Which are the best SIP funds? I want to invest lumpsum, which fund should I go for? Are your Prime Portfolios for SIP or lumpsum investing? SIP vs Lump sum? These are some of the questions we see from you and in discussion forums online. And because you search for these, the amount of content on this subject to catch Google’s attention is aplenty.

The SIP has become symbolic for investment. Equally well-known is the evils of lumpsum investing. So which are the best SIP funds and which are good for lumpsums? To answer that, it’s time to get back to the basics.

Please note that while the examples and illustrations in this article may be old, the basic argument is still valid.

What SIPs really are

What is an SIP? A fixed sum invested every month, you reply promptly. And correctly. Next, why SIP? Because it helps average costs and gives better returns. Also correct – partially. But that’s not the full answer. Here is what an SIP and its benefits really are.

An SIP is a method of investment. All that you’re doing is to put money into a fund at regular intervals through the year. An SIP is not a product itself. You can’t invest in SIPs and mutual funds. You invest through an SIP in mutual funds. In the many avatars that SIPs have these days, you could even be investing different amounts at each interval!

- The main benefit of an SIP is that it introduces discipline in saving. SIPs make sure that a part of your income gets invested. It addresses the risk that you over-spend and compromise on saving. It doesn’t give you the excuse of putting off investing to the next month.

- The next SIP benefit is that it lets you build up the amount you need for your goal gradually. Every small sum counts towards wealth building, especially if you have a long-term perspective. Given that most financial goals are large, putting in a one-time sum that will grow to meet the target will be a tall order. But putting away some amount regularly and increasing this as your income rises, make your goal a lot more achievable.

- The third SIP benefit is that it allows you to invest at different market/NAV levels. This reduces the risk that you put in a chunk of your surplus when markets are expensive and ripe for a correction.

All other SIP benefits are secondary to these main benefits. Now, take the firm belief in SIPs that most seem to have, and often the reason to run an SIP – that of cost averaging. There’s one pesky point about cost averaging, though. The point is this:

- You need a market fall in order to actually average costs (whether you’re looking at equity or debt). Without a correction, there is no way an SIP will offer cost benefits. This dip needs to be long enough or steep enough so that additional investments will be made at levels that can materially result in your overall costs dropping. When you run SIPs through market upturns, your costs are in fact moving up. Longer the rally, the more your cost trends upwards. The longer you run your SIP, the more you need a long market downturn to average. Real averaging of investment costs is not easy to do, a topic which we’ll cover separately.

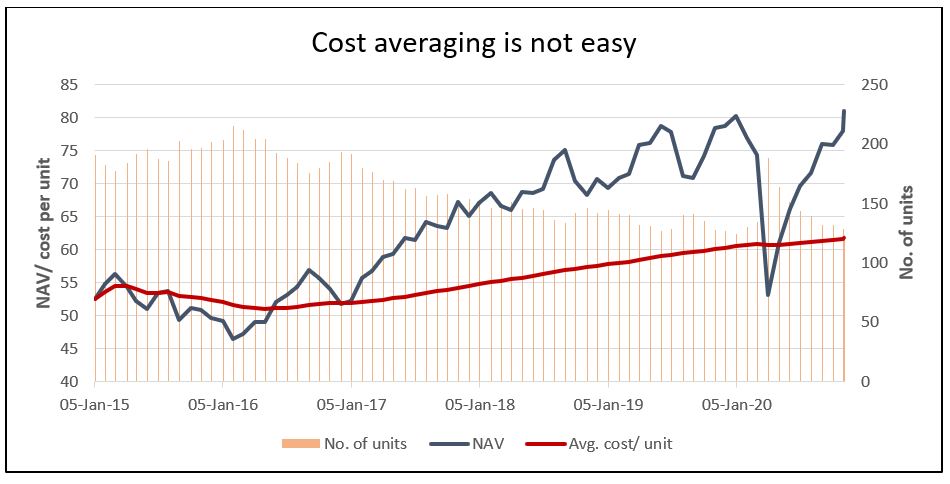

The example below shows average cost per unit for a Rs 10,000 SIP made from Jan 2015 to Nov 2020, in UTI Nifty Index fund. We picked this fund because it reflects actual market movement.

As you can see, the average cost per unit is slightly trending lower through 2015. No doubt, the average cost is lower than the prevailing NAVs. However, costs are still generally trending upward. Even the stiff market correction in early 2020 was not enough to lower the per-unit cost; the higher market levels between 2017 and 2019 pushed average costs up and kept them on a higher trend.

