- Data and index behaviour shows that large-cap equity funds will struggle to beat their benchmark convincingly.

- Selectively picking large-cap stocks directly or a passive strategy of holding large-cap index funds may become necessary

Once considered as the foundation of a beginner’s equity portfolio, large-cap equity funds are losing their sheen. These funds are now struggling to beat their benchmarks or at best outperforming by a low margin, in the past 2-3 years.

The phenomenon of lowering margin of outperformance in the large cap equity fund space is likely to stay. Part of the reason is the index construction itself, where high weights to few outperformers (as the weights are largely marketcap based) are skewing returns and making it hard to beat. The other part is the increasing focus on the top stocks, leaving limited room for price “discovery” and gaining from undiscovered stocks.

Being selective in picking and holding large-cap stocks is increasingly important besides holding simple large-cap index funds.

Faltering returns

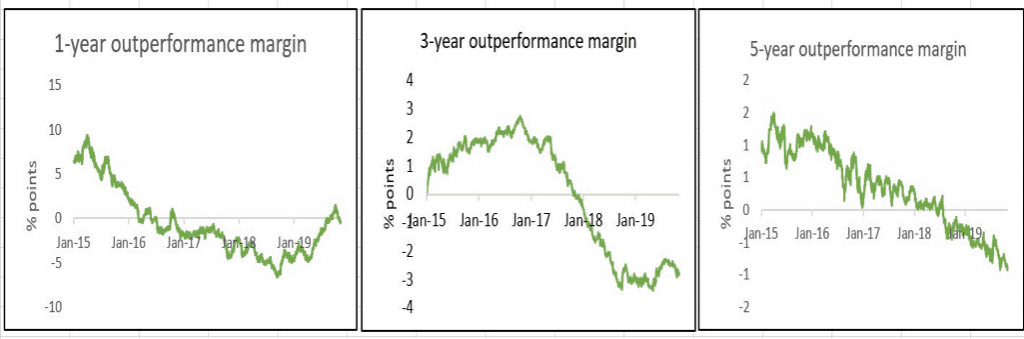

Three patterns emerge in the faltering returns of large-cap funds.

One, the number of funds beating the Nifty 100 TRI is going down. Only a tenth of the category beat the Nifty 100 TRI on a 3-year basis. Two years ago, funds’ 3-year returns beat the benchmark 75% of the times. Even on a 5-year basis, funds are struggling to deliver above index. The marked underperformance in the past two years has pulled down longer-term returns as well.

Two, the margin by which funds beat benchmark is shrinking. Over 2015, for example, the average margin by which funds’s 1-year return beat the Nifty 100 TRI was a good 6 percentage points. Over the past two years, a majority of the funds underperformed the index. Those that outperformed managed to beat the index by just 1-2 percentage points, barring a couple of outliers.

Three, the proportion of times funds beat the benchmark is also going down. That means there is a higher chance that a large-cap fund you bought may underperform the index. On an average, large-cap funds beat the Nifty 100 TRI just 24% of the time when 1-year returns were rolled daily for 3 years and just 35% of the time when 3-year returns were rolled daily for 3 years.

Influencing factors

So what explains the trend? One, fund strategies. In earlier years, large-cap funds often took to mid-cap and small-cap stocks to push returns. This helped immensely in the boom years of 2014-2016. In fact, the extent of midcap exposure caused wide differentials in returns between large-cap funds. But as mid-caps turned expensive, funds scaled back. Categorisation rules SEBI introduced in 2018 forced funds to hold a minimum of 80% in large-cap stocks, to prevent large-cap funds moving into mid-caps. This cut back reduced fund returns and margin of outperformance over index.

Second, the index itself is to blame. The Nifty 100 is constructed based on market capitalisation, i.e., stocks with higher marketcaps get higher index weights. Over 2018, the top-weighted stocks rocketed higher pulling the index up, in turn increasing their own weights in the index. The index began to get focused at the top. In 2017, for example, the top 5 stocks in the Nifty 100 held a weight of 28.9% in the index with the top weight at 6.9% (based on free-float market cap). Now, the top 5 stocks account for 33.7% of the index with the top stock making up 8.6% of the index.

Most other index constituents languished. Given the cap on individual stock holdings, funds cannot restrict their own holding to just the top stocks. As a result holding some amount of underperformers squeezed returns.

Thirdly, the large-cap space is increasingly a factor of getting stock weights correct and not necessarily buying and holding under-priced stocks or discovering stocks. This is partly because of the way the index is moving as explained above. Funds are also now unable to move more than 10-15% of their portfolio outside the top 100 to prop up returns.

Missing the weight

Funds have slipped up on snagging the outperformers, or accorded them smaller weights, or accorded higher weights to the underperformers.

For example, funds were caught on the wrong foot with Reliance Industries. The stock has skyrocketed in both returns and in index weight, but funds added the stock well into its run and for many, it didn’t form a large proportion at 5% or less for most. TCS rose steadily from early 2018 but funds built up exposure only later. They also accorded heavier weights to Infosys, which has trailed TCS in terms of returns.

While ITC has a heavy weight in the index and fund portfolios, the stock hasn’t done well. HUL has a reasonable index weight but rarely forms part of fund portfolios. Bajaj Finance is a star performer, but has low weight in both the index and fund portfolios. L&T features at 3% and higher in most portfolios and the index, but the stock is a laggard.

