With contributions from Anush Raj

We have a short video on the EV disruption. Watch this to get an overall idea on how the EV market has been evolving in India and around the world.

The automobile sector in India has been one of the fastest growing manufacturing sectors in the last two decades, be it two wheelers, passenger cars or commercial vehicles. But opportunity in the listed automobile space has been limited for investors.

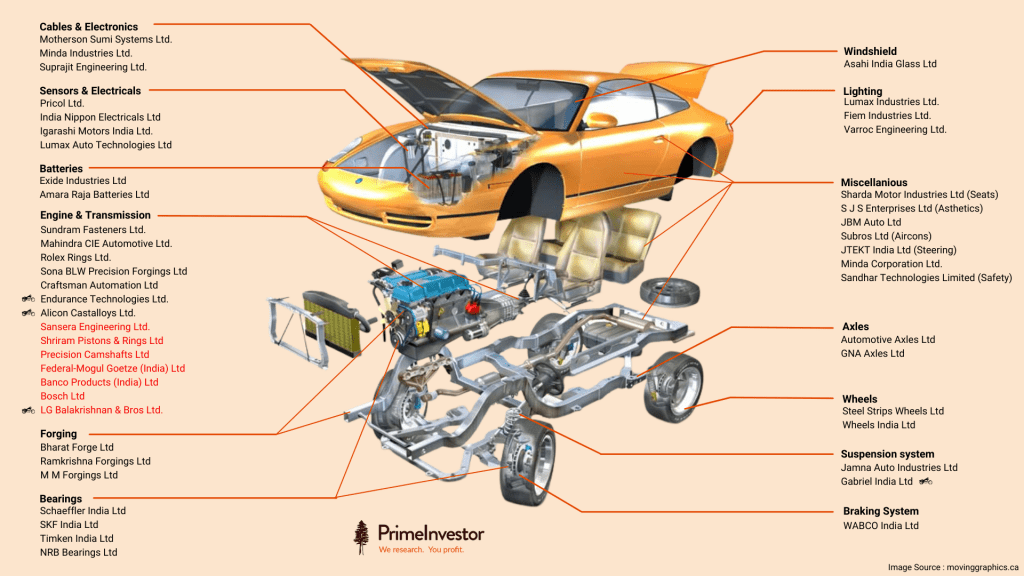

The auto component or auto ancillaries space, though, features more listed opportunities. These companies supply critical components such as engines, transmission, axles, suspension, brakes, lighting, electronics and batteries to automobiles. It is a major manufacturing sector, accounting for 2.3% of GDP and employing 1.5 million people. Piggybacking on the fortunes of the auto industry and another way to play the space, the auto ancillary segment can offer opportunities. With over Rs. 4 lakh crore in market capitalisation, this sector has more companies in its fold to play the auto space.

But the auto ancillaries space too is not having it easy, what with disruption in the auto industry. While a lot can be explained about the nature of disruption the industry faces, the one key disruptor is electric vehicles (EVs).

The EV shift could hurt conventional automotive businesses but also offer an opportunity to shape them for the future. Even for the auto ancillary sector, knowing which segments could face the heat and which are positioned to answer the challenge will point to where to place bets in the future.

This point is the one we’re aiming to address in this comprehensive report. We also explain how to approach the auto ancillary sector for a longer-term perspective.

The disruption in the auto sector

Disruption is both enticing and worrying. When disruption happens, stock prices react ahead of earnings and hence catch investors unaware. In the auto space, electric powertrain technology is the biggest disruption today. This disruption is becoming evident in the 2-wheeler space – electric 2-wheeler sales grew 132% to 2.33 lakh units in 2021. The expectations are much higher for 2022. And this is a very low base as it is only 1.5% of total 2-wheelers sold in the country.

CRISIL Research estimates that electric 2 &3 wheelers will continue to grow strongly. By 2025, EV penetration is expected to improve to 12-17% of new vehicle sales for e-2 wheelers and a whopping 43-48% for e-3 wheelers. For passenger cars for personal mobility, on the other hand, CRISIL Research estimates offtake will be subdued given poor cost economics and the lack of subsidies. As a result, barring 2 & 3 wheelers, EV adoption is expected to remain under 5% until 2025.

This view is corroborated by various other estimates by consulting firms, which put EV penetration in 2 & 3 wheelers at 40% by 2030. The best-case estimate on passenger cars is at 20%, though the government has a higher vision of a 30% penetration in passenger cars by 2030.

