Updated on 4th Sep, 2023

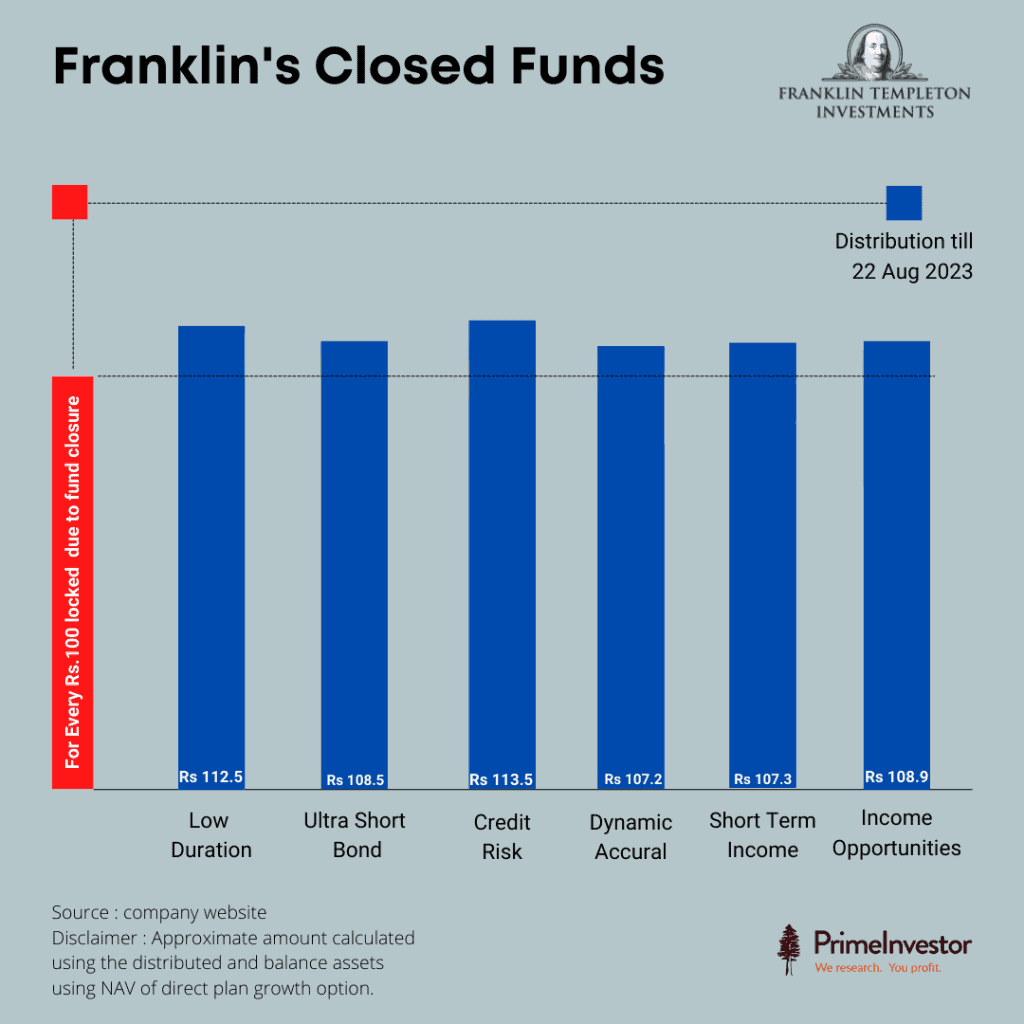

Franklin Templeton has made another tranche of repayment to investors in its six shuttered funds. Each of the six schemes have seen different amounts distributed – while those such as Franklin India Ultra Short and Franklin India Low Duration have seen a chunk of the amount due coming back, Franklin India Income Opportunities has seen only small payments still.

So you may be wondering how much was originally due to you, how much has been paid and what’s still left to be paid. Here’s the picture for each fund so you know where you stand.

