“Hey, do you use PhonePe?”

“Sure, it’s a great UPI app”

“They are offering mutual funds now…”

“Hmm…I thought they already did…”

“Yeah, they were offering tax-saving funds alone, now they are offering more”

“Oh, like an MF platform?”

“Not really, just a few funds”

“Like top equity funds in the market?”

“Ummm…no, just a bunch of fund of funds”

“Oh OK, from all fund houses?”

“No, just one fund house”

“Dude, seriously? Direct plans, I hope, at least”

“Sorry, just regular plans”

“Really? Why even…”

“Exactly”

When PhonePe announced last week that they were expanding their mutual funds offering on their app by offering so-called ‘Super Funds’, I was actually quite excited. I was an early adopter of the UPI app, and till date, it is my primary app for money transfers. They probably have the cleanest UX among all UPI apps and I was keenly watching their entry into MF services.

It looks like they are rolling out these ‘Super funds’ in phases to customers, and I was one of the guys to get it first on my app. So, I clicked in and went and took a look at the offering. And, boy was I disappointed. The more I looked, the more I could see why this is a product that should be avoided.

I am writing this piece on why this is not a good product – not so much for the actual readers of PrimeInvestor – I am pretty sure most of you would not consider this product even without our say-so. However, there could be friends/family members who turn to you for advice and if any of them ask you about this option, feel free to direct them here to understand why they should give this product a miss.

Let’s first look at what these ‘Super Funds’ are.

PhonePe’s Super Funds

PhonePe is offering three funds-of-funds (FoF) with a collective label of ‘Super Funds’. They are tagged by risk profiles of Conservative, Moderate, and Aggressive. These funds are:

- Aditya Birla Sun Life Financial Planning FoF – Conservative

- Aditya Birla Sun Life Financial Planning FoF – Moderate, and

- Aditya Birla Sun Life Financial Planning FoF – Aggressive.

The funds differ from each other primarily by their asset allocation – how much of their portfolio is in equity, debt, gold etc. At present, the conservative variant has 52% in debt, 35% in equity, 10% in gold, and 3% in other assets (cash, I guess). The moderate variant has 33% in debt, 56% in equity, 7% in gold, and 4% in other assets. The aggressive variant has 14% in debt, 73% in equity, 7% in gold, and 6% in other assets.

Each of these funds, in their current form, have more than a dozen underlying funds in them.

All these FoFs were launched about 9 years ago and have gone through various changes in the period (more on this below).

The funds are offered as ‘Regular plans’, with what looks like a 0.75% trail commission built in. Investors can do SIP on these funds for as little as Rs 500 a month.

Before we get into why we recommend staying away from these funds, a word on how PhonePe is showing data about these funds.

Misleading data display

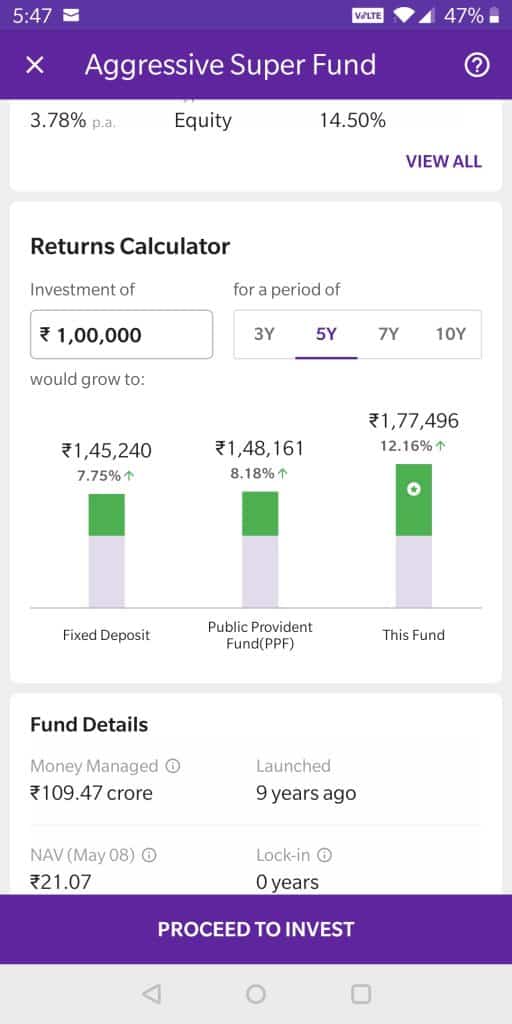

When you click into ‘Super Funds’ in the app, you see the three fund options, and clicking on each FoF takes you to showing details about the ‘Super Fund’. The place where they show performance of these funds is highly misleading.