Given the current sluggish growth in the auto space and the potential for disruption down the line, auto ancillary players appear to be on the cusp of marked change in their target market. If one is to play the auto ancillary space, therefore, it’s important to know what is driving the disruption, which segments and players will face the heat, and which ones likely to benefit. Here’s delving into these aspects.

#1 What is driving the automobile disruption?

Current consumption trends point to a clear disruption in the 2-wheeler segment. There are two key factors driving the adoption of electric 2-wheelers: one, the parity in purchase cost. Two, complete savings on running costs.

Here is a rough comparison of purchase cost between a petrol scooter and an electric scooter (after FAME II subsidies *). We have picked electric scooters that are players in the “value” segment, the most-sold category, where the switch from petrol to electric is mainly happening.

Note: This is a rough illustration of petrol and electric scooters (high speed) that are used for basic commuting purposes. The electric scooters shown are that of players in “value” segment (most sold category) where the switch from petrol to electric is mainly happening.

*Central Govt subsidy under FAME II (Faster Adoption and Manufacturing of EV) amounts to Rs.30,000 to Rs.50,000 per vehicle based on its battery capacity. Some states offer additional subsidies of Rs. 10,000 per vehicle.

As is clear from this comparison above, electric 2-wheelers are not cost-prohibitive and give petrol scooters strong competition on affordability. Lower running costs post purchase simply enhance the promise. Not just that, given the range of entrants in the 2-wheeler space, customers have plenty of choice.

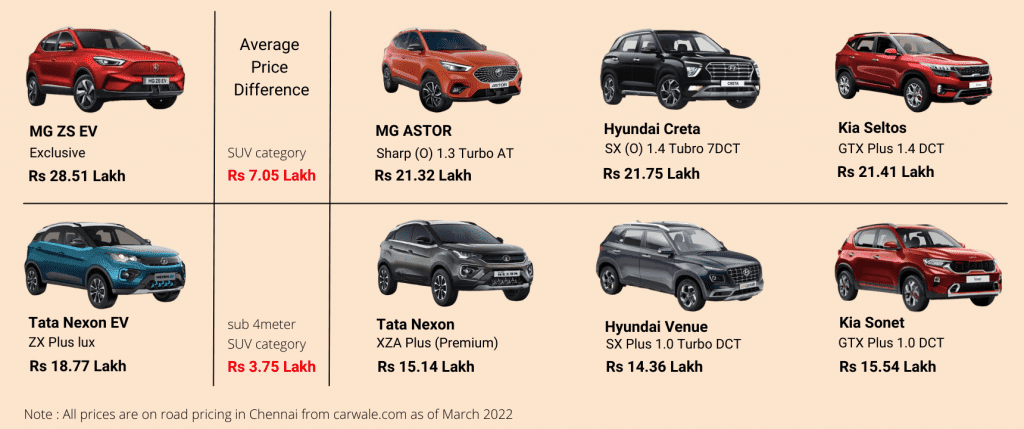

On the other hand, the adoption of EV in the passenger car space is expected to be much slower. The one segment that could see some adoption here could be the SUV space where the tax is as high as 45% (In the >4m segment, GST is 28% + Cess 17%) and fuel efficiency is lower (vs. small cars). But even so, the very high initial cost of acquisition of comparable electric vehicles could keep a lot of buyers away, and choices are also limited.

Here is a comparison of purchase cost between a petrol SUV and an electric SUV:

Note: There is no Central Govt subsidy on vehicles bought for personal use. But, under Section 80EEB of Income Tax Act, persons buying an EV on loan will be eligible for tax deductions Rs 1.5 lakh on interest paid on the loan amount. Some State Govts offer subsidies to the extent of 5-10% of cost of vehicle, waiver of road tax, etc to make them attractive for buyers

In the CV segment, at this juncture, there does not appear to be any indication of any disruption happening. This therefore leaves 2-and-3 wheelers the most susceptible to EV disruption, followed by passenger vehicles.

#2 Will the disruption impact the auto ancillary space?

Here is how we think the impact of the disruption in the component segment may unfold:

- Companies facing negative impact would be those catering to engine and transmission components to the 2 & 3-wheeler space followed by those supplying to passenger cars.

- Companies that may not feel the disruption hurt are those supplying components that will be common across new and old products and technologies. For example, the ones that may NOT see any disruption include the likes of companies supplying suspension, brakes, lighting, electronics, wiring, wheels, etc.

The following infographic gives you an idea of the product portfolio of components that go into a 4-wheeler. This will help understand auto components – and therefore auto ancillary companies – that will change with disruption and those that remain the same.

In the above infographic, we have marked the major components and the suppliers in the listed space. Here, we have taken the players who supply a passenger car. Such vendors may also be supplying similar products to 2 & 3 wheelers and commercial vehicles.

