The author is an external contributor. Views are personal and do not reflect the opinion and views of PrimeInvestor.

The bull seems unstoppable. As the market keeps making new highs (nothing wrong with it- our economy is growing at a decent clip), the question on everyone’s mind is “Is this too much, too soon? Should I exit?”

To put this in context, there’s no fundamental issue with growth in India. We are far away from being a developed economy and there is potential to achieve much more. Our GDP can easily double from here and still leave room for growth. How quickly? Let us assume a 6% GDP growth and 6% inflation. This means a nominal growth of 12%. In other words, in six years, we should double in nominal terms. Yes, we could get there a bit later if growth sputters. It is arithmetic, but the fact is that we will keep growing. Our per capita GDP is still under USD 2,500. Developed nations are at over USD 20,000.

Now let us turn to the problem on hand. Are the stock markets too expensive, at this juncture?

Stock market valuations should be assessed based on:

- Valuation metrics of companies (price to earnings and price to book are commonly used)

- Interest rate now and expectations (as interest rates decline, there is a flow of money towards risk assets – specifically, equities)

- Expectations about future growth

- Money flow in and out of markets.

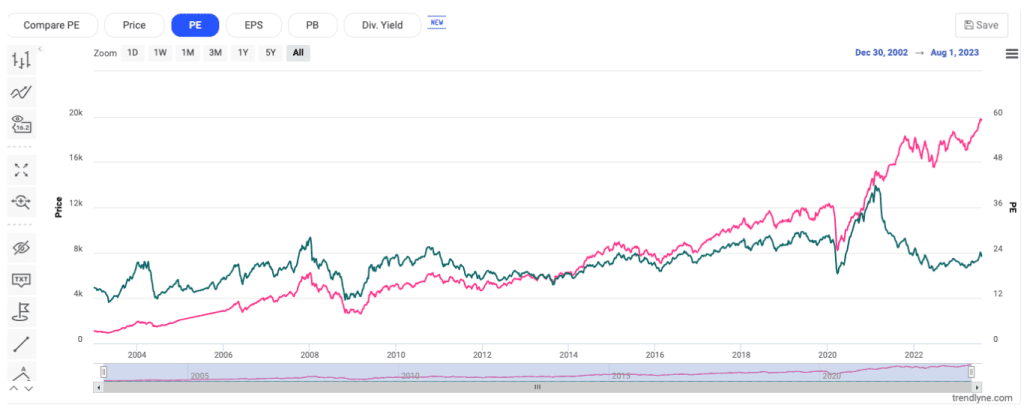

Valuations are always a matter of debate. At any level of the broad market, there will always be some stocks that are expensive and some that are worth buying. For the overall market, we use the broad indices. We can use the historical data on the P/E and P/BV of the Nifty. We simply aggregate the components of the Nifty and treat it as one share for this exercise.

When the current numbers are below the historic mean, we say that the markets still offer some headroom for gains. And when these numbers are above the historic averages, we say that the markets are expensive.

The basic premise is that the interest rate structure is unlikely to shift. We assume that earnings are not going to be elevated permanently. A one quarter or a one year poor show does not change the quality of a company materially. So long as the deterioration or improvement is not a permanent shift, historical averages are relevant and a useful guide to time your buying and selling.

Here are some graphs that tell us where we are:

(The red line is the Nifty and the green lines are the EPS, PBV and PE respectively. I have sourced these charts from trendlyne.com)

Where markets and returns stand

What is clear is that the Nifty 50 move is not as much out of whack as one thinks. This is because there is a huge jump in earnings post 2021. The question is whether this will be sustained and grow at 12-15%, from here. Perhaps the P/B is a bit high, but the earnings improvement (higher ROE, very likely) seems to be supporting it. The PE levels are not at highs, but we are at the upper end; i.e., prospective returns may not to be good.

The implications?

- At these levels, there is no room for error. In other words, there is hardly any Margin of Safety on PE, PB etc.

- All growth must now be purely based on earnings growth. If earnings do not grow from here, we are likely to see corrections. This seems likely in the commodities sector, which has enjoyed a dream run on the back of production and supply issues from China. Similarly, PSU banks have also enjoyed a dream run in the last couple of years. Their next NPA cycle is perhaps three to five years away

- When new money is to be invested, it is always good to have headroom. Now does not seem to be the right time, if you want to put in large lumpsums into the market

- If you are into equity fund SIPs, keep at it.

- If you have less than good quality stocks in your portfolio, this is not a bad time to convert them to cash.

Funds flow in to our markets seem quite strong – domestic as well as foreign. Today, the domestic money on its own, can lift markets. Of course, we have to presume that there is no FPI selling at a broad level.

Worry points

In all this, a worry point is inflation – demand contraction as prices climb is a threat. Yes, expansion of retail credit has helped overcome this so far as retail credit is rising. We will probably experience hiccups in retail credit in the not-too-distant future.

We all know that many companies have not added capacities. Till that happens, profits have to be squeezed out of present capacities. At some point competition will kick in to hurt profits. For example, the chemicals sector was treated like the FMCG sector until a year ago. Now that China is back in the market, the super profits are vanishing. Once China players enter the fray, earnings are not going to remain at year-ago levels.

