After lying low for a while, gold as an asset class has woken up from its long slumber in the last six months. International gold prices, which fell by 3.3% in 2021 and 0.3% in 2022, have gained 9% so far in 2023 (as of April 11) and are up by 20% in the last six months. In India, gold prices recently bounced off a lifetime high of over Rs 61,000/10 grams, having gained 18% in the last six months. This recent run has made investors sit up and take notice of sovereign gold bonds, gold ETFs and other vehicles to own gold. But should you jump on the bullion bandwagon now?

Gold always delivers returns in short bursts and then does nothing for long periods. So, to be able to tell if the ongoing gold rally will last or fizzle out, you need to track the factors that have been driving it. Here they are.

#1 US banking crisis

History tells us that the word ‘crisis’ is a good word for bullion investors, with gold prices rocketing up whenever there is a crisis of global proportions. But of late, gold has been selective in its response to crises, with rallies petering out quickly after cataclysmic events.

When the first wave of Covid began to unfold by March 2020, it did count as a major crisis threatening humankind. But on seeing the pandemic spread rapidly, most folks were prompted not to hoard gold, but to build up their cash coffers to deal with a health emergency. Therefore, as Covid raged on between 2020 and 2021, money flooded into bank deposits (and even crypto-currencies) and not bullion. International gold prices were up by 24.6% in 2020, but fell by 3.5% in 2021, even as the debilitating second wave of the pandemic wore on.

Wartimes also have usually been good for bullion, because they stoke shortages and oil prices leading to inflation. But the flare-up in oil and commodity prices caused by the Russia-Ukraine war proved to be short-lived, as the Chinese lockdown and waning global demand outlook dampened the rally in oil and commodities. Global gold prices again failed to sustain their brief rally between January and March and ended the year 2022 with a negative return of 0.3%.

However, the most recent rally in gold prices, which began in November 2022, is showing more promise. This rally initially took wing on fears of sustained rate hikes by Western central banks sparking recession and economic turmoil. This helped gold prices rise from about $1600/ounce in October 2022 to over $1900 in January 2023.

Just when the rally was losing steam, it received fresh impetus from the failure of Silicon Valley Bank (SVB) in the US on account of mark-to-market losses on its investment book, which called for an overnight bailout from the authorities. With Credit Suisse also requiring an emergency rescue and reports surfacing of many regional banks in the US facing the same balance sheet problems as SVB, a full-blown banking crisis has since been in progress in the Western world. As any crisis that weakens faith in financial institutions is good for gold, this has lent new legs to the global gold rally.

Since the SVB blow-up, the US Federal Reserve seems to have prevented many smaller banks from collapsing like dominoes, by offering a liquidity lifeline under its discount window to banks with treasuries as collateral (without any haircuts). US banks have been making liberal use of this facility, borrowing over $150 billion in the week ended March 14.

Going forward, signs of the US/Europe banking crisis dying down can take the wind out of the bullion rally. Murmurs of other US or European banks being in trouble will be positive for it. Apart from news reports, one way to track the US banking crisis would be to monitor the quantum of credit being extended by the Fed through its special discount window here. Any announcement from the Fed closing its no-haircut discount window will signal an end to the crisis. Prospective investors need to watch both, to know if the gold rally has more legs or is ready to wind down.

#2 Money printing

If the shakiness of banks and other financial institutions has lent a spark to the recent gold rally, an underlying factor that has kept it simmering is the fear of central banks (particularly in the US and Europe) debasing paper money by printing too much of it.

As we all know, central banks in the Western world indulged in record money printing after the global financial crisis of 2007-08. Under the elegant description of Quantitative Easing or QE, central banks pumped record sums of money into global financial markets by buying up government and corporate bonds that they warehoused on their own balance sheets.

Just when they were making up their minds to withdraw this QE in 2019-20 Covid struck. So, these central banks decided to not just continue with QE, but to add to it, to keep their financial systems afloat. An interactive chart from the US Fed shows us that its assets (consisting mainly of bonds bought up from the market and from lenders) which were at $4 trillion by March 2020, more than doubled to nearly $8.9 trillion by April 2022.

