Godrej Agrovet is a conglomerate with businesses spread across the agriculture and protein supply chain. It is in animal feeds, palm oil extraction, agrochemicals, dairy and frozen foods. The business has commoditised parts, seasonal parts and valued added parts.

This makes it difficult to model situations where all these parts fire on earnings simultaneously and deliver secular earnings growth. But that doesn’t mean conglomerates like Godrej Agrovet are best avoided in investing!

Such companies can be evaluated on the 4 main dimensions as follows:

- A decent RoCE at the conglomerate level

- Scope for growth in individual parts

- Stable cash flows and prudent capital allocation

- A reasonable entry valuation

If these things exist, then conglomerates such as Godrej Agrovet can warrant the attention of patient long term investors. Here’s exploring Godrej Agrovet along these lines.

#1 Conglomerate structure

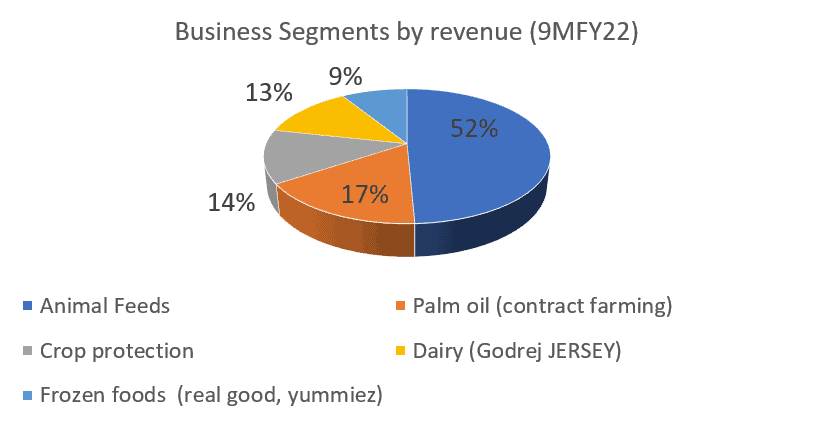

The various businesses that Godrej Agrovet is involved in and their contributions are outlined below.

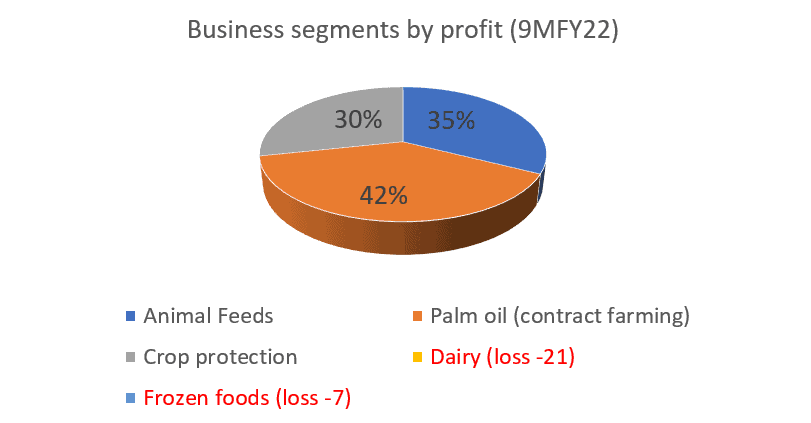

Animal feeds contribute to the lion’s share of sales and larger share of profits as well. However, the palm oil business has moved to become a major profit contributor, as soaring vegetable oil prices aided margins. This acted as a natural hedge for the company in protecting overall earnings.

Dairy remains the key grey area without meaningful profitability track record and intense competition that can keep a lid on margins and growth.

#2 Business Prospects

The table below gives the performance of individual business segments. As you can see, there has been a strong recovery post Covid. The company appears on track to deliver strong growth over the pre-Covid period in FY22. Barring the one-off real estate income it had in FY20, earnings growth has been looking upwards in both FY21 and FY22, despite challenges in agrochemical business.

Now, as we said at the start, it’s necessary to see how each different business segment is positioned in terms of growth and whether the conglomerate can hit the sweet spot of all segments firing at once.

Animal Feed

Godrej Agrovet is present across cattle, poultry and fish feeds. Animal feed is the major business segment that contributed to just over half of revenue and a third of segment profits (for the April-December 2022 period). Though a commoditised business, it is not highly capital intensive. The segment is a cash cow for Godrej Agrovet, owing to its low capital intensity and Godrej’s market share. Growth in this segment is linked to overall growth in domestic protein consumption.

A measurable trend of this protein consumption is the penetration of modern retail (super & hyper market), cold storage, dairy and packaged foods. This is leading to rising consumption of cheese, paneer, yoghurt, chicken, fish and meat products. Various estimates put protein consumption growth at 5% going forward. This apart, India is still protein-deficient with wide variation in income levels between states and between urban and rural populations. As base income levels inch higher and penetration of modern retail increases, protein consumption may have higher growth potential.