#3 What does disruption mean for companies?

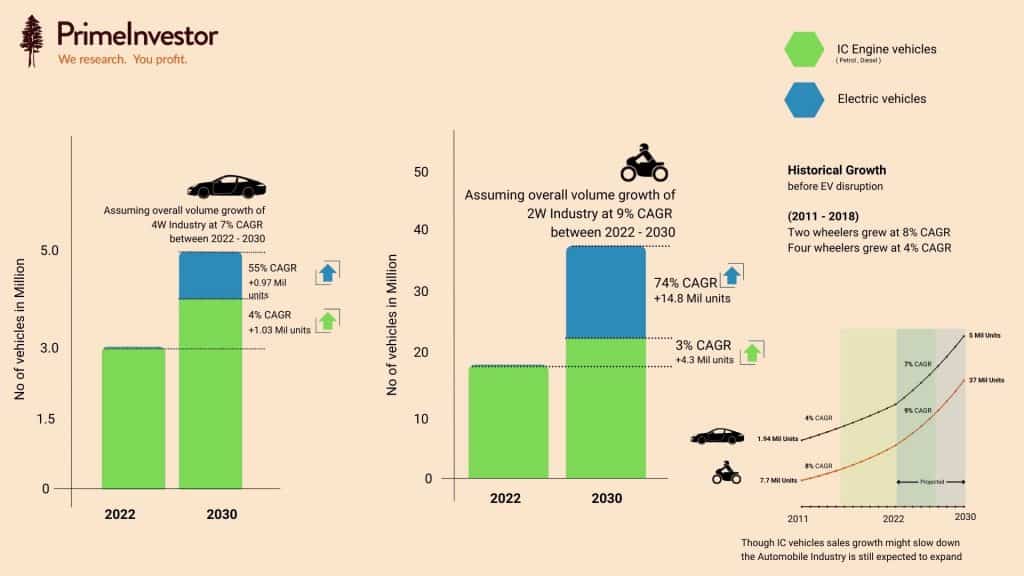

Disruption does not mean companies will go out of business. It means they will be forced to settle for lower growth if they do not adapt. Lower growth or even decline would mean lower market valuations. Let us explain this with the help of another infographic (yes, we like these!)

Here, we assume that 2-wheeler sales will double between FY22 and FY30 (9% CAGR) to reach 37 million in FY30 from 18 million in FY22. At a 40% penetration, EV will be 14 million (estimates by consulting firms) while petrol will be 23 million. Similarly, we assume that India will sell 5 million cars in FY30 compared to 3 million in FY22 (7% CAGR). EV will be 1 million at a 20% penetration, and petrol will be 4 million. These assumptions are best case scenarios with respect to EV penetration.

In both cases, you can see from the graph that internal combustion engine (ICE) vehicles (petrol and diesel) will face significant challenges, growing at a far lower rate than the industry growth. This is in a growing market scenario. If the disruption is happening in a stagnating market, then ICE vehicle sales will only decline as EVs gain market share.

To give an example on how it can affect stock price/valuation, take the case of Bosch India, an MNC and the leader in fuel injection systems. Sales almost peaked out for the company in FY15 while profit peaked out in FY19. The stock price hit a high of Rs.27,400 in FY15 but has been sliding lower and is hovering around Rs. 14,000 now. The dieselisation trend that took off in passenger cars reversed post 2015, due to narrowing prices between diesel & petrol and costs related to emission norms. The trend moved in a different direction – towards petrol, CNG and electric. This impacted the company’s growth. Similar challenges could happen for companies that face product disruption.

In the rest of the article below, we list out about 50 major auto ancillary companies and quantify the impact of disruption on them. We then let you know how to pick the winners and when to invest.

How to pick winners, amid disruption?

As is now clear, disruption can lead to lower growth or decline which in turn can lead to lower valuations. As investors, it therefore becomes key to look at companies whose growth prospects are evident. Here are some of the factors to consider while choosing a company for investment from the auto ancillary space.

- Low probability of disruption in their product portfolio (see info-graphic above)

- Expanding product portfolio to supply more content per vehicle or entering into newer vehicle segments or export markets

- A good aftermarket sales presence in addition to OEM supply can be an added advantage (possible in segments with high wear and tear/ replacements)

- Significant presence in non-automotive segments that are growing faster than automotive segments also be an advantage.

