from the O2C business), digital and retail (until such time a new business is added, that is!).

To this end, it would have to ready these businesses to be self-sufficient and self-funded. Remember back when RIL was in talks with oil major Aramco in 2020? Aramco showed interest in RIL’s O2C business. This carving out will help a more focused approach to such funding/strategic tie-ups.

RIL has already become conscious of capital allocation to this segment as can be seen in partnerships such as the one with BP (Reliance BP Mobility). In other words, this can be viewed as one more step towards freeing its balance sheet and focusing on new capital allocation opportunities (although RIL had already significantly deleveraged its balance sheet through various fund raise deals).

The company has stated that it plans to focus on new energy (renewables) and become net carbon-zero by 2035. This appears to suggest a long-term vision of seeing demand shift to alternative fuels from carbon-based fuels.

A report by Morgan Stanley sees maximum capital allocation happening in new energy and digital businesses over the next 10 years.

Q: When will this reorganization take effect?

The demerger will be effective January 1, 2021 subject to all the approvals from different stakeholders. The company has received clearance from SEBI and stock exchanges and hopes to complete all other approvals and formalities by the second quarter of FY-22.

Q: Is this a big deal for Reliance Industries?

Yes, it is. One, RIL is known to enter new business opportunities early on and aggressively combat competition. It is likely that it does see opportunities in clean fuels and is moving towards that.

Two, RIL has shown its mettle in entering new businesses that seemed to be a cash drag or are debt heavy, to monetizing them successfully later. It did this with its digital platform and retail venture. It was able to significantly reduce its leverage through such equity infusion. In other words, it has shown it can monetize assets in a timely manner and that is what it is trying to do with its O2C business now.

Three, it has, from its experience in its earlier ventures, learnt not to go debt-heavy and is therefore focusing on strategic stake/partnerships now to stay efficient on the capital allocation front.

Such moves do cause a re-rating in the market as well. Its stake sale in digital and retail ventures resulted in valuations moving north with price earnings ratio moving from 24 times in end December 2019 to 32 times now. Over this period, the expansion in per share earnings was negligible.

Q: Does this improve the prospects of RIL stock?

For you as an investor, until such time standalone entities are listed (like the digital business for instance), the embedded value of these business may not be fully realized. Or rather (IMHO), never be really understood!

However, ‘the value unlocking’ or ‘monetization of assets’ – as analysts love to say – would mean that brokerages will likely go overweight on the stock.

The RIL stock calls for a ‘sum of the parts (SOTP)’ valuation – a combination of EV/Sales or EV/EBITDA, last deal valuation and DCF – depending on which stage different business segments are in. This article does not seek to value the business.

However, it can definitely be said that the complexity is high, and a holding company structure often makes valuing the stock difficult as a discount is often given for such structures. This leads to multiple valuation techniques and a wide range of target prices. Happy relying (or not relying) on those for your Reliance stock! 😊

This article is not a recommendation of the RIL stock.

To access the RIL Presentation about the demerger, please follow this link.

4 thoughts on “8 things you need to know about Reliance Industries’ demerger plan”

Thanks..

New query

Can you in next article explain what is causing bonds to fall and yields to rise. In fact as laymen wishes to know what yields are rising when bonds are falling.who is buying bonds when they are falling ( I think govt). Pls help me in making me understand.

It will be explained in one of the Q&As in today’s article by Aarati on a FAQ on stock portfolio. Vidya

As mentioned in the Article of RIL Demerger by you; ie. “complexity is high, and a holding company structure often makes valuing the stock difficult as a discount is often given for such structures” does mean that on later dates to discount to this stock will get nullified and real value may emerge.

Agreed that it is very complex way to come to some value esp for this company; but then why and how are foreign investors like google etc are valuing it and providing necessary partnership? can you provide slight more insight on it.

Sir, Investors (VCs/PE/strategic partners) value companies without profits at billion dollr valuations 🙂 Google or Facebook may have its own thesis on why they think there is value and diversify in 10 such ideas and even if 1 works they recover. I do not think retail investors have that leeway. For eg: valuing the retail entity and Jio based on last deal (which is what brokerages fo,w ithout a thesis) is so not the best way for you simply because we don’t even know why those companies should be valued so. If I knew, I would say 🙂 Unfortunately, what I say would at best be conjectures 🙂 If the new sussidiary is say sold to Aramco (just eg), then it is a lot easier to comment on a business that has built cash flows and ROE.thanks, Vidya

Comments are closed.