When markets make merry, many stocks have seemingly compelling stories even for entering at peak valuation. And the market is fine with stretched valuations to accommodate such stories. In other words, every market-favoured stock appears to scream – buy me at any price.

But when challenges emerge, the same market starts react so sharply that investors who bought into the story midway start making losses. Yes, there isn’t a bigger disaster for stock market investors than earnings and PE multiples contracting together.

Don’t mistake the above for sectors cyclically falling out of favour or new themes being picked. That is different and is not new to equity investors. A cyclical capex story with growth in earnings or a commodity turnaround lasting for a few years before peaking out does not catch a seasoned investor by surprise as such sectors are prone to cyclical trends. Valuations in such cases also rise and get stretched only over a period of time.

But in the last 3 years we have also seen a different trend emerging. We have seen sudden take-offs in certain sectors mostly backed by long-term extrapolation of short-term triggers, leading to stretched valuations. What followed was a sharp de-rating that spelled disaster for stocks in the sector. While these traps become evident in hindsight, let us look at how these happen and how you can steer clear of such casualties.

The take-off stories, peak valuation and the fall

There were several sectors where Covid-19 turned out to be a trigger for a sudden wave. First, the IT sector that saw a massive up move with significant PE re-rating. Then it was the turn of chemicals, pharmaceutical and diagnostics sectors. In all these sectors what transpired had a common thread as follows:

- All of these sectors were mostly immediate beneficiaries of Covid and the upmove in their stock prices was accompanied by sharp earnings growth/margin expansion.

- The market started extrapolating these sharp growth trends assuming that they would continue well into the future. In other words, it misread short-term one-off spikes as structural shifts in earnings trajectory.

- That meant valuations factored in all such strong growth forecasts right away – leading to stretched valuations.

- When companies in the sectors did not deliver – and had both revenue and margin contraction (as the short-term triggers did not sustain), what followed was a sharp correction. Even slowing growth was meted out harsh treatment and stocks of such companies were punished.

Let’s look at how such trends played out in some of the major sectors and what lesson it holds for us.

#1 The big take-off in IT sector

ITsector was a major beneficiary of digitization spends globally in the aftermath of Covid-19. The narrative also started playing out in terms of double-digit earnings growth for the sector with mid-tier players doing far better.

But the sharp spike in US interest rates, expected funding winter (reduced capital inflows) for start-ups and steep correction in Nasdaq stocks put a question mark on this growth and a sharp correction followed. While the companies were still reporting double digit growth up to Q3FY23 with optimistic outlook, market was not in a mood to take it for granted as the digitization story risked a big pause.

The result? the large cap IT basket has seen complete reversal of the PE re-rating while the mid-cap IT is still holding on to some of the valuation gains as can be seen from the charts below.

The correction caught many on the wrong foot as investors had to give up on their gains entirely, especially if they had entered in the last one year. Even the ones who spotted the trend halfway up are not sitting on any gains.

What exactly transpired here? It is noteworthy that the actual earnings growth played out as expected until Q3FY23. It is the fall in earnings growth visibility that led to PE contraction. The entire sector correction of 30-50% in the last one year happened due to PE contraction alone. Expectations took a further knock after the SVB and Credit Suisse episodes as the sector is heavily dependent on the BFSI sector for its business.

Market seems to have extrapolated the trend of the Covid-aftermath digital narration and stretched valuations far beyond historical averages. The result is that the sector saw a steep correction and was wiped clean of the froth that had built up. For investors who shied away earlier on valuation concerns, this may well present an opportunity to check stocks in the sector. (Check Prime Stocks for our picks here)

#2 Spur in demand for pharma, chemical and diagnostic services

The above-mentioned sectors have taken investors for a rollercoaster ride in the last 3 years. For pharmaceuticals and chemicals, it was a period marked by an unpredicted and volatile growth phase where sudden spike in demand, supply disruptions from China and inventory stocking by customers led to sales and profit spike. Markets saw a new future for all of these sectors. But all the above three factors reversed together post Covid, leading to contraction in both sales and margins.

Let’s first look at the pharma basket with three diversified players just to illustrate: Divis, Pfizer and IPCA Laboratories. The table below shows their fall in stock prices.

For Divis and Pfizer their 9M FY23 numbers suggest that they are likely to see lower sales and profits in FY23 than FY22. Though IPCA may escape sales decline, profit is likely to halve from the high base of FY21 (FY22 was also a bit lower than FY21). All these three stocks peaked out in August – October 2021.