As Economics 101 tells us excessive money printing dents the value of currency and leads to runaway inflation. This began to play out from July 2020, when the US CPI Inflation rate soared from under 1% in June 2020, to 8.5% by April 2022. As the Fed took note of this runaway rise and began to raise its policy rate (the Fed Funds Rate) from near-zero levels in April 2022, inflation had already turned quite sticky. Over the last year until March 2023, the Fed has been relentless in hiking policy rates all the way to 5%.

But rates hikes, which jack up the price of money, tend to be effective only if accompanied by tightening liquidity. However, the unfolding banking crisis in the US (and Europe too) has prevented central banks from reversing their QE to QT (quantitative tightening). In fact, the SVB episode has forced the Fed to make more liquidity available to the market (not by printing money this time, but by lending generously to banks).

The inability of Western central banks to preserve the value of their currencies by curbing liquidity and winding down their balance sheet sizes, has led to rising fear-mongering about paper currencies, especially the dollar, losing purchasing power. While some die-hard believers have made a beeline for cryptocurrencies to hedge against this risk, more seasoned folks have begun to buy gold.

Going forward, gold may hold up as long as QE remains in vogue. Any sign that the US Fed is able to re-start its QT and materially shrink its balance sheet size, will be positive for the dollar and negative for gold. You can track the movement of the US Fed balance sheet here. The present balance sheet size of $8.7 trillion is certainly supportive for gold.

#3 Central bank buying

In the global bullion market, if there’s one set of participants who know exactly what they’re doing, it is the central banks – the largest institutional holders of gold. Central banks own the largest above-ground stocks of gold as part of their foreign exchange reserves. They also have a front row view of what’s happening with their economies, inflation, financial institutions and geopolitics. Therefore, central bank decisions to buy or sell gold in a particular year are often a good predictor of the medium-term prospects for gold as an investment.

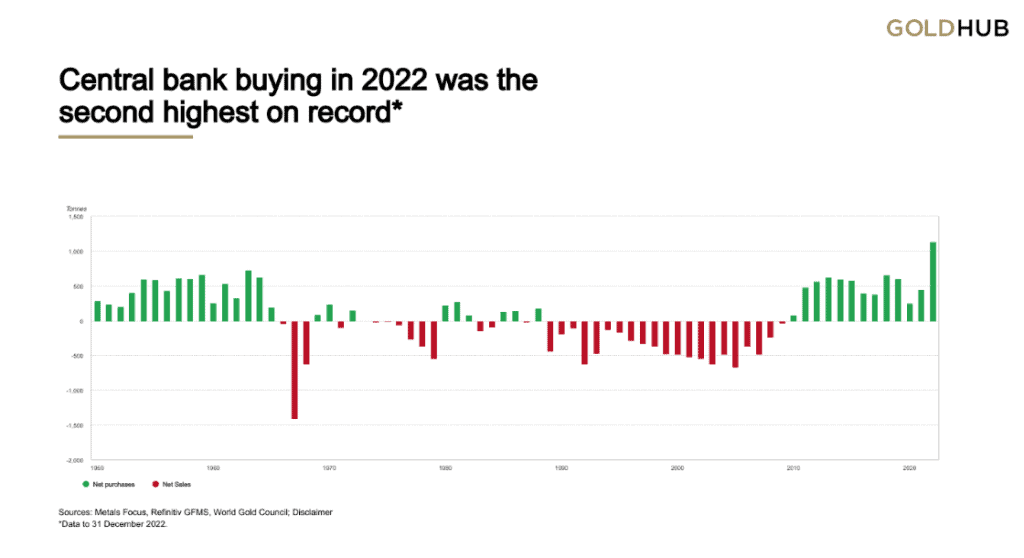

Global central banks have been consistent net buyers of gold in recent years, and sharply upped their net purchases in 2022. According to World Gold Council, central banks and other institutions bought 1135 tonnes of bullion in 2022, up from 450 tonnes in 2021, and the highest purchases on record. The central banks of China, Turkey, Middle East, as also India were the significant net buyers this past year. The graphic below shows trends in quarterly net changes to central bank gold holdings, which have been consistently green in recent years.