Please see the screenshot below.

There are two problems with this:

- The app says, “Investment of Rs 1,00,000 would grow to:”. This is a fundamentally wrong way to present a scheme performance and goes counter to SEBI guidelines that prohibit forecasting future returns.

- But, that is a smaller problem compared to the next – The returns shown are simply wrong and inflated for this fund. Remember, this fund has a track record of 9 years. And this app shows me a ‘10-year return’ for this fund!! My guess is that they have taken the CURRENT portfolio of constituent funds and taken its historic returns and PROJECTING it into the future! If so, this is wrong in so many ways, I can’t even start!

Truth be told, the aggressive variant of the Super Funds has a 5 year return of 5.64% per year and a 7-year return of 9.57%. Not shabby, but definitely not the 12+% that the app displays.

I hope PhonePe will fix these errors right away!

Anyways, moving on to the actual reasons why we don’t like these ‘Super funds’…

Reason 1: Portfolio quality

The first thing to do while evaluating a fund for investment is, well, to evaluate the fund. In this case, however, these are fund of funds, and hence we need to evaluate how the portfolio has been put together over time.

In this case, it does appear that the fund house has significantly changed the portfolio recently, probably due to it being featured in PhonePe.

ABSL FoF Series ran a portfolio with predominantly ABSL funds across equity and debt with barely 1 or 2 funds outside of its staple. Its debt exposure was into high risk funds such as Aditya Birla Sun life Credit Risk and ABSL Medium Term Plan besides risky funds such as Franklin India STIP. In fact even its conservative portfolio as of Dec-18 sported as much as 42% in ABSL credit risk alone, suggesting that the portfolios were not really conservative and safe for the said asset allocation.

By Dec-19, the fund house cleaned up this series a bit, removing/reducing credit risk by introducing its corporate bond fund and in equity too, removing the underperforming large-cap ABSL Frontline Equity.

It appears that the recent effort to make the portfolio more diversified across fund houses appears to have come on the back of the PhonePe deal. The following are largely the characteristics of the present portfolio:

- Close to 25% of the aggressive portfolio is into ABSL Nifty and gold ETFs

- Other equity funds across fund houses have been chosen to simply fill one fund in each category that SEBI has rather than a conscious effort to build a portfolio with mixed strategies. For example, there are 2 multicap funds and 2 focused funds with 1 of midcap and large & midcap funds each besides the Nifty ETF.

- The debt portfolio has been shifted to mostly banking & PSU and corporate debt funds, clearly given the pain that ABSL has gone through with its own debt funds in the last 1.5 years.

- While the earlier held, badly hit funds ABSL Credit Risk and Medium Term Plan no longer appear in the portfolio, their segregated units remain.

- All the funds in all 3 options are the same save for changing asset allocation.

- From the past records, it appears that the fund can move to themes and sectors as well. It has earlier had exposure to pharma and consumer-related themes.

You can see below the complete portfolio (as of Apr 30) of one of these funds (Aggressive).

Overall, there does not appear to be a coherent investment philosophy underlying the construction of the portfolio. There are other fund-of-funds (Quantum’s Equity FoF, for example) that have more focused, better structured portfolios than this FoF. Given the gyrations that the ABSLFoFs have gone through, and their significant recent changes, it is difficult to see where it is going. And any fund without a clear strategy is not something we prefer, performance or not. Knowing a strategy helps you align a fund to your own goals or requirements. That is a key part of portfolio planning.

Reason 2: Lack of flexibility and options

When you invest in a mutual fund, you are outsourcing your money management to a fund manager. When you invest in a fund of funds, you are not only outsourcing money management, you are also outsourcing your portfolio management to the same people managing your money!

This is inherently a bad idea – for one, these are different skills. Asset management companies are good at analysing markets, products, and at managing funds. Managing a portfolio is a different skill set altogether – one in which fund houses do not necessarily have competence.

Moreover, portfolio management is rightly done either by an advisor or by the investor themselves. For they understand their requirements, time-frames, risk profiles etc much better than AMCs.

Sure, for a platform like PhonePe, it makes for an easy product to sell, without having to offer personal advisory services. But, unfortunately, what is good for them is not good for you.

