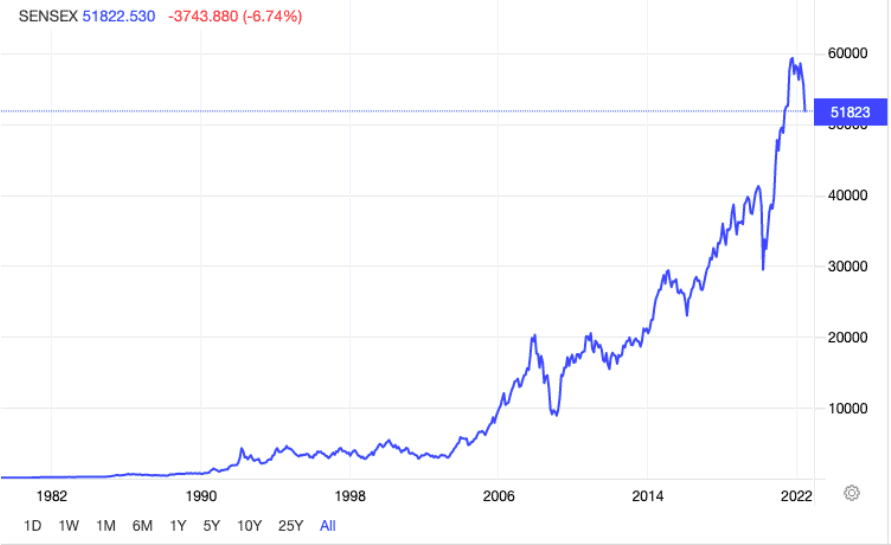

Looking at the graph of the BSE Sensex since 1981, it is hard not to marvel at the amazing journey of the Indian stock markets over the years. BSE data shows that January 1981, the Sensex value was 146.63. In forty one years, it is at around 52,000. Yes, it has not been a linear growth.

(Source: www.tradingeconomics.com)

This graph hides the pains and pleasures that people have felt along the way as they have ridden this unruly animal. Individual experiences vary based on where one got in and got out. Or in some cases, where one got in and is staring at the screen now. It took Harshad Mehta to kick the tires of so many of us. And the reforms of 1991 that then brought in global investors.

Bear markets are informally defined as 20% declines from a peak. If we go by this, we are not yet in a bear market, though it would seem to be just round the corner.

From peaks to troughs

Each peak had some reason. The most prominent ones in the past were driven by operators – there was the Harshad Mehta affair in the 80s and 90s and the Ketan Parekh affair (along with the global tech boom) in the late 90s. Both left long term scars on the market. The last peak was however something of an interesting thing. The world went berserk with money printed by central banks and valuations seemed irrelevant. This madness keeps happening in the post 2000 era, thanks to easy and reckless money printing, plus the sense of adventure driven by cheap money.

These mad moments were followed by gloom that enveloped everyone. As prices fall, people freeze, with some swearing to be away from markets forever. There is a small but growing crowd of people who welcome this gloom. While it is fine for everyone to like ever rising stock prices, investment is best done at lower prices. You do not have to be a rocket scientist. Valuations are simple arithmetic.

We all pay a price for earnings, growth and assets, with reference to prevailing interest rates. The moment this starts getting ignored and new valuations flood the market with irrelevant numerators and denominators, the madness increases. The crowd participation increases. And then something happens to pull the plug. This is a virtuous cycle in the market, as the gloom sets in and doomsday forecasts get wider, serious money smells opportunity and the cycle turns.

My investing framework

Now, let me turn to what rules I follow, when it comes to stock market investments. These rules are very general and apply in all markets. Emotion has no room in this framework. Yes, if you have money to burn then you write your own rules. I know that in a long-term journey, there will be ups and downs. This framework tries to protect us from being immobilised when the markets go to highs or lows.

A fair value estimate

Investment returns are all about timing. Timing, with reference to investments, is the price at which we buy. After all, returns are the difference between buy price and current market price. Thus, for me, timing is to buy when prices are reasonably fair. I have no way to predict the highs and lows of a stock, but every one of us has a method by which to determine a ‘fair price’ to pay for an investment. It could be a range or it could be an exact price that is based on assumptions regarding the future. The closer to this price we buy an investment, the higher the possibility of our prospective returns being good.

In a mad bull market, everything is priced sky high, so do not assume those prices are here to stay. Estimate what could be a reasonable price down the road, using the same methodology. For example, if I think that I am happy to pay 3 to 3.5 times book value for a Cholamandalam Finance or Sundaram Finance, my expected returns are simply a function of how they keep adding to their book value and the dividends that would come during the period I hold.

