13.4 million% returns. I’m not joking. That’s the price move of Bitcoin (BTC) in the last decade between 2011 – 2021. Now you know why you’ve been hearing so much about crypto in recent years and also the reason behind many millennials and Gen Z kids flocking towards these virtual digital currencies. In traditional finance, one has to take a 30% additional risk and invest in moderate risk equity mutual funds for an additional 5 -10% returns that equity might deliver over and above the risk-free rate. With that being the case youngsters did not really care about taking a 100% additional risk for a chance to gain a couple of hundred percent additional returns.

With that said, is BTC a one-time golden opportunity that most of us missed? Well not really. Though the absolute returns look humongous when you look at it in CAGR terms it isn’t that big. Second in line to the throne, ETH ( Ethereum ) has delivered a 237% CAGR in the last 5 years (2016 – 2021) whereas BTC delivered 172% CAGR in the same period. So in this blog, we will try to understand what makes ETH very different and interesting enough for people to FOMO in on this so much.

Bitcoin was developed with a very simple idea in mind that it will be a digital currency that will have no central issuer and will be used as a payment method with a fixed supply of 21 million tokens which will be mined (released over a period of time 2009 – 2140). As of today there are about 19 million BTC tokens that have been mined and are in circulation.

Ethereum though very similar to bitcoin in terms of the underlying technology it went one step higher rather than just being a payment system. It introduced the world to smart contracts where instead of just transaction details, a computer code could be stored in it which could power computer applications. Since the whole process is done in a decentralised way people started calling them Dapps (Decentralised applications). All of this was done using Ether (ETH) the native crypto currency of the Ethereum block chain.

Is ETH competing with BTC?

No, It’s more complimentary. Though there were a few others who tried to implement the concept of digital currency, BTC was the only one successful in terms of scaling to size. The pathway for adoption of digital currency was set by BTC whereas enabling the ecosystem with other features was started by Ethereum and further improvised by other alt coins. To understand the shift better I’ve made a simple infographic below.

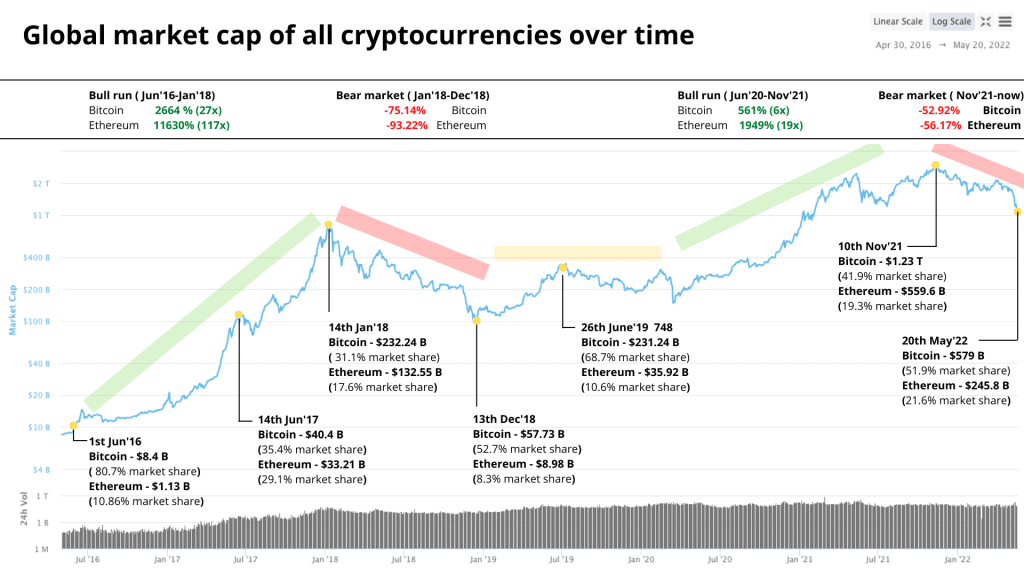

Source : coinmarketcap.com

Bitcoin used to be the dominant whale by holding the major market share until Jun’16 when it had over 80% of the global crypto market share in terms of marketcap. But things started to move pretty rapidly over the next 18 months. Ethereum and along with other Alt coins quickly went up the ladder with Ethereum grabbing a good 17% market dominance.

This is one of the first instances when ETH tried to decouple from BTC and create a place for itself. Bitcoin also rallied up in this period but it lost dominance to other cryptos and ended up holding a 30% market share at the end of the bull run. It is very Interesting to note that by Jan’18 the Global crypto market share of BTC & ETH combined was about 48% and the remaining were held by other alt coins like LTC , XRP Etc. What fueled this huge rally is what we discuss in the next section.

