If you’ve got a 5-year-plus timeframe, equity is the way to go as we explained this week. And yesterday’s steep correction offers up more buying opportunities for those with the risk appetite and timeframe. And if you need money in the very near term, we’ve asked you to stay safe with fixed deposits, liquid funds, and ultra short-term funds, given that the current climate offers no room for risks in the short term. But what about the in-between timeframe? What are your options should you have a horizon of 2-3 years and want better returns that fixed deposits or low risk mutual funds?

ICICI Prudential Balanced Advantage fund fits this requirement and is suited for conservative equity investors. This hybrid equity fund stands out for:

- its steady history in using valuation metrics to shift between equity, derivatives and debt, unlike other balanced advantage funds

- its ability to contain losses even in very short timeframes such as 6 months, along with lower volatility compared to peers

- its deft juggling of equity and derivatives to make the best of market movements, and consistent strong performance

If you have a 2-3 year time frame or have a longer time frame but cannot handle equity funds directly, then this low risk mutual funds is a tax-efficient option.

Strategy clarity stands out

Balanced advantage funds are clubbed with dynamic asset allocation funds in terms of SEBI category classification.

But such clubbing and no clear definitions on what the category itself is, leads to inconsistencies among funds. There are some, like Aditya Birla Sun Life Balanced Advantage, that hedge only a small part of the portfolio, to those such as HDFC Balanced Advantage that is exactly like an aggressive hybrid fund.

The confusion is compounded as many dynamic asset allocation funds also use derivatives, such as DSP Asset Allocation and BNP Paribas Dynamic Equity. The far more aggressive nature of asset allocation funds and the wide range that equity can go to makes it hard to pinpoint low risk mutual funds levels or understand fund behaviour. More, most funds in this category lack history to judge ability to correctly shift allocations or contain volatility – they are either recent launches or were different funds that came in post the SEBI mandate in 2018.

