Guaranteed income plans from insurers have been a popular alternative to traditional annuity plans, due to their more favourable taxation. Products such as HDFC Sanchay Plus and ICICI Pru GIFT have proved quite a hit with investors. LIC Dhan Sanchay, a new launch from LIC, aims to target this segment of customers.

What it offers

LIC’s Dhan Sanchay offers a guaranteed income or a guaranteed lumpsum benefit, in return for either single or regular premium payments. It also provides life cover. This is a non-linked, non -participating, individual savings plan. This effectively means that the returns from this plan are not linked to the market or LIC’s own performance.

The minimum age of entry for the policy is 3 years, maximum age of entry varies from 40 to 65. Minimum maturity age is 18 years. It offers plans with single payment and regular payment options. You can choose to get maturity proceeds as regular payment or lumpsum. The policy also provides death benefits, which vary based on the plan selected. There is one plan that is focused on higher death benefits.

Features of LIC Dhan Sanchay

To choose between guaranteed income plans from insurers, you need to evaluate the following aspects.

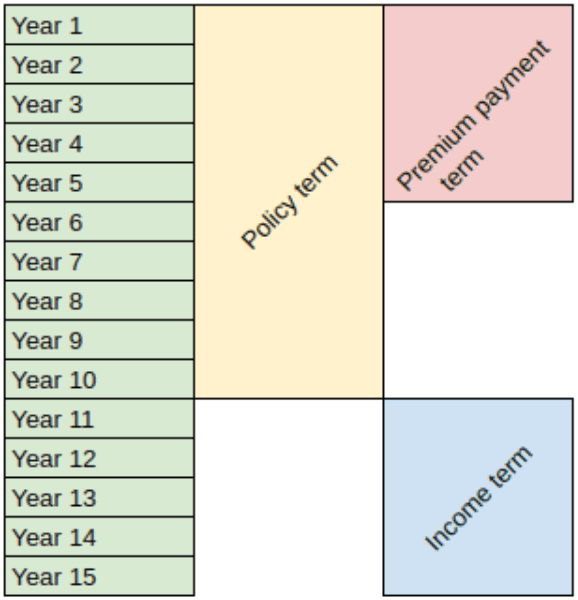

Policy term: This is the period for which the life cover under the plan is applicable

Premium payment term: This is the limited number of years for which you need to pay premium.

Income term: This is the number of years for which you receive income from the insurer. Usually in such plans, the income term starts once the policy term is complete.

See an illustration below for a 10 year policy term, 5 year premium payment term and 5 year income term.

Guaranteed Income Benefit (GIB): This is the guaranteed income that the insurer is promising to pay you. You can choose to receive this monthly, quarterly or annually.

Guaranteed Terminal Benefit (GTB): This is a final lumpsum payment by the insurer along with the last income payout.

Maturity benefits as lumpsum: All plans have an option to receive maturity benefits as lumpsum. Upon opting this, a single payment will be made at the end of policy term.

Plans

If you’re investing in LIC Dhan Sanchay you need to choose between the following plans.

Option A: Level income benefit

The plan gives both a guaranteed income and a terminal benefit. This plan is available for ages 3 to 50. Minimum annual premium is Rs 30,000. There is no maximum limit. There are 2 policy terms available: 10 and 15 years. For a policy term of 10 years, you can opt to pay premiums for 5 years or 10 years. For the policy term of 15 years, you can opt to pay for 5 years, 10 years, or 15 years. In terms of the income benefit, the policy offers ‘incentives’ for premium payments of Rs 50,000 and above.

Income benefits: This plan offers income for the same number of years as your premium paying term. To illustrate how this policy works, if you opt for a policy term of 10 years and premium payment for 5 years and opt to pay an annual premium of Rs 2 lakh, your premium payment will be Rs 2.09 lakh for the first year and Rs 2.045 lakh for the subsequent 4 years, after accounting for GST.

You will get an income of Rs 2.25 lakh per year starting the 11th year for the four years until the 14th year. A final payout of Rs 5.82 lakh will be made in the 15th year. Upon opting for lumpsum payout, a single payment of Rs 12.87 lakh will be made in the 11th year. If you opt for a policy term of 15 years and premium payment for 15 years, you will get Rs 3.37 lakh per year starting the 16th year going on until 29th year, and a final payout of Rs 11.56 lakh in the 30th year.

On opting for lumpsum payout, you’ll receive Rs 38.34 lakh in the 16th year. To understand actual returns from such policies, it is critical to work the IRR or Internal Rate of Return after factoring in premium outgo and cash inflows in the form of income and maturity payouts. We worked out the XIRR for some combinations for a 40 -year old as below. We’ve assumed a premium of Rs 2 lakh.

