We are delighted and excited to launch a brand new tool that many of you have been asking about for quite some time – a tool that reviews your LIVE mutual fund portfolio – Portfolio Review Pro! This path-breaking tool is:

- Easier to use and view your holdings than the few such tools available in the market – no need to upload any PDF statements anymore!

- More flexible and powerful than any review tool

- Provides consolidated view of ALL your MF holdings (demat or non-demat, from multiple brokers etc) in one single place.

- Shows deep insights into your holdings, and guides you into rebalance and changes if necessary.

- Most importantly, tells you our well-researched opinion about your portfolio and how you can make it better!

With this tool, and with our host existing products, we think you are fully equipped to become a confident DIY investor!

What Portfolio Review Pro tool gives you

Portfolio Review Pro ensures that not only get to view your live portfolio but also get actionable insights on it. This new tool will give you:

- A consolidated view of all funds you hold, wherever you hold them. You can update this data so it stays refreshed and you have ready access to your portfolio information.

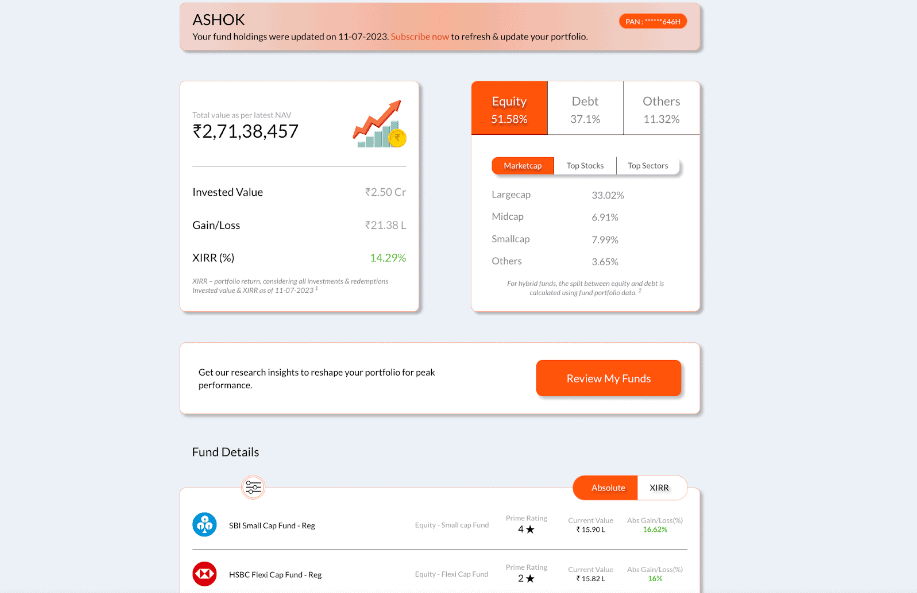

- A snapshot of the main characteristics of your portfolio. This starts with XIRR returns, fund-wise returns, current vs invested value and goes on to your equity-debt allocation, top stocks or sectors in equity, credit or maturity profile in debt and so on.

- Our research opinion on your portfolio. This is where you will know how good your portfolio is! Our insights will cover your asset allocation and the level of portfolio risk, buy/sell/hold calls on funds, the ideal number of funds you should hold, identify concentration risks, and flag funds where costs are high.

Portfolio Review Pro assigns your portfolio a health score – so you know in a single view whether there’s a complete overhaul needed or just small tweaks will get your portfolio in top shape!

Portfolio Review Pro is available to Growth and Essentials subscribers. Our trial users will also get to try this tool out in their trial period!

How Portfolio Review Pro works

Portfolio Review Pro lets you view (and review) all your funds – whether direct or regular, and regardless of which platform or means you have used to invest in them. We have tied up with MF Central for retrieving your fund holdings, and use your PAN and mobile number, along with an OTP to retrieve your fund data.

Here’s all you have to do – enter your PAN and mobile number for the funds you want to review. Enter the OTP you receive, which will allow us to retrieve your fund holdings. The next step will take you straight to viewing your portfolio. A few points to note here:

- Currently, we’re enabling only one PAN per user. However, we’re already working on multi-PAN per user.

- You need to enter your PAN only once. After that, you can return to Portfolio Review Pro at any time to view/review; most data such as asset allocation, market cap allocation, current value, and the review section etc is updated on a daily basis. So the value you will see will be the latest!

- However, you need to refresh your fund holdings details if you have made any fresh transactions (investment or redemption) since the last time you viewed your holdings (we will mention when you refreshed/updated last). You will only have to generate an OTP every time you need to do such updates. Growth users can update every 7 days (or 4 times a month) and Essentials can update every 14 days (or 2 times a month).