On the midcap / small cap space, I do not have enough historic data to make a comment. I would apply the same yardsticks. I would be circumspect in small companies because nine of ten small ones do not make it bigger. I have to have lady luck on my side to pick the right one! I always feel that the Margin of Safety in small companies is lower than what we think. Of course, it cannot be denied that it is the pocket where we also find multi-baggers. But today, with the internet, the discovery of something new that others haven’t found is not easy.

Greed and markets

As an investor, these are difficult times. On the broad market, the potential for gains seems rather limited. The markets are likely to peak out and then remain rangebound for some time, till earnings catch up again.

Today, the markets punish short term disappointments very severely. That is where I would keep a look out. Good and the bad get punished instantly. Opportunities are always to be found there, for some unusual gains.

The mood of the participants in the markets seem to be one of positivity. All you have to do to make money is to buy something. There is immediate jump in prices based on news flow like ‘orders’, ‘margin improvement’, ‘AI’, ‘defence contract’ etc. Soon ‘chip’ will get added. This takes me back to 1991-92. Of course, this time, the investors seem to be playing with their own money and there is no sign of a scam. What I see is money that is willing to take risks.

There is too much greed around. I can see that in many conversations. Everyone is talking bullishness, without worrying about valuations. Clearly, this is someone ringing a bell.

As a long term investor, I am not selling out. I am happy to sell some of my ‘trading’ portfolio and to keep cash of 25-40% of the trading portfolio in cash. I will wait for stock specific bad news and buy at an attractive price. My long term investments can go on. For those who were planning some selling in the next two to five years, it is a good time to start some selling. For those of us who like mutual funds, keep doing your SIPs.

I also see a lot of people looking at ‘High Yield’ fixed income. Thanks to social media and the internet platforms, everyone is talking about returns of twelve to eighteen percent per annum. Of course, no one knows the risks and often do not even know much about the company they are lending to! To these people, good luck.

Coming back to equities, I do not see any reason for ‘re-rating’ our markets. Interest rate structure is unlikely to shift lower. Inflation seems to be here to stay elevated. The Warren Buffet indicator of ‘market cap to GDP’ is over 100% which indicates overvaluation.

The other worrying thing is that there is an increase in number of false accounting and poor governance cases, which does not seem to bother the markets. Ultimately poor governance and stories will lead to loss of capital. A simple corporate action is greeted with a rise, without even knowing what the implications are. Any news or action is treated as good news. The only action that gives a temporary whiplash is ‘earnings’ disappointments. After a few days, that is also forgiven.

It is good to be circumspect in a market filled with optimism. In normal times, one would say ‘anytime is a good time to invest.’ I am not sure I want to say it without qualifications at this juncture in the market. I am happy to wait for another three or four quarters before I make any serious commitment to this market. As a trader, the one thing that is important is to have a ‘stop loss’ in place. Serious long term investors have also started talking price rather than business. Clearly tells me that we are in an overbought markets.

When we buy into high prices at high multiples, it signifies that we have expectations of very high growth from those companies. It does not always happen. These expectations can be met or failed. There is no way these expectations can be exceeded. In simple language, the risk of downside is higher than the possibility of upside. These are not good odds to get a better than market return.

As an investor, do not get carried away. If you have your rules, do not break them now. If there is nothing to buy now, based on your rules, don’t buy. Not investing is also a form of investing. Sooner or later, opportunities will come your way. Cash is also an investment. There is no loss of principal. As an individual investor, you are not in a race to compare daily NAVs. Your objective still is to preserve capital and aim for better than market returns.

If you are a conservative investor, then keep a look out on your asset allocation. Take some money off equities as it keeps gaining weight. You will take away enough to put it back when markets fall or do not move up for longer periods.

Keep a hold on your purse. Follow your process and rules. Do not tweak them. It is never “different this time”. Two and two is always four.

7 thoughts on “There is greed in the air”

Markets discount the future and if one wants to make money, he has to be ahead.

Going by the growth of the country in GDP terms, may be the markets are discounting the future growth prospects.

The price increase/decrease that is happening is broad based and more on news flows.

However, one has to be wary of price manipulation that may not be ruled out.

Thanks for the timely note. In layman speak, I understand that if we zoom out over the years, the growth has not been phenomenal per se. It is just that we are seeing a rise in a short duration. Is that true? Your perspective on it? 🙂

Earnings growth numbers distorted by COVID. However, profits in many companies at their record highs. I will still respect valuations in terms of ROCE, ROE and PE . The key is what kind of earnings growth one sees. If GDP is 6 to 7 percent, earnings growth should be 12 to 15 percent and not much higher. Yes, there will be the young companies that will grow faster in the first few years and then stabilise

Thanks for detailed analysis. Pls also make advise if we should liquidate some of out holdings and wait for right opportunity. thanks

I have done that myself

Also useful to keep a look out for opportunities when there is bad news

Good one. Brings us back to ground, from the stratospheric levels

Comments are closed.