If you are gadget-crazy or a crypto enthusiast or you work in the auto, consumer durables or electronic sectors you may be familiar with the present shortage in the semiconductor industry. You may also know, by now, that almost the entire fate of the industry sits on the head of one tiny island – Taiwan.

This country has been in the limelight ever since the chip shortage saga began as it is the largest chip manufacturer, commanding a 53% market share in chip contract manufacturing and over 80% share in overall global chip manufacturing revenue. In addition, when it specifically comes to advanced semiconductor manufacturing technology (like your smart phones or hardware for crypto mining), Taiwan is almost a monopoly.

Nippon India AMC has therefore decided to focus on the investment opportunity in this nation with its NFO – Nippon India Taiwan Equity Fund (NITEF).

About Nippon India Taiwan Equity Fund

This international fund will directly invest in stocks of Taiwanese companies and will seek to replicate the Cathay Cathay Fund, an actively-managed fund domiciled in Taiwan and run by the largest AMC in that country.

Nippon India entered an agreement in April 2021 with Cathay Holding for cross selling of ideas/products. As part of this, it will be advised by the Cathay group’s AMC. The Nippon India Taiwan Equity fund is not a Fund of Fund. It seeks to replicate the Cathay Cathay Fund by investing in the same stocks. The Cathay Cathay fund’s mandate allows it to leverage MFs in its market, and Indian regulations do not permit leverage by MFs. Therefore, the Nippon India AMC sought to avoid holding the fund itself, and will instead directly invest in the stocks.

The Nippon India Taiwan Equity Fund will invest in the new Taiwan dollar (NRD) currency. It is noteworthy that this currency has appreciated by about 5% annually against the rupee over a 10-year period. The NFO of the Nippon India Taiwan Equity fund will close on December 6, 2021 and will again open for reinvestment. Exit load will be 1% if you sell within 3 months of purchase. Like any other international fund, this fund will be taxed like a debt fund for capital gains purposes.

Cathay Cathay fund: performance & portfolio

Since the Nippon fund will invest in the Cathay Cathay Fund, let us look at its makeup. The Cathay Cathay fund’s sector holding below will tell you that semiconductors is the largest sector holding followed by electronic parts, for which Taiwan is known for. Essentially, Nippon India Taiwan Equity Fund seeks to provide exposure to the semiconductor market for a large part of the portfolio.

The Cathay Cathay fund held the following top 10 stocks as of September 2021. Among its holdings, you will see that the global giant Taiwan Semiconductors Manufacturing Company (TSMC) and the slightly lower-end chipmaker UMC are among the top holdings. UMC’s earnings tripled in 2020 while TSMC’s grew 50%. Both UMC and TSMC are listed on the NYSE as well.

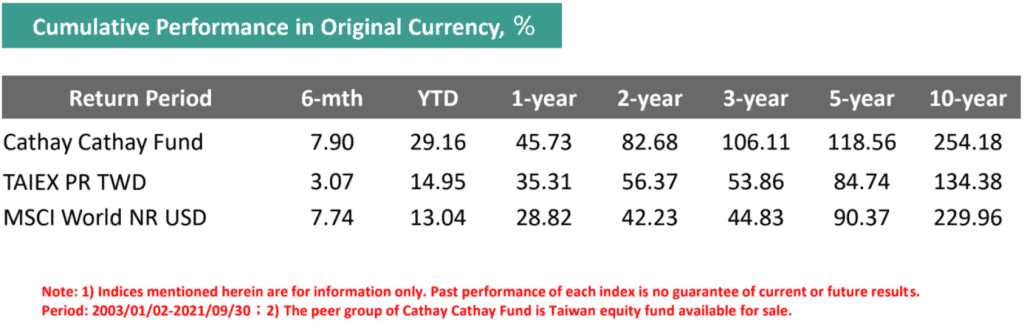

The Cathay Cathay fund delivered healthy returns (see data below), convincingly beating the Taiwan benchmark index TAIEX across time frames. However, since these are in the respective country’s currencies, we have not done any comparison with Indian markets. Returns in the table are absolute and not annualized (as disclosed by the AMC) and are as of September 2021.

Source : Product Presentation

As a market, Taiwan has delivered higher returns than China or India in the last 10 years, going by the MSCI indices in dollar denomination (to make markets comparable). This is largely driven by the increasing demand for semiconductors and electronics from Taiwan. But this also means that the Taiwanese market has had a big bull run. This apart, it may not be entirely right to compare the 15.3 times PE ratio of TAIEX with India, as it is around the historical average for the index and the market seldom crossed PE of 20 times.

If you decide to invest in Taiwan, the primary motive can only be to participate in the semiconductor industry. Therefore, you need to know what is happening in the industry and whether its prospects will remain bright. Do note that the semiconductor industry has been quite cyclical in the past. In fact, semiconductor sales declined worldwide in 2018 and 2019.

