In March 2021, our call on the commodities fund we added panned out well. But we decided to issue a book profit call in June 2022, as we wanted to preserve some of the profits given the cool off that was visible then in commodity prices.

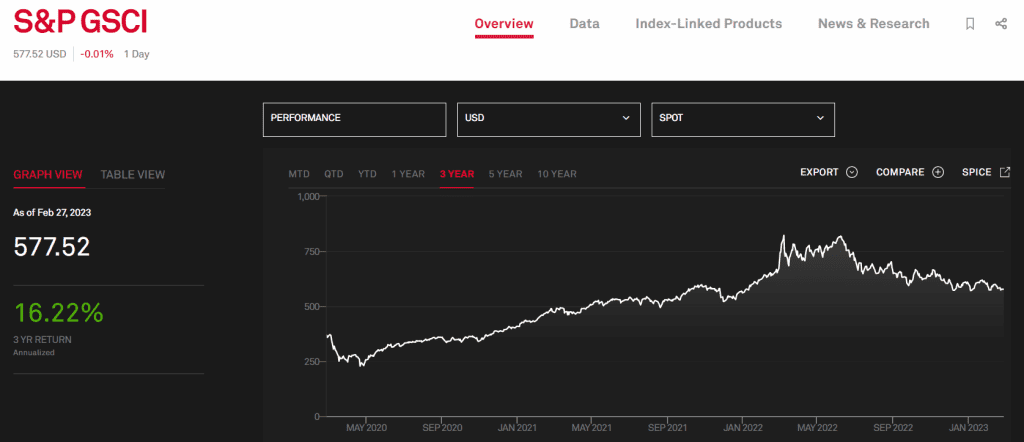

And as anticipated, commodities cooled off a fair bit globally. Triggered by inflation-driven rate hikes and recession fears, pre-emptive physical destocking (reducing inventories anticipating higher cost of holding inventories) resulted in lower prices. The traded Goldman Sachs Commodity index graph below will tell you that our call was largely in line with this index’s move.

But we now think that this trend could reverse. The very factors that cooled the commodity rally, together with the limited supply-side response could keep the rally going; lower stocks (post destocking) once again pose the threat of demand outstripping supply. This essentially suggests that the commodity cycle is far from over.

The global extended commodity cycle

Commodity super cycles (as analysts call it) appear to have specific characteristics that have repeated historically under certain conditions. To quote from commodity analysts Goehring and Rozencwajg (G&R) in a 2022 blog on the signs preceding a commodity bull market:

- First, prior to each commodity buying opportunity was a decades-long commodity bear market that produced price declines so severe that capital spending in many extractive industries was impaired.

- Second, each period was characterized by excessive monetary creation.

- Third, all three periods saw intense financial speculation.

- And fourth, each period saw a major shift in global monetary regimes.

All four conditions are once again present today and, in many instances, they are far greater in magnitude than in any of the previous three cycles.

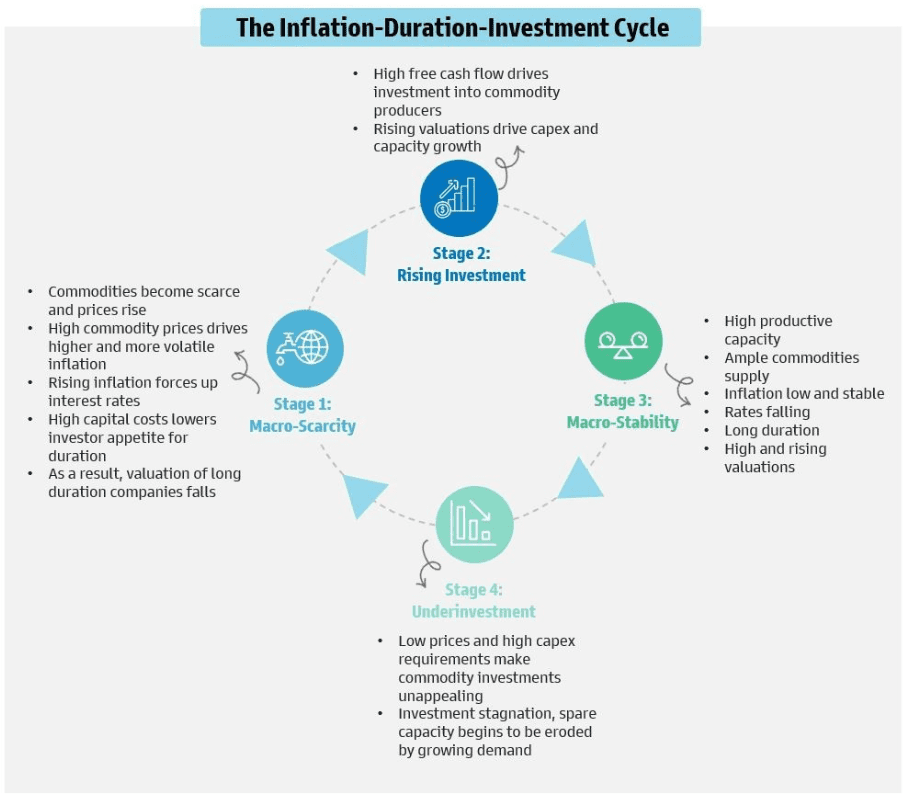

In the image above (courtesy a Goldman Sachs report), Goldman Sachs states that we are probably at Stage 1 of the cycle as characterised by inflationary pressures.

We believe the underinvestment in the commodity space can continue to stoke commodity prices for the following reasons:

- There is global consensus emerging that economic growth is slowly set to rebound with the reopening of China.