All your data are stored in highly secure, India-based servers and transmitted in industry-standard encrypted formats. We do not and will not share any personal information about you with any third-party for any reason, unless required to do so by market regulators or government agencies. Your data is solely to provide insightful information about your portfolio to you; we neither track your data nor do we have any ability to make changes to your portfolio.

How Portfolio Review Pro helps you

There are two parts to Portfolio Review Pro. The first part gives you an overview of your portfolio and the second part gives you pointers on the good and the to-change in your portfolio.

#1 Your returns & portfolio composition

The overview section is the first one you see. This section breaks up into three main parts.

Here’s what each part tells you:

- Returns & value: This section will help you know the current value of your investments and the cost of such investments. When it comes to returns, the real returns on your portfolio should account for every transaction (inflow and outflow) you’ve made in all your funds since you started investing (for now let us say since the time CAMS & Karvy have this data), and where values stand today. Such a calculation will give you the annualised, time-adjusted true return of your portfolio. This is captured in the XIRR you see in this section.

- Asset allocation: Here, you’ll know how much equity and debt your portfolio has, with hybrid funds also split based on their portfolios. But even more, you’ll know the top stocks you hold across all funds together and sectors. This will give you an idea of whether there’s a lot of similarity in your fund portfolios. You’ll also know the market cap allocation. On the debt side, the break-down of maturity profiles will tell you if you’re very long-term or only short-term in your holdings – so you have an indication on where you can make fresh investments. Similarly, credit-rating breakdown can help you pinpoint if any of your funds, even if they are not pure credit risk funds, take credit calls.

- Fund details: This is the list of all your funds. You will be able to see both absolute returns and fund-wise XIRR, besides other details. This section is great to understand the full list of funds you have, especially if you’ve invested through multiple platforms. You can sort & filter funds here to slice and dice your fund list and understand how your holdings are distributed.

