To secure your finances against health emergencies, Primeinvestor recommends combing a hospitalization plan with a critical illness cover. Our earlier article on what to look for in a critical illness health plan discusses this in detail. We subsequently shortlisted a few critical illness covers, from which we reviewed Activ Secure Critical Illness Plan by Aditya Birla Health Insurance, Criti Care policy by Bajaj Alianz General Insurance and IFFCO Tokio’s Critical Illness Benefit Policy.

Here, we review the Star Critical Illness Multipay Insurance Policy. We think this plan has a good structure without being over-complicated.

Key Features

Like other critical illness plans, the Star plan too is a benefit plan that provides a lump sum payout on the first diagnosis of a listed critical illness. Here are the main features of the plan.

- This is an individual policy and the policy term can be 1, 2 or 3 years. This cover is available to persons aged between 18 and 65 years.

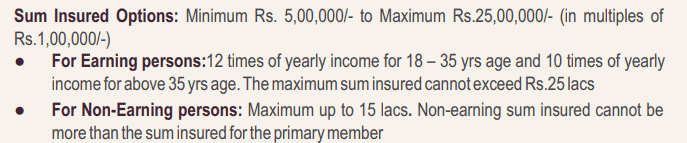

- The minimum sum insured is Rs. 5,00,000. This can go up to Rs. 25,00,000 in multiples of a lakh.

- It comes with standard exclusions such as illnesses arising from alcoholism, intentional self-injury, anything arising out of activities that are in breach of law, war etc. The policy also excludes pre-existing diseases (for which treatment was received or was diagnosed in the 48 months prior to the effective date of the policy).

- The initial waiting period on this policy is 90 days and the required survival period is 15 days.

- A pre-policy medical may be required for persons over the age of 50 or for those with adverse medical history.

- The premium can be paid in quarterly or half yearly installments but this will attract a loading of 3% and 2% respectively.

For this policy, the 37 critical illnesses covered are grouped into 4 categories:

- cancer related conditions,

- heart related conditions,

- brain and nervous system related conditions and major organs and

- other conditions.

The plan will make a maximum of one lump-sum payout per category in a lifetime. It allows for one claim under each of the 4 categories as long as there is a waiting period of 12 months between 2 claims and there is only one claim per policy year.

If a claim has been made for a critical illness, the cover will be renewable for critical illnesses under the other 3 categories. If a claim is made for multiple critical illnesses at the same time, then a payout will be made only towards one group.

It comes with lifelong renewability as long as there is at least one section where no claim has been made.

What we like

#1 Sum Insured can go up to 400%

This plan splits the covered critical illnesses into four groups and allows one claim per group per lifetime as long as there is a minimum of 12 months in between two claims and there is only one claim per policy year. Each claim is eligible for a 100% payout as long as the above criteria are met.

This means that the payouts under this plan can go up to 400% of the sum insured and we think that this is the biggest positive of this plan.

#2 Structure not over-complicated

This plan is not a plain vanilla critical illness cover where the cover ceases once a claim has been met. But its structure that places the 37 covered critical illnesses in four buckets is still simple and useful to the buyer.

What we don’t like

#1 Sum Insured linked to income levels

While the sum insured under this plan ranges between a minimum of Rs. 5 lakhs and a maximum of Rs 25 lakhs, this is linked to the income and age of the primary member.

This cap could mean that if you are still young and in the early stages of your career, the sum insured may be insufficient. We laid out the principles for arriving at the sum insured for critical illness cover in our earlier article.

The policy does not allow the sum insured to be enhanced even at renewals. This, coupled with the caps on sum insured, could prove to be a disadvantage if you purchase this plan when you are young and your income levels are lower.

#2 Reasonable coverage but excludes illnesses such as Parkinson’s

While the policy has a reasonable coverage of 37 critical illnesses (more than the 25 major critical illnesses covered by the Criti Care policy of Bajaj Allianz which has a more complicated structure), it does not cover a neurological biggie like Parkinson’s disease. However, this plan covers certain illnesses that don’t find a place in some other plans like Creutzfeldt-Jakob disease. The list of conditions covered needs to be studied closely to see if it fits one’s requirements.

