In the past week, long-standing warnings by market gurus about the imminent popping of the stock market bubble seemed to come good, with interest rates for US treasuries spiking up sharply and triggering a fairly sharp correction in stock prices across the world. But why should stocks fall if interest rates rise and will such a rate hike impact India?

Rates and equities

Well, let’s start with a little bit of history. For savers looking for avenues to park their money, riskier assets such as stocks always compete with the safest options in the market – bank fixed deposits or government securities. This makes for an inverse relationship between interest rates and equity valuations.

In the 1980s, company fixed deposits in India yielded coupon rates of 13-14%. Many finance companies offered effective rates that were even higher. Some would pay interest monthly, some quarterly and some half yearly. Upfront incentives for investing in fixed deposits were also common. Double-digit rates on bank fixed deposits were par for course. At some point, we even had government securities trading at yields of over 14%!

With this kind of returns on debt investments, it is no wonder that equity investments were simply not on the radar of most ordinary investors. The shallow stock market with its extremely high transaction costs, zero transparency and a paperwork-laden system wasn’t attractive to most, especially as income levels were also poor, making for poor risk appetite. Buying and selling stocks was not very easy and awareness about wealth creation through the stock markets had not yet set in. Fixed income apart, gold and real estate were the most preferred avenues to channelize investment.

But in the mid-1990s, the golden period for fixed income investors began to end. As an offshoot of reforms that deregulated small savings rates, interest rates in India started to moderate. By 2003 we saw government securities trading at below 6% yield. Company fixed deposit rates and bank deposit rates also followed suit.

Today, the saver cannot expect beyond 5-7% on safe fixed income investments. On the other hand, this period has seen many companies emerge whose earnings grew at a rapid pace even as the economy was booming. You can now trade in stocks from your mobile phone and there are excellent systems and an extraordinary level of awareness about the wealth creation potential of stock markets. This has led to a record number of retail investors abandoning the safety of fixed income to try their luck in stock markets.

The tide of liquidity

What has given them a decisive nudge are the record-low interest rates the world over. Zero rate of interest is something we in India have not come across so far, but in the last decade they have been very much a reality in developed markets. In effect economic activity was so low, that the regulators/governments were willing to offer almost free money to encourage it.

When money comes into equity, the minimum it expects is a premium to the return on the safest possible instrument (government securities), loaded with a hypothetical premium. There’s no universal basis to determine what this risk premium should be. So the theoretical assumption is that there is a pool of money to be deployed in various assets. When interest rates rise, some of that pool gets re-allocated from riskier assets like stocks to fixed income instruments that offer capital safety with returns. Keeping aside this theory, it is useful to figure out what are the causes and effects of changes in interest rates.

Today, the world is awash in liquidity. Since the 2008 Lehman scam, governments have minted more currency to fight their way out of slowdowns. A fancy name ‘Quantitative Easing’ has been given to such money printing. Most of this money ultimately finds its way into the financial markets. This leads to ‘asset price inflation’ – a polite term for what is really irrational exuberance.

Of course, we have umpteen reasons to justify this exuberance and any cautionary words are treated with disdain. Initially, value stocks look cheap. Then we chase growth. Once we do that, then there is ‘re-rating’ of stocks and sectors. After that it becomes ‘thematic’ investing. Each leg up is also justified with new valuation metrics. Easy money sets off a cycle of increasing demand, booming credit and recovery in economic activity. All works well as long as inflation remains within reasonable bounds that nations are willing to tolerate.

Inflation risk

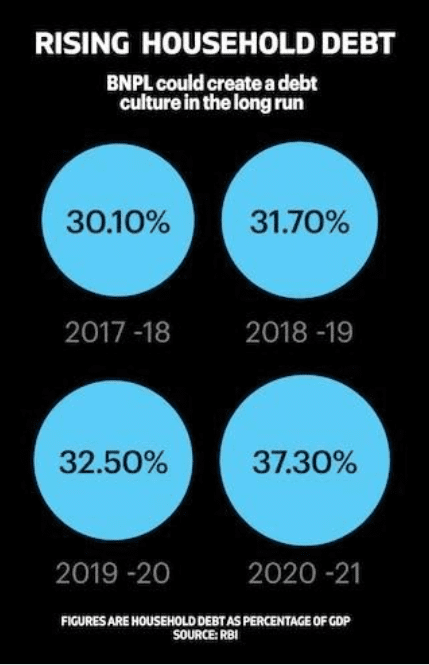

But sooner or later, the excess money and easy credit light the fuse that sparks inflation. This is because the supply side does not have the confidence to grow even as easy money with the spenders drives up demand. Once this happens, inflation gradually inches up and one fine day, central banks start to ‘tighten’ their belt. Gradually they suck the liquidity out of the system and try to stem the flow of easy money. If you want to see how debt or leverage can impact demand, here is one interesting table I came across:

Consumer spending today is at record levels. One of the reasons why we recovered so quickly and strongly from the pandemic is the easy availability of money and the relatively low level of borrowings by the spenders. In the US, household debt is at around 85% of their GDP. For India, this is a new start and I think the percentage can only go higher.