Accretion and repayment

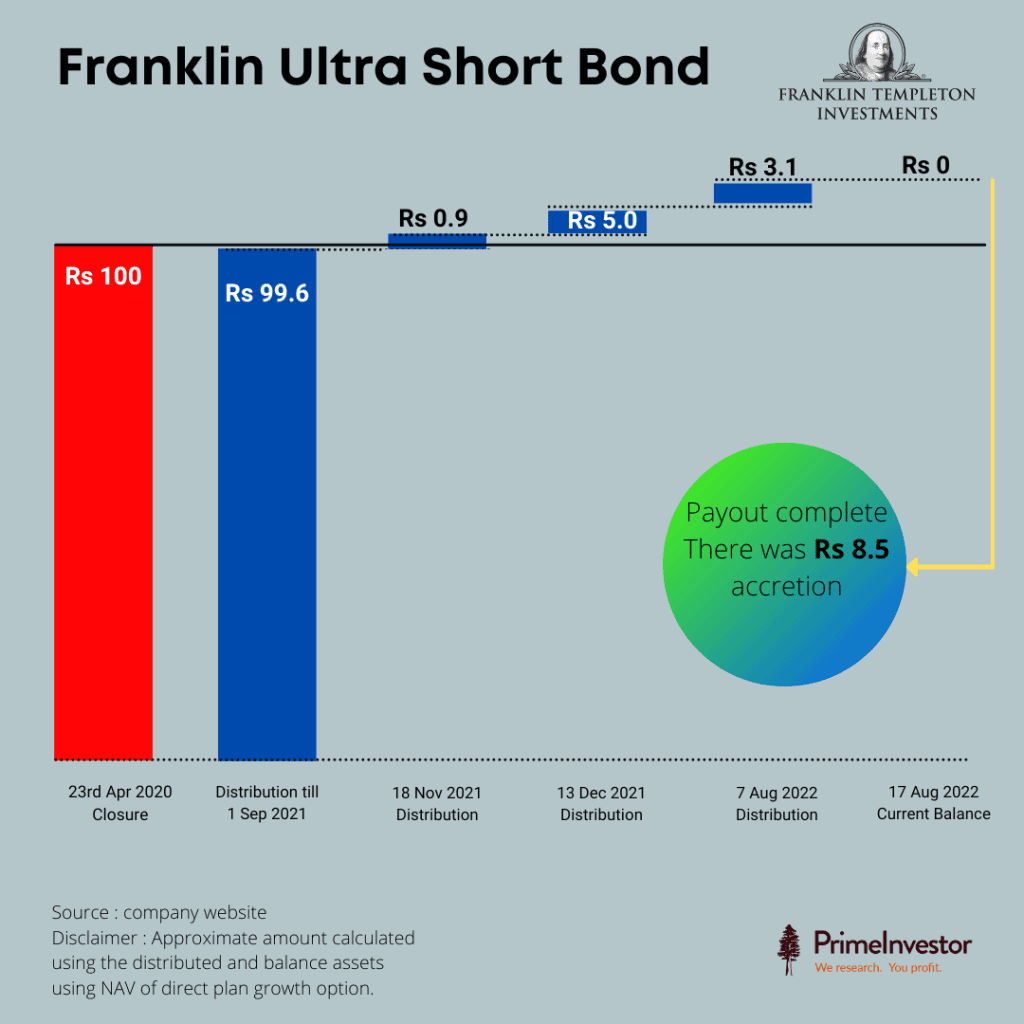

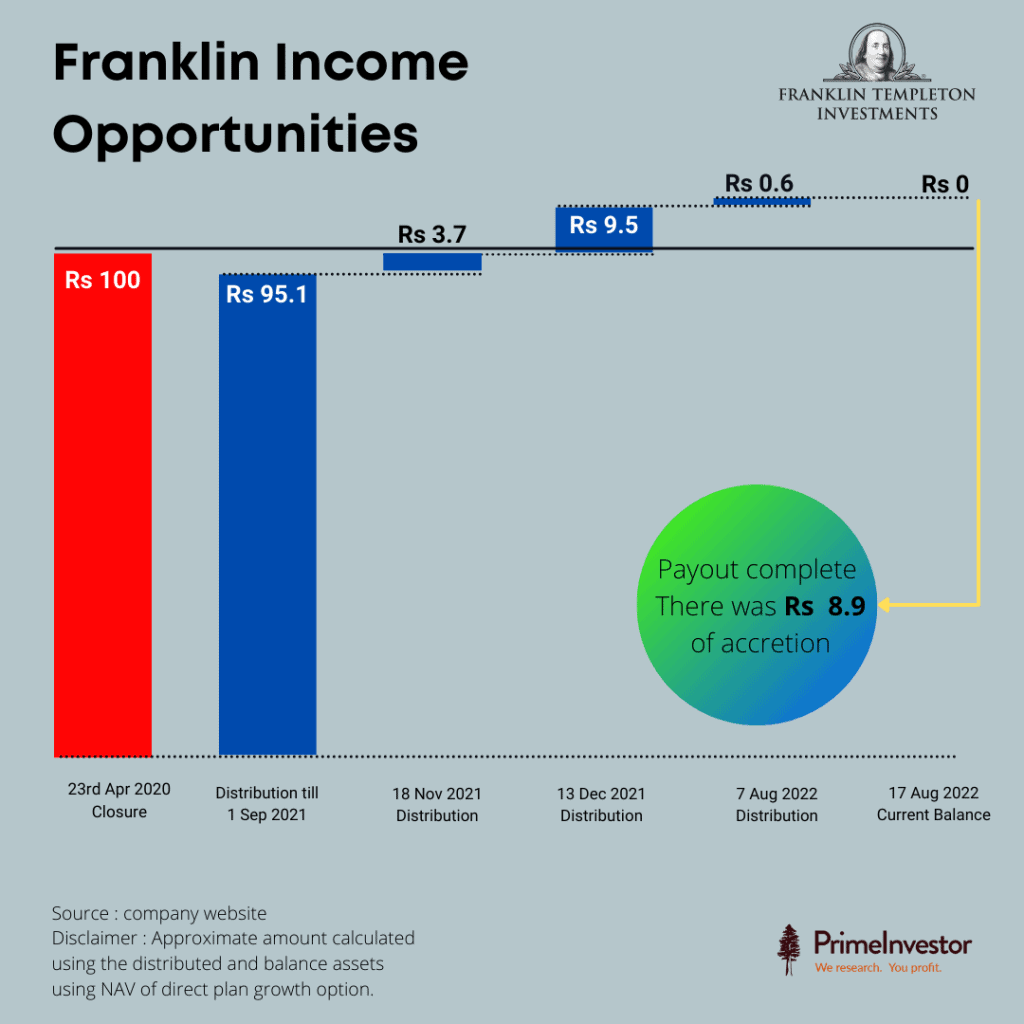

