Fund ratings, at a glance, tell you a little about the history of a fund. For many of you it’s a quick reference on whether a fund is a good one or not. PrimeRatings (Free registration required to access) is a mutual fund rating system. But it’s not simply yet another fund rating tagging on to the list of ratings that are already available. PrimeRatings’ methodology:

- uses a more diverse combination of risk and return metrics,

- looks at fund categories based on their characteristics and investment purpose and not just their SEBI-defined category,

- spreads ratings out into a smoother curve which provides better distinction between funds and circumvents the problem of a sharp jump or fall in ratings

Here’s a look into our ratings process and how we’re different.

Being selective

Not all funds are rated. Funds must meet two basic requirements: AUM and age. The cut-offs depend on the type of fund. Equity funds, for example, need a minimum 3-year timeframe of existence and an AUM of Rs 100 crore before we rate them. Index funds have a lower AUM requirement. Liquid and ultra short term funds have a far higher AUM cut-off at Rs 1,000 crore and Rs 500 crore, but have a shorter timeframe.

We have different age and AUM cut-offs because each fund type is different. Liquid and other very short-term funds certainly don’t need a long history as their nature allows us to judge performance quickly. But given their high institutional interest, a large AUM is more prudent. Equity funds, on the other hand, need a longer timeframe to judge performance but can manage deftly even in smaller AUMs.

The next eligibility criteria is the category. Sector and themed funds are not rated – themes and sectors are tactical calls. Rating these funds as 5-star or 1-star serves no purpose. One, it doesn’t shed light on the potential of a theme. Two, it can additionally mislead you into thinking a fund is good simply because it holds a high rating.

We also don’t rate categories where the number of funds are too few to show meaningful results, such as multi-asset allocation funds, US-based funds, or emerging market global funds. We don’t rate closed-end funds.

Different rating system

PrimeRatings use half-star ratings progressions in the 1 to 5 star range. That is, it’s not a simple 5-4-3-2-1 star rating system but a more graded 5★ to 4.5★ to 4★ to 3.5★ and so on until 1★. This is a key metric on which we stand apart.

There are two reasons for adopting this methodology. Firstly, it provides better distinction between fund performances. This holds especially true in categories that have several funds. When a single rating houses a large number of funds, there often is a distinct difference among the funds. For instance, consider the equity multicap category. A Kotak Standard Multicap could be rated 4★ star and so could Aditya Birla Sun Life Equity. However, the Kotak fund fares much better on all metrics. A 4.5 rating for the Kotak fund would establish this superior performance.

Secondly, it provides a more gradual shift in ratings when fund performances change. For instance, let’s say a 3★ fund begins to pick up. Instead of it jumping straight to 4, the up-move is more gradual to a 3.5★ and then to a 4★ if performance sustains. This offers a more realistic measure of a fund’s performance than a quick rating improvement. The same holds when a fund begins to falter in performance – moving from, say, 3 to a 2.5 and then to a 2 instead of a precipitous drop from 3★ to 2★.

This is important because each rating has attached to it a certain implicit understanding. A sharp rating climb or drop can be misleading in terms of understanding a fund’s performance.

Comparing it right

The second way we stand apart from other fund rating providers is the way we club similar categories and then rate them. This gives a truer picture of a fund’s performance and is far stricter than sticking to SEBI-defined categories. SEBI’s categories in both debt and equity have overlaps in terms of their characteristics and the role they play in your portfolio.

For example, there is limited distinction between a low duration fund and an ultra short duration fund. Both funds serve a 3-12 month holding timeframe. Both invest in money market instruments such as commercial papers and certificate of deposits. Both have similar return and maturity profiles. As an investor, your choice for a less than 1-year timeframe would encompass both categories. Similarly, there are several overlaps between corporate bond funds and medium duration funds in credit risk and/or maturity. The choice isn’t between categories, it is between funds that do the same thing.

Consider equity funds. A multicap equity fund could follow a value strategy. A value equity fund could be multicap in nature. A focused fund could either be large-cap oriented or multi-cap. A large-cap fund could follow a focused strategy.

Therefore, to get the true picture of a fund’s performance, these need to be compared correctly. In PrimeRatings, we put and rate comparable categories together. This ensures that funds aren’t advantaged or disadvantaged and that you have the right picture when you look at ratings. Other rating agencies do not have this approach.

Tailoring metrics

The third way we stand apart is the scoring system itself. We tailor metrics and weights for each category depending on the characteristics of that category. Using a set of metrics uniformly across equity funds, debt funds, and hybrid funds as other rating agencies do fail to consider the uniqueness of each category. Our experience in analysing fund performance over the years also shows us that each fund category is developing very differently in terms of potential, performance, and risk. They therefore need to be rated distinctly.

For example, for large-cap funds the ability to beat benchmarks across market cycles carries a higher weight as it gets increasingly tough for them to do better. For small-cap funds, however, benchmark beating is not very difficult.

In dynamic bond funds, performance across rate cycles showcases their ability to alter their portfolios to capture opportunities much more than just looking at returns. In categories where there can be vast differential in credit risks, metrics need to take such risks into account. Expense ratios are a key return differentiator in some categories but not in others.

Metrics we use also strike a balance between looking at longer term performance and recent performance. This way, the ratings do not consider data that may have turned irrelevant nor is completely swayed by recent performance.

We suggest you use ratings as an indicator as to how your fund is doing. While we address risks and returns in our rating methodology, do bear in mind that these are based purely on historical returns. While our ratings may showcase trends of turnaround or dip in performances better than others, it is not a prediction for future performance. Qualitative assessments are required in addition to quantitative metrics to make an investment or exit call. Those are considered in our fund recommendations, which will be available once we go live.

Look out for our philosophy on our other researched products soon. If you’ve not read our first one on fixed deposits in this series, here it is:

https://www.primeinvestor.in/2019/11/29/what-we-look-for-in-fds-the-primeinvestor-approach/

How to read our ratings

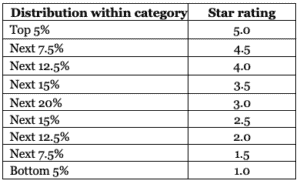

Based on metrics and weights, each fund has a score. The scores are rated on a curve in the distribution as in the table below.

In the below scale, 1★ indicates the lowest in terms of relative performance within the rated set, moving gradually higher to 5★. For example, 5★ funds are those in the top 5% in terms of score for the rated period. We update PrimeRatings every quarter.