Once the screw tightens and interest rates go up, or there is a strong signal that it will go up, money flows can change. There is a shift away from equities, as people want to take lower risk. They worry that high interest rates would slow down economic activity, slow down demand and eat into profits. The optimism that low interest rates bring about, gets turned on its head.

But often, expectations of interest rate changes themselves cause volatility in the markets and the actual event may not impact markets when it happens. Yes, for the economies where inflation is traditionally at two percent and it jumps to seven percent, there is a reaction from the governments, to tighten money supply.

The India story

This story has an India chapter. We have had one of the sharpest bull runs in history, both in terms of the breadth of participation and staggering sums raised from IPOs and OFS. If we take a rupee-weighted gain in the market, this bull run of the last eighteen months or so should clearly be the largest ever in the history of our markets, so far. There are good corporate results, low interest rates, low debt on company balance sheets, the lure of the sunrise industry – e-commerce – and a future where man is driven by technology.

New terms like ‘platform’, ‘customer acquisition’ and more have entered the stock market lexicon to justify exaggerated valuations. Two and two no longer need to equal just four, but can be made to equal at least twenty-two! The consumer is egged on to spend money he does not have now. And that money is available even without being face to face with the provider. What a combination!

But I do not believe that a hike by one or two percent will make any difference to the Indian economy. We might see some knee-jerk reactions to what the US markets do, but Indian markets will be driven by corporate results and our dreams.

In the past, Indian markets used to be hyper dependent on FII flows. But in the last one year, domestic retail flows have driven the markets even as FII flows turned negative. We are also seeing retail participation through the SIP route in mutual funds reach record levels. The equity cult has taken wing.

Plus, barring the disappointment of the PayTM listing, the enthusiasm has not waned for the fintech or techfin businesses. There are enough investors willing to bet on scalable businesses even with profitability being a faraway thing. We are at the beginning of the technology start-up revolution and it may take some more years before there is closer scrutiny about what to expect from investments. But one aspect on which investors do need to exercise caution is a random event or a big disappointment from any one sector triggering a correction. Valuations are high and we could see prices waiting for earnings to catch up.

I do believe interest rates will go up. Maybe by up to two percent per annum. We will see the NBFCs and banks hike rates on lending and borrowing. For fixed income investors, it will probably be a relief. Our tax revenues are buoyant and this will give the government enough room to plan big spending on infrastructure. The government will want a healthy and bullish mood in the stock markets as more and more developmental work has to be met through private participation.

So I do not expect a big jump in government borrowings. We are also seeing the resumption of borrowings abroad at fairly competitive rates. Yes, they seem to bank on the rupee being stable. I support this expectation, given that our export growth has got a fillip from government policies. Our trade deficits do seem to be manageable.

As an investor in equities, thanks to the above factors, I am cautious but not worried. I am happy to hold good quality stocks and am not bothered with a twenty percent drawdown (which is my downside expectation). I firmly believe that our businesses are resilient and the economy will grow at six to seven percent per annum over the next decade or so, irrespective of politics. Yes, politics that encourages commerce, irons out the creases. The big positive is the use of technology across revenue streams for the government which helps plug traditional leakages.

2 thoughts on “Interest rates: Should you move out of equities?”

Very timely note, even if I do not understand. Hopefully you fully guide us continuously

Could you also specifically comment on Smallcap mutual funds (and also stocks)..

And your comment ” I am happy to hold good quality stocks and am not bothered with a twenty percent drawdown” – What is the probability of this happening?

Going by the trend of P/E and P/B valuations it looks as if the probability of correction is very high.

Dear Mr Bala,

I feel there is a real risk from the asset quality of our banks and NBFCs.

A lot of that is still not clear due to the government’s easing of disclosure requirements in the pandemic years.

A lot of creating accounting may be on.

One ILFS took the market down significantly. Are more waiting to happen?

Would love to hear your thoughts.

Regards

Comments are closed.