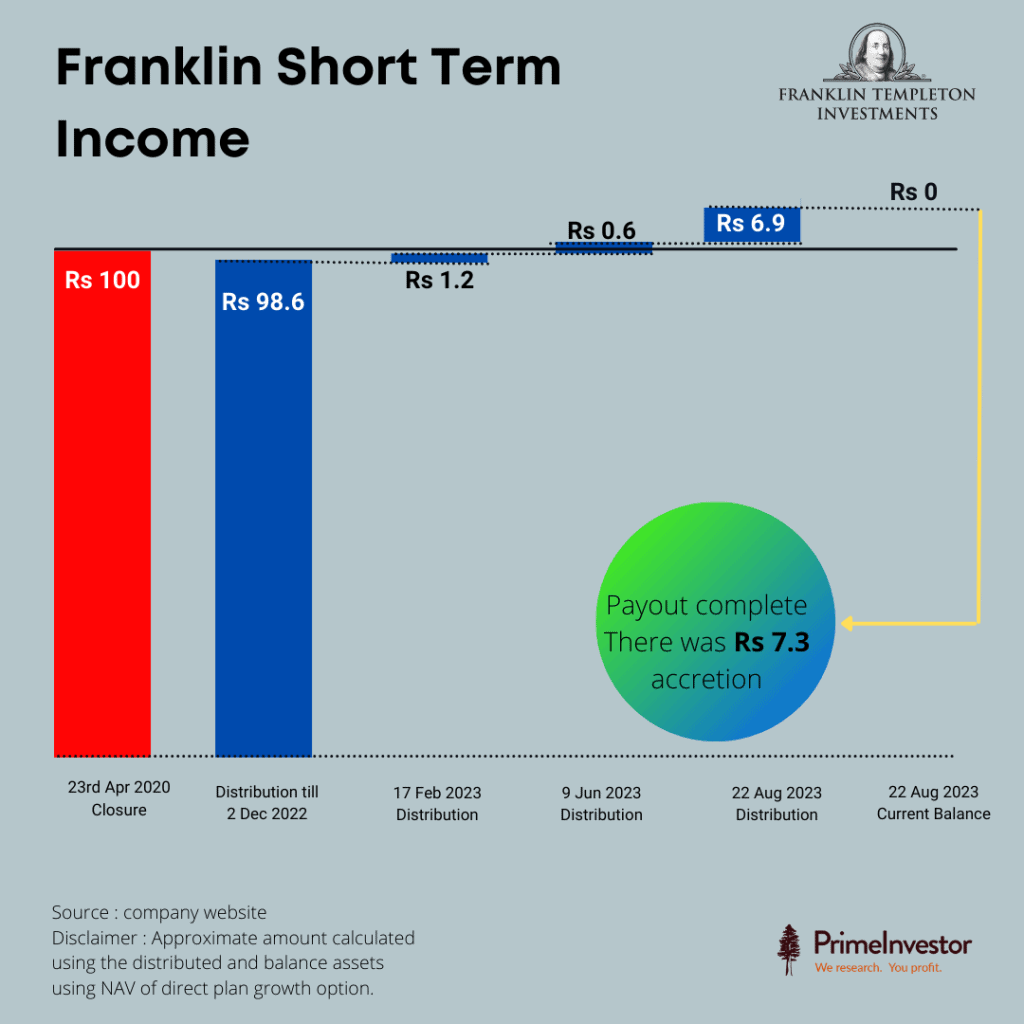

There are two aspects to working out how much is due to you – the accretion and the repayments.