Central banks adding steadily to gold reserves suggests that they are either a) diversifying from the US dollar b) hedging against economic crisis or financial turmoil that is likely with monetary tightening and withdrawal of QE.

It is unclear as yet if the buying binge will continue into 2023. In January and February of the year, central bank buying totaled 74 tonnes and 52 tonnes respectively. But if central banks have been steadily buying gold in recent years, retail investors would not lose in the long run by following their example.

#4 US treasury yields

In acting as a safe haven for global investors, gold has a powerful rival in treasuries – or bonds issued by governments to borrow money. While gold offers no cash flows or regular payouts, treasuries offer a yield in the form of coupon payouts from the government. In the global pecking order, US treasuries are the favourite safe-haven for institutional investors because they are backed by the world’s largest economy and the US dollar, which seldom loses value against other currencies.

Therefore, if US treasury yields rise sharply, they act as a magnet for institutional and safe-haven investors, weakening the case for bullion. With the Fed hiking rates sharply, US treasuries saw their yields improve from under 1% in early 2022 to nearly 5% by February 2023, acting as a dampener to the gold rally. Treasuries are also highly responsive to liquidity and Fed’s intent of starting QT also propped up treasury yields.

But as the US banking crisis has re-opened the liquidity taps and raised market hopes for a pause in Fed rate hikes, US treasury yields have cooled to sub-4% recently. This has breathed new life into the gold price rally. The latest US inflation reading for March at sub 5% offers further hope that Fed will pause sooner than later. But US treasury yields may need to subside a lot more (or the dollar will need to weaken) for gold to deliver a convincing rally from here.

#5 Rupee dollar moves

For Indian investors considering gold ETFs or SGBs, most of the factors driving gold prices are global (as almost all of India’s gold requirements are sourced through imports). So domestic demand or supply factors have very little role to play in their investment returns.

But one factor that can add to or dent their investment returns from gold is the Rupee-Dollar exchange rate. Historically, the Rupee depreciating steadily against the dollar has added about 3-4% annually to their returns from gold. In fact, the double-digit returns earned by Indian gold ETF or SGB investors over the last 5 years come partly from such Rupee depreciation. Therefore, for Indian gold investors the exchange rate is a key metric to track to gauge future bullion returns.

Do note though that, after depreciating sharply in 2022, the Rupee has lately been strengthening against the US dollar. Today, India’s economy, fiscal situation and current account balance all appear to be in a stable state, relative to the US economy. Therefore, the probability of the Rupee depreciating sharply against the dollar appears low in the near term. This suggests that even if global gold prices were to continue their rally, returns for Indian investors may be muted by the Rupee holding up against the dollar.

What to do

- Given continuing QE and valid worries about the dollar losing its mojo, the case for allocating 5-10% of your portfolio to gold remains strong.

- Indian investors need to look at gold, not as a high return generating asset, but mainly as a hedge against unexpected Black Swan events or equities plunging into a bear market. At this juncture, bonds deserve a far higher allocation than gold, as government bonds are delivering handsome 7% plus returns for one year in this high-rate environment.

- If you have a zero allocation to gold in your portfolio, you can accumulate a 5% allocation now. But if you already have a reasonable gold allocation at around 5% or so, it is best not to add significantly to it now, as gold is best bought when there are no cataclysmic events propping up its prices. Just as insurance is best bought when there’s a blue-sky scenario!

- SGBs are the best vehicle for wealth creation through gold given their higher returns and favourable taxation (especially with the new mutual fund tax rules), followed by gold ETFs. Check Prime ETFs for our gold ETF recommendations. Physical gold doesn’t score high on liquidity or taxation, so avoid investing in gold through coins or jewellery.

20 thoughts on “What’s firing up gold prices and what you can do about it”

Nice informative article, thank you.

Comments are closed.