- Good RoCE and RoE track-record in the last 3 years (>cost of capital, say 12%). Use our Stock Screener to get the 3-year average RoCE and RoE of all the auto ancillary companies at one go and download into Excel. (See the video in the end to know how to apply the metrics)

Now let us look into the threat of disruption in various companies and segments. We have categorised companies based on extent of disruption impact as below:

- No impact – Companies that can grow in line with industry growth irrespective of ICE or EV.

- Low impact – Growth is unlikely to get impacted much due to EV transition despite exposure to the categories undergoing disruption.

- Medium impact – Growth is likely to get impacted due to EV transition in some products, but the companies are diversifying attempting to reduce the impact by venturing in to new/EV related areas. Detailed research is needed in such companies to figure out NET impact on growth.

- High impact – Growth is likely to get impacted and such companies may face the heat of disruption.

Our classification of auto ancillary companies based on the disruption impact is given below.

Auto PLI Scheme:

The PLI Scheme is an incentive structure to encourage automobile industry to make fresh investments for indigenous global supply chain of advanced automotive technology products. The scheme covers automobile manufacturers under “Champion OEM” scheme and component manufacturers under the “Component Champion Incentive Scheme”

The Component Champion Incentive scheme is a ‘sales value linked’ scheme, applicable on pre-approved advanced automotive technology components of all vehicles, CKD/SKD kits, vehicle aggregates of 2-Wheelers, 3-Wheelers, passenger vehicles, commercial vehicles and tractors including automobile meant for military use and any other advanced automotive technology components prescribed by MHI depending upon technical developments. The incentive payable for Component Champion and New Non-Automotive (Component) Investor company ranges from 8% to 11% of incremental sales with an additional 5 % incentive for Battery Electric Vehicles & hydrogen fuel cell vehicle components.

You can read more about it and the list of companies approved under PLI at the Press Information Bureau.

For this classification, we have taken into account the pace of EV disruption, impact on different vehicle segments and the resultant impact on component suppliers plus their risk mitigation plans. Some companies are reinventing well to convert this disruption into opportunity, and we have considered this as well.

When it comes to choosing companies, the ideal thing would be to scout for those with ‘no impact’ or settle for those with ‘low’ impact. But do note that this doesn’t mean that all the NO impact companies are a BUY. Rather, the idea is to only narrow down the list of companies for further study.

In the case of those with ‘Medium’ impact, their diversification initiatives should be looked into in detail to assess if they are promising enough to navigate disruption and still manage growth.

Is this the time to invest?

But if disruption will shape the future of auto and auto components, the nearer-term scenario also merits attention. For one, the auto sector faced headwinds over the past two years that dented demand and growth. Second, when growth goes downhill, it is reflected in dropping prices and low valuations. This, thus, offers good hunting grounds as prospects change for the better.

Despite being a fast-growing sector since 2000, the automobile industry has seen a lot of headwinds between FY20 and FY22. While sharp recovery was expected in FY22, it didn’t play out as rising vehicle cost, fuel prices, supply chain disruptions, and rural distress have delayed the recovery. As we near the end of FY22, the 2-wheeler segment is expected to end the year with a marginal decline while the passenger car segment is likely to end with a 10-12% growth over FY21.

When the auto sector goes through tough times, auto ancillaries go through even tougher times, for two main reasons:

- Inability to pass on prices when automakers are facing sales decline: Pricing has always been an area of challenge in tough times. When automobile companies see sales decline, it not only impacts the ability of ancillary companies to take price hikes but can also depress their price at times.

- Working capital intensity and margin contraction affecting cash flows: Auto ancillaries are working capital intensive. While the cash conversion cycle for the automobile companies is negative (at -23 days, indicating robust cash flows), it is 48 days (though it varies across companies) for ancillary companies and this can get worse during slow growth phases. This along with margin contraction takes a toll on cash flows.

With the sluggish auto sector, the ancillary sector has not been far behind, though a few did buck the trend. Pricier commodities, the latest challenge, has begun hurting margins over the past two quarters; companies are expected to achieve pass through in costs only in the next 2-3 quarters.

But growth may receive a boost as broad-based economic recovery gathers pace going into FY23.

Further, a stabilising credit environment, higher agri-commodity prices and a normal monsoon can aid in strong rural recovery. This combines well with higher Government spending to spur recovery across the board for the auto sector. In the wake of a strong recovery, the PLI schemes which the Govt approved recently can also act as another trigger for the sector. Rating agencies such ICRA and CRISIL, which had earlier downgraded growth outlooks for autos, remain optimistic going into FY23.

Consequently, the auto ancillary sector may also improve. This recovery, juxtaposed with a company’s ability to weather disruptions will hold in good stead for longer-term stock picking.