Please refer to the spreadsheet LIC_Dhan_Sanchay_IRR.xlsx for more details.

Death benefits: In the event of death during the policy term, your nominees will get death benefits at the higher of:

- 11 times annual premium (excluding any taxes)

- Sum assured on maturity

- 105% of total premium paid till date of death (excluding any taxes)

As per our calculations, for a 40 year old paying Rs 2 lakh premium per year for a policy term of 10 years and premium payment term of 5 years, the death benefit will be Rs 22 lakh. For a policy term of 15 years and premium payment term of 15 years, the death benefit will be Rs 37.5 lakh. Given the low sum insured, this policy should clearly not be used for securing life cover.

Option B: Increasing income benefit

The plan also gives both a guaranteed income and a terminal benefit. This plan is available for ages 3 to 50. Minimum annual premium is Rs 30,000. There is no maximum limit. There are 2 policy terms available: 10 and 15 years. For a policy term of 10 years, you can opt to pay premiums for 5 years or 10 years. For the policy term of 15 years, you can opt to pay for 5 years, 10 years, or 15 years. In terms of the income benefit, the policy offers ‘incentives’ for premium payments of Rs 50,000 and above.

The key difference between option B and option A is that, while the guaranteed income stays the same in the case of option A, it increases by 5% per year at a simple and not compounding rate, in option B. So, if the first year’s income is Rs 1 lakh, then the income for the subsequent years will see a rise of Rs 5000 per year to Rs 1.05 lakh, Rs 1.1 lakh, Rs 1.15 lakh and so on.

Income benefits: This plan offers income for the same number of years as your premium paying term. If you opt for a policy term of 10 years and premium payment for 5 years and an annual premium of Rs 2 lakh, your premium payment will be Rs 2.09 lakh for the first year and Rs 2.045 lakh for the subsequent 4 years, after accounting for GST. You will get Rs 2.04 lakh in the 11th year, Rs 2.15 lakh in the 12th year, etc and Rs 2.35 lakh in the 14th year.

A final payout of Rs 6.09 lakh will be made in the 15th year. On opting for lumpsum payout, a single payment of Rs 12.87 lakh will be made in the 11th year. If you opt for a policy term of 15 years and premium payment for 15 years, you will get Rs 2.66 lakh in the 16th year, Rs 2.79 lakh in the 17th year, etc and Rs 4.38 lakh in the 29th year. A final payout of Rs 10.84 lakh will be made in the 30th year. On opting for lumpsum payout, you’ll receive Rs 38.26 lakh in the 16th year.

The IRR for some combinations for a 40 -year old is as below. We’ve assumed a premium of Rs 2 lakh.

Please refer to the spreadsheet LIC_Dhan_Sanchay_IRR.xlsx for more details.

Death benefits: Same as for Option A

Option C: Single premium level income benefit

This plan is available for ages 3 to 65. In this plan, you will pay a single premium at the beginning. The minimum premium in this plan is Rs 2 lakh. There is no maximum limit. Under this plan, there are 3 policy terms available: 5, 10, and 15 years. Income term will be the same as the policy term. Income term will start once the policy term ends. This plan also provides a guaranteed income and terminal benefit. The ‘incentives’ for higher premium payments start at a single premium of Rs 3 lakh.

Income benefits: The plan gives income for the same number of years as your policy term. If you opt for a policy term of 5 years and a single premium of Rs 25 lakh, the premium payment will be Rs 26.13 lakh after accounting for GST. You will get an income of Rs 6.39 lakh per year starting the 6th year for the four years until the 9th year. A final payout of Rs 10.52 lakh will be made in the 10th year.

Upon opting for lumpsum payout, a single payment of Rs 31.8 lakh will be made in the 6th year. If you opt for a policy term of 15 years, you will get Rs 4.09 lakh per year starting the 16th year going on until 29th year, and a final payout of Rs 26.35 lakh in the 30th year. On opting for lumpsum payout, you’ll receive Rs 51.95 lakh in the 16th year.

The IRR for some combinations for a 40 -year old is as below. We’ve assumed a single premium of Rs 25 lakh.

Please refer to the spreadsheet LIC_Dhan_Sanchay_IRR.xlsx for more details.

Death benefits: The death benefits here are slightly different from Options A and B. In the event of death during the policy term, your nominees will get death benefits at the higher of:

1. 1.25 times single premium (excluding any taxes)

2. Sum assured on maturity

For a 40 year old paying Rs 5 lakh single premium for a policy term of 5 years, the death benefit will be Rs 6.25 lakh. For a policy term of 15 years, the death benefit will be Rs 10.16 lakh. This option also falls short of giving any meaningful life cover.