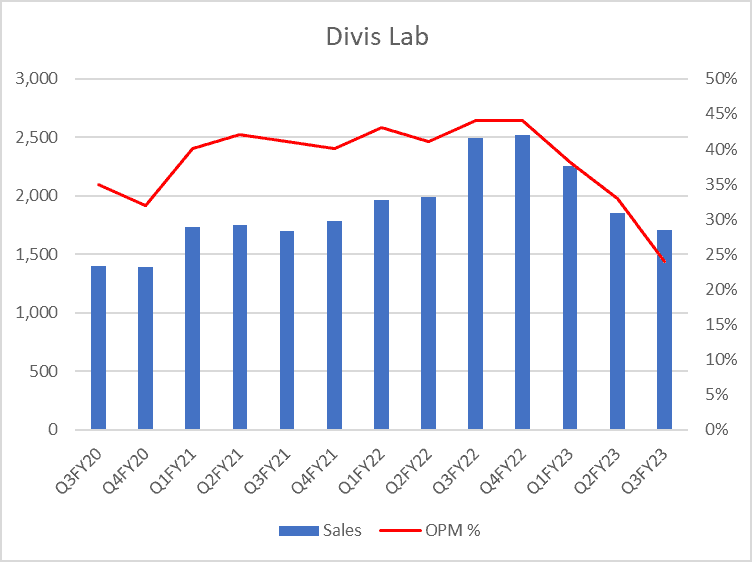

In the case of Divis, the graph shows how sales and margin have contracted for last three quarters in a row as the sale of Covid drug (Molnupiravir, a Merck drug) took a deep plunge. By October 2021, market was assigning the stock its peak valuation of 70 times at the time of peak earnings. Now, post this correction, the PE may look optically low (at 31 times) based on TTM earnings. But that would be a deceiving number as TTM earnings include the stellar Q4FY22 (see graph). Q4FY23 may come much weaker than that and push down TTM numbers.

For Pfizer, the maker of Corex cough syrup, Becosules (Vitamin B) and Gelusil, sales saw a huge spike of ~50% in Q2FY22 vs Q1FY22 when Covid-19 Wave-2 was at its peak. The stock also saw its PE ratio crossing 50 times. Since then, sales, profits and margins have plateaued for it and the company is likely to report a contraction in sales in FY23 Vs FY22 going by data thus far. PE multiple has also contracted from 50 to 30 post this correction. In the 5 years prior to Covid, Pfizer was a company with hardly any growth. Yet the market lifted its multiples higher since the pandemic.

IPCA was also a beneficiary of Covid as its anti-malarial drug (Hydroxychloroquine) suddenly found huge demand. While IPCA is still doing well on sales growth, margins peaked out between FY21 and FY22 and has since seen a sharp decline in the 9 months of FY23. The margin contraction is so sharp that IPCA is likely to report a 50% decline in profits in FY23 over the high base of FY21 (FY22 was a bit lower than FY21).

Now, let’s get into the chemical space. We will take a market favourite stock - Aarti Industries - to illustrate.

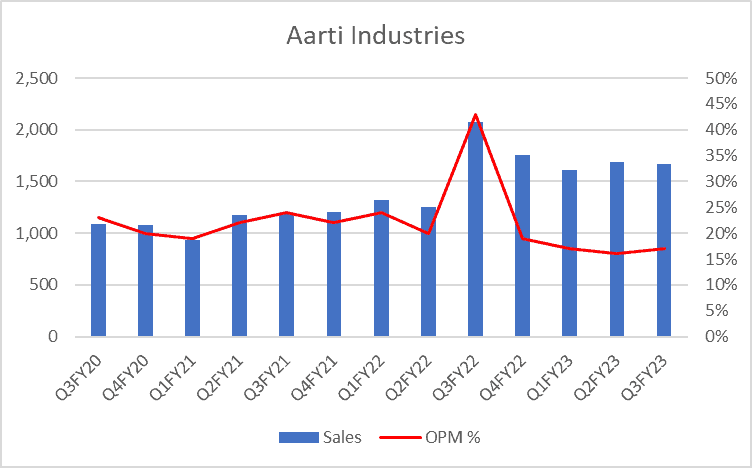

Given below is the quarterly sales and margin performance of Aarti Industries for last 13 quarters. Though sales growth remains, the pace appears to be moderating. Margins have slipped below pre-Covid levels in the last few quarters.

Even though there is no PE contraction for Aarti Industries, PAT is likely to more than halve in FY23 versus FY22. An already 50% correction in stock price has kept the PE at the same level. This story has played out in many chemical companies.

The chemical sector was also in the limelight post Covid and the sector saw a rush of IPOs – be it chemicals, speciality chemicals or pharmaceutical APIs.

