You will soon be getting some money on part of the segregated Vodafone Idea debt units of Franklin India. The segregated units of Franklin India received the full amount of principal and interest due on its Vodafone Idea debt security dated July 10, 2020.

This comes at a time when the main units of the very same Franklin funds are locked, after the fund house decided to close the running of the schemes.

If you had held the 6 (now) closed funds of Franklin India as of January 16,2020, you would have received the segregated/side pocketed units of 2 Vodafone Idea debt papers, that had gone bad.

Just to recollect:

- 2 papers of Vodafone Idea (falling due in July 2020 and September 2023) were fully written off on January 16, 2020 and later the units were segregated from the respective parent funds.

- On June 12, 2020, it received Rs 102.71 crore as annual interest on the July 2020 papers. This amount was distributed to unit holders.

- On July 10, 2020 it received Rs 7.88 crore of balance interest up to July 10,2020 and principal amount of Rs 1245 crore.

- With this, the entire segregated units pertaining to July 2020 papers will stand extinguished.

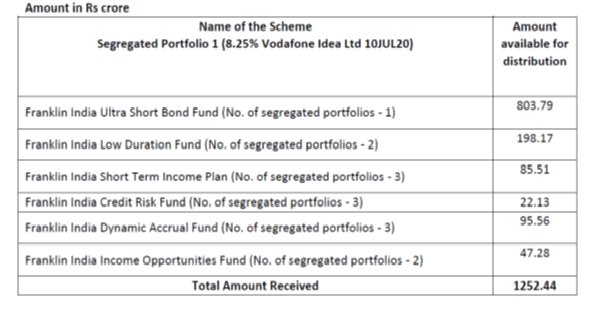

Franklin India schemes have now received the following amounts on the July 2020 due segregated units:

The above amount is after deduction of Rs 0.44 crore as operational expenses. Please see the full document from Franklin India AMC here: https://www.franklintempletonindia.com/downloadsServlet/?docid=kc8w04wl

Money will hit your bank account

If you’re worried that this amount will get stuck with the rest of the units that are now closed, pending voting and sale and distribution of assets, that is not the case.

This money will be returned to you as these units were created separately (in January 2020) to distribute amounts as and when repayment was received from the bad instrument.

The full repayment, according to the AMC, will be made as follows:

“For units held in physical/ statement of account mode, all outstanding unitholding as on 10 July 2020 will be extinguished and the amount will be distributed to unitholders by 14 July 2020. For units held in demat mode, all outstanding unitholding as on 17 July 2020 (i.e. the record date) will be extinguished and the amount will be distributed to unitholders by 20 July 2020.”

Only one Vodafone paper is repaid

Please note that the money currently being received is for only one of the papers dt. July 10, 2020. Five out of the six funds above (other than Franklin India Ultra Short) still have segregated units in Vodafone paper falling due in September 2023 with a put option in September 2021.

The below table will tell you what was the break-up of the exposure (which was fully written off) in the two papers as of December 2019.

In other words, only the segregated units of Franklin India Ultra Short Bond have received their dues fully.

Other fund houses too receive dues

Please note that Nippon Life and UTI MF too have confirmed that they have received payment on the Vodafone papers. For the list of open-ended funds (including Franklin funds) that took a hit on the Vodafone Idea paper, please refer to our analysis in January 2020, when the hit took place.

Tax treatment

Receipt of money on segregated units also attract capital gains tax. If you wish to know how segregated units are taxed please refer to our article here.

In the case of Franklin India units, unfortunately, you will be paying tax on the entire amount of receipts on the segregated Vodafone paper. This is because the cost of units of the segregated portfolio was zero. Why was it zero? Franklin’s debt schemes had written off the Vodafone paper in full, before they segregated it. So, the cost of the segregated units was zero at the time of segregation. This essentially means that the entire receipt for these segregated units will be taxed as capital gain – long-term or short term, based on your original date of purchase.

3 thoughts on “You’re getting some money on your Franklin India debt units – here’s how!”

Thanks for the lucid explanation.

One question though…

If the acquisition cost for franklin segregated units is to be taken as zero, then one will not be able to get the cost escalation benefit (for LT holding) when calculating the tax, unlike other dent fund units. Am I right?

You’re right.

Thanks for the detailed information.

Comments are closed.