In these reviews, we pick stocks that have rallied, or where businesses are interesting or changing, or where companies may be relatively unknown and so on. We present an analysis of these stocks, covering what has driven them, business prospects, threats and more. These reviews are meant to give you an understanding of a stock. They are not our recommendations.

India is reportedly the country with the third largest number of family-owned businesses after the US and China. Barring sectors like financials and multinational companies, family-owned businesses are common in most sectors. According to an OECD report on Ownership Structure published in 2020, among all listed companies, promoter holdings has ranged between 48-53% since 2006.

One such reputed family-owned business empire in India has been the Godrej group, founded in 1897. Starting from “lock” manufacturing, the company diversified into soap manufacturing in 1928 (from vegetable oils) and then to animal feeds, real estate, processed foods and chemicals. Godrej Consumer, the flagship company was born out of Godrej Soaps in a demerger in 2001 while Godrej Soaps became Godrej Industries, the listed holding company for the group.

As a business group, Godrej is known for two things: one, good corporate governance and two its practice of buyback of shares of its companies when markets tested its stocks.

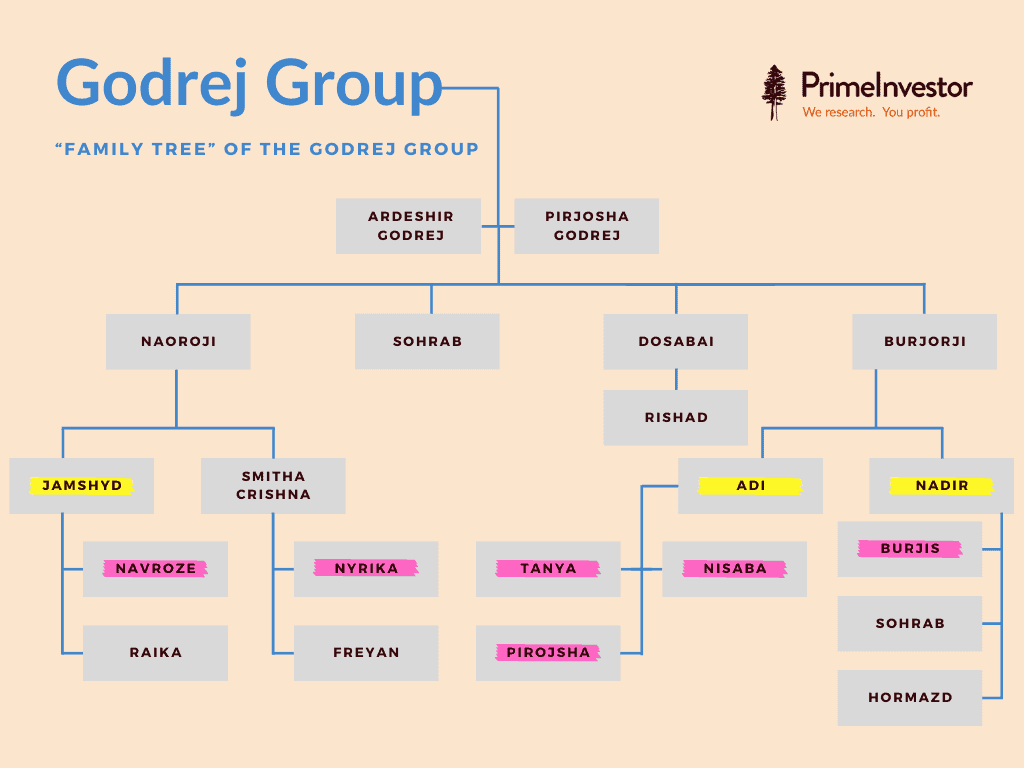

With reported news of the family being headed for a split, we thought it would be a good point to look at the group’s key listed companies, their ownership and board composition so that we know what’s at stake for investors when a split happens. Before getting to the details of the businesses, let’s take a quick look at the “Family Tree” of the Godrej Group from the founders to the present generation that occupies the Board position in various group companies.

The 2nd generation comprising Jamshyd Godrej, Adi Godrej and Nadir Godrej are at the helm of various businesses of the Group (highlighted in yellow). Their next generations have also been inducted into businesses and hold key positions (highlighted in pink). Rishad Godrej, also an environmentalist and author, has stayed away from family business.

Key businesses

The key listed group companies are:

- Godrej Industries: The company has a standalone chemical manufacturing business consisting mainly of oleo chemicals and is also the leading exporter. It is also a promoter holding company for Godrej Properties and Godrej Agrovet while owning a minority stake in Godrej Consumer Products.

- Godrej Properties: Real estate arm of the group and 2nd largest real estate developer in India by market value.

- Godrej Consumer Products: Leading consumer products company with brands such as Good Knight, HIT, Cinthol, Aer, Ezee, Nupur, B Blunt, etc. It is also the biggest listed company by market cap and profits for the Godrej group.

- Godrej Agrovet (and subsidiary Astec Lifesciences): The company is into animal feed, palm oil contract farming, dairy products and frozen food products (Real good chicken and Yummiez brand).

In the unlisted space is the group’s oldest company – Godrej & Boyce manufacturing Company. This firm is into several businesses including home appliances, construction, furniture, security systems, material handling, aerospace equipment, etc. Home Appliances and home furnishing housed under Godrej Appliances and Godrej Interio are the key unlisted consumer facing businesses of the company.