- Weak industrial activity in Europe, partly deliberate (in a bid to improve energy efficiency) may already be masking the real shortage in energy and green metals (copper, aluminium, zinc etc.).

- Slowing of the aggressive Fed Rate hikes in the US may also help inventory build-up and slower release of inventory – triggering commodity inflation.

- And lastly, none of these appear sufficient enough triggers for a major global commodity capex yet, as, globally, commodity companies (including energy and metals) run with limited spare capacities. Higher interest rates, stiff regulatory environmental norms have acted as a deterrent for capacity additions. For example, with the world turning to low-carbon renewable energy in the past few years, capacity additions in carbon-intensive sectors have remained low. Renewable energy made for cheap investment in a zero-interest scenario. But with rate hikes changing the picture, the return to the hydrocarbon sector caused a spike in energy. Similar theses hold good for metals as ore grades deplete and deteriorate in quality.

As the data below will tell you, metal prices globally are on the surge once again.

In short, higher global infrastructure spends and post-Covid delayed capex activities in manufacturing, together with underinvestment in commodity capacities can effectively play up the commodity story longer than expected.

Playing commodities locally

While commodity prices in India are largely driven by global prices (given our net import), this time, locally, the story has been a bit different, specifically for ferrous metals.

Real demand – backed by higher infrastructure activity and real estate activity – ahead of global uptrend in demand, caused a rise in prices. But supply too began to adjust itself elastically with higher production and with more capacity additions happening. And now, improved export prospects on the back of reversal in export duty hikes (in Nov. 22) can also help steel companies (exports were healthy before the May 2022 export duty hike) expand their volumes and keep prices healthy.

In other words, the local capex boom has primarily helped commodity companies locally to thrive and grow. At the same time, export prospects can be expected to pick up again.

To provide a few examples- JSW Steel has aggressive plans to expand with projects under execution to increase capacity to 37MT from 27MT. Jindal Steel & Power plans to raise capacities to 15MT from 9MT by FY-25. And this after it reduced its debt by 84% (in 6 years) and after divesting non-core assets.

In cement, a CareEdge report expects 16-17% capacity additions in cement between FY23-25. Do note that all of these come after years of stagnant supply situation.

But as capacity additions/consolidation in this space happens, the price rise in the Indian context may not necessarily follow the global rise (which comes from supply constraints). It is for this reason that the local commodity index has underperformed the Nifty in the two months of 2023.

Still, healthy demand and the ability to keep margins protected would be sufficient reasons for stocks from this sector to excel. We believe that this is a good time to again add a commodity fund. Please note that the returns from the fund may not pan out as quickly as it did when we gave the call in 2021. Hence, some patience on this front will be necessary. Exposure too, should be capped at 5-10% of total portfolio.

Our call

Our call on this theme is the ICICI Pru Commodities Fund. We added this fund in Prime Funds in January 2023. Those of you who retained the fund from our original call in March 2021 (even if you booked profits and held the rest in line with our recommendation in June 2022) can continue to hold the fund. The performance of this fund is superior to the other domestic fund option from SBI. The other fund from Aditya Birla is an international agri fund with restrictions on investments due to RBI cap on international flows.

ICICI Pru Commodities Fund tactfully plays sectors, picking upcycles well. It increased cement exposure from 20% in December 2021 to as much as 40% by October 2022, before reducing to about 36% now. Similarly, from 49% allocation to metals and mining in December 2021, it cut it to 21% by July 2022 after commodities peaked and has since been slowly adding and bringing it to 40% again (Jan-23). The company also selectively plays the chemical and energy space, carefully ignoring overvalued segments.

While the recent weakness in both cement and steel has not boded too well for its performance, we believe the correction provides opportunities to enter and hold the fund. As always, remember that thematic funds such as this requires a high risk appetite.

13 thoughts on “Prime Recommendation: Commodity and the rise of the old economy”

Hello Madam

I have invested in lumpsum in ICICI Pru Commodities Fund . Will you track it and give an exit call whenever deemed necessary?

Yes, we will track it – it’s part of Prime Funds, so if there’s any profit booking or exit to be done, we will alert. – thanks, Bhavana

I saw the explanation of this fund in fund recommendations section also. I liked the fact that you called out that this fund should not comprise more than 5 to 10% of portfolio. I think that is a valuable call out. Thanks.

Q1. Thank you for this recommendation. What is your suggestion on ICICI PRU Business Cycles Fund & India Opportunities Fund, esp. the Business cycles Fund which might mimic the Commodities cycle before moving into another theme in a few years.

Q2. Given your expertise, it will be appreciated if you can review the solution-oriented funds(Retirement / Children) and give your views on Hold / Sell, though they may not form part of PRIME Funds. Investors who had invested in the past may need guidance for the same.

Thanking you in advance.

Will respond to your ticket through mail. Thanks, Vidya

I invested lumpsum today with a hope your call would come out true. Fingers crossed 🤞

Hopefully, patience will pay 🙂 Vidya

Hello Vidya,

Thank you for the wonderful article. Should we invest in ICICI Pru Commodities Fund in lumpsum or do a SIP?

Lumpsum is preferred or in 2-3 tranches on market falls. Vidya

Thank you, would you recommend a lumsum or SIP.

We prefer lumpsum bit be prepared to see falls. Else, invest in 2-3 instalments. Vidya

But madam, how to purchase, lumpsum or SIP route ? If you clear, it will be beneficial.

We prefer lumpsum bit be prepared to see falls. Else, invest in 2-3 instalments. thanks, Vidya

Comments are closed.