Option D: Single premium enhanced cover with level income benefit

This plan is available for ages 3 to 40. In this plan also, you will have to pay a single premium at the beginning. The minimum premium in this plan is Rs 2 lakh. There is no maximum limit. Under this plan, there are 3 policy terms available: 5, 10, and 15 years. Income term will be the same as the policy term. Income term will start once the policy term ends. This plan also provides a guaranteed income and terminal benefit. The ‘incentives’ for higher premium payments starts at a single premium of Rs 3 lakh and above.

The key difference between option C and option D is that option D prioritises death benefits over income. Hence option D has a lower IRR than option C while its life cover is higher.

Income benefits: The plan gives income for the same number of years as your policy term. If you opt for a policy term of 5 years and a single premium of Rs 25 lakh, the premium payment will be Rs 26.13 lakh after accounting for GST. You will get an income of Rs 5.11 lakh per year starting the 6th year for the four years until the 9th year. A final payout of Rs 11.69 lakh will be made in the 10th year.

Upon opting for lumpsum payout, a single payment of Rs 28.03 lakh will be made in the 6th year. If you opt for a policy term of 15 years, you will get Rs 2.56 lakh per year starting the 16th year going on until 29th year, and a final payout of Rs 8.22 lakh in the 30th year. On opting for lumpsum payout, you’ll receive Rs 28.82 lakh in the 16th year.

The IRR for a 40 -year old is as below. We’ve assumed a single premium of Rs 25 lakh.

Please refer to the spreadsheet LIC_Dhan_Sanchay_IRR.xlsx for more details.

Clearly this plan is not meant for those who are looking for a reasonable return with regular income.

Death benefits: In the event of death during the policy term, your nominees will get death benefits of 11 times of the single premium (excluding any taxes)

For Rs 5 lakh single premium, the death benefit will be Rs 55 lakh. Even though this plan has the best life coverage under available plans, it falls short of meeting a real life requirement. The maximum term of 15 years and maximum age of 40 to join the plan further limit its usefulness.

Should you buy?

LIC Dhan Sanchay was launched as competition to popular guaranteed income plans such as HDFC Life’s Sanchay Plus and ICICI GIFT. However, it falls short on both the friendliness of its features and its effective returns. HDFC Sanchay Plus’ IRRs go upto 6.12% (please see our review here). ICICI Prudential Guaranteed Income For Tomorrow (GIFT) plan offers upto 5.43%. But the comparable IRR for LIC’s Dhan Sanchay stands at 5.12% for a 40 year old.

While the tax-free treatment lifts the returns above those of LIC’s own annuity plans which are taxed at your slab rates, you need to note that annuity plans offer lifelong income at a guaranteed rate, while LIC Dhan Sanchay’s income term is limited to 5 to 15 years. With market interest rates rallying in the past few months, 20, 30 and 40 year g-secs are available to investors who seek complete capital safety with regular income. These currently provide post tax income higher than LIC’s Dhan Sanchay. The yield of a 30 year g-sec stands at 7.71% as of August 7 2022. This would generate post tax income at the rate of 6.91%, 6.11% and 5.3% respectively for those in the tax brackets of 10%, 20% and 30%. Meanwhile the maximum IRR on LIC’s Dhan Sanchay's income plans stands at 5.12% for a 40 year old. Investors who can more actively manage their portfolios can also invest in corporate deposits, bonds and GOI Floating Rate Savings Bonds for better post-tax returns.

The life cover offered by this policy is inadequate both in terms of value and duration. In the options A and B, the life cover at about 11 times yearly premiums. In option C, the life cover could be as low as 1.25 times the single premium. Even though option D has a life cover of 11 times, the fact that it is available for a maximum 15 years reduces the usefulness. We recommend pure term plans for life cover, which are available for cheaper premiums and for longer durations. Refer to our term insurance section to see how much term insurance we recommend and the current ranking of term insurance plans for various age groups.

Note: For policies issued starting 1-Apr-2023, the maturity amount will be taxable if yearly premium exceeds Rs.5 lakh. For more details, see How is your insurance policy taxed?

1 thought on “Prime review: LIC’s Dhan Sanchay”

Any Savings products be it vanilla Endowment, Guaranteed plans or Whole of Life plans offer Low single-digit return and that too as Simple interest[ other than Payout plans] . The average IRR/XIRR hovers between 5-6.2% depending on plan and insurer. As also the Sum assured offered is pretty low if a Need-based approach is adopted while opting for such plans. Moreover the Tax free maturity is not enough as the payments are due 10/15 years from first premium payment and unlikely to beat inflation. Therefore, leads to Wealth Destruction and not Wealth Creation. Alternatively , if at all one has to buy plans from Insurance companies across industry yet want somewhat lower volatility than Equity investing, one can consider various fixed income funds under ULIPs. Choose those plans which have lower costs and overall fund performance is good in long term

Comments are closed.