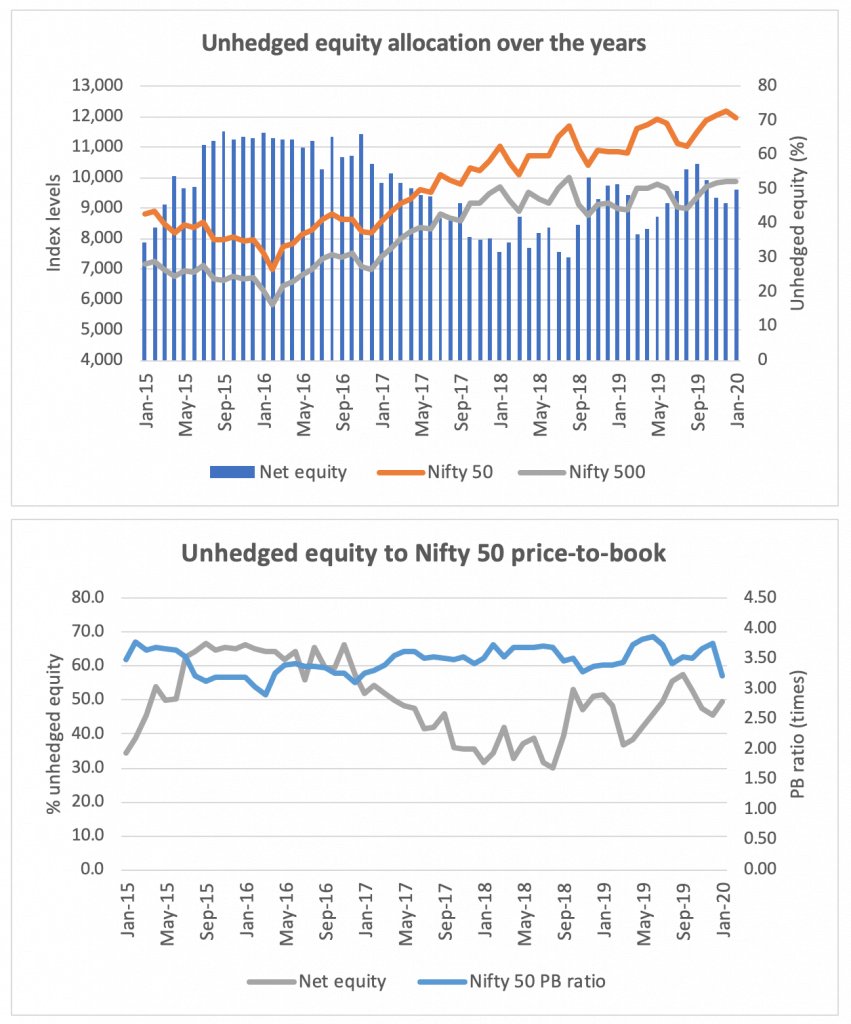

ICICI Prudential Balanced Advantage (IPru Balanced Advantage) is among the few funds that has been around across market cycles and has maintained a steady strategy. It uses a long-term price-to-book value to shift allocations, upping derivatives when valuations are high and vice versa. For example, unhedged equity dropped below 50% early on in 2017 and went all the way down to 30%-odd levels as markets heated up. Allocation then crawled higher towards the end of 2018 and moved to around 50-55% over 2019. Unhedged equity exposure runs a strong negative correlation with the Nifty 50’s price-to-book ratio as well as the index itself.

On the debt side, IPru Balanced Advantage more or less maintains a 30-35% allocation. It also tends to have a short maturity profile for the most part, briefly dipping into duration strategies in periods such as 2016 where opportunities were ripe. Over the past five years, the average portfolio maturity has been 2.7 years.

Suitability

IPru Balanced Advantage suits different needs:

- For investors with a 2-4 year timeframe, who want returns above pure debt funds and willing to take on a little higher risk. As the fund is an equity-oriented fund, it is more tax-efficient than debt funds and more so in timeframes less than 3 years.

- For conservative investors, even for those who have long-term timeframe, who want equity exposure without the high risks.

- For investors worried about the ongoing correction and wish for funds that can contain downsides, manage volatility, and deliver over time.

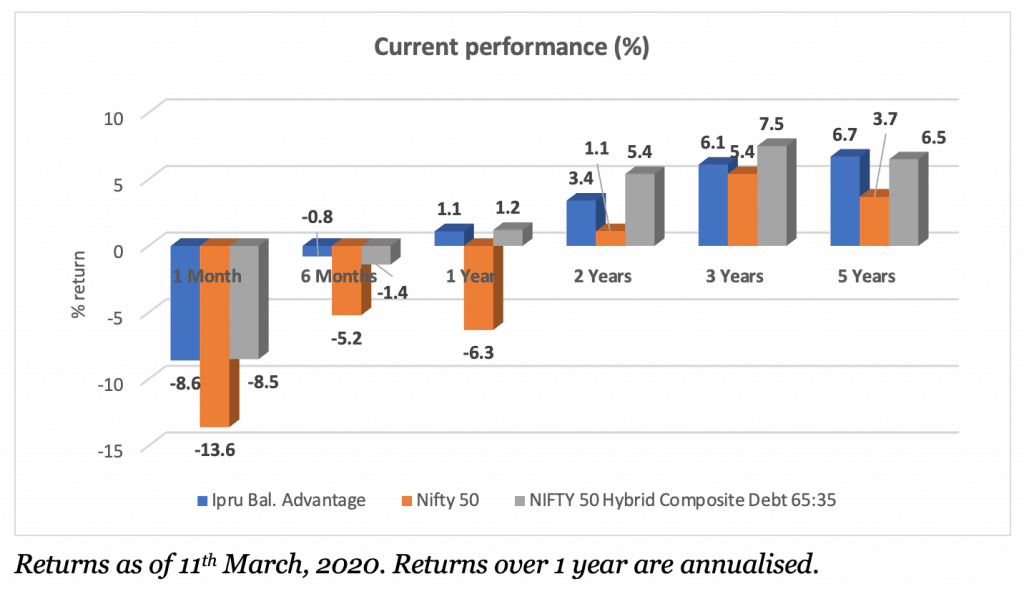

As a equity-oriented fund, it is not immune to market corrections in shorter periods of less than 6 months. The fund has delivered negative returns 30% of the times when returned were rolled daily for 1-month periods, since 2015. In this aspect, it is more volatile than pure debt funds. However, over longer periods, this whittles down. Rolling 6-month returns from 2015 shows that the fund delivered losses just 13% of the time. The average such loss was 2%.

