In our stock coverage so far, we’ve been analysing and recommending stocks, writing on trends in markets, sectors, earnings and more. We’re adding to this through stock reviews. In these reviews, we pick stocks that have rallied, or where businesses are interesting or changing, or where companies may be relatively unknown and so on. We present an analysis of these stocks, covering what has driven them, business prospects, threats and more. These reviews are meant to give you an understanding of a stock. They are not our recommendations. This week’s review on Dr Lal PathLabs is written by our external contributor and stock analyst Pavithra Jaivant. Pavithra is a CA and a management graduate who has worked in financial services. She enjoys working with numbers to arrive at insights.

Growth estimates are being placed at a CAGR of around 10% for the next five years for the diagnostics sector, presenting a very attractive opportunity to players that are ready and able to take advantage. Dr Lal PathLabs is a leading diagnostics player, building up its presence outside its traditional stronghold of Delhi.

Growth estimates are being placed at a CAGR of around 10% for the next five years for the diagnostics sector, presenting a very attractive opportunity to players that are ready and able to take advantage. Dr Lal PathLabs is a leading diagnostics player, building up its presence outside its traditional stronghold of Delhi.

The stock has had a good run, and with healthcare-related stocks and sectors now in the limelight, here’s an analysis of how Dr Lal Path Labs has grown, its strengths and potential risks to growth.

Industry overview

Broadly speaking, there are several growth drivers for the diagnostics industry:

- An increase in lifestyle diseases

- Greater awareness of preventive testing,

- Rising income levels and greater penetration of insurance,

- Greater life expectancy and a slowly growing number of senior citizens

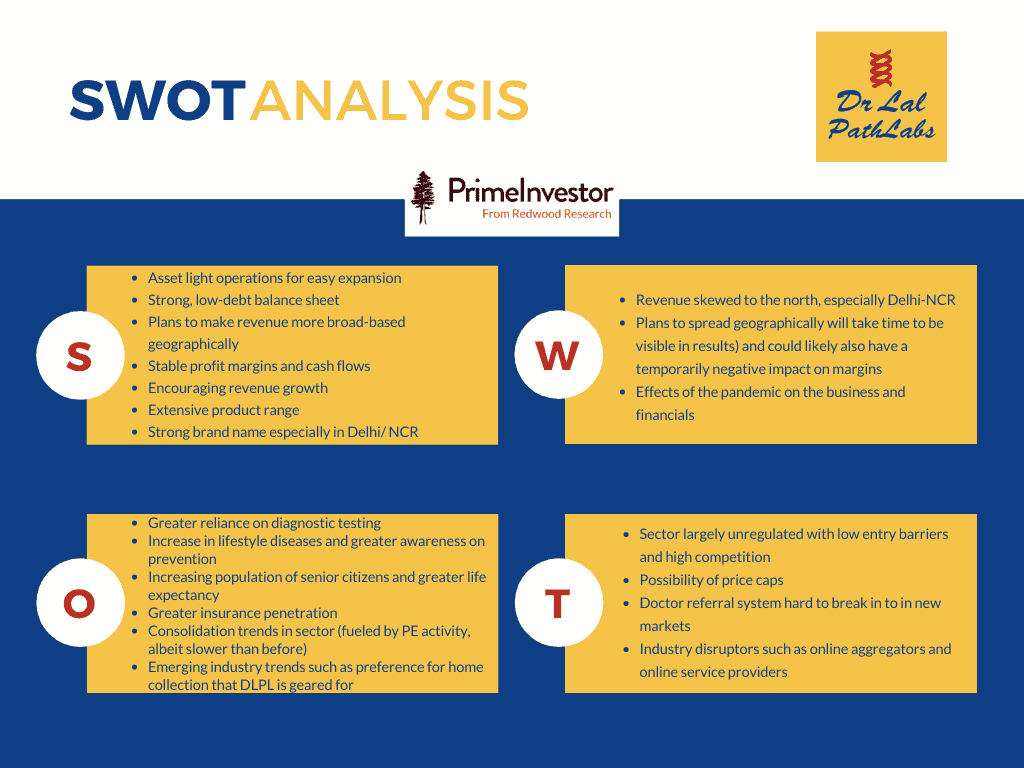

However, the industry is also volume-driven, characterized by a largely fragmented set-up and low capital costs.