In essence, you need multiple market phases and specifically multiple/deep market falls, for your SIPs to cost average effectively. This is why short period SIPs of 2-3 years seldom work (unless of course it was for a good part in a down phase) in averaging cost.

- SIPs are not a cure for low returns nor a recipe for high returns. Just because you are running an SIP in a fund, it does not mean that you will never see losses. Needless to say, when market falls, you may incur losses as the market value of investments go down. Similarly, SIPs do not guarantee higher returns than lumpsum investing. In fact, if you had been investing through SIPs in a rallying market, chances are that lumpsum will look better in returns because you did not buy at higher NAVs like SIP. This holds whether your fund is equity, debt, or hybrid.

What lumpsums really are

A lumpsum investment is when you invest a certain sum of money in a fund and you’re not doing it like clockwork every month. Lumpsum is also a method of investment.

Lumpsum does not mean that you invest only one time. If you invest, say, 5 times in a year, you’re making 5 lumpsum investments. In fact, you could even decide to invest a sum every month on different dates in a year. In such a case, you’re making 12 lumpsum investments. If such an investment were to happen on the same date, with the same amount every time, you’d call it an SIP.

- Lumpsum investments are not wrong. It is not that your returns are going to be low just because you put your money in at a single shot. If you get your timing right – such as in March-April this year – you could be sitting on handsome gains when markets rally and far better than if you were doing SIPs! There are scenarios where investing lumpsum may be the best route to take. For example, if your income is uncertain or fluctuating it could limit your ability to commit to a fixed SIP amount each month, and making lumpsum investments at different times may be more manageable. If you’re trying to time a theme, lumpsum can work better.

- Timing is the key risk in lumpsum investing. Market highs and lows are known only in hindsight. If you get in at a high, you could suffer more during a correction. So, if you’re investing through lumpsums, you need to ensure that you make multiple such investments, to capture different market/NAV levels. Only this can help mitigate timing risk.

- Not all asset classes have lumpsum (timing) risk: Taking off from the earlier point, timing is a big risk in asset classes like equity and gold where there is a high chance of steep falls. Duration based funds, such as gilt funds and dynamic bond funds, are next in line but are nowhere near as volatile as equity. In other fund categories like liquid or other accrual-based funds, lumpsum investments are not highly risky.

The underlying fund matters

The reason for covering the basics of SIP vs lump sum is to drive home the following point – SIPs and lumpsums are methods of investing in a mutual fund. They are not investments themselves. SIP/ lumpsum is a way to invest.

This establishes the following points – one, the underlying investment in SIP or lumpsum is actually the mutual fund. Two, your returns come from the mutual fund’s performance. If your underlying fund’s returns beat the benchmark and peer average, then your investment holds good. If the fund lags the market, it will suppress your returns regardless of whether you invested through a lumpsum or an SIP.

Look at it with an illustration. Consider HDFC Equity and Kotak Standard Multicap (direct plans in both). In one scenario, take an SIP in both these funds from January 2015 to date which amounts to Rs 71,000. In the second scenario, take a lumpsum investment of Rs 71,000 made in the same two funds, in January 2015. The tables below show the value of the two funds in both scenarios, against a hypothetical investment in the Nifty 500 TRI.

As you can see, whether investment was through SIP or lumpsum, returns in HDFC Equity are below that of the Nifty 500. Why? Because HDFC Equity is an uneven performer, prone to suddenly shooting above the index and falling back. On a rolling 3-year return basis, HDFC Equity has beaten the Nifty 500 TRI only about a third of the time since 2013. It falls more than the index during corrections, and is unable to adequately capture upsides. This poor performance shows up in returns, and investing through an SIP does not help.

Kotak Standard Multicap, on the other hand, delivered well. This fund is a consistent performer, beating the Nifty 500 TRI all the time on a 3-year rolling return basis. Across other metrics, such as downside containment and risk-adjusted return, the fund scores well. The fund’s quality, therefore, shows up in its ability to generate market-plus returns whether in SIP or in lumpsum.

The graph below captures the movement of the difference between the investment value of the funds and the Nifty 500 TRI through the course of the SIP illustrated above. The difference between HDFC Equity and the index wanders wildly through the years, while Kotak is more stable. Therefore, SIP vs lump sum does not matter – if the underlying fund is poor, returns and going to be poor. If the underlying fund is a good performer, you will be able to beat the market and peers whether you invest through SIP or lumpsum.

