The author is an external contributor. Views are personal and do not reflect the opinion and views of PrimeInvestor.

In the previous update on the Nifty 50 trends, we had shared a bullish view – with a caveat that a fall below 19,200 would be a sign of weakness and the Nifty 50 index could test the next lower target of 18,650-18,700. Well, the index breached 19,200 and almost reached the above target. The Nifty 50 index dropped to a low of 18,837 but has since been on a recovery path.

So let’s take a fresh look at the short-term outlook for Nifty 50 index. Given that there are opportunities outside the index too, we will also focus on promising sectors and market segments. We start with the outlook for the Nifty 50 index.

Nifty 50 short-term outlook

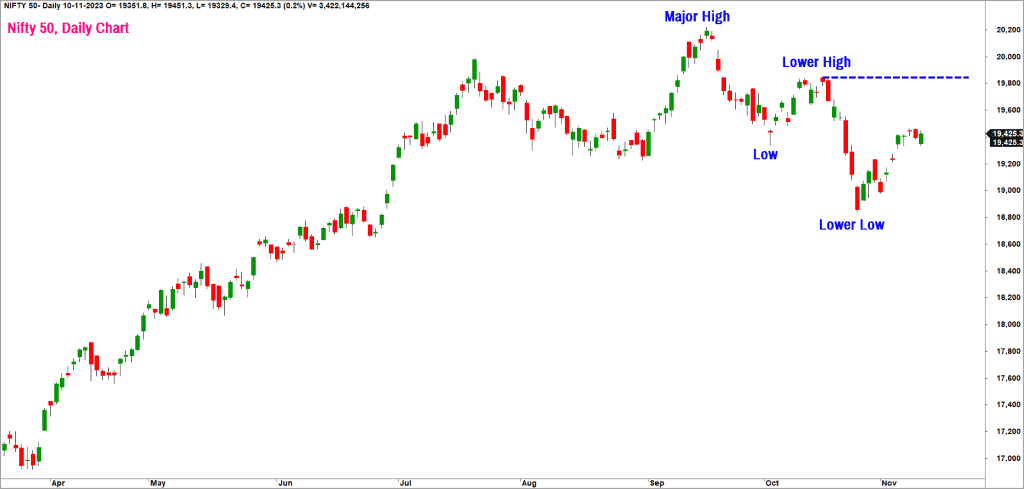

Here is the daily candlestick chart of the Nifty 50 index.

It is evident from the above chart that the Nifty 50 index is still tracing out a bearish sequence of lower highs and lower lows. While the recent pullback looks promising, the price is yet to display any signs of reversal of the bearish trend.

A close above the recent swing high at 19,900 would be an early sign of strength and could open up the scope for further upside. Else, there is a strong case for a volatile range-bound action within the 18,800-19,900 zone.

A look at the PF-X% breadth indicator does suggest some scope for further upside. This breadth indicator in 1% box size (capturing short-term breadth) is currently in neutral zone and has not reached overbought extremes.

Interestingly, the recent rally has been propelled by the Nifty non-heavyweight constituents. The relative performance of the Nifty 50 Equal Weight Index and the Nifty 50 index is a clear indicator that the Nifty heavyweights are yet to fire. If they start showing some promise, it could result in an accelerated up-move in the index. The question is, will the top guns fire? There is no clear-cut answer to this question yet and we just have to await more clarity from the ensuing price action.

We are headed towards event-heavy months in terms of state elections. There are a few state elections coming up shortly and then the general elections next year. Expect volatility to spike up owing to domestic developments; and of course, keep an eye on geopolitical events across the globe too.

The Bank Nifty influence

Let us shift our focus to the influential Nifty Bank index which remains a sore spot as far as the Nifty 50 is concerned. As emphasised in several prior updates, this index plays a key role both technically and fundamentally. The Nifty Bank index has been an underperformer versus Nifty 50 since mid-May.

At long last, there are early signs of a reversal of this underperformance. But bear in mind that these are only just green shoots. It would be prudent to wait for more confirmation about the sustenance of this outperformance. The Nifty Bank index has to move past the recent swing high at 44,700 to suggest bullishness.

Along with a breakout above 44,700, it is equally important that the Nifty Bank index continues the outperformance that it is showing in the last couple of weeks. Keep an eye on this sector for additional clues about how the Nifty 50 can perform.

While the short-term outlook for both Nifty and Nifty Bank is still hazy and moderately favouring the bullish camp, the interesting aspect is the stock and sector specific opportunities that are available aplenty.