Funds like Axis Bluechip managed weights deftly. For example, the fund held very high exposure to stocks such as Bajaj Finance, Kotak Mahindra Bank, and HDFC Bank early on. Mirae Asset India Largecap’s top three stocks were strong performers.

However, funds such as Franklin India Bluechip, while holding significantly on to performers, was still pulled down by cement, energy and other cyclical exposure and a slow recovery in portfolio heavyweight Bharti Airtel. Invesco Large Cap’s heavy exposure to ITC, L&T and Infosys negated exposure to outperformers such as HDFC Bank and Reliance Industries.

Given the wide lag between the fund and the index, which amounts to as much as 4-6 percentage points (on a 3-year basis) for some funds, the recovery will have to be significant.

Long road to recovery

Yes, cyclical and low valuation choices hold good when considering fundamental and valuation metrics. While Bajaj Finance, HUL, Asian Paints, Nestle were shining performers, they are expensive. Fund choices such as L&T, Bharti Airtel, Ultra Tech Cement, NTPC and the like are value picks.

But how long markets take to reward these stocks is important. Given the wide lag between the fund and the index, which amounts to as much as 4-6 percentage points (on a 3-year basis) for some funds, the recovery will have to be significant. Funds have remained behind the index for a while now – the longer they remain this way, the higher the opportunity loss.

What now?

Here’s the situation:

- The Nifty 100 is increasingly skewed in terms of stock weights. A few stocks wield disproportionate influence on index returns. Funds can find it hard to hold those stocks, in those weights

- Stock weights and deft changing of these weights are becoming important, compared to buy-and-hold undervalued or undiscovered long-term stocks

- All large-cap funds are now restricted to the top 100 stocks. This makes differentiation hard to come by. The top 100 stocks are also widely researched and information advantage is limited.

So, what’s the solution?

- Include plain vanilla large-cap index funds. The Nifty 100 and the Nifty Next 50 are both options here. This would ensure a stable large-cap component that works in line with the market, allowing you to boost portfolio returns using funds from other categories where return potential is higher.

- Get very selective in large-cap funds. Only those with differentiated strategies or characteristics, such as active management of stock weights or containing downsides, will work.

- Start including multi-cap funds with steadily dominant large-cap holding in the place of pure large-cap funds.

- If you are an active stock investor, then select large-cap stocks can work better in place of large-cap funds.

If you hold underperforming large-cap funds already, don’t immediately exit them. Instead, reduce SIPs in these funds. Add index funds or increase exposure to moderate-risk multicap funds. Which large-cap funds to hold? Or which index funds or multicap funds to substitute poor performers? Stay tuned for our products to go live, to get the list.

See also : Our ratings of the best Index Funds India

8 thoughts on “Large-cap funds are losing the appeal”

Thanks for a well analysed article.

Even some multi-cap funds with a large cap tilt have also not delivered a significant alpha over the benchmark [Eg. ABSL Equity Fund]. Appreciate your thoughts on this.

Hello sir,

True, there are multi-cap funds that are also failing at beating the all-market Nifty 500. ABSL Equity was a great performer that took tactical sector calls and usually held up well. But the issue of being unable to beat the index is not as prevalent or a characteristic of the category itself as it is with large-cap. Nor is the situation such that these funds will continue to find it hard to beat the market since they have a long rope (this is not including SEBI’s new rules, and I’m also talking about categories like focused, value etc which are multi-cap by portfolio).

Thanks,

Bhavana

With existing exposure to a Nifty 50 index and Nifty Next 50 index fund in the passive space, would it be wise to also hold a quant fund in the large cap space? Will a DSP Quant fund for example help in a more efficient strategy in the active space?

Hello sir,

Yes, adding a quant fund will help give a leg-up to returns. It depends on the quant fund in question and which index you are trying to combine it with. In the large-cap space, definitely, it can help if it beats the Nifty 100. The Next 50 is more multicap in terms of volatility and returns. DSP Quant is an option (we have reviewed it here) but the fund hasn’t got a long enough track record to clearly work out its consistency in beating. You can consider keeping with the current index funds you have and add quant when there’s more certainty on its performance. You can still find moderate risk multicap funds that can add returns without taking high mid-cap exposure (look for options in Prime Funds, moderate risk)

Thanks,

Bhavana

Hello Mam , Can you expand on the shortlisted funds in this aspect ” selective in large-cap funds. Only those with differentiated strategies or characteristics, such as active management of stock weights or containing downsides, will work” ..Is there an existing article already that covers this point ?

Hello sir,

You can find funds that fit the metrics that are mentioned in this article, in Prime Funds. You can check “why this fund” to understand our reasoning behind each fund.

Thanks,

Bhavana

Perhaps it might be a better idea to focus on medium and small cap fund

Hi Sumesh,

Yes, you’re right…mid and small-cap space offers good return potential and one needs to look at that space for long-term returns. However, a portfolio still needs a large-cap component as large-caps are less volatile, protect returns from sliding too much in correcting markets, and give exposure to strong, core important companies.

The idea is not to remove large-caps but to change the way in which you’re getting this exposure. Large-cap stocks aren’t losing potential, active large-cap funds are, because they’re simply not delivering. This is why index funds are a great alternative. Some multi-cap funds have steady holding of above 70-75% in large-cap stocks and are thus a good option too, since they are only slightly higher in risk profile compared to large-cap stocks and have the freedom to invest outside the top 100.

Thanks,

Bhavana

Comments are closed.