#3 Star Wellness over complicates matters

The Star Wellness Program intends to incentivize a healthy lifestyle through various listed wellness activities. It does this through a system of points. Activities such as participating in marathons, undergoing regular preventive diagnostic tests etc. fetch you a pre-determined number of points. The points earned translate into a discount in premium.

While the discount in premiums may be a good carrot to encourage staying healthy, some may just not bother with all the tracking in the app and if you are one of those, then this benefit is of no use to you.

About the Insurer

Star Health and Allied Insurance Co is the largest private health insurance provider in India. Claims settlement efficiency ratio – which measures the proportion of claims settled within 3 months – is 99.1%, far better than the average for health insurers. Claims settlement by number stands at 82.5%. All values are based on data for the period of 12 months ended March 2022. Our article, ‘Which insurers settle your claims the best’ will tell you what these numbers mean for you when shopping for a health insurance product.

Star Health does not use third party administrators (TPAs) for claim settlement and all claims are settled in-house.

Suitability

While the structure of the policy that allows payouts to go up to 400% makes this an attractive plan, the caps on sum insured, inability to enhance the same and illnesses covered makes this plan not an ideal one for everyone.

It could find a place in your shortlist if the following apply to you:

- If you want to be prepared for more than one critical illness incident in your lifetime;

- If your age and income levels allow you to maximise your cover under this plan or you are able to build a corpus that compensates for the limitation in sum insured;

- If the illnesses covered match your requirements based on your medical history and your doctor’s inputs.

If having a critical illness cover that provides multiple payouts is of importance to you, do also compare this plan with the Criti Care plan by Bajaj Allianz (you can read our review here). The table below compares the cost of a cover of Rs. 10 lakhs under Criti Care and Star Critical Illness Multipay Insurance plans (excluding tax) based on the premium information available online.

While their unique designs mean that you cannot blindly compare based on premium alone, it is worth noting that to start with, the Star Critical Illness Multipay Insurance Policy is almost at par with the Criti Care policy from Bajaj Allianz. However, as the age of the insured advances, the Multipay plan tends to get more expensive.

Criti Care comes with five sections that come with their own individual sums insured that can also be opted for individually. It also lets you get a total cover of up to Rs.2 crores as against Star’s Multipay plan which comes with a maximum sum insured of Rs. 25 lakhs but lets you make 4 claims each going up to 100% of sum insured.

While some may find the structure of the Criti Care plan to be complicated, it scores on the sum insured front. It also allows you to choose between 0,7 or 15 days for your survival period – a feature that is not available with Star Health’s Multipay plan.

However, Criti Care lags in coverage. It covers a total of 43 illnesses, but only 25 are major and 18 are minor that don’t fetch a full payout as against 37 major critical illnesses under Star’s Multipay plan. CritiCare also comes with a longer initial waiting period of 180 days that can be shortened to 120 days in exchange for loading.

As always, do go through the fine print in the policy wordings, if possible with your doctor, to see if there is anything that could work against you (in view of your personal medical history). Do consider the exclusions and various criteria to be met under each critical illness for a claim payout to be made.

Important documents relating to this policy: Brochure; Premium Charts; Policy Clause; Prospectus

Disclaimer: Please note that the above is only a review of the plan and not a recommendation. Please make a decision based on your requirements.

2 thoughts on “Critical Illness plan review: Star Critical Illness Multipay Insurance Policy”

If a person buys critical care insurance from two different providers, are both obligated to provide the sum insured? How are original documents shared with both insurers in that case?

Sir,

Thank you for your query and in response:

As per IRDAI Health Insurance Regulations 2016, in the case of fixed benefit policies, on the occurrence of the insured event in accordance with the terms and conditions of the policies, each insurer shall make the claim payments independent of payments received under other similar policies.

So, yes, both insurers are obligated to pay. This is also mentioned in Section F under Standard Conditions in the Policy Clause document of the Star Critical Illness Multipay Insurance Policy.

Regarding the documents to be submitted, please do check the same with the insurers.

Comments are closed.