Given below are some of the high-profile IPOs in the last 3 years. These stocks have also given up 40-50% from their peak. Extrapolation of trends that could not sustain and peak valuations accorded at peak earnings resulted in their stock fall.

From the total PAT and M Cap at the peak, you can see that the average PE works out to 90-100 for these 5 stocks.

Now’ let’s discuss the diagnostics space.

Diagnostic stocks were a celebrated lot post Covid, almost as if the market discovered a new high growth space to play. Domestic franchisee and absence of USFDA inspection worries made them preferred bets over pharmaceuticals and PE multiples expanded to 70-80 times for these stocks at one point of time, doubling from their pre-Covid multiples.

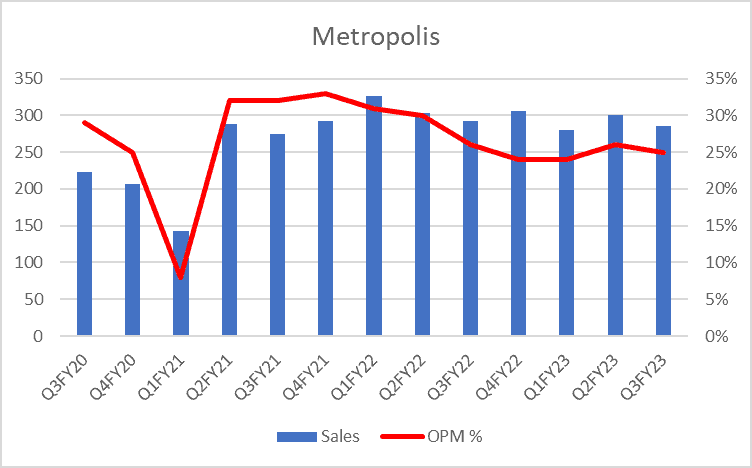

The stock price of Metropolis Healthcare has now fallen below its pre-Covid price while Dr Lal PathLabs is back to its pre-Covid price. Both these companies are likely to report lower sales and profit in FY23 Vs FY22 and lower profits Vs FY21 as well. PE multiples have also contracted to pre-Covid levels following the 55-65% correction in their stock prices. This was in no way anticipated of this sector.

From the graph of Metropolis below, you can see that growth peaked in Q2FY22 and has been in a contraction mode since then, on both sales and margin. Though there is still some growth versus pre-Covid, that is nothing more than normal growth anticipated of these high growth stocks.

To sum up, what we have discussed so far is representative of what has happened to the overall pharmaceutical, chemical and diagnostics space in the last 3 years.

For investors who shied away from these stocks during such times, it presents an opportunity to plunge into a deeper analysis of good quality stocks in this space.

But when you do so, be cognizant of the following factors:

- Buying stocks based on % correction (price anchoring) or TTM PE may still be deceiving until earnings contraction is complete. You are better off waiting to see visibility in earnings growth than try to catch a falling knife.

- Market was enthused by capex plans of many of the companies in the above segments and in such cases, weak growth and margin contraction may take the RoCE assumptions for a toss. So companies putting very high capex have to be looked upon with extra caution.

- Some of the companies have openly spoken about competitive intensity from China after re-opening. Margin assumptions may have to be revisited in such cases. Even the diagnostics sector has seen competitive intensity.

#3 Pent-up demand and discretionary consumption

Boom in discretionary consumption trend post lock downs turned out to be as deceiving as the trends in Covid beneficiary sectors of healthcare. While there was a pent-up demand, there were quick shifts in consumption patterns and divergent consumption trends in premium and value segments. These trends turned out to be highly deceiving for investors as stocks within the same sector were moving wildly in opposite directions.

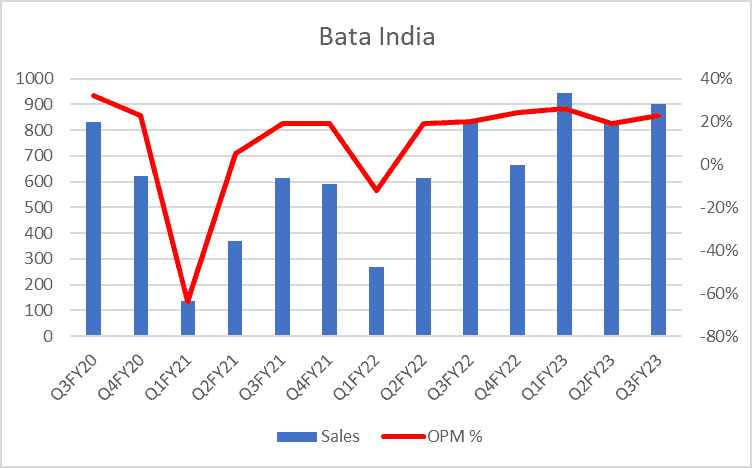

Take the case of Bata. Investors confidently betting on it to make new lifetime highs post lock downs were in for a disappointment as subsequent numbers showed that Bata barely managed to churn out any sales growth compared with pre-Covid period.