Nifty MidSmall Cap 400 index

We have shared our positive outlook for the broader markets for several months now. The Nifty MidSmall Cap 400 index has been in a strong uptrend and has been a rank outperformer versus the Nifty 50. There is nothing technically to suggest a reversal of this bullish trend in price and relative performance.

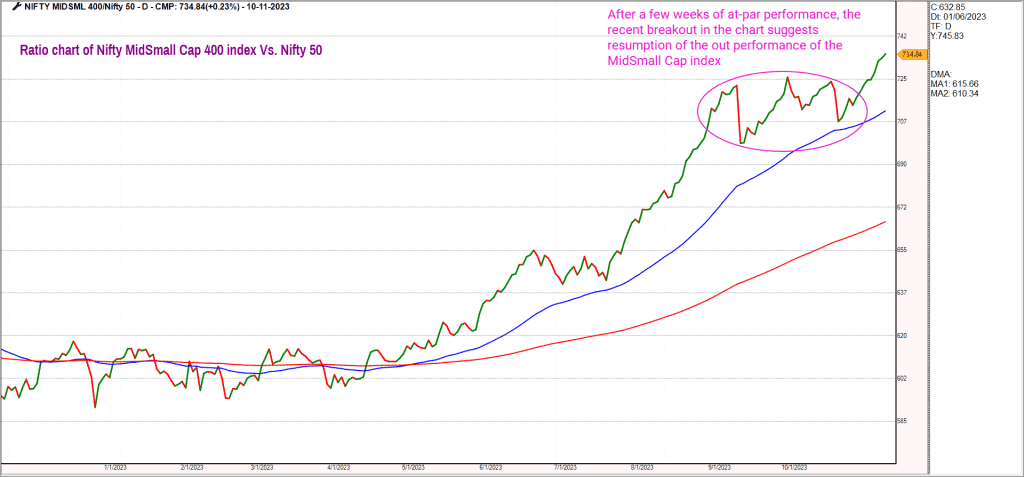

Here is the ratio chart comparing the performance of the Nifty MidSmall Cap 400 index versus Nifty 50.

As highlighted in the above chart, there is a clear breakout from a prior range which indicates resumption of outperformance of the MidSmall Cap 400 index. This is a sign that the broader market is the place where the action is. Only a fall below 12,800 would be a sign of weakness and would warrant caution.

Beyond the MidSmall Cap 400 index, the small cap space is bullish too. The Nifty SmallCap250 and the MicroCap 250 indices remain extremely bullish. So, the broader message here is that there are lots of stock specific opportunities available outside of the large cap space. A relatively safer approach could be taking exposure to these segments via the mutual fund route.

Now let us shift attention to sectors that are bullish and displaying outperformance.

Sector indices

#1 Nifty Realty

This sector continues to rock and has been a star performer of the rally that commenced in end-March. The technical outlook for this index remains bullish. As observed in the previous update, there is a possibility of the rally extending up to the 700-720 range. A fall below 550 would be an early sign of weakness and could reduce the chances of a rally to this target zone.

#2 Nifty PSE / CPSE

Along with the Realty sector, the CPSE/PSE stocks have performed well, too, in the past several months. This sector remains strong and quite a few stocks from this space are setting up well for the next leg of the rally. The downside levels to keep an eye on for these sectors are 5,650 for the Nifty PSE index and 3,650 for the Nifty CPSE index.

#3 Auto, pharma, IT & others

The Nifty IT index remains an underperformer while the PSU Bank is in the midst of a correction. It would be interesting to watch if the PSU Bank space manages to resume its recent outperformance. Along with CPSE/PSE, the Nifty Pharma index too setting up well and quite a few stocks from this space are displaying promise. Have this sector on your radar to explore stock-specific opportunities. Similarly, select stocks from the power sector too look promising.

In the previous update, we had highlighted the mining and automotive tyres as sectors to watch out for. The stocks from these two sectors performed well and continue to remain bullish. Along with these two sectors, select stocks from the storage battery space are looking strong. Unfortunately, there is no index to track this segment. One has to undertake stock specific study or create an equal weighted index to track such sectors where official sector index is unavailable.

To summarise, the short-term outlook for both the Nifty 50 & Nifty Bank is hazy but there are lots of opportunities beyond the large cap space. A stock & sector specific approach could be the appropriate strategy in the current market environment.

1 thought on “Technical outlook: A look at the short-term trends in the Nifty 50”

Good info

Comments are closed.