For you, it means lack of flexibility and options. Initially, it may mean that you have a ‘fire and forget’ investment. But over time, you will realize that you are stuck with a single fund house to manage your portfolio and a set of funds over which you don’t have any control. And you will always be wondering about the biases that the fund house has for its own funds. All in all, not the best way to go about investing for the long term.

Reason 3: Higher costs

When you invest in a mutual fund, you incur a cost – an expense ratio – that goes to the AMC for the fund management. That is a fair price to pay for the convenience of investing and for the fund manager’s expertise.

Read this primer on Expense Ratio Mutual Fund to know more about the expense ratio.

But when you invest in these Super funds, you not only pay this cost, but also two other costs. Your total cost is not just ‘x’, but ‘x+y+z’.

- You pay an extra cost for the Fund of fund’s expense ratio. In the case of these funds, they range from 0.31% to 0.46%.

- That is, if you go with the ‘direct’ plan variation of these funds. With PhonePe, you will be investing in their regular plans. This cost ranges between 0.85%-1.1%

It is really unconscionable to pay these extra amounts for investing. When an entity sells regular plans, they are supposed to provide advisory and customized fund recommendations. PhonePe does neither and just for offering a FoF on its platform, it charges investors a cool 0.75% extra!

And that comes directly from your online mutual fund investment! As good a reason to avoid these funds as any!

Here’s an article that tells you how to decide between Direct vs Regular Mutual Fund.

Reason 4: Not tax efficient

A fund-of-fund is an inherently tax inefficient way to invest in a set of funds due to the tax structure they are subject to.

According to Indian tax law, fund-of-funds are treated on par with debt funds when it comes to taxation. Which means gains for the first 3 years are taxed at the tax payer’s income slab rate. Beyond 3 years, investments can be indexed and the post-indexation gains are taxed at 20%. This is almost always less tax efficient than equity investments where long-term rules after just 1 year (not 3 years), and gains are taxed at 10% (after the first 1 lakh of gains that are tax-exempt).

PhonePe’s Super funds are all Fund of funds meaning they will be subject to debt-fund like taxation rules – even though each of the funds have substantial equity investments. Not good for the investor!

Summary

PhonePe’s mutual fund foray appears to be a way for them to monetize their audience by doing the least amount of work possible for themselves. Just offer a set of 3 fund-of-funds and pocket 0.75% of commissions without providing any services other than a platform.

For investors, however, it represents an inflexible, costly, poor investment option that is tax inefficient. Hence, our recommendation to stay away from them.

Go with a simple portfolio from our list of Prime Portfolios or with your own selections from our Prime Funds and use a direct mutual fund platform (like Kuvera, Groww, or Zerodha Coin) – this is the best and most cost-effective and tax efficient option. Any kind of asset allocation can be achieved with this and it also allows you to weed out any bad funds periodically.

Use the FoF option when you cannot get the underlying theme or strategy otherwise. For instance, Motilal Oswal Nasdaq 100 FoF or the Edelweiss Bharat FoF are options for those who cannot go the demat route to investing in ETFs nor invest in an international market directly.

Stay safe!

Source: PhonePe’s announcement

11 thoughts on “PhonePe’s Super Funds – Not so super!”

Good to know at the right time!!

In recent times Mutual Fund investment is a rapidly growing and easy investment tool to build one’s wealth through a Systematic Investment Plan(SIP) and onetime Lump-sum purchase.

I invested asum amount and i have withdrawn too but it has been 7 days and they are nof returning my money ..can anyone tell me why they are taking do much time ?

Sorry, this is something you can raise with them or directly withe the AMCs where you invested. thanks, Vidya

To explain it in 1 sentence – “Good platform but poor product”

at the right time, i’m reading this.

An eye-opener. Good stuff.

Reading your piece..I am reminded of a line used in the animation movie ‘The Incredibles’ (about superheroes)……The villain in the movie plans to mass manufacture super heroes…The villain is called ‘Syndrome’.

He says: “And when everyone’s super, (Evil Laugh) no-one will be.”

🙂 yup!

Excellent eye opener analysis at right time . I was about to invest . You saved my money ! Thank you

I actually have scheduled Superfund sips starting from June 2020, now after reading this I have plan to cancel it , but where can I cancel tht schedule ??

You have to ask them sir. thanks, Vidya

Comments are closed.