In case of a Reliance share it could be 15 times earnings or in case of a HUL it could be 40 times earnings. These are merely illustrative, simple assumptions and not based on any calculations I have done. You need to have your own methods to value stocks so please stick to that.

Thus when we buy at prices that are far higher than ‘fair value’ we are actually investing for a return that can be poor when the market is normal. The idea behind investment is to assume a normal market condition valuation (yes, you say things are never an ‘average’ at any given time) at exit and therefore, it is important to buy at or below our fair value.

No investor likes ‘bear’ markets. However the highest returns are possible when investments are made in a bear market. Thus, the investment framework one has should ensure that we are able to take advantage of both moods in the market. Profit from the market moods rather than be part of it.

My buy and sell rules

Let me now explain my simple rules on portfolio buys and sells. Here’s what I own:

- A core portfolio that I rarely disturb and will hold forever. This basket of stocks rarely changes and selling is only if I think a company’s fortunes have irreversibly changed or I am in need of money that is not a normal need. For those in their early to mid stages of their investment journey, this basket will keep getting bigger in terms of value as well as number of stocks. For someone like me who has completed his earning life, the objective is to maximise returns when exiting gradually.

- A secondary portfolio or a ‘trading’ one that I use to simply be in the market. I am happy getting a decent positive return and am not in a race for performance. I have rules about individual stock limits, strict stop losses, stop profits etc. I may indulge in poor quality stocks and may deal purely on price rather than valuations. I am going with the momentum. However, here I do keep away from names I have an allergy to or businesses that I do not understand.

- CASH is an important part of my equity allocation. It is a fairly significant portion that I like to keep, simply to take advantage of bear markets. For me a ‘bear’ market is stock specific and is a means to enhance my portfolio returns, by trying to capture some abnormal returns in short periods.

- In the past, one could think of ‘trading on inventory’. This essentially means selling something we have when there is an abnormal spike in the price and then replacing it by buying it soon at a lower price. This has risks attached to it and needs a lot of time to be active in the market during market hours. For example, I may pick up a stock like CRISIL, that is in my core portfolio, and keep selling and buying a part of it because there is a large price volatility in them.

Recently, the price moved to a band of Rs.3000 to Rs.3500 so one can sell some when the price is closer to 3500 and buy it back when the price falls a couple of hundred rupees. I have just added a small return to my core holding. However, the imposition of capital gains has robbed me of this pleasure. Someone I know has converted two or three of his entire holdings to ‘short’ term and is actively trading in them by selling and buying.

His holdings remain the same, but he has juiced up his returns from those stocks. This is something that institutional investors keep doing day in and out because mutual funds/insurance companies are unfairly exempt from capital gains. - When the market starts to fall, I scan for two opportunities. One is to buy any stock in my core portfolio that corrects by more than 25%. Obviously if the fall is due to permanent loss in valuation, I have to exit. In most cases, I will slowly add that to my second basket. Say, if my cash available is Rs.10 lakh, I will commit upto 50,000 to a single idea. I will not buy Rs 50000 worth of stock in one go. I will divide it in to three or four lots and buy.

Sometimes the price does not dip after my first buy, in which case, I do not chase it. I am happy with my call. If there is a fall by a further 10% from my first buy, I will add one more lot. At the next 5% fall I will add one or two lots. I will hold this till the market conditions get better. I will sell this, when it rises above ‘fair’ value. In early 2020 I used some of my cash to buy stocks like Cholamandalam, Apcotex, Thirumalai Chemicals etc.

There was the curious temptation of buying ITC when it fell to 165-170 levels in October 2020. I sold these stocks when the prices rallied. I held them for one year plus and got some fantastic returns. The profits went back to increase my cash hoard. - Sometimes, in the fall, one discovers the possibilities of adding a stock to the core portfolio. The fall in markets gives an opportunity to buy it. Again, this money has to come from the cash bucket.

- Selling something from the core portfolio is a difficult challenge, but I could take some calls when stocks like Titan, HUL went to ridiculously high valuations. I sold those stocks and may buy them again if they come to my range of buying.

What is ridiculous? When the price for a company has generally reflected a 25 to 50 PE and nothing has changed in the business or the growth outlook, but the PE moves to 75, then I am happy to dump most of my holdings. I know that the prices can remain irrational for long, but I am not good at timing. I believe that I have got a great return by selling at those prices. I am not in the race to stack up my XIRR or some such return with a portfolio manager.