What’s the big ado about chip shortage?

The semiconductor industry is in the limelight due to a severe shortage of chips faced by industries across auto, smartphones, laptops and gaming. Let’s understand the importance of these chips and the possible reasons for the shortage.

As we are well aware, semiconductor chips are used for everyday appliances and gadgets from your smartphone to cars to air conditioning units, and, of course, in cryptos. Any advanced computing, communication and application requires a chip today. For example, they are used in integrated circuits used in your car’s digital displays, entertainment systems and even in assisted parking.

But chip-making is not easy. Chips can broadly be classified into two types based on their complexity. One, simpler microcontrollers, that typically control things like a car’s engine systems. Two, microprocessors or System-on-a-Chip (SoC) which is complex (as it integrates almost all components in an electronic system or computer) and are needed in, say, a car’s infotainment system. The latter is not easy to manufacture because of its extreme complexity. (If you’re keen on understanding it deeper, check this video on why chip making is really hard). So, most buyers whether they are giants like Apple or NVIDIA or not, outsource the manufacturing of chips even as they own their design.

Still, the industry was running fine and demand and supply largely remained balanced; supply was even in excess in years like 2018. Yet, there is a severe shortage now. What caused it?

The pandemic: The pandemic appears to be a primary factor. By mid-2020, when auto makers thought Covid-19 would cause a recession, they cut back on their orders or cancelled them. Even consumer durable companies scaled back orders. Chip manufacturers, therefore, diverted their capacities to where there was demand – computer equipment and mobile devices, communication platforms like Zoom or other video streaming services – driven by work-from-home policies.

This is important because a company never gets semiconductor chips on demand, especially the higher-end ones (and most are becoming high end!). It can take several months before Apple or NVIDIA to receive their supplies. Semiconductor fabrication units (called fabs) need tens of billions of dollars in capex and take time to build. Because a significant chunk of revenue needs to be deployed in such capex and returns are therefore not that great, fabs are built only on firm estimated projections.

Therefore, when several industries cut back on orders and chip makers diverted capacities, two things went wrong:

- One, the likes of automakers and durable companies realized their mistake in cutting supplies as pent-up demand surged. They frantically needed chips in large quantities but could not secure them.

- Two, the demand for computers and other infrastructure needed for remote work as well as gaming and cryptos (effect of sitting at home?!) surged in an unanticipated manner. This demand was something that was new to both the buyers and sellers of chips and threw the demand-supply out of whack.

More shortage: Much of the higher-end chip supplies come from one company - TSMC. Its present capacity is not sufficient, even as it promises to deploy more capital to expand. But that’s not all. There is more complexity.

Companies like TSMC buy high-end extreme ultraviolet (EUV) lithography machines from a Dutch-player called ASML. Lithography machines are used to etch circuit patterns on silicon wafers. Here’s the cracker - ASML is the only company that has cracked the code for EUV machines! Moreover, they can make just 30 machines a year and it takes several planes to even ship them.

Even assuming that TSMC is able to up its production, chips are populated on printed circuit boards that have hundreds of other components such as capacitors, inductors, resistors and so on. These are primarily manufactured in China. These factories are currently facing acute power shortage and running on low capacities as a result of China's brewing energy crisis (another reason for the bitcoin crackdown in China).

So, you know, this is just tying itself in knots!

But before we move to when the shortage will end it is important to be aware that the pandemic may only have been a catalyst for a chip demand that was anyway surging. There were and are other new drivers:

- Connectivity through 5G and mobility (self-driven cars or advanced transport mechanisms) are all new demand that is still not estimated accurately.

- Graphic processing units (GPU) that are in demand by the fast-growing gaming fraternity and crypto miners also caused severe shortages as their demand remains unpredictable. These make the demand for the semiconductor industry quite volatile and erratic.

- Internet of Things (IOT) connected smart devices can be in use from running your washing machine, car or your watch. The emerging demand trends on these needs more validation.

Even as the semiconductor chip may become the most valuable commodity, it is not easily commoditized, given the complexities in manufacturing. Gartner says the shortage can last until the second quarter of 2022, while others like this blog by Forrester’s Vice President say the shortage won’t ease soon. While we are not experts to agree or refute these claims, our reading of many tech journals suggests that the shortage can last long and the new demand can still keep the industry growing at a healthy pace.

Hence, we are inclined to believe that this space offers opportunity.

The risk lies in the fact that many of these stocks have run up and the Taiwan market has also seen a significant rally. Hence, a play from here on can be quite volatile. And remember, many of the companies in the semiconductor space need to be viewed like commodities and subject to cyclicality.