On the profitability front, the business has been facing headwinds from input cost inflation –soybean prices are up about 22% since the start of this year and nearly double of that two years ago, driven by higher demand, lower production, country export policies, and the Ukraine conflict. Corn prices are similarly skyrocketing for the same reasons; Ukraine accounts for about 15% of global corn trade.

To protect its margins in this segment, Godrej Agrovet has been banking on its R&D efforts to use substitutes and has worked on gaining market share. While the pass-through of input cost prices may happen with a lag, the company is confident of maintaining margins on an annual basis. It has been able to increase its market share in some of its key markets in the last 2 years.

Agro Chemicals

This segment has been subdued in the past few quarters. The business contributed about 14% of sales and 30% of segment profits for the April-December 22 period. This has been a contraction, from the 18% revenue contribution and 40-45% of profits for the comparable 9MFY21 and the whole of FY21.

This has been mainly due to seasonal factors, price decline in generic agrochemicals and a production shutdown at its subsidiary Astec Lifesciences due to floods in the Mihan SEZ. The segment is at this time domestic-focused, suffers from growth inconsistencies and depends on agricultural demand and monsoons.

Going forward, this business segment can improve. One the boom in agri commodity prices can act as an incentive for higher production, though contingent on monsoon. Astec Lifesciences is aiming to better tap growth in international markets (exports) with its R&D backed custom synthesis and contract manufacturing operations (CRAMS) in the agrochemical space.

Astec Lifesciences is a leader in triazole fungicides, which has a global market size of US$ 3 billion. This chemistry has been contributing over 60% of overall revenues. To mitigate concentration risk, Astec has forayed into other agrochemical categories (herbicides) as well as CRAMS with a capex of Rs. 180 crore for a herbicide plant and R&D centre. In fact, Astec Lifesciences is richly valued at 6 times sales, 48 times earnings and 10 times on price-to-book for its strong growth prospects.

Even so, for Godrej Agrovet, the ability to reduce domestic risks and improve product mix needs to be watched.

Palm Oil (contract farming)

This business contributed 17% of sales and 41% of profits in 9MFY22, a significant increase from 11-13% of sales and 15-17% of profits in 9MFY21 and whole of FY21 respectively. This is mainly due to a significant increase in vegetable oil prices, which climbed to an 11-year high. Segment margins expanded from 13% to 19% in 9MFY22.

India meets two-third of its vegetable oil demand through imports and palm oil contribute to 60% of this. There is now significant government thrust with the National Mission on Edible Oils – Oil Palm scheme to reduce dependence on imports. The Govt is aiming to treble the area under cultivation by 2026 and quintupling by 2030. An initiative taken now could lead to reducing import dependence from the 7th or 8th year when the plantations start production.

Godrej Agrovet is planning to take its area under Oil palm contract farming from 75,000 hectares at present to 1 lakh hectares over the next 3-4 years while backing it up with R&D in producing a high yielding variety of seeds. With both this increase and government thrust, the palm oil segment can turn out to be a sustainable growth business in the medium to long term.

In the near term, margins may stay elevated between 13% - 15%, cooling off from the recent spike, as the Govt may maintain higher import duties to boost domestic cultivation.

Dairy

This business is the key challenge for Godrej Agrovet. This business is housed under a 51% subsidiary, Creamline Dairy. While it contributed 13% of sales in the April-December 2022 period, it was loss-making. This is a step down from the 15-16% topline contribution in the year-ago period and a small 2-3% profit contribution.

Godrej Agrovet entered the dairy business with the acquisition of a minority stake in Creamline Dairy Products in 2005, acquiring a further 26% in 2016 and making it a subsidiary. It has also been rebranded as Godrej Jersey.

Though dairy is a lucrative growth business, it is a highly competitive one. Players such as Hatsun, Heritage and Dodla dominate the southern markets of Karnataka, TN, AP, Telengana and parts of Maharashtra where Creamline Dairy also operates. A French dairy major also entered these markets through acquiring Thirumala Milk Products in 2014 and Prabhat Dairy in 2019. The sector is also seeing players like Milky Moo (Odisha), Milky Mist (Tamil Nadu) and Epigamia (Maharashtra) making significant inroads in value-added products. This apart, State co-operatives hold the lion’s share in many States. In other words, Godrej may not find it easy to achieve profitable scale in the dairy segment.

The key lies in Godrej’s ability to achieve economies of scale in procurement, bring value-added products and build extensive distribution reach.

Hatsun, Heritage and Dodla have been able to grow their sales at a healthy pace in the last decade. But despite efforts from Creamline Dairy to enhance its procurement infrastructure, bring more value-added products and grow, it has faced challenges to growth and profitability. In an effort to boost growth, the company hired a CEO with an FMCG background to spearhead distribution and growing value-added products last year.

Being complementary to its animal feeds business, the company’s intention is to retain and scale the dairy business rather than exit. Progress on this front, therefore, needs close watching. As it stands, the dairy business is currently a drag on overall profitability.

