If you are an NRI, the chances are that you usually keep an eye out for places to park your surplus earnings in India that are safe, will protect you from exchange rate changes and fetch a respectable return. You probably already have NRE deposits and FCNR(B) deposits, the bank FD equivalents for NRIs. But did you know that there have been recent regulatory relaxations by RBI that give you a window of opportunity to lock into higher rates on these tried and tested savings tools? Here is a closer look.

Recent changes by the RBI

With global upheavals causing foreign investors to pull out money from India and causing the rupee to slide close to 80 levels to a dollar, RBI has been exploring innovative methods to bring in more foreign currency flows. In July 2022, it laid down the red carpet for NRIs by announcing the following:

- It exempted FCNR(B) deposits and NRE deposits raised (with base date of July 1, 2022) until November 4, 2022, from calculation of CRR and SLR (RBI circular). Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) are RBIs tools requiring banks to set aside a chunk of their deposits at low returns with RBI. This exemption encourages banks to attract more NRE and FCNR(B) deposits, by allowing them to earn higher yields from them.

It temporarily removed the interest rate ceilings on NRE deposits and FCNR(B) deposits (RBI circular) from July 7, 2022 until October 31, 2022. This gives banks leeway to offer higher interest rates on NRI deposits than before.

NRE Deposits

Interest on NRE deposits is governed by RBI guidelines (Master Direction dated March 3, 2016 and Master Direction dated May 12, 2016). These guidelines place the ceiling for interest on NRE deposits at ‘interest offered on comparable rupee domestic term deposits’. After the July 6 RBI circular, several banks have announced revisions to the rates on NRE deposits. Here’s a look at some of them:

Please note that the above is just an illustrative list and are not our recommendations.

While not all banks have revised NRE deposit rates upwards, some like HDFC Bank and Federal Bank have announced special windows during which eligible customers can avail of special rates on NRE deposits that are significantly higher than their regular rates. For instance:

- HDFC Bank ’s published interest rates for NRE deposits over Rs. 2 crores is 5.75% for 1 and 5-year tenures. However, the bank held a special drive during a 2-day window during which NRE deposits were offered 6.8% for amounts of Rs. 2 crores to Rs. 150 crores with 12 to 15 month tenures.

- Federal Bank too has announced a special window during which it will offer a higher interest rate of 6.4% for NRE deposits below Rs. 2 crores and 6.65% for NRE deposits above Rs. 2 crores for tenures of 15 months.

Other banks may roll out such drives too and NRIs can benefit from keeping watch on this.

Points to note with NRE deposits

NRE (Non Resident External) is an account meant for an NRI to remit foreign earnings into India and hold it in rupees. This contrasts with the NRO – Non Resident Ordinary – account, which is meant for an NRI to park income earned within India. NRE accounts can be of different types such as ‘Savings’, Current’ or ‘Deposit’.

An NRE deposit is therefore, a fixed deposit out of the funds of an NRI from the income earned outside India. This deposit can be set up by transferring from an NRE account or by other means such as direct remittances, as laid out by individual banks but NOT by transferring from an NRO account. This deposit can be opened by an NRI or a PIO (Person of Indian Origin) or an OCI (Overseas Citizen of India).

NRE deposits are available for tenures of 1 to 10 years. Premature withdrawal is usually allowed but if it is before completion of 1 year, interest is not paid. Higher rates of interest that are usually available on term deposits for senior citizens are not applicable to NRE deposits.

Pros

- The amount in the NRE deposit account and income earned on it is tax free in India.

- The amount and interest earned on an NRE deposit can be repatriated out of India.

Cons

- Because this account requires converting your forex earnings into Indian rupees at the time of deposit and withdrawal, it is subject to exchange rate risks. If the rupee depreciates against your home currency during the period of deposit, you will suffer losses to your principal and vice versa. This factor has to be weighed against the interest you earn.

FCNR-B Deposits

If converting your earnings to Indian rupees is not something you want to do, a FCNR(B) deposit that allows the money to be held in foreign currency, is an alternative. Usually, interest on FCNR(B) deposits too are subject to ceilings as stipulated by RBI guidelines (Master Direction dated March 3, 2016 and Master Direction dated May 12, 2016).

