UTI ULIP(G)-Direct Plan

View the regular plan of this scheme

Rs 45.1448 -0.127(-0.281 %) NAV as on 13 Jun 2025

Prime Rating:

Prime Recommendation:

Upgrade to

see

Fund type:

Hybrid

AUM (in crores):

₹ 5,467.51

Fund category:

Dynamic Asset Allocation

Fund manager(s):

Sunil Patil, Ajay Tyagi, Ravi Gupta, Kamal Gada

Benchmark:

NIFTY 50 Hybrid Composite Debt 50:50 Index

Minimum investment:

₹

15000

Launch date:

01 Jan 2013

Min. additional investment:

₹ 1000

Expense ratio:

0.96 %

Exit load:

N/A

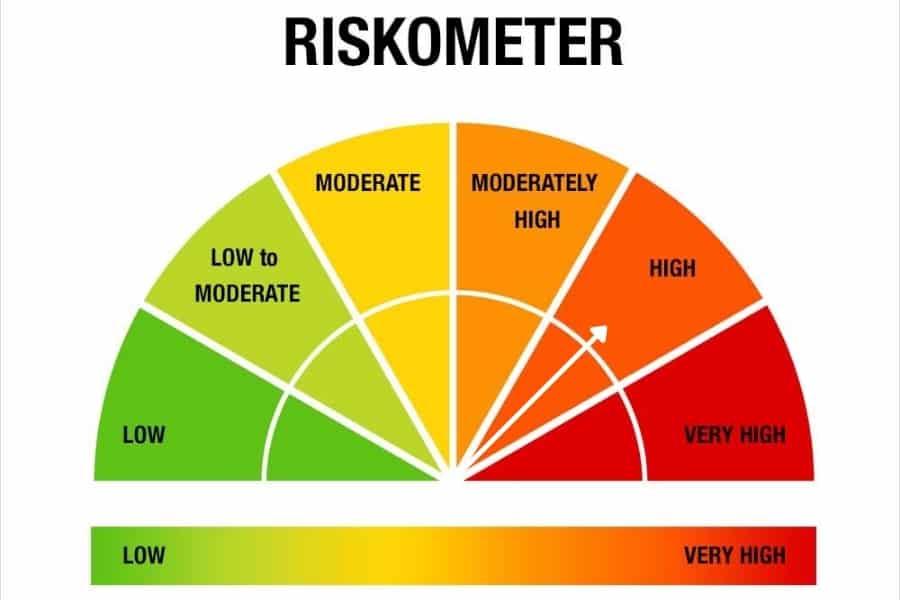

Scheme Objective: An open-ended balanced fund with an objective of investing not more than 40% of the funds in equity and equity related instruments and balance in debt and money market instruments with low to medium risk profile. Investment by an individual in the scheme is eligible for exemption under section 80C of the IT Act 1961. In addition the scheme also offers Life Insurance and Accident Insurance cover.

Performance (As on 13 Jun 2025)

Performance data is not available for this scheme.