Below is a brief insight into the numbers and market value of various group companies for FY21.

How are these businesses controlled?

Since we are discussing the Godrej Group in the context of family split, let us look into in detail the board composition and ownership of key companies to understand how the businesses are controlled.

From the board composition, it can be seen that Adi Godrej and his children are in the board of the listed companies while Jamshyd Godrej, his sister Smita Godrej Crishna and their children are board members of Godrej & Boyce Manufacturing Company (See image of Family Tree).

Reported Split

According to reports, the group is looking for a division between two groups; one led by brothers Adi Godrej and Nadir Godrej, and the other by Jamshyd Godrej and his sister Smitha Godrej Crishna. Recently Vijay Crishna, husband of Smitha Godrej Crishna, resigned from the boards of Godrej Industries and Godrej Agrovet.

For the purpose of looking at ownership, two key companies matter; Godrej & Boyce and Godrej Industries (listed). In both Godrej & Boyce as well as Godrej Industries, the five families of the 2nd generation comprising Jamshyd Godrej, Smitha Godrej, Adi Godrej, Nadir Godrej and Rishad Godrej owns following stakes through several family trusts.

Valuation – a critical factor and the “suspense”

As is the case with any family-owned split, it is the valuation of key companies, Godrej & Boyce and Godrej Industries in this case, that are critical. The table earlier already has the market value of the listed companies.

#1 Land bank

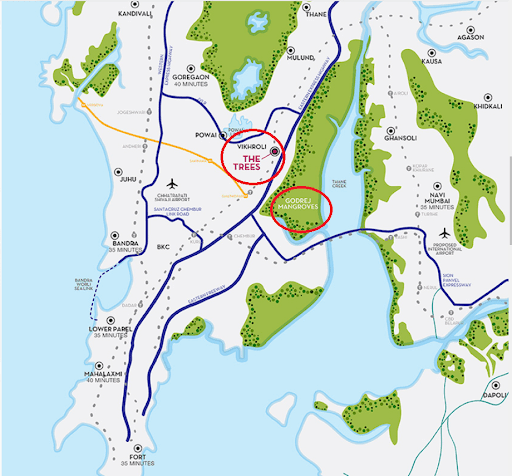

The suspense here is the 3,400 acres of land in Vikhroli in Mumbai that Godrej & Boyce owns. While it is mostly a land of mangroves and the Group’s objective was to preserve it, the stance has changed to development of about 1,000 acres and preserving the remaining acres as mangroves. Besides, 300 acres is encroached. The difference of opinion in development of land banks has been cited as one of the key reasons for the family split. Interestingly, both Jamshyd Godrej and Adi Godrej are in the Forbes richest list of Green Billionaires. The value of this land bank will become a critical component in the valuation of Godrej & Boyce and will significantly out-weigh its manufacturing business valuation.

Source: Godrej Properties, godrejthetrees.com

To give a sense of the value of development potential at Vikhroli, Mumbai, Godrej Properties itself has an ongoing project in Vikhroli, Godrej Trees, in a piece of land measuring 34 acres (See the map above). The project starts at a per square feet price of Rs. 17,500 for residential units and moves upwards. It houses two large commercial spaces as well.

In one has to arrive at a rough estimate of the group’s land bank (if developed) based on Godrej Properties’ project - Vikhroli has a Floor Space Index (FSI - maximum area that can be constructed on a piece of land) of 2.5-3 times (MH FSI has been subject to multiple amendments in recent times) which indicates a total development potential of over Rs. 2.5 lakh crore. This may happen over a 10-20 year period depending on the demand in Mumbai even if the group arrives at a consensus to fully develop it.

#2 Holding company

On the other hand, the holding value of Godrej Industries in Godrej Properties, Godrej Agrovet and Godrej Consumer is ~Rs. 60,000 crore while the stock of Godrej Industries is quoting at a market value of Rs. 20,000 crore, a steep discount of 65% (as it often happens with holding companies). But, during family settlements, the entire value of holdings will assume importance as the ownership of the group in listed companies is mainly through Godrej Industries as can be seen from the table below;

Business as usual for now

As things stand there seem no real concern over the family split for various reasons:

- One, the ownership structure in existing entities is clear with almost equal stake for all the families in all major group companies.

- Two, the succession plan seems to be in place with the stakes consolidated under Family Trusts.

- Three, all the listed companies are run by professional CEOs while the family members occupy key board positions.

But how the promoter holdings turn out to be, post split is still something that will have to be watched. Again, there appears no near-term concern here.

What to watch

Group splits attract market attention, especially for holding companies. Godrej Industries is the key holding company for its listed companies. Godrej Industries is still driving new business incubation with housing finance being the latest addition (Godrej Housing Finance with focus on retail lending). This company is aiming at an AUM of 10,000 crore in 3 years.

Apart from Godrej Industries, the other company in focus would be Godrej Properties on whether it will get the right to develop the massive land bank that Godrej & Boyce owns. In March 2021, Godrej Properties raised Rs.3,750 crore via QIP to institutional investors at Rs.1,450 per share. These price points will assume importance when the valuation game begins.