#2 Asset allocation balance you need

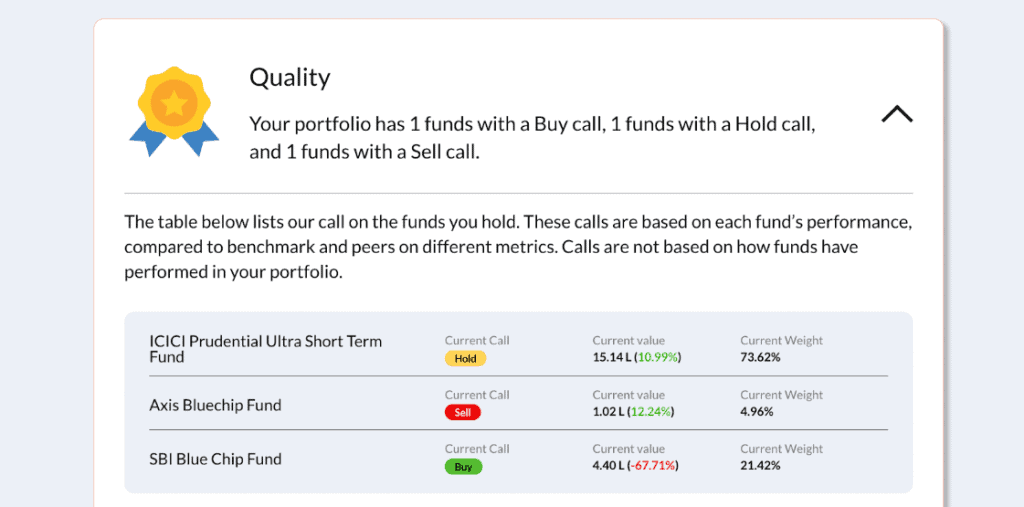

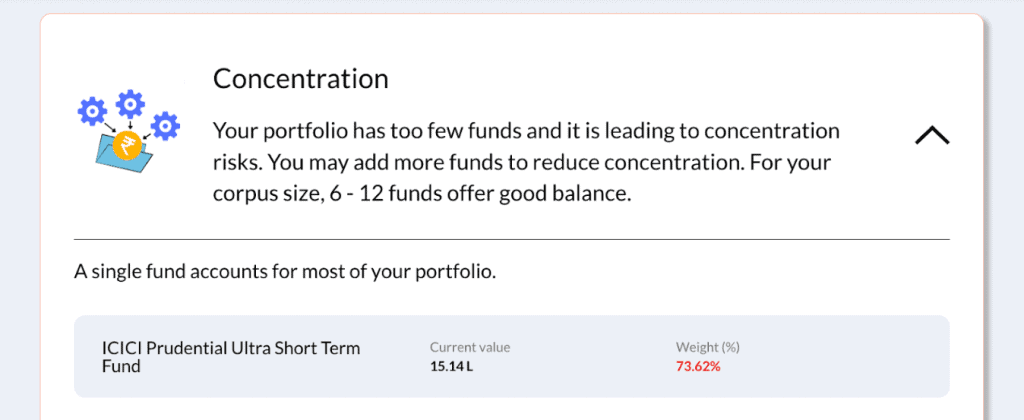

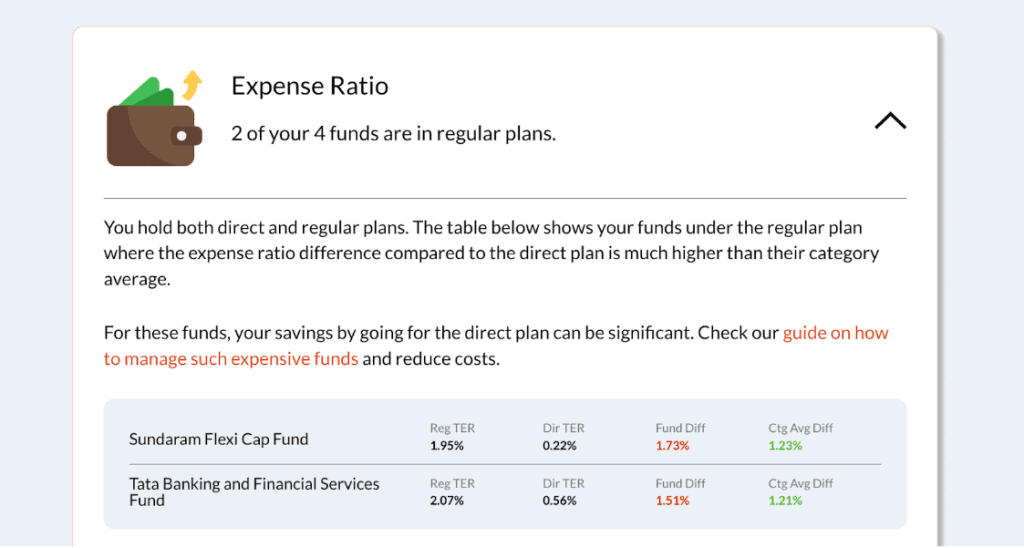

From this section, the real actionable insights on your portfolio begin. We segment our analysis of your portfolio based on Performance, Risk, Quality, Concentration & Expense Ratio.

Portfolio Review Pro stands apart from any other tool you may find on the range and depth of the observations we provide. A unique advantage that Portfolio Review Pro has is that you can select which funds you want to review as a portfolio. So, if you’re saving towards multiple goals, you can split your funds into each goal and then review them, for a more accurate review than simply seeing all your funds together.

Now let’s get into the first section of review – which is your asset allocation balance.

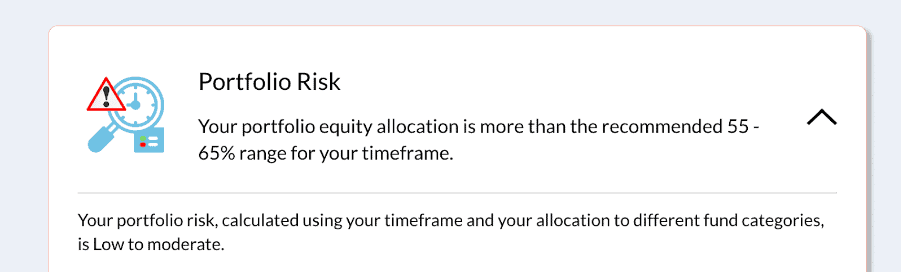

In any portfolio, what we stress on is the balance between equity and debt given a timeframe and risk level. Too much equity (which means you have too little debt) and you run the risk of volatility or losses. Too little equity means you could be losing out on returns.

So, using your inputs on risk & timeframe, the Portfolio Review Pro will tell you if you’re over-invested in equity or debt and what the ideal allocation should be. This ideal allocation is based on our research on the balance needed to contain downsides and optimise returns in different timeframes.

Takeaway: The asset allocation insight will help you bring in the balance your portfolio needs.