This tells us the following:

- The only question you need to ask is if the fund is a consistent and quality performer, one that has a clear strategy and the ability to stay ahead of the market and peers across market cycles. This goes for any fund category, whether it is debt, equity, or hybrid. These are the funds that can form a part of your portfolio, whether you invest in them at one time, in multiple tranches over time, or through SIPs.

- When you have quality funds, investing through SIP or lumpsum is a matter of choice – you can go for whichever method is more convenient for you. SIPs are useful because they enforce investments and allow you to invest at different prices, the primary benefits we talked about earlier.

- There are no ‘best SIP funds’ or ‘good lumpsum funds.’ There are quality funds worth investing in and poorly performing funds that you can avoid or exit. Don’t be swayed by ‘best SIP funds’ declarations in the news, or your mutual fund platform or by your distributor/advisor. Any and all good funds can be held via SIPs (except for liquid and overnight funds, as most AMCs and platforms don’t allow SIPs here). Any and all good funds can be held through lumpsum investments. At best, when funds need timing – such as if you wish to play the interest rate cycle, or want to pick up sector/thematic funds, then lumpsum investing is the way to go rather than SIPs.

- SIP and lumpsum returns cannot be compared. For one thing, the compounding times for a lumpsum and an SIP are different; in a lumpsum, the entire amount is compounding for a longer time than in an SIP. For another, returns will always be influenced by the market cycle. Remember that any lumpsum return will be calculated using the start date of investment and the current date. It will ignore all market gyrations in between. So, an investment made at a low and returns seen after markets have rallied will result in high lumpsum returns while SIP returns will be lower. The reverse is true when the lumpsum was made at a high. For example, a lumpsum invested in UTI Nifty index fund in December 2013 (low levels) returned 11.5% CAGR until December 2016. A 3-year SIP clocked an IRR of 6.5% over the same 3-year period. On the other hand, a lumpsum invested in December 2017 (high level) is now up 7.5% CAGR while an SIP run over this period generated an IRR of 9.08%. Given that SIPs and lumpsums are routes to investing, you cannot look at their respective returns and conclude that one way is better than the other.

How to use SIPs and lumpsums effectively

So, you now know that what matters is the fund’s quality and that you can do SIPs and lumpsums in the same fund. Here’s how to use these two different methods of investment to improve your returns.

- Supplement SIPs with lumpsums: You can make lumpsum investments in a fund in addition to running an SIP in the fund (or funds in a portfolio). At times of market falls, especially when such falls are quick and steep, you can deploy lumpsum investments even as your SIP is running. This improves your ability to capture cheaper prices (by deploying more money than the regular SIP amount) and will help increase the effect of averaging costs lower.

- Don’t stop with single lumpsum: Lumpsums are absolutely fine, provided you do two things: one, make it a habit of investing lumpsum at different times. If you cannot look for fall opportunities, at least make sure you invest periodically when you have surpluses. But keep a clear long-term goal, as you should with any equity investment. Two, do not get into the invest and forget mode Make sure you review your fund. Compounding is less effective if you do not stay with the right fund.

- Highly volatile funds can be more amenable to SIPs than to a lumpsum. Categories such as large & midcap, midcap, and smallcap fit in this. However, volatility should not supersede other performance metrics when you’re looking for funds – i.e., you first pick a quality fund. If it happens to be more volatile/aggressive than peers, then a SIP will work well. A volatile fund does not automatically mean that lumpsums are barred. The concept of an SIP is to invest at different price points – as explained before, make multiple lumpsum investments for a similar effect especially in volatile funds.

To sum it up in very simple terms:

- SIPs and lumpsums are methods of investing in a fund. SIPs have a benefit in that they enforce investing.

- You can do SIPs and/or lumpsums in any fund with a caveat that you need a very long-term horizon for both methods when it comes to equity or equity-oriented funds.

- The risk of timing exists in both and can be solved by investing at different market/NAV levels for which you need multiple market phases (and longer time frame). In fund categories other than equity and duration funds in debt, the risk of timing is also low.

All our fund recommendations in Prime Funds and portfolio recommendations in Prime Portfolios can be invested through SIPs and lumpsum. Choose whichever method is the best for you.

There are no separate ‘best SIP funds’. If someone claims otherwise, stay away from them. They are salesmen and not advisors.

Article video ↓