Large and fragmented – offers scope for consolidation

Estimates place the diagnostics services sector in India (includes pathology and radiology / imaging services) at Rs. 70,000 to Rs. 80,000 crores with over 1 lakh players. Diagnostic services are provided by hospitals, standalone diagnostic centers and diagnostic chains, with standalone centers commanding the largest piece of this pie. Diagnostic chains control only an estimated 15% of this market.

The four major national players here – Dr Lal Path Labs, SRL, Metropolis Healthcare and Thyrocare account for about 5%. The diagnostic services space has also witnessed PE activity that has spurred more consolidation and competition which could in the long term see the larger players gain more market share.

Low Barriers to Entry

The sector is highly unregulated, with regulations largely varying from state to state (The Clinical Establishments Act 2010 was passed but has not been enacted by all the State Governments). This, coupled with an initial capital investment that is not prohibitive, has meant that there are little to no entry barriers to new players. It also means that competition is often price-based, making this a volume driven business.

There is also no mandatory certification of labs. Labs, though, are increasingly opting to be NABL accredited, CAP (College of American Pathologists) accredited and ISO certified. Dr Lal Path Labs’ network includes 33 NABL accredited labs and 1 (the National Reference Lab) CAP accredited lab.

However, what does prove to be a challenge for newcomers is the loyalty that local and often standalone players enjoy with the local customers and the doctors who provide referrals. One way to address this could be through acquisition of the right candidates.

Dr Lal Path Labs – a brief overview

Dr Lal Path Labs (DLPL) was incorporated in 1995 and received its first PE investment in 2005 with WestBridge Capital investing Rs.42 crores for a 26% stake. At this time, DLPL had only 10 labs. It embarked on a major expansion plan which also coincided with the arrival of Dr. Om Manchanda (the currently MD), spearheading the expansion. DLPL was the first diagnostic services company to go public in 2015.

DLPL offers a wide menu of tests (455 test panels, 2,537 pathology tests and 1,961 radiology and cardiology tests) apart from a more recent addition of Covid-19 and allied tests. Apart from this the company invests in R&D and offers specialized tests (Genevolve: the genomics initiative among others).

DLPL has several positives in its favour, that has spurred growth and can continue to hold it in good stead.

#1 Asset-light operating model allowing scalability

Like the other large, organised diagnostic chains, DLPL operates using a scalable ‘hub and spoke’ model – with one National Reference Lab in Delhi, a Regional Reference Lab in Kolkata and several smaller clinical labs across the country. These are in turn fed by asset-light Patient Service Centers (PSC) and Pick-Up Points (PUP).

In FY 2020, the company increased its PSCs by 20% and its PUPs by 9%. DLPL plans to open two more Regional Reference labs (in Mumbai and Bengaluru) which will be fed by a network of collection centers and satellite labs both via the organic and inorganic route. This is in line with its strategy to spread its reach in the South and the West, from the Delhi-dominance it has otherwise has.

Reagents are a key input, and DLPL has order agreements with suppliers which allows the company to use equipment free of charge. Such agreements allow expansion without heavy investment in equipment.

While other diagnostics players would also have similar agreements, and will be able to expand using the hub-and-spoke model, DLPL has the ability to fund strong expansion plans.

#2 A healthy balance sheet that can fuel expansion plans

The company is debt-free and cash-rich, built up by regular positive cash flows. After a pandemic-driven slow-down in the June ‘20 quarter, revenue has started to pick up. Covid-19 testing and allied services (21.6% of the revenue in Q3 21) helped growth. Q3 2021 saw an all-time high quarterly revenue of Rs.452.4 cr. DLPL’s business is more volume-driven, but realisations per patient have been rising, indicating strong offtake. DLPL has had strong revenue growths (between 11% and 15% over the previous year) since 2015-16.

Revenue per patient increased to Rs.685.75 per patient in FY 2020 from Rs.659.43 in 2015-16. Revenue per test, though, dropped to Rs. 279 in FY 2020 from Rs. 300.88 in FY 2016. This indicates two things: one, this is a volume driven business and two, the increasing use of bundled test packages. Bundled tests are gaining popularity due to their cost-effectiveness for the patient. DLPL’s ‘Swasthfit’ bundled package, for example, contributed to 13% of revenue in Q3 2021.

In Q3 2021 both revenue per patient and revenue per test rose to over Rs 800 and Rs. 335 respectively. This jump was partly due to revenues from Covid-19 and allied testing (Rs.97.5 crore or 21.6% out of Rs. 452.4 crore). This, though, may not be sustainable.