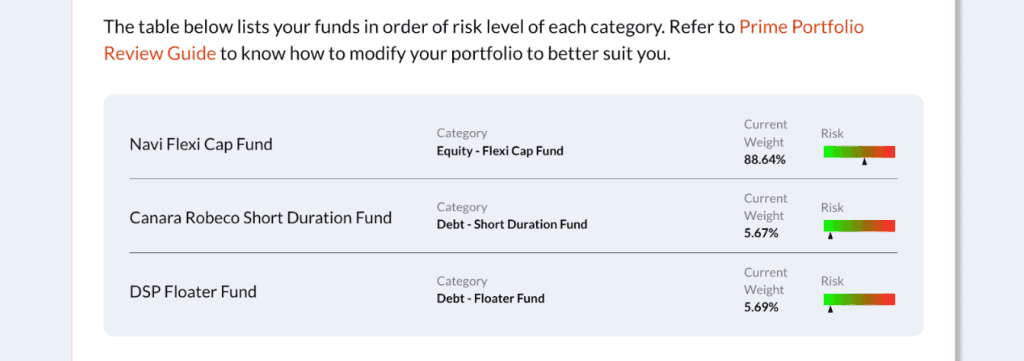

#3 Manage your portfolio risk

As you would know, categories vary in terms of risk within an asset class. So, while you could be holding the perfect asset allocation, your portfolio may be weighted towards riskier categories (you’re taking on more risk than you should) or may be completely under-invested in these high-return categories (your returns could be less than it should be).

Review Pro scores your portfolio using 3 aspects to arrive at the portfolio risk level:

- Your timeframe

- The weight of each fund category in your portfolio

- The suitability of each category for a timeframe

This risk observation tells you how risky your portfolio actually is. Compare this with your stated risk level – a mismatch means that you have to work on aligning your portfolio with your requirements.

Here’s an example. You could have a 2-3 year timeframe, and hold only debt funds. You may think you’re on safe grounds, since debt is low risk. But say you have 60% of this in dynamic bond funds or gilt funds. Your portfolio risk is not low. That’s because these categories need at least 3-5 years in holding as interest rate cycles can cause volatility, losses, or very low returns in shorter time frames.

Take another example. Let’s say your equity allocation is within range. But you hold multi-cap funds or focused funds. You may be unaware that, in terms of market-cap allocations or in strategy, both categories are in fact higher risk than flexi-cap funds. If you’re invested heavily here, or you additionally hold mid-caps/small-caps, your portfolio risk could be much higher than you bargained for.

This could even be the other way! You may be a high-risk investor – but may be inadvertently underinvesting in the higher-return, high-risk categories. Your real portfolio risk may be moderate or low.

Takeaway: The portfolio risk section will help you understand the true risk in your portfolio to let you tone down or tone up the risk or return potential.

#4 Improve returns by holding only good funds

Our buy/sell/hold calls on funds will tell you which ones you can continue to invest in or hold, and which funds are underperforming. (These calls are based entirely on fund performance and market conditions – not on how the fund has performed in your portfolio) This will help identify funds where performance is deteriorating, but which may escape your attention if you looked only at the returns in your portfolio.

Takeaway: Exiting the poor funds and reinvesting in Buy funds or Prime Funds will ensure your portfolio holds only good performers and therefore enhance returns.

#5 Diversify better through the right number of funds

How many funds should I hold? That’s the question most of you have! Too many and your investments are spread too thinly. Too few and you’re probably missing out on different strategies funds can offer and truly diversify your portfolio.

Portfolio Review Pro tells you if you have too many or too few funds given your portfolio’s size. It also goes a step ahead to analyse if there are concentration risks in your portfolio – fund-wise and AMC-wise.

Takeaway: Right-sizing your portfolio in terms of number of funds and exposure to each fund will help you diversify better and allow each fund to contribute to your overall returns.

#6 Reduce costs by identifying regular plans with high expense ratios

Other apps may tell you how much you hold in regular plans and how much in direct. And that you can save costs by going direct. That’s true, but there is always a cost associated with exiting your regular plans and shifting to direct! Moreover, some funds have only a marginal difference between regular & direct while others may be high.

That’s why Portfolio Review Pro doesn’t blindly call out regular funds and make heady claims on how much you save! What it does is to check the expense ratio differential between your regular plan and the direct plan. Where this differential is higher than average for the category, these funds are highlighted as key cost-saving centres.

Revisiting this section periodically will let you catch funds where expense ratio changes make regular plans very expensive.

Takeaway: You can shift out of regular plans where the expense ratio is high enough that it can significantly affect your returns. This will help you keep costs in check and reduce the tax impact of the regular-to-direct shift.

So go ahead and get a comprehensive portfolio review now!

Complete offering

With the launch of Portfolio Review Pro, we have built a full-stack mutual fund product offering catering to every investor. Here’s how:

Roadmap for Portfolio Review Pro

While we’ve spent the past several months getting Portfolio Review Pro in top shape, we’re already working on ways to make it even better. Here’s what is in the works (but work will take a while!) which you can look forward to!