How to play the shortage

If you believe that the chip shortage is here to stay, you can choose to play this theme through international stocks and ETFs or through the Nippon Taiwan Equity fund.

If you are familiar with international stocks and have an account to invest abroad (especially in the US market), then investing directly in stocks must be your first choice. The reason is that stocks/ETFs help you directly own the semiconductor industry and play the chip shortage; in the Nippon fund, over 40% of your exposure would be in other sectors as the fund is a play on the overall Taiwan market.

#1 Stock route

Of the top stocks in the Cathay Cathay fund, the stocks of UMC and TSMC are also listed in the US market, if you have access to it. Besides, Dutch lithography machine maker ASML (discussed earlier) is also listed on US exchanges. Of course, R&D companies such as Intel, NVIDIA are already familiar names for many.

Consider owning 1-3 stocks and ensure that your exposure is under 10% of your stock portfolio and averaged. We are not experts to recommend a filtered list of these international stocks. Please do your own research.

#2 ETF route

If stock-picking is not your game, then there are US-based ETFs such as the iShares Semiconductor ETF (NASDAQ: SOXX) and VanEck Vectors Semiconductor ETF (NASDAQ: SMH). The former invests in the semiconductor industry in the US while the latter invests in the sector worldwide. You cannot buy these unless you have an international brokerage account or are offered one through your local brokerage.

#3 Fund route

If you do not have access to international stocks directly, then the Nippon India Taiwan Equity fund could be your option to ride the chip shortage opportunity and semiconductor space. But remember, there are some limitations:

- One, this is a Taiwan fund and not a semiconductor-focused fund. However, semiconductors do account for a large proportion of its portfolio at present.

- Two, your investment will be subject to volatility in the Taiwanese currency NTD, although we have mentioned that it has generally gained against the rupee historically.

- Three, the Taiwan market has had a prolonged bull run and can see volatility or correction.

- Four, the Taiwan market (as suggested by MSCI indices) has a lower correlation with India (at under 0.5%) in the last 5 years. But it is even lower with the US markets. Hence, this is not the best diversification strategy. Rather its concentrated exposure to one sector makes it similar to a thematic fund.

- Five, while political risks have so far been a war of words, a real threat of China taking Taiwan (or a war of words) in its fold can rock the Taiwan stock markets too!

Exposure, if any, should be not over 5%. Cost averaging on dips may be needed. View this as a thematic exposure and book profits periodically. While the active fund route will have a higher expense ratio, it need not be necessarily higher than the stock or ETF route as the cost of investing internationally is not low. So, cost comparison need not be a priority in this case.

8 thoughts on “NFO Review: Nippon India Taiwan Equity Fund – ride the chip shortage”

“Four, the Taiwan market (as suggested by MSCI indices) has a lower correlation with India (at under 0.5%) in the last 5 years. But it is even lower with the US markets. Hence, this is not the best diversification strategy. ”

I would have thought, “lower correlation” would mean good diversification isn’t it ? So didn’t quite understand this statement.

Sorry, it is not clear. we meant India’s correlation is lower with US than with Taiwan. thanks, Vidya

Well researched & comprehensive review !

Although, many companies & countries are going to invest huge money in Chips industry, considering tremendous complexity, all these companies will take at least next 2 to 3 years to become operational. Till then, Taiwanese companies have no competition. Also, with Electrical vehicles (needs 4 times more Semi Conductors than petrol cars) becoming new craze, this product will be in huge demand further aggravating the shortage. Even political threats by China are not for near future. So I feel, it will be good bet on this particular industry as well Taiwan as a whole.

pls advice on currecny risk

so if the fund performs by 5%

and taiwan currency appreciates 5% against inr.. like the trend

do we get a return as 0 ? or 10 % ?

The extent of currency returns cannot directly be converted into your fund returns. it depends on the fund’s own purchase of stocks at different price levels. So we cannot really tell you. Directionally fund should move up if currency appreciates. thanks, Vidya

Thanks for the good write up. There are multiple flexi funds in India that has international exposure. I am wondering if any of those funds have invested in these stocks? I wish some of the ‘opportunities’ fund made use of this situation but I doubt if they did.

excellent review! I was looking into this fund on my own yesterday but could not get even half the details you have mentioned in the review. Could you please review Axis/ edelweiss greater china funds?

These are benchmarked to MSCI golden dragon index which seems to be more diversified.

As per my understanding MSCI golden dragon = 2/3 MSCI china + 1/3 MSCI taiwan approximately which makes it a much more diversified offering.

Also, since china+ taiwan is 50 percent of MSCI emerging markets, a single fund can provide good diversified emerging market exposure. Greater china funds being more diversified can be a core holding while you have rightly said that the nippon taiwan fund is a thematic offering.

Thank you sir. If we are well placed to understand and cover those markets, we will review. Vidya

Comments are closed.