By accretion, we mean the normal returns that the fund would have accumulated through collecting interest and maturity amounts on the papers it holds. Remember that while each fund was closed, the underlying portfolio continued to accrue such returns. Therefore, the amount that is owed to you would be higher than your investment value at the time of closure in April last year.

Repayments are, obviously, the cash distributed in each fund. This distribution is dependent on the cash levels for each fund, and has not been uniform across funds. Since the repayments are coming in batches, return accretion would continue on the remaining amount in the fund.

And in terms of AUM – distributed and still locked:

Franklin debt funds - Fund-wise picture

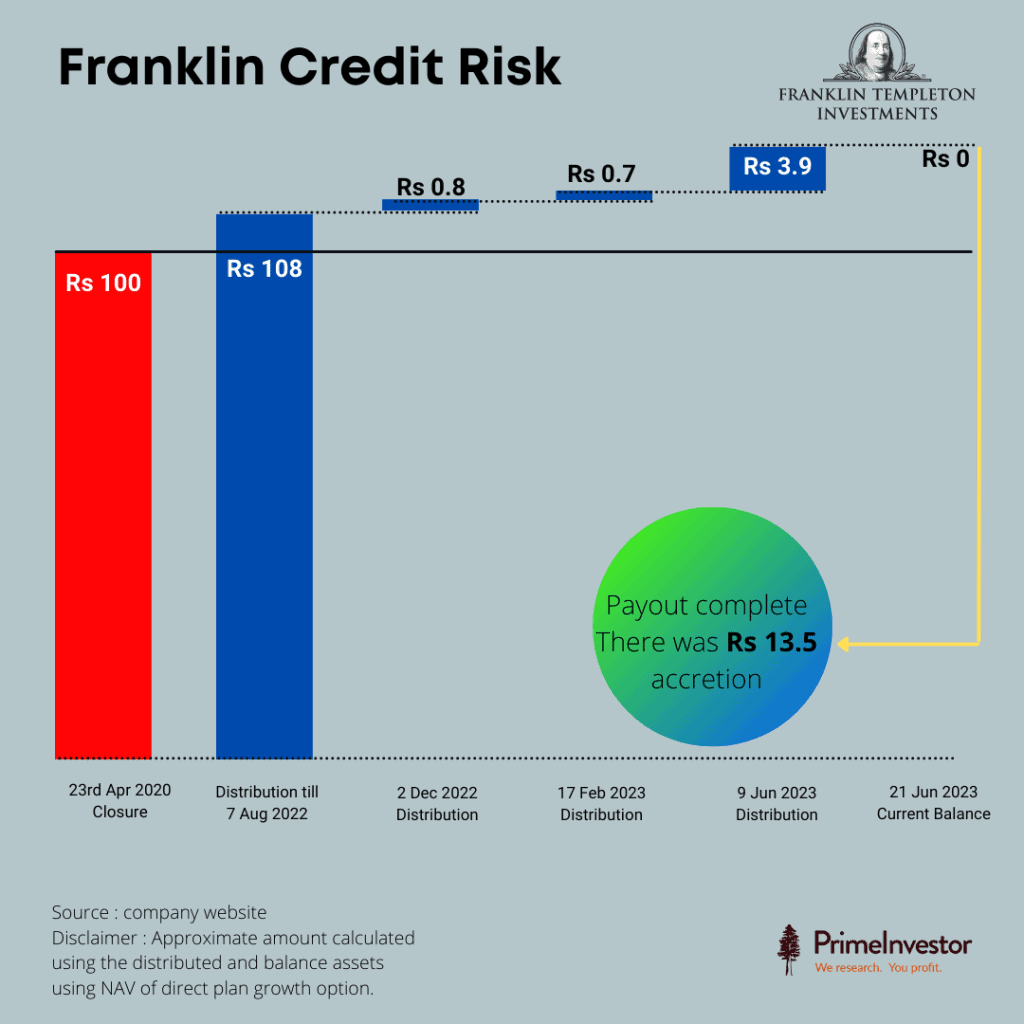

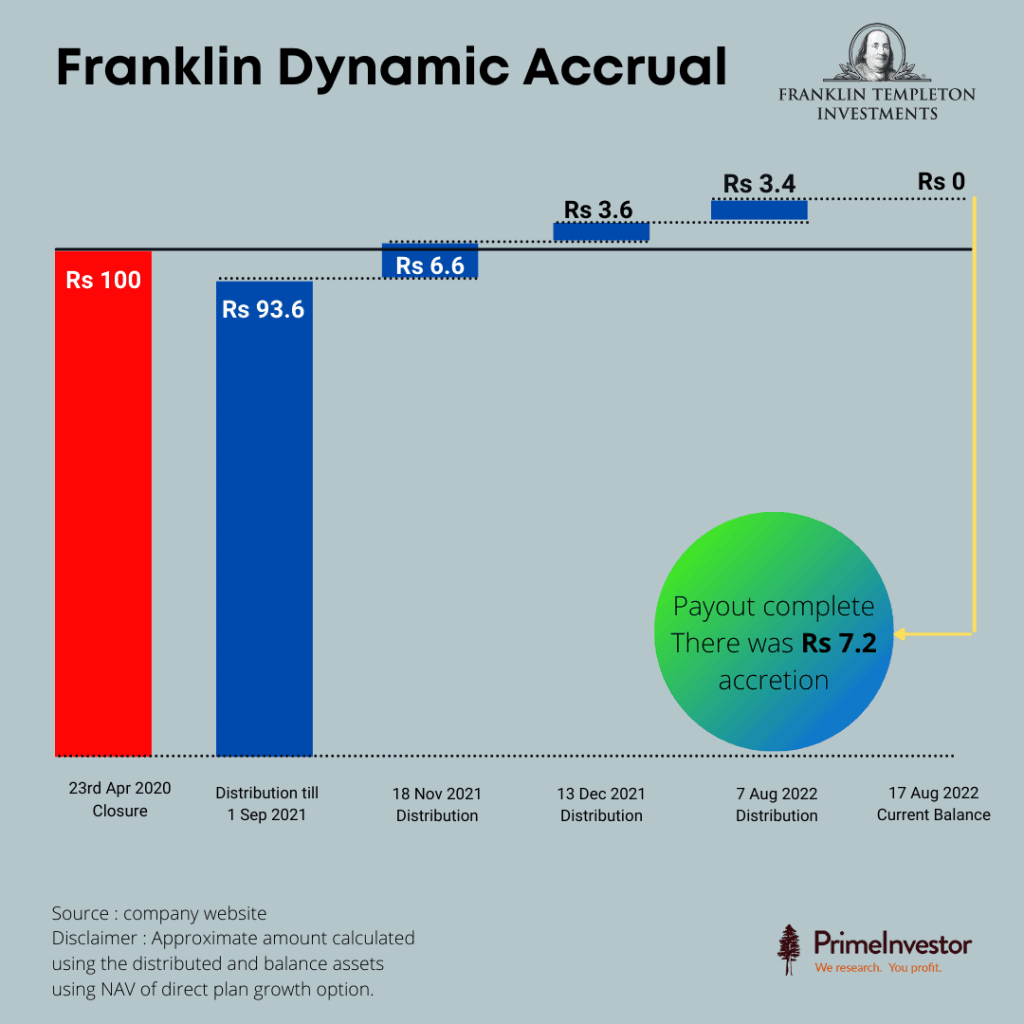

So, here’s the picture for each fund. We considered the original investment value at the time of closure (April 2020), and then worked out the return accretion and repayment amounts for each fund based on the NAVs (direct plan, growth option) and AUMs. This is shown in each graph below.

To make it easy to understand, we took the original investment value at Rs 100. The total accretion so far – that is, the returns each fund made from April 2020 to now – is shown in green. Please note that this is to show the accretion clearly; each repayment would in reality include part of the original investment and the accrued amount.

We'll keep this page updated as more disbursements are made.

Data source: Franklin Templeton website

Attribution: Data collation by Bipin Ramachandran, Infographic by Anush Raj.

Hope you found this data useful. If you did, please share it on social media and with friends/colleagues who may find it useful!

17 thoughts on “Franklin debt funds – How much has come in and how much is due?”

Recently FT has sent an email informing unit holders of these funds about changes in the Riskometer of these funds. For example – the risk rating of Short Term Income Plan has changed from “High” to “Very High”. Does it mean that now it has become more difficult to recover the money?

For all other funds the ratings have come down (risk has been lowered). Does it mean that it is now more easy to recover money in these funds?

Please read our article on this subject: https://primeinvestor.in/potential-risk-class-matrix-for-debt-funds/

thanks

Vidya

Comments are closed.