- Multiple PANs per user

- Feature to divide & save your funds into portfolios, and view individual portfolio performance

- Feature to receive alerts on rating changes, call changes etc on your funds

- More advanced recommendations on the current insights provided in the Review Pro

Portfolio Review Pro is one of its kind in the online space today for a few reasons:

- One, it does not just allow you to view your fund holdings like many apps allow you to. It provides deep insights on your portfolio and thus helps you build an optimal portfolio.

- It gives you a great direction on whether your allocation and risk are in line with your own time frame and risk appetite and thus helps you to maintain a risk-adjusted portfolio.

- It gives a clear recommendation on whether the funds you hold are a buy/hold/sell based on our in-house research. This gives you the means to periodically course-correct and stay with good funds.

- It allows you to choose and review select funds if you have earmarked them for specific goals. The funds you hold for your children’s education and those for your retirement can be reviewed separately for your varied time frame and goals.

- It lets you know whether you are paying a high cost on some of the regular plans you hold.

- Very importantly, our tool DOES NOT NUDGE YOU to transact or switch or churn - as done by most transaction platforms. The tool tells you what can be done to reduce risk and make better returns in all ways possible!

So give Portfolio Review Pro a try and let us know what you think! Please read the Portfolio Review Pro help page for FAQs and other details.

25 thoughts on “New launch – Introducing Portfolio Review Pro”

What does the % in the beginning of the tool signify?

Say 79%. Good Job…..means what?

It’s a score of how well your overall portfolio is constructed and the quality of funds held. Higher the score, the better you have built your portfolio and the less change it would need to make it more suitable for your requirements. – thanks, Bhavana

Looks impressive and shows health of portfolio with suggestions! Couple of enhancement requests from my side which you might already be considering.

1) Can we show invested amount for every MF holding? Presently it shows for entire portfolio and not for individual MF

2) Can we have daily Value change (Total value change as per latest NAV) also displayed. This feature is very good in Value research where we can see 1 day, 1 week etc and can benchmark across indices

3) How to delete the data once uploaded?

4) Any option to group the portfolio under goals and we can start tracking them towards completion !!

Thanks !

PI Team – This is super cool! Appreciate how you keep adding value to us. Can you please enable adding of atleast 1 more PAN to keep track of overall family investments.

Hello,

Roadmap doesn’t mention about stocks, would like to have a view beyond MF.

Thanks

The roadmap mentioned is for the MF review pro product. Of course, we are already thinking on the lines you said 🙂 It will be a road less travelled and hence will not be a short-term roadmap. Vidya

Hello Team Primeinvestor,

First of all congratulations and hats off for building such an excellent tool. It shows how much effort & hard work has been put for building this tool.

In the Asset allocation part you have considered even the debt portion of hybrid funds as an part of overall debt allocation. Is this the prudent way since many of the aggressive hybrid funds & also some BAF funds are equally volatile as pure equity funds. Also we don’t have control how & when the fund manager will allocate between equity and debt in these funds.

In the Equity Allocation part comes market cap,it is further divided into large caps,mid caps, small caps and others. Now what is this others,is it micro caps?

Thanks.

Thanks! Regarding asset allocation – It is a different point that you do not have control over how a hybrid fund will allocate between equity and debt. Whatever the allocation, a hybrid fund will necessarily contribute to debt and equity in your portfolio. For example, an aggressive hybrid fund will increase equity exposure – if you do not consider this part, you may have the impression that you are under-invested in equity while in reality, you may already have adequate exposure in equity because of this hybrid fund. Risk is different – this is taken care of in the risk score calculation once you review your portfolio, where hybrid is lower risk than pure equity.

On equity allocation – the large/mid/small split is calculated using the stock marketcap info, and will be for domestic stocks only. Outside this, some funds may have some part of their portfolio in overseas stocks (even if they are not overseas funds) and we do not have marketcap data for overseas stocks. Funds could also have some FDs, cash, etc. All this is shown separately in the ‘others’ part. – thanks, Bhavana

Excellent!

hi PI Team,

how to remove Pan details after reviewing . i dont want to give access of my investments .

We show details of your investments to make it possible & easy for you to see updated value, returns, funds etc., and for reviewing. However, we understand privacy concerns so we are working on a feature which will allow you to delete your holdings. – thanks, Bhavana

Where is the link to the tool :-)?

Somehow missed adding the link in the article in our excitement 🙂 Sorry about that. Updated now. You will also find it under Recommendations -> Mutual Funds or Tools -> mutual funds. Or here. Thanks for pointing out the omission! – regards, Bhavana

Comments are closed.