- “Buying the dip” can be often painful and the dips can keep going on. This is why I like to spread my cash allocated towards a stock over three or four lots. I buy only at, say 25% fall, 30% fall and 35% fall. Sometimes one may not be able to buy all the three. Not a problem, but I should not violate my rule. Similarly, it is possible that there may be a fourth or a fifth fall that is beyond 35%. In that case, I will not buy and will wait it out. Once I make an exception, then it is easy to run out of cash or go crazy in one or two stocks. The important thing is to have conviction in the stock. Thus, it has to be a high quality stock for us to be included in my buy list.

- I also mentioned a trading portfolio. That is pure price action based and may have stocks of less-than-high quality. Here, the important rule is to strictly follow the stop-loss and exit price rules. Sometimes, I do tend to let some winners ride. Along the way, I liquidate part of the holdings to psychologically reduce the price of what I hold. Not logical, but a weakness. Why have this trading portfolio at all? Simply to keep my ear to the ground, learn new things and try and get a better return than fixed income, on this portfolio.

- Finally, if you are a mutual fund investor, do not stop your regular investments. At each fall, you should try and put in something extra. When the bull comes back, sell off the extra investments you made. It will come in handy next time the bear comes back.

Cash as a weapon

Bear markets are a part of the market cycles. They give us an opportunity to improve our investment returns. At the beginning of our investment life, we should drill this in to ourselves and treat cash as an important weapon. We should never go all out in to equities, cash is useful when there are falls. These falls can happen in select stocks even without a bear market. Commodity stocks become ‘value’ buys when no one wants them, they are losing money and their PE goes to high double digits or triple digits. These are opportunities that come our way and the cash portion helps us to take advantage of them.

I have discussed my approach with some friends. The downside is that my total money is unlikely to earn the maximum possible returns. However, this approach is what gives ME peace. While I do not earn the maximum possible returns, I am also not frozen during market falls. Being fully invested is not something I care for. In fact as valuations keep getting out of hand, it is a good thing to keep selling gradually and keep the cash. Irrationality cannot last for too long. Every fad comes with ‘this time it is different’. That belief too is a normal part of stock markets!

14 thoughts on “How I handle bear markets”

An outstanding article Balakrishnan. Thanks for publishing it . Especially , the importance of CASH Component is well spelt out . Kindly let me know , if the same rules hold good , if one gets into a portfolio of only ETFs and Debt Funds (for managing cash component) by excluding individual stocks since I’m not very good at picking them. Also let me know if there are any thumb rules to be followed for managing the CASH Component along the investment journey especially during the Bull and Bear phases .

I have no rules for this. Cash is a great weapon. Buy the bear and remember to restore the cash balance soon on recovery and also take some cash home

Very elaborate & timely article. Shall copy few things with pride e.g. segregation of Core & Trading portfolio. Cash is also an asset class, market has taught us this many times.

Have one question, to better understand your framework & align : How much % of your investment is in Cash at present ?

Thanks again for sharing

Thank you sir for letting us know on the Tactical allocation to Equities you follow.

When you say Cash, do you park the money in liquid funds or any other instrument?

Hi

Why is my question is still awaiting moderation? I am a paid prime member as well?

It is in liquid or savings or FD. Something that is readily available, without risk to the principal

Good post

Wonderful. Timeless wisdom. Thanks for sharing.

Hi Balakrishnan.. Your strategy is worth giving a go !!

Important take away is the discipline in spends of dry powder. Thank you for sharing the same.

May I request you to highlight valuation metrics for index like Nifty 50 (other than traditional PE/PBv ratio & Dividend Yield as well)

Regards… Jatin

From the NSE Website, we can chart the P/B and P/E of the Nifty 50 for the past. You can get a range of both. The one problem is that sometime around 2016 or so, the BFSI became the biggest weight in the index. This means that the PB line or the PE line is not the same. I would ideally like to take the BFSI out and have another index – Ideally split the index in to BFSI and Non BFSI. That may help us better. Of course, in the non BFSI, we have some bloated valuations like Titan/Unilever that have persisted for a long time. It is sometimes a judgmental call also

Excellent post showing us a matured way of investing. Lots of points to note and implement. At the end peace is what we all want. Thank you.

Thanks for sharing your rules!

What’s your portfolio CAGR, maximum drawdown investing horizon?

Please also compare these parameters with a simple Nifty Index (40%), Nifty Smallcap 250 Index (0 to 60%) and Long Term Gilt/Liquid Fund (0 to 60%).

You have asked me things about which I have no idea. I have not bothered to measure. I used to put away in to equities and forget the whole thing. It has given me returns enough to live a peaceful life. I do take a ball park estimate and perhaps the return is between 15 and 20 CAGR over three decades. For a very modest amount that I put in to equities, it has done quite well. Investing with an excel sheet is not my forte

Comments are closed.