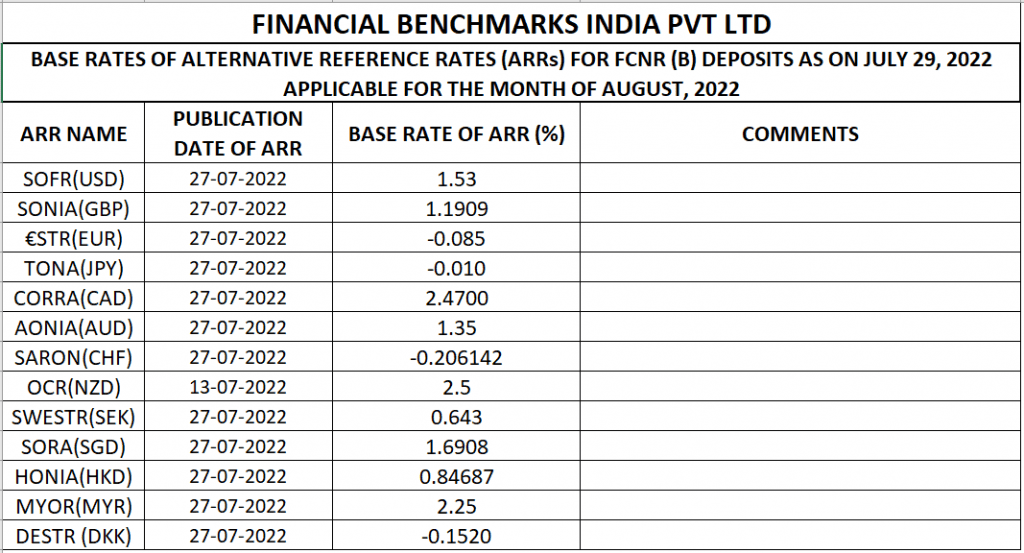

However, in addition to NRE deposits, the RBI has (via its circular dated July 6, 2022) temporarily lifted the cap on interest rates on new FCNR deposits until October 31, 2022. For FCNR(B) accounts, the interest rate is linked to the Overnight Alternative Reference Rate (ARR – published by Financial Benchmarks India Pvt. Ltd.) for the respective currency as on the last working day of the preceding month. The latest ARRs applicable for FCNR-B deposits can be found on the FBIL website. The table below contains the ARRs for the month of August 2022.

Source: FBIL website

For FCNR(B) deposits with periods ranging from 1 year to 3 years, the ceiling was fixed at ARR + 250 basis points and for those with tenures from 3 years to 5 years, the ceiling was fixed at ARR + 350 basis points. With the temporary lifting of the ceilings, some banks have revised the rates they offer on FCNR(B) deposits. The table below highlights some of these banks.

Please note that this is just an illustrative list and are not our recommendations.

Points to note with FCNR(B) deposits

FCNR is short for Foreign Currency Non Resident and is a fixed deposit held in foreign currency in India (USD, GBP, JPY etc.). The FCNR(B) accounts replaced the FCNR-A accounts that were in existence before. An FCNR deposit can be held by an NRI or a PIO or an OCI. The tenure of these deposits can be between 1 and 5 years. Premature withdrawal is usually allowed but like NRE deposits, if it is before completion of 1 year, interest is not paid.

Pros

- FCNR accounts (both principal and interest) are exempt from tax in India.

- Both principal and interest can be freely repatriated out of India.

- Since the deposit is held in foreign currency, it is not exposed to exchange rate risk.

Cons

- Because the bank takes on exchange rate risk, interest rates offered are much lower than those for either local term deposits or NRE accounts.

How to use this opportunity?

- Your individual requirements and circumstances will determine whether your surplus funds have to be parked in Indian rupees (NRE deposit) or in foreign currency (FCNR deposit).

- While the temporary lifting of the ceiling on interest rates has thrown up an opportunity, all banks have not reacted uniformly to the RBI’s measures. Some have increased rates for certain tenures, some have left rates unchanged and others have held special drives during limited time intervals with higher interest rates. Those that have increased rates too, have not done it in one smooth movement. SBI has made more than one revision of FCNR rates since the RBI announcement per news reports that have brought the 1 year FCNR deposit rate from 1.8% to 2.85% and then to 3.5%.

- FCNR rates have not been revised for all holding currencies. This has been done mainly for deposits held in USD.

- It may therefore take a little shopping around (on bank websites and via emails and phone calls) to find the bank with the best rates. In this process, one will naturally tend to be partial to the bank one already has a relationship with.

- However, high deposit rates alone cannot be the factor that determines where you park your savings. Our earlier article, ‘9 things to look for before you choose your bank FD’ has some useful points which will be relevant when shopping for NRE deposits and FCNR deposits as well.

- While both NRE deposits and FCNR deposits are covered by deposit insurance by DICGC (Deposit Insurance and Credit Guarantee Corporation) this is only to the tune of Rs. 5 lakh per account holder. The DICGC Amendment Act 2021, that came into force last year brought about some welcome changes and that you can read about in our article here.

- Prime Bank FD tool, which filters banks based on metrics that reflect the financial health of the banks will further help in evaluating banks in order to make an informed choice on where to place your deposits.

2 thoughts on “Higher rates offer a window of opportunity for NRIs”

thanks for the article.

wish to know whether FCNR deposit and Premium Rupee Plan (offered by yes bank) are once and the same ?

can you please provide clarity on it ?

also as RBI has removed certain restrictions; is it safe to place NRE Deposits or FCNR deposit to private banks like RBL ; IDFC First and Yes bank ?

Regards;

Vrajesh

Hello Sir,

Thank you for the question.

1. The Premium Rupee Plan from Yes Bank is not the same as a plain FCNR deposit. The Premium Rupee Plan combines an FCNR deposit with a forward contract.

2. On whether it is safe to place NRE / FCNR deposits in private banks, our article, ‘9 things to look for before you choose your bank FD‘ will help. The points in this article are applicable for NRE and FCNR deposits too. Please also take a look at our ‘Prime Bank FD Tool‘. This tool filters banks on metrics that will help you guage the financial health of the bank. This will help you in deciding where to place your deposits.

Thank you.

Comments are closed.