Performance

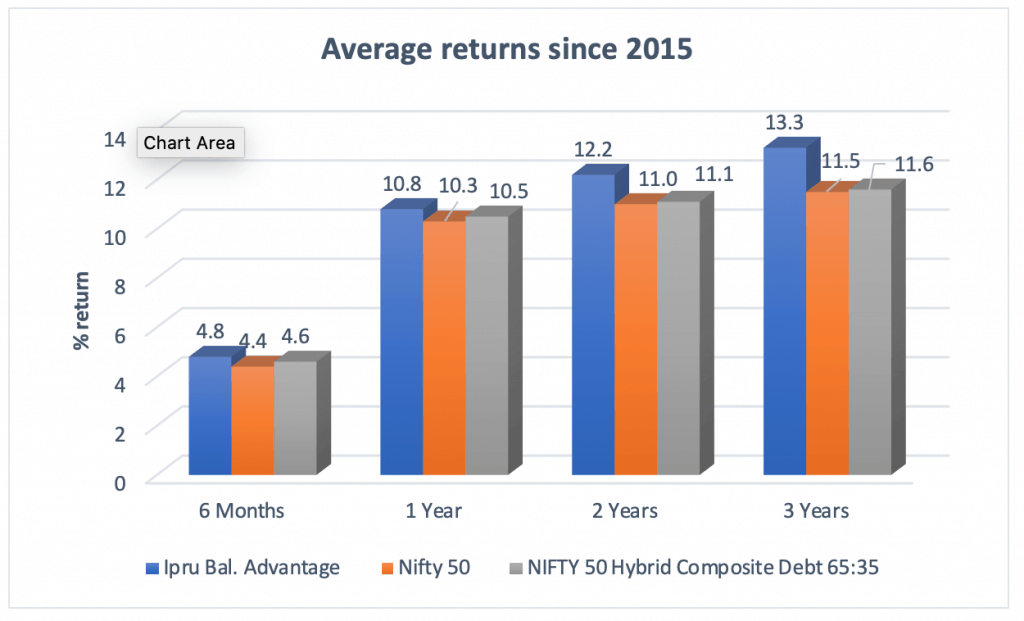

IPru Balanced Advantage on an average delivered a 1-year return of 10.8% from 2015 to now. Short-duration debt funds, in the same period, delivered an average of 7.6%. The fund has, in strong markets, delivered returns in the 15-25% range as well. In this aspect, it does fit longer-term portfolios for conservative investors too. But do not enter the fund expecting equity-like returns.

Strictly, IPru Balanced Advantage isn’t really comparable with peers given the wide variety in strategies and allocations. Still, in ability to contain downsides (measured by the downside capture ratio using 1-month returns against the Nifty 50), it scores above average. The fund captures just 35% of a month’s market downside. On other risk-return metrics such as Sharpe ratio and Sortino ratio, IPru Balanced Advantage scores well above peers.

IPru Balanced Advantage’s recent performance, obviously, has been hurt by the meltdown of the past few days. The hedged equity portion of the February portfolio is also low at 8.6%. While the recent fall may be sharp, it needs to be noted that the fund may find good buying opportunities in this time. The low risk mutual funds ability to contain downsides is also strong, and as explained above, 1-month losses generally tend to dissipate over time.

30 thoughts on “Prime Recommendation: A low-risk option for the conservative equity investor”

The fund has recently amended its asset allocation to include preference shares, REITs and INVITs, apart from Money market instruments. Appreciate if you can let us know about change in risk profile with your recommendations.

Hello Sir, there is no change in risk profile due tot he SID change. thanks, Vidya

While this note is dated March 2020, what is your view on the quality of the debt holdings in this fund ? If this is pegged as a suitable option for equity investors who wish to protect some of the downside risk, by exposing lower quality credits, is the fund doing disservice to its target audience ?

Latest being Srei Equipment that has a 0.08% exposure (agreed its minuscule), but however the names in the debt portfolio leaves a bit to be desired.

Look forward to your views. Thanks

Hello sir,

Yes, the fund has been taking a bit more risk on the debt side. However, as you’ve also noted, this risk is low. The fund takes low exposures to individual papers and therefore spreads the risk out. If there’s volatility or low returns, it is more likely from the equity side than the debt calls. The minimum holding period should help. Using this fund along with other pure, low-risk debt funds, when your timeframe is less than 4 years, will also help mitigate risks.

Thanks,

Bhavana

Hello ,

While selecting funds is it advisable to select 5 star rated funds or the funds with report displayed are prime selection from investors though with low rating score.

Secondly is it good time to invest lumsum in debt funds at present level of market or will doing SIP in debt will be advisable.

No, the fund’s rating is not the same as recommendation – there are several aspects to a fund’s performance and its suitability for you outside the rating. This is explained here: https://primeinvestor.in/mutual-fund-ratings-not-a-recommendation-to-buy/. As far as debt goes, if you’re investing in gilt/constant maturity funds, yes, you can do an SIP to capture any volatility or low-return phase that may come as the rate cycle turns. Otherwise, SIPs are not really useful in debt. This is explained here:https://primeinvestor.in/should-you-run-an-sip-in-debt-funds-or-in-lumpsum/ – thanks, Bhavana

Comments are closed.