Three things behind the ETH & Altcoin rally (Jun’16-Jan’18)

ICO Boom

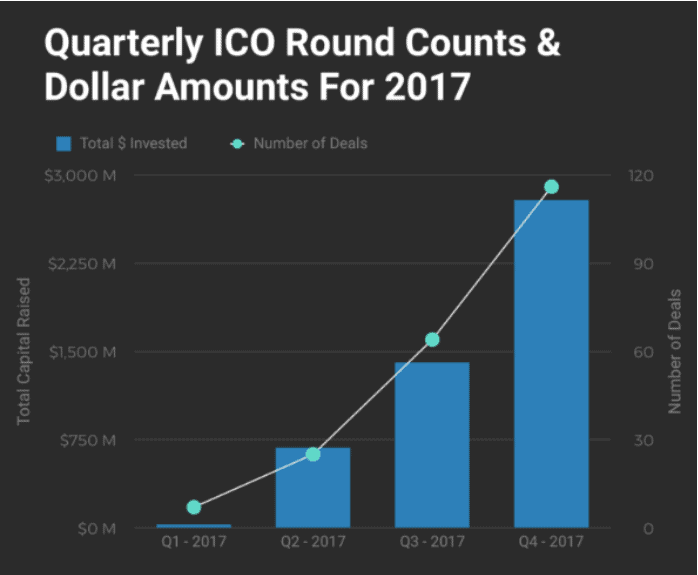

Just like how we have IPOs in our traditional markets here in the crypto space it’s called ICO ( Initial Coin Offering ) which enables startups to raise seed capital. The difference is that for an IPO you pay money in fiat to your brokers for allotment of shares in that company. Here you will be paying cryptos like BTC and ETH for allotment of tokens. One major difference when it comes to IPO, is that it is always handled by regulated centralised exchanges and with financial watchdogs that oversee the company’s past before they can go public.

But in the case of ICOs risk levels were like that of a VC trying to make investment in early stage startups which may or may not succeed. Generally this kind of investment is kept far from reach in traditional investing methods. By using crypto where no central authority was involved, getting a lot of participation from retail investors was easy. It was more or less a crowd funded startup by using crypto. The picture clearly explains how there was an increasing number of ICO’s and also a substantial increase in the amount of capital raised by many DAOs and Web3 companies.

Ethereum too came out as an ICO in 2014 for which you had to pay in BTC.

EEA Enterprise Ethereum Alliance was formed in Feb 2017 which aimed at bringing together various partners from fortune 500 companies along with subject matter experts from the Ethereum network to make ethereum scale higher as an enterprise grade product building platform. Just like how seasoned stock market traders say “Buy on rumour & sell on facts”.

The very idea of top global companies coming together to build on a new technology created a massive bull run just like how we had the internet bubble in 2000. It is worthy to note that several Indian companies including the top ones like Tata Consultancy Services are members of the EEA.

Exchange Listing

With a lot of new tokens coming out on a daily basis the number of crypto tokens doubled in the year 2016 – 2017 which pushed a number of tokens getting listed on crypto-exchanges around the world. With new exchanges getting set up and taking BTC to new highs to $19,000 towards the end of 2017. The next in-line prodigies Ethereum & Litecoin were also listed alongside and scaling to all time highs very quickly.

The Great Crypto Bear market 2018

Following the glorious run of crypto up until Jan ‘18 when Bitcoin,Ethereum and other Altcoins all scaled to new all time highs, the market knew there was going to be a pullback but it was in for a surprise when correction went deep to -84%. It was continuously hit by multiple bad news taking down the global market cap to about $100 Billion in Dec’18 from $748 Billion in the beginning of the year.

There were multiple factors that lead to the correction. There were many exchange hacks during this period in Japan and later Korea. Many companies that raised money with ICOs were playing a shell company game which came to light and along with that, the most important one was governments planning to ban crypto trading and investing.

Just like how companies start losing value when there are no growth prospects, the fear of a ban meant that newer markets could not be penetrated and existing markets too will shut down leading to a huge global sell-off. Pushing Ethereum down to -93.2% and Bitcoin down to -75.1% scared retail investors. And the overall market was consolidating at that level for another year.

The next bull run (Jun’20 – Nov’21)

Post covid when all markets were going up in full speed so did the crypto market too. Many of the companies that ICO’d in 2016-17 went missing but some stayed and those that stayed built the space with multiple new use cases for the crypto token follow by the un-ban of crypto in a few countries and US setting some firm ground rules around crypto and treating it as an asset brought in a lot of Institutional investors.