But before jumping straight into picking the low PE or ‘No impact’ stocks above, know a few points. One, due to the growth decline the sector witnessed in the last 3 years, the PE ratio can be misleading as low earnings show an inflated PE. Two, it also will be company-specific as there are outliers that grew through acquisitions, diversification, increasing content per vehicle and so on. Three, some stocks rallied sharply in the recent past - as happens during mid-cap rallies – but the recent correction has seen a significant cool-off in prices.

Therefore, the following checklist may help.

- A comparison of the latest fixed assets turnover ratio with the last 5-year average can give a sense of the potential sales a company can achieve in future as the industry recovers.

- A comparison of latest sales with FY19 sales can give a sense of recovery.

- Looking at the PE ratio after taking into account the margins in a normal/growing business environment (take last 5 years average PAT margin) can give a better sense of valuation.

- Outliers who have already surpassed FY19 sales by a wide margin should be given attention closely as they have bucked the trend and are already on a growth path.

- Valuations afforded to stocks will entirely depend on their growth. For example, a company expected to grow its earnings at 15% with a current price earnings multiple of 25 times cannot be termed expensive even if its PEG is upward of 1.5 times.

To help you in applying this checklist, watch the video below. It explains how to filter auto ancillary companies on various parameters such as market cap, valuations, 3-year average growth (sales, EBIDTA, PAT), RoE, RoCE, cash conversion cycle, asset turnover, etc. You can further shortlist using the filters available in our Stock Screener. Click on each individual stock in the Screener for its financial statements over the past 5 years.

You can check our recently recommended stock with no disruption woes, from this space. Keep watching for more of our reviews/recommendations on stocks from this sector!

8 thoughts on “Auto Ancillaries: The EV disruption and how to pick winners now”

Very confused , at on end you project growth of EV across segments in less than a decade and related auto ancillaries, also you give a call on Gas distribution companies (with dividend play,) when effectively they have no growth prospects, with CNG vehicles are a major contributor 🙁

Welcome your query sir

Not to be confused much as the penetration is EV is more on the 2 &3 wheeler side.

Even then you may see in the graph that more petrol 2W may be sold in 2030 than it is today, in a growing market scenario (explained in the article)

On the other hand, CAR Cos are launching more CNG models to bring down running cost for buyers (refer launches of Tata, Maruti, Hyundai). Also, in small cars CNG provides more economics over EV while it changes with highly taxed and less fuel efficient SUVs

So, EV is growing while CNG is adding new users due to high petrol/diesel prices. CNG Cos have room to plan their growth taking into account regulatory environment also

Thank you

very informative article.

based on article and information perceived; i ran the screener multiple times with different combination of parameters selection and found below companies which are having mcap of less than 1000 cr and having good numbers.

1) Jullundur Motor Agency (Delhi) Ltd & 2) Talbros Automotive.

needed your guidance on above 2 companies if possible or your feedback on above 2 companies.

Thanks you.

Welcome your query sir and appreciate your efforts

Since we had to look at lot of companies for classification, we thought of applying the M Cap filter and avoid micro-caps for now

If smaller Cos can also deliver top-line and bottom-line growth and have an expanding RoCE, they are worth looking at.

The most important thing to look for is GROWTH combined with good RoCE

If you find companies beating their FY19 topline, despite declining sales for auto sector, they are outliers and merit more attention for further research (on expanding product portfolio, export focus, replacement market, etc)

In your effort, if you are getting interesting candidates meeting these criteria, they are good to consider for further research

Not commenting individually on the prospects of these stocks.

Thank you

Very informative article and several filters to choose the right company.

However the variables are too many and all required info may not be available with everyone.

Hence it is better if PrimeInvestor analyse all factors and recommend 3 top companies to invest.

Welcome your query sir

Agree with your point that there are several variables to pick a stock, finally

Our objective was to make investors aware of the disruption, the Cos that could get impacted and narrow down the candidates for investment

We have recommended one stock from this space recently and also looking forward to pick few more from this space

Thank you

Sir, please advise on Amara Raja and Exide, and impact, growth potential for both these companies. Which one will be good for next 3 to 5 years? Please advise.

Welcome your query sir

As mentioned in the article, these Cos fall under the “medium” impact category. So, the NET impact on growth need to be assessed.

We have not assessed these companies in detail from the recommendation point of view.

Only growth has been a problem for these Cos. 5 Yrs of almost flat profits. That has to shift towards growth.

Await signals on strong growth recovery in automobile sector (all categories) as well as their plans to address disruption to take a call.

Thank you

Comments are closed.