You can see from the graph that the sales growth between Q3FY20 (pre-Covid) and Q3FY23 is barely in single digits. The stock gave up 30-35% from its peak with contraction in PE multiples from 80 times to 55 times.

While this trend transpired for Bata, its newly listed peer Metro Brands managed to generate significantly higher growth. While Bata is expected to close FY23 with just 10% growth over FY20 (Pre Covid), Metro Brands is on its way to clock a 50-60% growth in the same period.

So why didn’t the pent-up demand play across companies and that too the popular brands? This can be explained by divergent consumption trends in the premium versus value segments. Metro operates in premium segments with brands such as Metro, Mochi and Crocs. We also noticed a similar trend in a leading fashion player - with its premium segment doing extremely well in Q3FY23 while its value segment and athleisure segments (shift in consumption pattern) put a poor show. We have written about this in our recent update on the stock.

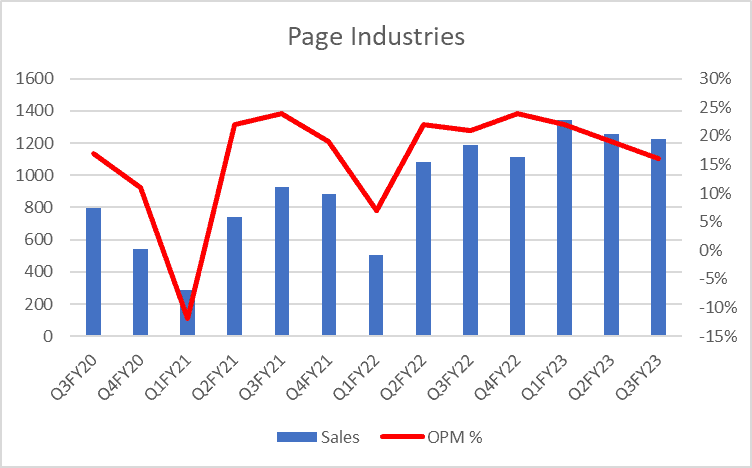

Another company, Page Industries, the franchise for Jockey, turned out to be a victim of such shift in consumption pattern. While Page Industries was seeing significant demand for its athleisure products post the lockdowns, market mis-read it for a secular growth trend and took the stock price way higher, to 90-100 times earnings. But the declining sales growth in last two quarters along with margin contraction led to 30-35% correction in the stock price with PE multiple contracting to 60 times from 90 times.

Here again, market was extrapolating trends and giving peak valuation at the time of peak earnings only to realise later that many of these consumption trends were not structural. The short-term growth bursts caught investors at the deceiving end with many of the stocks correcting by 30-40% from their peak.

Like the Bata Vs Metro brands, a divergent trend played out in Jubilant Food (Dominos) Vs Westlife Food (Mc Donalds). While Westlife managed to grow, market was not at all impressed with the 24% absolute growth of Jubilant over a 3-year period (6-7% CAGR) as the stock was priced for much higher growth. This led to a 45% correction in Jubilant while Westlife gave up just 10% from its peak. Here, market may have extrapolated in-home consumption trend for Jubilant while Westlife fully benefited from the pent-up demand and out-of-home consumption trend post lockdown.

While the extrapolation of consumption trends and peak valuation at peak earnings led to sharp corrections, most of these are good quality franchises. At least the cool-off in valuation offers opportunities for investors to hunt for winners.

Unlike in the pharmaceuticals, chemical and diagnostics space we discussed earlier, the valuation in this space is still expensive.

This calls for investors to arrive at the right entry PE multiple that match the growth rate of each stock to see returns.

Which sectors are at peak valuations now?

Hotels and Hospitals are seeing similar trends that we discussed above. Current valuations are rich at a time when their earnings are also at their highs. Obviously, majority of the companies in both these sectors are enjoying best EBIDTA margins in many years and hence valuations (EV/EBIDTA) may optically look cheaper.

Let’s take the case of the hotel sector where a combination of higher room rates, higher occupancy and lower supply of rooms are playing out. This is a lethal combination that allows companies to earn high margins and Return on Investment (RoI). But these are also the drivers that lure companies to go for capacity expansion. And when that happens, they all do together as no one wants to miss the bus.