“Yes, it’s a Ponzi scheme. But who cares? So are the dollars in your pocket”

Andrew Thurman of coindesk

NFT Summer 2021

Non-fungible tokens though not new, the real traction started when a huge $69 million sale for a Digital art made by american artist Beeple. The sale took place in crypto. It is at that time when people understood that the tokens in crypto which had only social value can now be tagged with a digital asset like images / music / videos etc and then also put it on to a tamper proof blockchain like ethereum to prove authenticity and also having it as a smart contract which enables the creator to get some kickbacks everytime the NFT is traded in the market.

Following this many brand identities were created with similar smart contracts and then found ways to integrate themselves to other segment areas of crypto like Defi, DAOs,Token Sale, Airdrop etc. One of the best examples is Bored Ape Yacht Club (BAYC) a project created by Yuga Labs which started out as a 10,000 NFT token sale for 0.08 ETH (Rs 20,000) which entitled the addresses holding these token to further airdrops and free NFTs with their own DAO tokens $ape.Today all with all the airdrops included their floor price is around 150 ETH (Rs 2.4 Crore).

To create these NFTs, list them, sell them and move them around, you need Ether. All this was possible because of the extra features that ethereum brought to the table. It wouldn’t have been possible to create the underlying tech behind NFTs with bitcoin.

Whenever crypto tokens are used more, the price keeps pushing high due to demand and low/limited supply. These types of new developments in the space and also being backed by Ethereum put it on track for a 19x return in the period (Jun’20 – Nov’21) when even Bitcoin moved up “only” about 6x.

The current bear market and how is it different?

As seen in the table below it’s very evident that Ethereum has decoupled from BTC. During the previous bear market Ethereum crashed down -93% when Bitcoin crashed -75%.

But this time even as Bitcoin crashed -52% Ethereum did not get deeply cracked like before and stayed around its peer with a -56% loss.

Not just in terms of price the overall dominance in terms of market cap with a much lower fall Bitcoin still fell to its 52% market dominance like how it was during the previous crash. Ethereum, though falling in price, tried to keep up its market dominance which shows that holders of Ethereum are not treating it like the other alt coins anymore and has now found solid ground in the Crypto space.

What next for Ethereum?

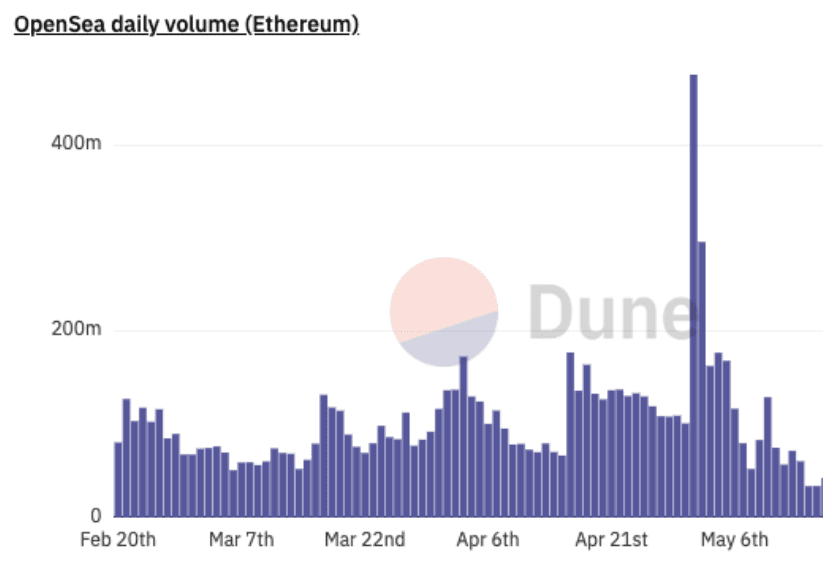

If Bitcoin were to be called the transactional layer of the crypto-ecosystem then it would be apt to call Ethereum as the application development layer for public ledger based crypto-ecosystem. Ethereum with its additional features in terms of smart contracts enabled many new web3 applications. One of the best use cases seen is Opensea, a NFT trading platform with an average daily volume around $100 million.

Going forward as the number of new developers in the web3 space go up and much more interesting Dapps come in and the overall use cases becomes more b2c along with governments around the world supporting the ease of doing business with crypto increases. It gives a lot of scope for Ethereum to grow higher both in-terms of price and also market dominance.

This article is an opinion piece on the cryptocurrency space and should not be considered as an advice to transact in the cryptos/securities mentioned in the article.