Processed Foods

This is a 50:50 JV with Tyson Foods of USA, and contributed to 10% of sales in the April-December 2022 period and reported losses. Like with the dairy business, this is a contraction from comparable earlier periods. In this frozen food business, Godrej Agrovet holds brands such as Real Good chicken and Yummiez. It caters to hotels, restaurants and QSR chains besides selling it to consumers through retail channels.

The potential for this segment holds good; this is a scalable business with growth in protein consumption, both in-home and out of home. The penetration of super and hyper market chains, packaged snack products, food delivery players and QSR are positives for branded organised players in this segment. However, Godrej’s own ability to weather near-term margin pressures and capitalise on the growing trends remains to be seen.

To summarise:

- The animal feeds business is a stable, if low-margin, one. However, there is a threat of competition with stronger players in the dairy industry such as Hatsun and Heritage are starting to diversify to animal feeds, which can dampen market-share led growth.

- Long-term growth potential lies in its palm oil business, provided government efforts to reduce import dependence pay off. Regulatory risks may also come up, in terms of licensing, procurement and pricing.

- Agrochemicals are a more seasonal business segment, hinging on domestic crop coverage and agricultural production. Efforts to balance this via higher-margin formulations and a focus on exports are factors to watch.

- Dairy is currently a drag and needs close watching; the heavy competition can make it hard to grow and maintain reasonable profitability.

- Similarly, the frozen foods business is nascent and needs watching to understand how Godrej Agrovet taps the segment’s potential.

Overall, 85% of the business segments are poised for growth while 60-65% of segment profit (EBIT) is positively skewed towards the high commodity price environment.

#3 Capital allocation & returns

Now, let’s take up the other evaluation factors we’d mentioned – capital allocation & efficiency and cash flows.

Below is the data for the last 5 years. As you can see, the company has maintained reasonable RoCE and may end FY22 with a similar 17-18% RoCE.

Standalone businesses are capital light. Subsidiary Astec Life Sciences is capital-intensive and is expanding, but aims at building a high-margin business with an export focus which can compensate.

The dairy business may require significant investments to become a larger player where its competitors are more aggressive. A merger of this business into the company will have a negative impact on the RoCE.

Cash flows and capital allocation

Though cash flows have been hit over the last 2 years, it is expected to get back to normal in the second half of FY22. The company has historically maintained a healthy cash flow profile. The decision to replace suppliers’ financing with borrowings also resulted in additional borrowings

On capital allocation, the company has been investing more for growth in animal feeds and agrochemicals. It has invested Rs. 80 crores for a fish feed plant in UP while Astec Lifesciences is investing Rs. 180 crore.

Godrej Agrovet along with the promoters recently acquired ~5% stake in Kerala-based KSE Ltd, a company focused on animal feeds and dairy. The company has a market value of Rs. 750 crore, is debt free with cash of Rs. 115 crore. While promoters own only 25% stake, a single HNI investor holds ~19% stake. This can be a takeover candidate that may add to further capital requirement while a merger may entail less cash outflow.

Therefore, acquisitions and the dairy business may be two areas that may entail higher capital investments in the near future with short term drag on RoCE. Further investment plans on dairy business need to be closely watched as the company may have to make significant investments to catch up with competition.

#4 Valuation

At the current price, Godrej Agrovet is quoting at 28 times earnings and at 4.4 times price to book value. This is slightly lower than its average PE of 30 times (since listing in October 2017) and 5-6 times book value. The stock is also on the lower end of 16-25 times EV/EBIDTA band it has traded in since listing.

A comparison with companies that have somewhat similar lines of business and financial profile is below:

There are two key takeaways here:

- While Godrej Agrovet may look attractively valued compared to its own average, it is more expensive compared to similar players. Hatsun has been an outlier in this space of growth.

- As a conglomerate, Godrej Agrovet may not receive a PE re-rating. Therefore, it is only earnings growth along with any corporate action (mainly demergers) that may act as key triggers for the stock. On this earnings front, the picture is a mixed bag as explained in the earlier sections.

Therefore, while Godrej Agrovet is positioned across attractive business segments with 85% of businesses and 60% of EBIT skewed towards growth in the present environment, its capital allocation towards dairy business and ability to turnaround need to be closely watched. For conglomerates such as these, a margin of safety in terms of valuations is necessary.

Please note that this is only a review of Godrej Agrovet and not a recommendation. We have taken this stock for review as it has been nearly 5 years since its listing. While the IPO received overwhelming response, being oversubscribed 95.41 times and making a good debut, it has since delivered no material gains.

Our attempt was to delve into how to analyse conglomerates like Godrej Agrovet, looking at the various business parts and bring to light what is aiding and dragging performance. With the Godrej group gearing up for a planned split, what will be the fortunes of listed group companies and how the family is going to consolidate their stakes? Read more to know more about the Group's family tree and the planned split.