Here valuations (EV/EBIDTA) may not look stretched compared to their respective historical averages due to record high EBIDTA margins. But if margins were to move back to their averages, then multiples will stretch far beyond the averages.

Other sectors that may be seeing such trends are defence and capital goods though it is difficult to quantify to what extent it is stretched and whether it is the case across stocks. This is because leading companies like ABB and Siemens used to trade at stretched valuations even prior to Covid when their business was not good. But in hindsight, those valuations look reasonable as companies managed to pull fresh orders and delivered better earnings.

It requires a bit more caution in defence, as the order book building is seen with lot of excitement by the market. Let’s take the case of PSU defence behemoth HAL. The management did a Concall in May 2022 in which they gave a hint of the potential size of orders and the products for which orders are expected. And HAL being the only manufacturer of such products, the order is obviously expected to flow in at some point of time. Between May 2022 and March 2023, the stock has already rallied 50% and it would be safe to assume that the market has built in a lot of expectation on potential order wins.

Like all the order book stories, companies do well during the order accretion phase and troubles start mounting up during the execution phase and payment phase. So, getting into these stocks at multiples beyond their long-term averages during their upcycle can spell trouble later. Even if all goes well, the returns may be limited as market may have already built in all the good things in price.

How to steer clear of such risks

When there is too much expectation form any stock or sector, market doesn’t leave much on the table for investors other than earnings growth because PE multiple expansion may have already happened. If earnings growth disappoints for whatever reason, the downward journey for the stock starts.

For example, if a stock is giving 20-25% earnings growth and is quoting at 40-50 PE, there is no further room for PE rerating. An investor will get only the 20-25% earnings growth by buying such a stock while carrying the risk of PE contraction.

It is important to get upside on both earnings growth as well as PE re-rating to get the desired returns from a stock. In our own stock recommendation, we faced this struggle in getting stocks that offer both earnings as well as valuation upside.

When confronted with a mouth-watering opportunity in a stock, ask yourself these questions:

- How big the recent spike (last 1 year) in the stock price is and what’s the reason behind it?

- Is the spike in stock price accompanied by earnings expansion or expected earnings expansion (changing cycles, order accretion, acquisitions, Govt. policies, etc)?

- If there is any unusual growth in sales and can you identify if it is led by structural factors or temporary factors?

- If there is any unusual deviation in margin from historical averages (say 5 years or 10 years). Is it led by structural factors or temporary factors?

- Does the current valuation still look reasonable due to sharp spike in earnings in the last few quarters or say in the last 1 year?

Needless to say, Warren Buffett summed it all up when he said – “The investor of today does not profit from yesterday’s growth”.

5 thoughts on “Entering a stock at peak valuation? – 5 questions to ask”

Interesting article. Banks which had a good rally have now corrected, especially the PSU basket. Post this correction, does this space offer good upside potential in the mid term?

Welcome your query sir,

After Q2 results, we did an earnings update on banking stocks with focus on key factors driving such robust earnings growth

https://www.primeinvestor.in/should-you-still-bank-on-banking-stocks/

The bottom line was that re-rating is done with and what an investor buying now will get returns equal to earnings growth for reasons mentioned in it. Kindly go through

Having said, we are still positive on growth and hence returns from this space, but not to the extent we have seen between 2020- 2022

Thank You

Excellent Article, Thank you

Paid membership of Prime Investor is best investment I made so far in stock market.

Since joining Prime, I removed all junks stocks from my portfolio which I added based on so called ” hype & news ”

Started investing in Quality business based on recommendations from prime.

Since then, even when overall mood is down in Indian market, I can literally see the the improvements in my portfolio performance and for first time I saw in real life version of comment from Warren buffet ” The first rule of an investment is don’t lose money. And the second rule of an investment is don’t forget the first rule”

Absolutely happy with Prime Investor paid subscription and your business ethics & best practices.

Thank you entire team of Prime Investor

Regards

Amar

Good Article.

Your view on sugar stocks . Your opinion needed on it as sugar prices have already hit all time high

Welcome your query sir,

Pl refer to our update on Balrampur chini in this context

You might have noticed/ read from our reports also that this ethanol diversification is reducing volatility in earnings and cash flows for sugar Cos

Our update on Balrampur chini will throw light on how ethanol diversification is helping sugar Cos

But, then this also brings in Govt. intervention on pricing, volume off-take, capacity utilization, etc

One has to be watchful of these new challenges as well

Thank you

Comments are closed.