Home-testing and higher-end testing – where realisations are higher – were also good contributors to the increase in revenues. In Q3 2021, 6% of non-Covid-19 business was from home-collections. This was a trend that was already prevalent in the sector and has been hastened by the emergence of the pandemic which has made customers hesitant to visit a lab or collection center. With rising preference for home-testing, this avenue could help drive differentiation from other, smaller, players.

Higher-end testing, where competition may be limited and pricing power a tad better, could also prove a growth driver. These avenues could help improve profit margins, which is hard in an otherwise highly competitive, volume-driven sector.

#3 Stable operating profit margins

A large part of the expenses varies in proportion to the revenue and have kept pace with revenue growth. Operating profit margin for Dr Lal Path has, therefore, been steady if not improving. The cost per test which was highest in Q1 2021 (when the effects of the pandemic would have been felt) at Rs 288.1 as against Rs. 225 for the FY 2020. In Q2 and Q3 of 2021 the cost per test seems more stable at between Rs. 234 and 236.

However, DLPL’s flat margin profile may change if the company moves towards a more favourable product mix. Greater focus being placed on home collection (which requires more staff in the form of phlebotomists who go to collect samples but needs less real-estate) could be margin accretive.

What to watch for

While Dr Lal Path Labs has growth potential in its favour, there are a few key factors to watch out for which can have an impact both on margins and on revenue expansion.

#1 Potential pressure on revenue growth

- Given that the pandemic is nowhere near over, the impact it has on the financials bears watching. With the prices of RT-PCR tests being capped, its profitability will no longer be as attractive as it was. The impact could be amplified by the fact that a significant chunk of the revenue is generated in Delhi / NCR.

- Further, a return of customer hesitancy may again pressure growth. Encouragingly, the company’s non-Covid-19 revenue was up 8% from the same quarter last year.

- Greater use of bundled testing could result in an increase in volume with a less-than-proportional increase in revenue.

- Disruptive trends in the industry such as online aggregators and online service providers could amplify price-based competition, though these are yet nascent trends and have faced hiccups in execution. Home-testing services could help address competition from online aggregators.

#2 Business skewed toward Delhi / NCR

DLPL’s presence is strongest in Delhi NCR and the rest of North India, where it derives the bulk of its business. Its presence and brand loyalty are strong enough that the company is able to command slightly higher prices here. However, it also serves to skew revenues towards this region, and it could reach a relative saturation point in terms of expansion. Expansion should help address this imbalance by making the business more geographically broad-based. On the flip-side however, margins can see short-term pressure.

This apart, the expansion Dr Lal Path has taken so far has not really changed the geographical revenue concentration. There are difficulties in ramping up growth in new geographies, such as competition from existing players and breaking into the ‘inner circle’ of patient loyalty and doctor referrals. The impact of expansion, therefore, needs watching.

Market moves and valuations

DLPL stock has gained nearly 18% in the last 3 months alone even as the main Nifty 50 index shed 2.7%. In the last 12 months, the DLPL stock has rallied almost 80%. The company’s strong December quarter results which showed a recovery in non-Covid revenue, likely buoyed up the stock price. The stock’s PE has consequently shot higher; its current PE multiple at 98 times is well above its average of about 50 times. While other diagnostics players have also rallied, the PEs in these stocks – Metropolis Healthcare and Thyrocare Technologies – are still lower.

Therefore, while the company has strong financials and is well-placed to take advantage of the potential boom in healthcare and diagnostics, its ability to expand into newer markets, cement its position in these markets, and improve margins bears watching.

Disclaimer: This review and analysis is not a recommendation to buy or sell the stock. It is meant for informational purposes only. The author of this report does not hold shares in the company reviewed.

4 thoughts on “Stock review: A healthy player in the diagnostics space”

Hello good morning. Can I invest in Lal pather labs in sip mode from now for 18 months? Please advise.Thank you

As explained in the article, we have not issued a recommendation on the stock. This is simply a review of its positives and negatives. You may invest in the stock if you think it holds promise. As far as SIPs go, please read this article before deciding on SIPs in stocks. – thanks, Bhavana

Is it prime stock??. Or aded to watchlist?. Can you confirm?.

As explained in the note, this is not a recommendation. It is a review of the company’s business. We have not added it to Prime Stocks or the watchlist; we’ll mention it if so. – thanks, Bhavana

Comments are closed.